India Automotive Components Market Size, Share, Trends and Forecast by Vehicle Type, Component, Demand Category, and Region, 2026-2034

India Automotive Components Market Summary:

The India automotive components market size was valued at USD 58.21 Billion in 2025 and is projected to reach USD 82.67 Billion by 2034, growing at a compound annual growth rate of 3.97% from 2026-2034.

The India automotive components market is witnessing robust expansion, driven by the country's position as one of the world's largest automotive markets. The sector benefits from rising vehicle production volumes, growing middle-class population with increasing purchasing power, and supportive government policies promoting domestic manufacturing. The expanding network of original equipment manufacturers, coupled with strengthening aftermarket demand, is accelerating component production across multiple categories. Furthermore, the shift towards electric mobility, adoption of advanced manufacturing technologies, and emphasis on localization are reshaping the competitive dynamics. Strategic investments in research and development (R&D) activities, integration of lightweight materials, and enhanced export capabilities are collectively driving the market share.

Key Takeaways and Insights:

-

By Vehicle Type: Passenger cars dominate the market with a share of 35% in 2025, driven by rising urban population, expanding middle-class income levels, and growing consumer preferences for personal mobility options that provide comfort, safety attributes, and fuel economy.

-

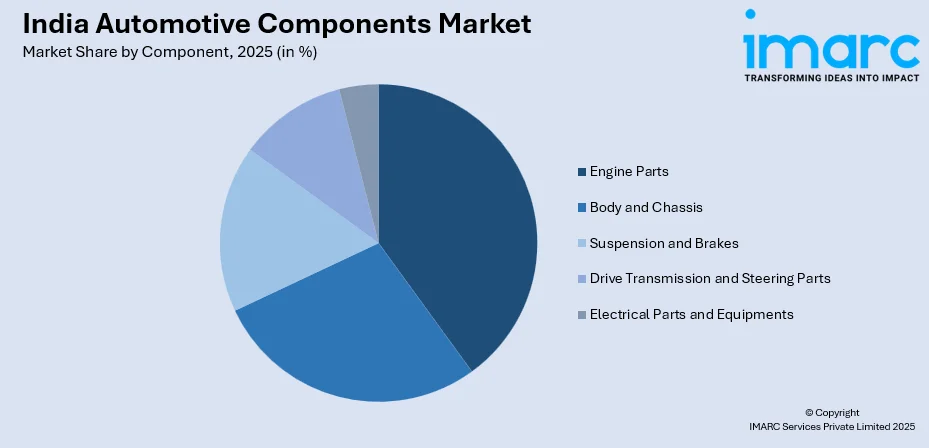

By Component: Engine parts lead the market with a share of 28% in 2025, owing to consistent demand from vehicle production facilities, ongoing technological advancements in powertrain systems, and the critical role of engine components in determining overall vehicle performance and efficiency.

-

By Demand Category: OEM comprises the biggest segment with a market share of 60% in 2025, reflecting the strong vehicle manufacturing ecosystem in India with direct supply relationships between component manufacturers and automakers ensuring quality standards and production efficiency.

-

By Region: North India represents the largest region with 31% share in 2025, driven by the concentration of major automotive manufacturing hubs in Delhi NCR, Haryana, and Uttar Pradesh, along with well-established supplier networks and robust infrastructure connectivity.

-

Key Players: Leading manufacturers in the India automotive components market are focusing on expanding production capacities, investing in advanced manufacturing technologies, and strengthening partnerships with global automakers. Their strategic emphasis on electric vehicle (EV) component development, localization initiatives, and aftermarket expansion is accelerating market growth.

.webp)

To get more information on this market Request Sample

The India automotive components market is advancing, as manufacturers embrace technological innovations and expand their global footprint. The sector has emerged as a critical pillar of the manufacturing economy, with the industry achieving a record turnover of Rs 6.14 Lakh Crore (USD 74.1 Billion) in FY2024, representing a 9.8% increase from 2023, according to the Automotive Component Manufacturers Association of India (ACMA). The transition towards electric mobility is creating substantial demand for specialized components, including battery management systems, power electronics, and electric drivetrains. Government initiatives are encouraging investments in advanced automotive technology manufacturing. Additionally, the growing emphasis on lightweight materials, emission compliance, and fuel efficiency is propelling R&D activities. Export growth, coupled with strategic acquisitions and joint ventures, is positioning India as a preferred destination for automotive component sourcing globally.

India Automotive Components Market Trends:

Surge in EV Component Manufacturing

The India automotive components market is experiencing a significant shift towards EV component production, as manufacturers scale up capabilities to meet rising demand. With the government targeting 30% EV adoption by 2030, companies are investing heavily in developing battery packs, power electronics, and electric drivetrains. Firms are actively developing indigenous battery management systems to reduce import dependency. The localization of lithium-ion battery production is expected to lower component costs substantially, making EVs more affordable and accelerating India automotive components market growth.

Adoption of Lightweight Materials in Component Manufacturing

The increasing emphasis on fuel efficiency and emissions reduction is accelerating the adoption of lightweight materials, such as aluminum, carbon fiber composites, and high-strength steel, across automotive component manufacturing. As India's fuel efficiency norms tighten, automakers are mandating suppliers to reduce component weight while maintaining structural integrity. Companies are investing in high-strength aluminum alloys for engine parts and body structures. The integration of biodegradable interior components by leading automakers demonstrates the sector's commitment to sustainable manufacturing practices.

