India Automatic Door Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Automatic Door Market Overview:

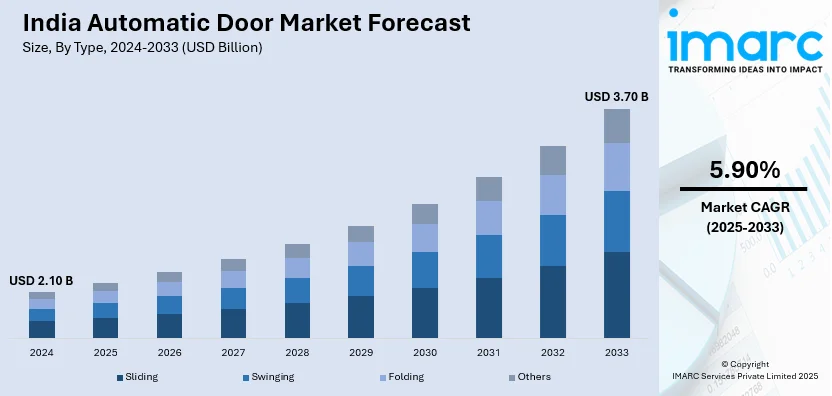

The India automatic door market size reached USD 2.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.70 Billion by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. Increasing adoption of smart building solutions, growing infrastructure development in commercial and residential spaces, rising demand for contactless access due to hygiene concerns, technological advancements in sensors and automation, and government initiatives for smart cities are contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.10 Billion |

| Market Forecast in 2033 | USD 3.70 Billion |

| Market Growth Rate 2025-2033 | 5.90% |

India Automatic Door Market Trends:

Integration of Touchless Technologies

The increased frequency of viral and infectious illnesses has fueled the need for touchless entry solutions, resulting in the widespread use of automatic doors outfitted with motion sensors, gesture recognition, and smartphone-based access systems. These technologies reduce physical touch, lowering the risk of infection transmission and improving cleanliness in public settings. Manufacturers are using artificial intelligence (AI) and smart sensors to improve door performance, including innovations like Dormakaba's IoT-enabled doors that provide remote diagnostics to boost operating efficiency. In India, sectors like healthcare, hospitality, and retail are increasingly integrating touchless automatic doors to prioritize safety and convenience for users. This trend aligns with the broader global push for contactless environments in commercial and public spaces, reinforcing the long-term demand for automated entry solutions.

To get more information on this market, Request Sample

Incorporation of Energy-Efficient Designs

With sustainability becoming a priority, energy-efficient automatic doors are playing a crucial role in modern building designs by minimizing air leakage and optimizing thermal insulation. India has emerged as a leader in green building initiatives, ranking third globally in LEED certifications in 2023, with 2,200 commercial projects covering over 212 million GSM. Additionally, the Indian Green Building Council (IGBC) has registered more than 4,500 projects, accounting for over 4.53 billion sq ft of sustainable infrastructure. According to the Door and Hardware Federation (DHF), energy-efficient automatic doors can reduce energy costs by up to 30%, making them an attractive choice for eco-conscious consumers. Manufacturers like GEZE India are innovating with sliding door systems that enhance energy efficiency and lower carbon footprints, aligning with the global shift towards sustainable construction. The automatic door market is witnessing rapid growth, with installations of energy-efficient designs increasing at an annual rate of 15-20%, driven by stricter regulations and sustainability goals. In India, their adoption is accelerating in urban infrastructure and smart city projects, fueled by rising construction activities and greater consumer awareness.

India Automatic Door Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Sliding

- Swinging

- Folding

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes sliding, swinging, folding, and others.

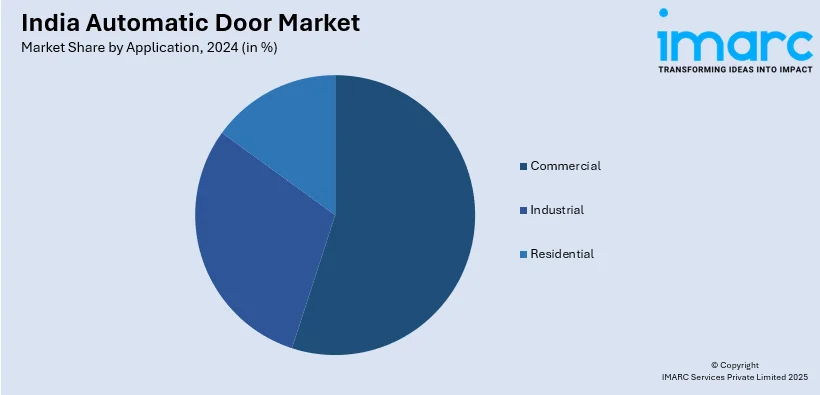

Application Insights:

- Commercial

- Industrial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automatic Door Market News:

- January 2025: Encore-Alcom, a prominent aluminum door and window manufacturer from Hyderabad, established India's largest aluminum door production plant, which includes automated doors, in Surat, Gujarat. The business, which covers 1,84,000 square feet, employs 500 workers and can manufacture 35,000 square feet every day.

- November 2023: Shakti Hörmann invested Rs 175 crore in establishing a greenfield manufacturing facility for fire-rated wood and steel doors at Mahindra World City in Jaipur. The plant is set to produce 1.3 lakh wooden doors and 2 lakh steel doors, including automated models, annually, catering to both the commercial and residential door markets.

India Automatic Door Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sliding, Swinging, Folding, Others |

| Applications Covered | Commercial, Industrial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automatic door market performed so far and how will it perform in the coming years?

- What is the breakup of the India automatic door market on the basis of type?

- What is the breakup of the India automatic door market on the basis of application?

- What are the various stages in the value chain of the India automatic door market?

- What are the key driving factors and challenges in the India automatic door market?

- What is the structure of the India automatic door market and who are the key players?

- What is the degree of competition in the India automatic door market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automatic door market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automatic door market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automatic door industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)