India Automotive Air Filter Market Size, Share, Trends and Forecast by Type, Propulsion, Vehicle Type, Sales Channel, and Region, 2026-2034

India Automotive Air Filter Market Overview:

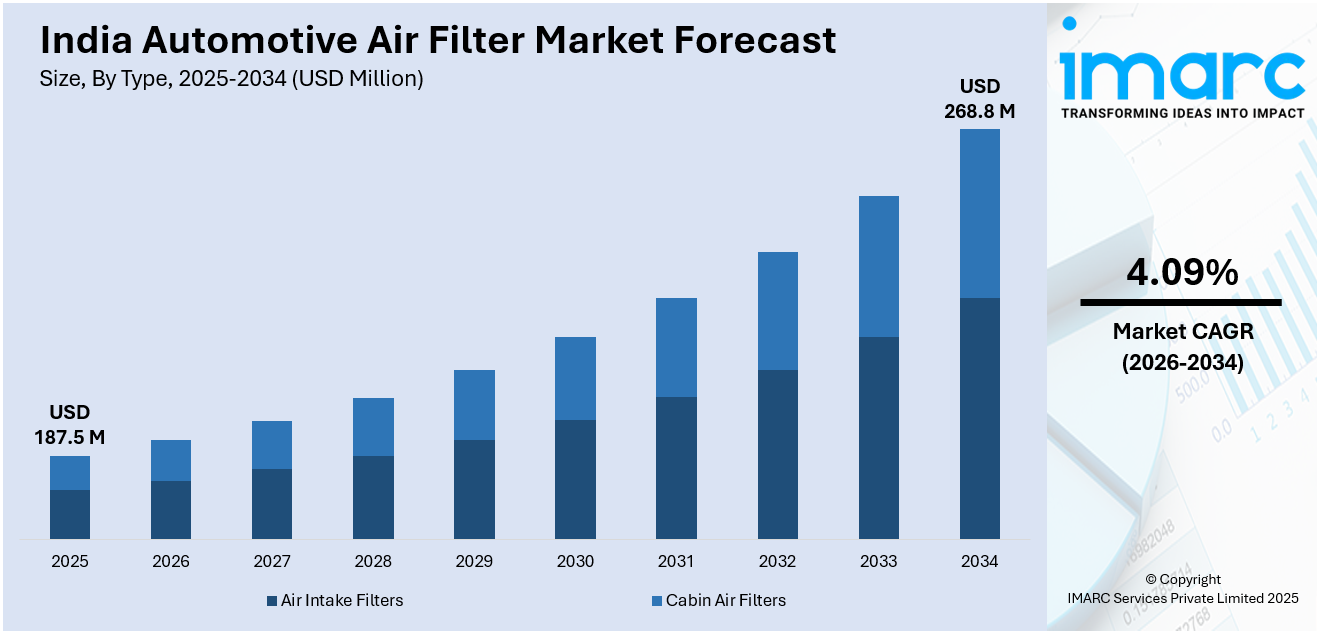

The India automotive air filter market size reached USD 187.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 268.8 Million by 2034, exhibiting a growth rate (CAGR) of 4.09% during 2026-2034. The rising vehicle production, stricter emission regulations, increasing consumer awareness of air quality, growing demand for fuel-efficient vehicles, expansion of the electric vehicle sector, and advancements in filter technology are boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 187.5 Million |

| Market Forecast in 2034 | USD 268.8 Million |

| Market Growth Rate 2026-2034 | 4.09% |

India Automotive Air Filter Market Trends:

Rising Adoption of Advanced Air Filtration Technologies

The India automotive air filter market is experiencing significant growth due to the increasing adoption of advanced filtration technologies. With stronger emissions rules and rising consumer awareness of air pollution, manufacturers are investing in high-efficiency particulate air (HEPA) filters, activated carbon filters, and nanofiber-based filtering systems. These sophisticated filters improve both engine efficiency and in-cabin air quality by capturing fine particulate matter (PM2.5 and PM10), allergies, and hazardous pollutants. India's growing air pollution levels have fueled this demand. According to a report by the Central Pollution Control Board (CPCB), air pollution in urban areas has increased by 15-20% over the last five years, directly impacting vehicle air filtration needs. Furthermore, government measures such as the Bharat Stage (BS) VI requirements, which went into effect in April 2020, have prompted automakers to include modern air filtration systems in order to fulfill rigorous emissions standards. As a result, the use of high-performance air filters has increased, with major manufacturers such as Tata Motors and Maruti Suzuki incorporating cutting-edge filtering systems into new vehicle models.

