India Automotive Aftermarket Accessories Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Sales Channel, End User, and Region, 2025-2033

India Automotive Aftermarket Accessories Market Overview:

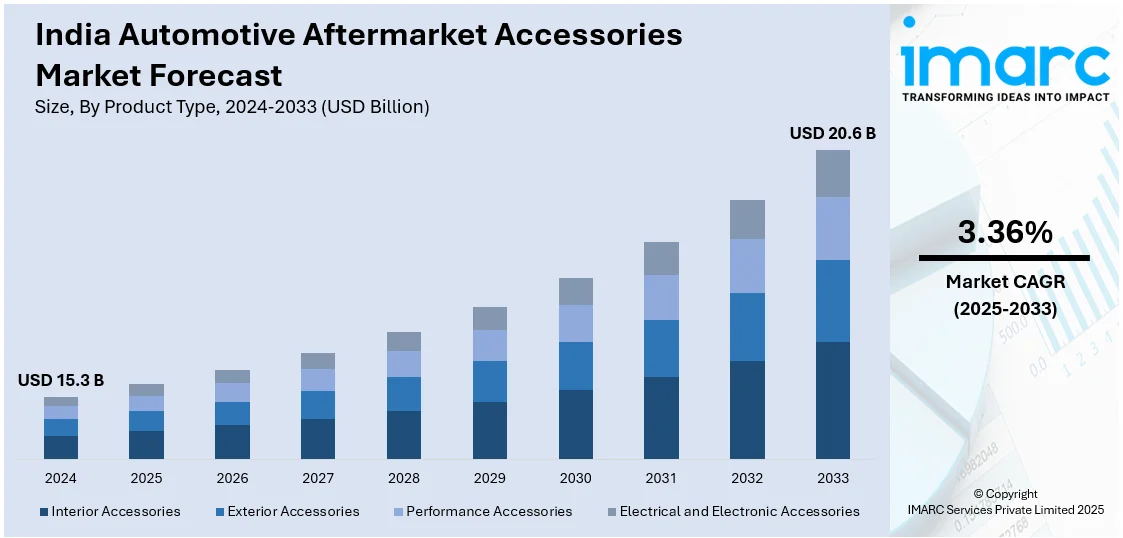

The India automotive aftermarket accessories market size reached USD 15.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.36% during 2025-2033. The market is driven by rising vehicle ownership, increasing disposable incomes, and consumer demand for customization and advanced tech features. Growth in e-commerce, urbanization, and improved road infrastructure further enhance demand. Additionally, the expanding used car market and rising awareness of vehicle aesthetics and safety are further expanding the India automotive aftermarket accessories market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.3 Billion |

| Market Forecast in 2033 | USD 20.6 Billion |

| Market Growth Rate 2025-2033 | 3.36% |

India Automotive Aftermarket Accessories Market Trends:

Rising Demand for Smart and Connected Accessories

The market is witnessing a rise in demand for smart and connected accessories, driven by increasing tech-savvy consumers and advancements in vehicle technology. Products such as advanced infotainment systems, GPS navigation, dash cams, and wireless charging pads are gaining popularity as buyers seek enhanced convenience and safety. The growing adoption of electric vehicles (EVs) is further fueling this trend, with consumers looking for compatible tech upgrades. India is leading the electric vehicle revolution across emerging Asia, creating a USD 1.3 Trillion investment opportunity by 2030 as electric two- and three-wheelers proliferate. In the year 2023, India emerged as a world leader in electric three-wheeler sales with 580,000 units and 60 percent market share and also totaled 880,000 e-scooter sales for second place globally. The rise of electric vehicles is driving the need for automotive aftermarket accessories. Additionally, smartphone integration features are becoming standard expectations among car owners. Companies are investing in IoT-enabled accessories that offer real-time diagnostics and remote monitoring, catering to the demand for smarter vehicle solutions. With increasing disposable incomes and a preference for premium vehicles, the market for high-tech automotive accessories is expected to expand significantly in the coming years.

To get more information on this market, Request Sample

Growth in Online Sales Channels for Aftermarket Accessories

The significant shift toward online sales platforms, driven by the convenience of e-commerce and increasing internet penetration is creating a positive India automotive aftermarket accessories market outlook. As of June 2023, India had a significant 895 Million internet connection and is expected to have 1.1 Billion smartphones by 2025, fueling the digital growth of the country. This improved connection, along with rising incomes, has promoted e-commerce, which is expected to touch USD 1 Trillion by 2030. The expanding digital landscape is reshaping consumer behavior, making online purchases of automotive accessories more accessible. With categories such as direct-to-consumer (D2C) and business-to-business (B2B) growing, the market is positioned for sustained growth. Consumers are increasingly purchasing accessories such as seat covers, alloy wheels, LED lights, and car care products through online marketplaces and specialized automotive platforms. The availability of detailed product descriptions, customer reviews, and competitive pricing is encouraging this shift. Additionally, the COVID-19 pandemic accelerated the adoption of digital shopping, with buyers preferring contactless transactions. Aftermarket retailers and manufacturers are leveraging digital marketing, social media promotions, and influencer collaborations to attract online buyers. The rise of omnichannel retailing, combining online and offline experiences, is further propelling the India automotive aftermarket accessories market growth. As digital payment systems become more secure and accessible, online sales of automotive accessories are expected to grow at a rapid pace in India.

