India Automotive Cabin Air Filter Market Size, Share, Trends and Forecast by Type, Vehicle Type, Distribution Channel, and Region, 2025-2033

India Automotive Cabin Air Filter Market Overview:

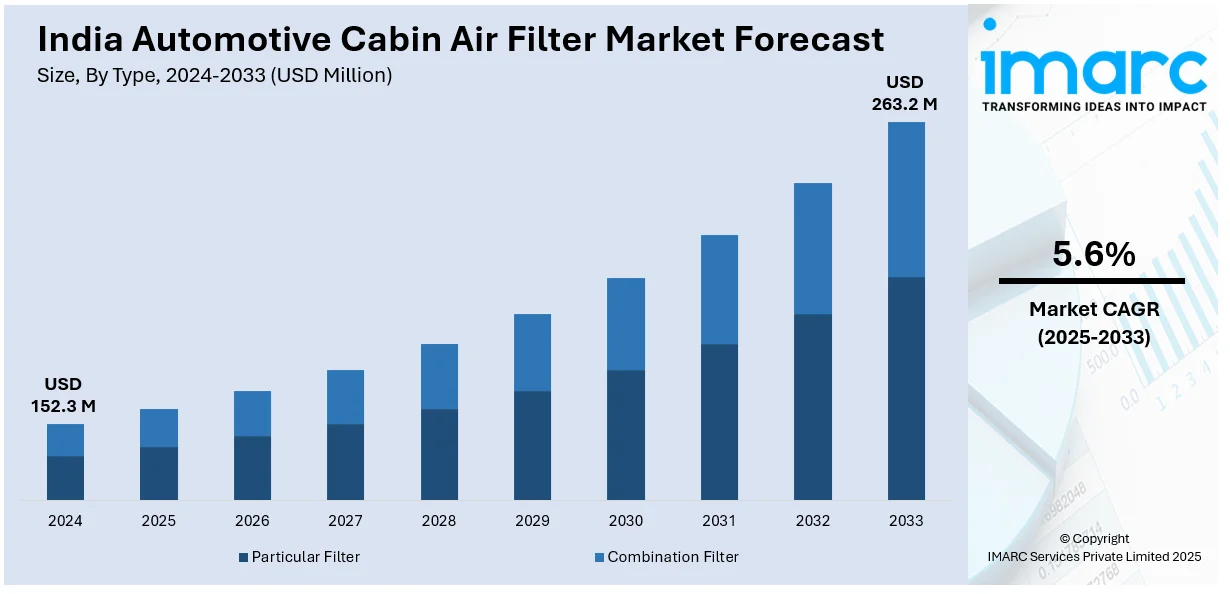

The India automotive cabin air filter market size reached USD 152.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 263.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market is growing steadily, by mounting air pollution issues, improving vehicle sales, and customer requirement for improved in-cabin air quality, as technical progress in filtration technology improves performance, efficiency, and long-term viability in passenger as well as commercial vehicle segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 152.3 Million |

| Market Forecast in 2033 | USD 263.2 Million |

| Market Growth Rate (2025-2033) | 5.6% |

India Automotive Cabin Air Filter Market Trends:

Growing Demand for High-Efficiency Cabin Air Filters

With increasing levels of air pollution in Indian cities, consumers are intensely focusing on vehicle cabin air quality. Consequently, demand has increased for efficient cabin air filters that can trap fine particulate matter (PM2.5 and PM10), allergens, and toxic gases. For instance, in June 2024, Uno Minda introduced high-performance cabin air filters in India, with high-efficiency media technology to eliminate contaminants, allergens, and odors, making in-car air cleaner and health hazards lower by enhancing overall air flow. Moreover, emerging filter technologies, including multi-layer filtration and electrostatically charged fibers, are becoming popular as they can effectively trap microscopic pollutants. In addition, antimicrobial and anti-odor filters with activated carbon layers are gaining popularity among health-conscious consumers. The trend towards superior and luxury vehicles in India is also driving the replacement of better filtration systems, as manufacturers incorporate advanced air cleaning technologies as a primary selling proposition. As public awareness regarding respiratory health and indoor air quality continues to increase, the requirement for cabin air filters that offer enhanced efficiency, and durability is likely to emerge steadily in all segments of vehicles in India.

To get more information on this market, Request Sample

Increasing Adoption of HEPA and Nano-Fiber Filtration

HEPA and nano-fiber technologies are picking up pace in the Indian automotive cabin air filter segment. These advanced filters provide greater air cleansing by capturing minute particles, such as dust, pollen, bacteria, and airborne viruses. With greater awareness among people about air purity, automobile companies are equipping mid-range and premium cars with HEPA-grade filters to further improve the in-cabin climate. Nano-fiber filtration, recognized for its incredibly thin fibers, which are known to deliver heightened breathability yet high filtration efficacy, is similarly being incorporated in next-generation air filters. Owing to their growing emphasis on driver and traveler well-being, these technologies have the potential to become mainstream within premium and electric vehicles (EVs). In addition, as global health issues fuel air filtration innovation, manufacturers are working to create affordable HEPA and nano-fiber solutions for mass-market cars in India, making advanced air purification systems more accessible.