To get more information on this market Request Sample

Growth of the Electric Vehicle (EV) Sector and Sustainable Air Filters

The rapid expansion of India’s EV industry is driving significant changes in the automotive air filter market. While traditional internal combustion engine (ICE) vehicles require engine air filters, the focus in EVs is shifting towards high-efficiency cabin air filtration and thermal management air filters that enhance battery cooling and improve passenger comfort. India’s EV market is projected to grow at a CAGR of 57.23% from 2025 to 2033, with government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) II scheme supporting this growth. Leading manufacturers such as Tata Motors, Ola Electric, and Mahindra Electric are expanding their EV portfolios, thereby increasing demand for specialized air filtration systems. Additionally, there is a rising emphasis on environmentally friendly and biodegradable air filters. Conventional synthetic air filters add to plastic waste, therefore producers are developing filters made from organic fibers, plant-based materials, and recyclable components. Market giants such as Bosch and Mann+Hummel have produced sustainable air filters that improve filtering effectiveness while also reducing environmental impact. Furthermore, as consumers become more aware of in-cabin air pollution, the need for multi-layered HEPA cabin filters with antiviral and antibacterial capabilities rises. According to studies, over 60% of Indian customers choose automobiles equipped with modern air filtration systems, indicating a significant market trend toward cleaner, healthier in-cabin air quality solutions.

India Automotive Air Filter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, propulsion, vehicle type, and sales channel.

Type Insights:

- Air Intake Filters

- Cabin Air Filters

The report has provided a detailed breakup and analysis of the market based on the type. This includes air intake filters and cabin air filters.

Propulsion Insights:

- ICE and Hybrid Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes ICE and hybrid vehicles and electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

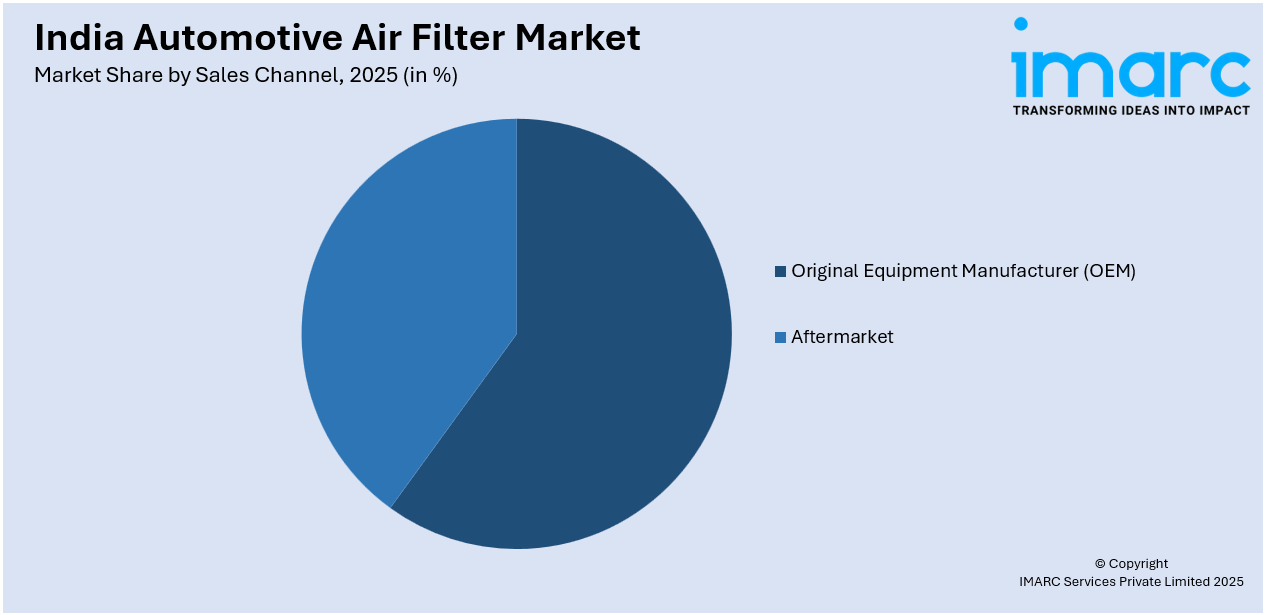

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturer (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturer (OEM) and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Air Filter Market News:

- June 2024: Uno Minda launched a new line of automotive cabin filters in the Indian aftermarket, aimed at improving air quality and enhancing the driving experience. The ₹639 filters come with a one-year warranty and may be purchased at a number of retail establishments.

- March 2024: Hengst Filtration unveiled its state-of-the-art facility in Yelahanka, Bengaluru. This expansion aims to meet the growing demand for air filtration systems across various industries, including automotive.

India Automotive Air Filter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Intake Filters, Cabin Air Filters |

| Propulsions Covered | ICE and Hybrid Vehicles, Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive air filter market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive air filter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive air filter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive air filter market in India was valued at USD 187.5 Million in 2025.

The automotive air filter market in India is projected to exhibit a CAGR of 4.09% during 2026-2034, reaching a value of USD 268.8 Million by 2034.

The growth of the India automotive air filter market is driven by increasing vehicle production, rising consumer awareness about engine maintenance, and stricter emission norms. Growth in aftermarket sales, expansion of service networks, and requirement for fuel-efficient vehicles are also contributing. Additionally, rising urban pollution and focus on in-cabin air quality are boosting the demand for high-performance air filters.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)