India Automotive Aftermarket Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, vehicle type, sales channel, and end user.

Product Type Insights:

- Interior Accessories

- Seat Covers

- Floor Mats and Carpets

- Dashboard Accessories

- Steering Covers

- Others

- Exterior Accessories

- Body Kits

- Spoilers and Skirts

- Wind Deflectors

- Roof Racks

- Others

- Performance Accessories

- Exhaust Systems

- Air Filters

- Suspension Kits

- Turbochargers

- Others

- Electrical and Electronic Accessories

- Car Audio Systems

- Lighting

- Navigation and Infotainment Systems

- Parking Assist Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes interior accessories (seat covers, floor mats and carpets, dashboard accessories, steering covers, and others), exterior accessories (body kits, spoilers and skirts, wind deflectors, roof racks, and others), performance accessories (exhaust systems, air filters, suspension kits, turbochargers, and others), and electrical and electronic accessories (car audio systems, lighting, navigation and infotainment systems, parking assist systems, and others).

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, and two-wheelers.

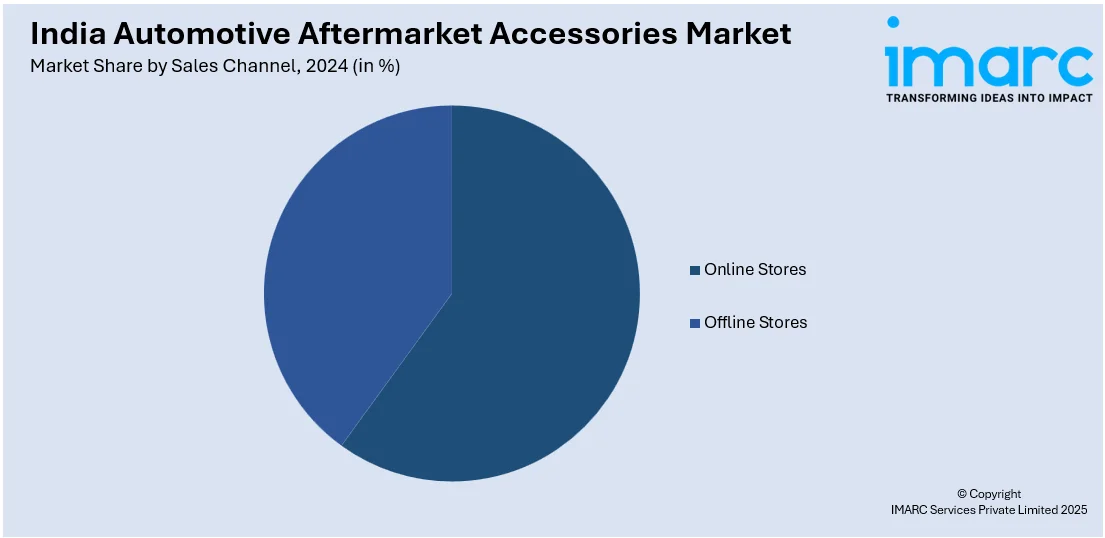

Sales Channel Insights:

- Online Stores

- Offline Stores

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes online stores and offline stores.

End User Insights:

- Individual Consumers

- Automotive Repair and Service Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual consumers, and automotive repair and service centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Aftermarket Accessories Market News:

- February 23, 2025: ZF Group launched its first ZF (pro) Tech Plus workshop in Delhi to help drive growth in India's auto aftermarket industry. Independent repair facilities are able to obtain technical training, service assistance, and manufacturer-level technical assistance through this workshop. ZF plans to increase its footprint across India to empower local workshops and enhance the sale of aftermarket accessories.

- December 18, 2024: MyTVS launched Hypermart, a last-mile solution for auto parts distribution that aims for a 1 to 2-hour delivery time in India's auto aftermarket. Currently, the company operates 14 dark stores in Tamil Nadu and Karnataka and plans to ramp it up to 250 across the country by March 2025. The platform has 8 Million SKUs on offer, a return rate of 1-2% operates with over 22,000 retailers and 30,000 garages across India.

India Automotive Aftermarket Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers |

| Sales Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Individual Consumers, Automotive Repair and Service Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive aftermarket accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive aftermarket accessories market on the basis of product type?

- What is the breakup of the India automotive aftermarket accessories market on the basis of vehicle type?

- What is the breakup of the India automotive aftermarket accessories market on the basis of sales channel?

- What is the breakup of the India automotive aftermarket accessories market on the basis of end user?

- What is the breakup of the India automotive aftermarket accessories market on the basis of region?

- What are the various stages in the value chain of the India automotive aftermarket accessories market?

- What are the key driving factors and challenges in the India automotive aftermarket accessories market?

- What is the structure of the India automotive aftermarket accessories market and who are the key players?

- What is the degree of competition in the India automotive aftermarket accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive aftermarket accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive aftermarket accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive aftermarket accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)