India Automotive Aluminum Market Size, Share, Trends and Forecast by Product Form, Vehicle Type, Application, and Region, 2025-2033

India Automotive Aluminum Market Overview:

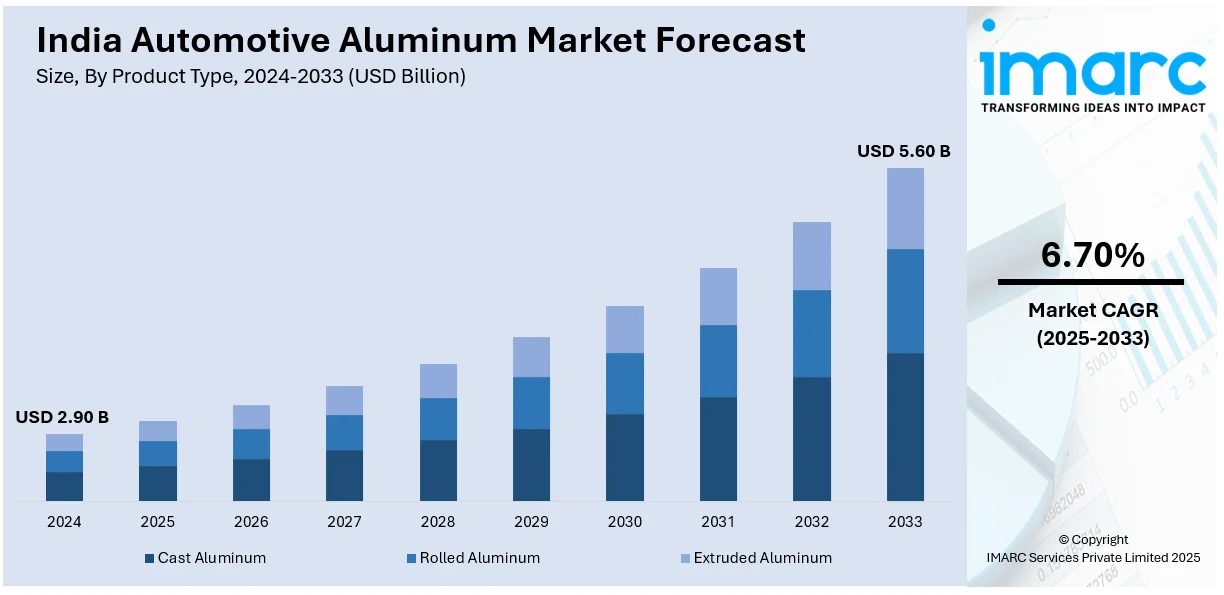

The India automotive aluminum market size reached USD 2.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.60 Billion by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is driven by the demand for lightweight vehicles to meet stricter fuel efficiency and emission norms, particularly in electric vehicles. Government initiatives including FAME and a focus on sustainability are augmenting the India automotive aluminum market share. Additionally, the expansion of aluminum recycling supports cost-effective and eco-friendly manufacturing practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.90 Billion |

| Market Forecast in 2033 | USD 5.60 Billion |

| Market Growth Rate 2025-2033 | 6.70% |

India Automotive Aluminum Market Trends:

Rising Demand for Lightweight Vehicles

The increasing demand for lightweight vehicles is creating a positive India automotive aluminum market outlook. With tightening environmental regulations and growing establishments on fuel economy, automotive manufacturers continue to leverage aluminum material to reduce the weight of the vehicle. Aluminum is about 40% lighter than steel and thus makes for an ideal material to manufacture parts such as engine blocks, wheels, and body panels. This is especially the case within electric vehicle (EV) manufacturing, as weight reduction is crucial for increasing battery range and performance. In addition, the Indian government's vision for cleaner, sustainable transportation through the implementation of programs, including the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) enhances the pace of aluminum usage in the automotive sector. According to a research report by the IMARC Group, the India electric vehicles market value was USD 2,361.0 Million in 2024. The market is also expected to reach USD 164,420.4 Million by 2033, growing at a rate of 57.23% CAGR between 2025 and 2033. As a result, aluminum consumption in the Indian automotive industry is expected to grow steadily over the next decade.

To get more information on this market, Request Sample

Expansion of Aluminum Recycling Initiatives

The growing emphasis on aluminum recycling is significantly supporting the India automotive aluminum market growth. With sustainability becoming a priority for both manufacturers and consumers, the automotive industry is increasingly focusing on recycling aluminum to reduce its carbon footprint. Recycled aluminum requires only 5% of the energy needed to produce primary aluminum, making it an environmentally friendly option. Automakers in India are collaborating with recycling firms to establish closed-loop systems, where scrap aluminum from end-of-life vehicles is collected, processed, and reused in new vehicle production. This trend is further supported by government policies promoting circular economy practices and waste management. As recycling technologies advance and awareness of sustainability grows, the use of recycled aluminum in the automotive sector is expected to rise, contributing to cost savings and environmental benefits. This trend aligns with global efforts to create a more sustainable automotive industry. On 11th September 2024, Novelis announced advancing the case for automotive aluminum recycling by producing alloys with high recycled content and enhancing the recovery of scrap from end-of-life vehicles. This could lead to an 83% reduction in greenhouse gases relative to primary aluminum production, with the potential to drive this number as high as 94% with further development. As 44 million electric vehicles are projected to be sold globally annually by 2035, aluminum recycling is key to the move toward sustainability. As the Indian automotive sector gravitates towards lighter and eco-friendly materials, the pioneering experience brought by Novelis will help accelerate our journey of aluminum reuse and reduce carbon footprints.