Rising Preference for Eco-Friendly and Long-Lasting Filters

Sustainability is now becoming one of the drivers of purchasing decisions in the Indian automobile industry, fueling demand for cabin air filters that are environmentally friendly. Shoppers are buying filters with biodegradable or recyclable materials, lower environmental impact while maintaining performance, to which manufacturers are responding by designing with plant-based fibers and reusable filter components to increase product lifespan and decrease waste. For example, in September 2024, Fleetguard Filters Pvt Ltd was awarded the 'Iconic Brands of India 2024' award for its cutting-edge automotive filtration solutions, honored for innovation, sustainability, and leadership in the industry. Furthermore, durable filters with longer replacement cycles are becoming popular, with cost savings and convenience advantages for vehicle owners. With more regulatory focus on waste management and emissions from vehicles, sustainable filtration products are likely to be widely adopted. Vehicle manufacturers are also including intelligent filter monitoring systems that remind drivers when they need to replace them, in order to minimize unnecessary disposals and encourage environmentally friendly maintenance. As sustainability trends emerge, the demand for long-lasting and environmentally friendly cabin air filters is expected to increase in India's fast-growing automotive market.

India Automotive Cabin Air Filter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, vehicle type, and distribution channel.

Type Insights:

- Particular Filter

- Combination Filter

The report has provided a detailed breakup and analysis of the market based on the type. This includes particular filter, and combination filter.

Vehicle Type Insights:

- Passenger Car

- Hatchback

- Sedan

- SUV

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger car (hatchback, sedan, SUV), and commercial vehicle (light commercial vehicle, heavy commercial vehicle).

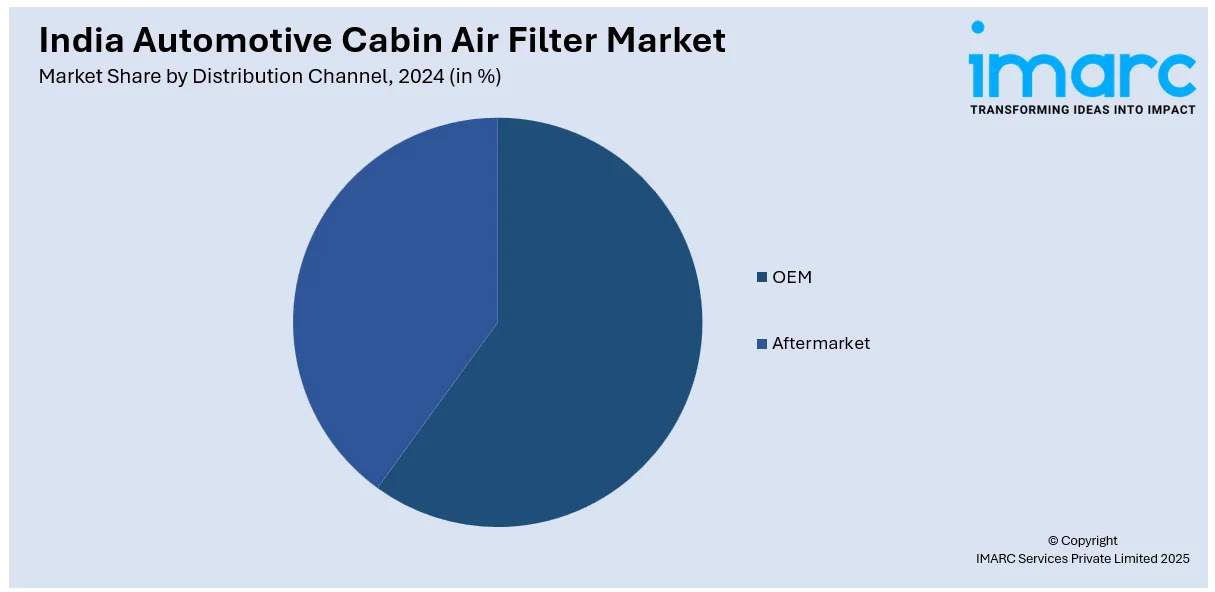

Distribution Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEM, and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Cabin Air Filter Market News:

- In October 2023, Toray Industries commenced production of air filters at its Sri City factory, India. The first integrated facility will promote local production of high-performance filters for automotive, building, and air purifiers, responding to India's increased demand for air quality solutions and complementing Toray's localization and sustainability strategy.

- In August 2024, Mann+Hummel introduced the Mann-Filter FreciousPlus, a nanofiber-based advanced cabin air filter. Designed for BMW 5 and 7 Series, it removes ultra-fine particles, allergens, and pollutants with ease. With patent protection, the innovation contributes to improving vehicle air quality and facilitating sustainability in automotive filtration.

India Automotive Cabin Air Filter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Particular Filter, Combination Filter |

| Vehicle Types Covered |

|

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive cabin air filter market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive cabin air filter market on the basis of type?

- What is the breakup of the India automotive cabin air filter market on the basis of vehicle type?

- What is the breakup of the India automotive cabin air filter market on the basis of distribution channel?

- What is the breakup of the India automotive cabin air filter market on the basis of region?

- What are the various stages in the value chain of the India automotive cabin air filter market?

- What are the key driving factors and challenges in the India automotive cabin air filter market?

- What is the structure of the India automotive cabin air filter market and who are the key players?

- What is the degree of competition in the India automotive cabin air filter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive cabin air filter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive cabin air filter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive cabin air filter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)