India Automotive Aluminum Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product form, vehicle type, and application.

Product Form Insights:

- Cast Aluminum

- Die-Casting

- Permanent Mold Casting

- Sand Casting

- Rolled Aluminum

- Aluminum Plate

- Aluminum Sheet

- Aluminum Foil

- Extruded Aluminum

The report has provided a detailed breakup and analysis of the market based on the product form. This includes cast aluminum (die-casting, permanent mold casting, and sand casting), rolled aluminum (aluminum plate, aluminum sheet, and aluminum foil), and extruded aluminum.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV).

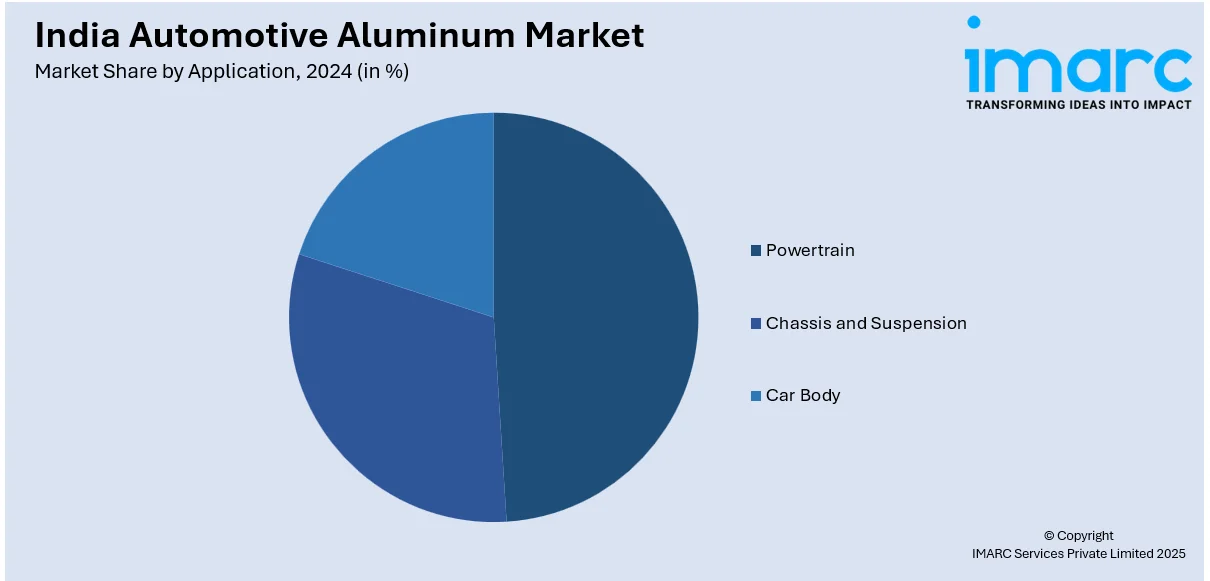

Application Insights:

- Powertrain

- Pistons

- Engine Blocks

- Fuel Systems

- Heat Shields

- Heat Exchangers

- Chassis and Suspension

- Suspension Parts

- Wheels

- Steering Systems

- Brake Systems

- Car Body

- Body Structure

- Roof and Trim

- Car Interiors

- Hang-On Parts

The report has provided a detailed breakup and analysis of the market based on the application. This includes powertrain (pistons, engine blocks, fuel systems, heat shields, and heat exchangers), chassis and suspension (suspension parts, wheels, steering systems, and brake systems), and car body (body structure, roof and trim, car interiors, and hang-on parts).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Aluminum Market News:

- April 24, 2024: Vedanta Aluminium hosted AutoEdge 2024 in New Delhi, where it highlighted the role of aluminium in India's growing automotive industry, which is expected to contribute about 15% of the GDP by 2031. Vedanta supplies hundreds of alloys, ingots and billets for electric vehicle innovations and sustainability, as electric vehicles utilise around 260 kg of aluminium physically per unit. The company is already a major player in the aluminium sector, producing 2.37 million tonnes of aluminium in 2024 alone and currently serves multiple industries, including the automotive sector, with low-carbon, high-performance aluminium solutions.

India Automotive Aluminum Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Forms Covered |

|

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive aluminum market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive aluminum market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive aluminum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive aluminum market in India was valued at USD 2.90 Billion in 2024.

The India automotive aluminum market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 5.60 Billion by 2033.

The market is driven by the rising demand for lightweight vehicles to improve fuel efficiency and meet stringent emission norms, coupled with increasing adoption of aluminum in electric vehicle manufacturing. Growth in automotive production, expanding infrastructure, and technological advancements in aluminum processing are further supporting market expansion, along with favorable government policies promoting sustainable mobility solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)