Digital Transformation and Industry 4.0 Integration

The automotive components sector is witnessing accelerated adoption of digital technologies and smart manufacturing solutions to enhance production efficiency and quality standards. As per IMARC Group, the India automotive software market size reached USD 764.9 Million in 2024, driving demand for advanced electronic components and connected systems. Manufacturers are implementing automated production lines, data analytics platforms, and artificial intelligence (AI) solutions to optimize operations. This digital transformation is enabling component makers to transition from traditional hardware suppliers to integrated technology partners in the mobility ecosystem.

Market Outlook 2026-2034:

The India automotive components market is positioned for sustained growth through the forecast period, supported by rising vehicle production volumes and expanding export opportunities. The market generated a revenue of USD 58.21 Billion in 2025 and is projected to reach a revenue of USD 82.67 Billion by 2034, growing at a compound annual growth rate of 3.97% from 2026-2034. The sector is expected to benefit from enhanced localization efforts, particularly in EV components, as manufacturers aim to capture opportunities arising from global supply chain diversification. Government support through policy initiatives and incentive programs will continue to attract investments and strengthen India's position as a global automotive component manufacturing hub.

India Automotive Components Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Vehicle Type | Passenger Cars | 35% |

| Component | Engine Parts | 28% |

| Demand Category | OEM | 60% |

| Region | North India | 31% |

Vehicle Type Insights:

- Passenger Cars

- Two-Wheelers

- Three-Wheelers

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Off the Road Vehicles

Passenger cars dominate with a market share of 35% of the total India automotive components market in 2025.

The passenger car segment commands the largest share of the India automotive components market, driven by sustained growth in vehicle sales and expanding production capacities of domestic and international automakers. In FY25, domestic passenger vehicle sales reached 43 Lakh units, reflecting strong consumer demand. The segment benefits from the growing preferences for personal mobility solutions, particularly in urban and semi-urban areas where improved road infrastructure is encouraging vehicle ownership.

Rising disposable incomes and availability of financing options are making passenger cars more accessible to a wider consumer base. Automakers are also increasing localization of components to reduce costs and enhance supply chain resilience, boosting demand for domestic suppliers. The shift towards advanced features, such as infotainment systems, safety technologies, and fuel-efficient powertrains, further supports component consumption. Additionally, increasing adoption of electric and hybrid passenger vehicles is creating new opportunities for high-value components, strengthening the segment’s long-term market leadership.

Component Insights:

Access the comprehensive market breakdown Request Sample

- Engine Parts

- Body and Chassis

- Suspension and Brakes

- Drive Transmission and Steering Parts

- Electrical Parts and Equipments

Engine parts lead with a share of 28% of the total India automotive components market in 2025.

Engine parts represent the largest component category in the India automotive components market, driven by consistent demand from vehicle production facilities and the critical role these components play in vehicle performance. The segment encompasses pistons, crankshafts, cylinder heads, engine blocks, and valve train components. In April 2024, Ramkrishna Forgings Limited secured a significant contract to supply powertrain components to Tesla, highlighting India's growing capabilities in precision engine component manufacturing for global EV makers.

The engine parts segment is witnessing transformation, as manufacturers adapt to changing powertrain technologies. While internal combustion engine components continue to dominate current demand, companies are investing in developing components for electric and hybrid powertrains to ensure long-term relevance and competitiveness. Advanced manufacturing techniques, such as precision forging and lightweight alloys, are improving efficiency and quality. Export demand for high-performance engine and powertrain components is also rising, strengthening the segment’s contribution to overall market growth.

Demand Category Insights:

- OEM

- Replacement

OEM exhibits a clear dominance with a 60% share of the total India automotive components market in 2025.

The OEM segment leads the India automotive components market, reflecting the robust vehicle manufacturing ecosystem and established supply relationships between component manufacturers and automakers. OEM components are specifically designed to meet exact vehicle specifications, ensuring optimal fit, performance, and quality standards. As per SIAM, in July 2025, overall vehicle manufacturing, including passenger vehicles, two-wheelers, three-wheelers, and quadricycles, hit 26.98 lakh units, marking a 10.7% increase from the 24.37 lakh units recorded in July 2024, driving substantial demand for OEM-grade components across categories.

The OEM segment benefits from long-term supply agreements, collaborative product development initiatives, and integrated quality management systems. Major component manufacturers maintain dedicated production lines for OEM customers. Government schemes are further strengthening OEM manufacturing capabilities by encouraging investments in advanced automotive technology components and supporting localization of critical systems. Increasing adoption of EVs is prompting OEMs to source more technologically advanced and high-value components from domestic suppliers.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the leading region with a 31% share of the total India automotive components market in 2025.

North India leads the India automotive components market due to the strong concentration of automotive manufacturing hubs across Delhi, Haryana, Uttar Pradesh, Rajasthan, and Punjab. Delhi experienced a modest increase in vehicle registrations in 2024 in comparison to 2023. In 2024, the registration reached 7,09,024 vehicles, marking a 7.8% rise from 6,57,954 in 2023. The region hosts major vehicle assembly plants and dense networks of tier-1 and tier-2 component suppliers, enabling efficient supply chain integration. Well-developed industrial corridors, proximity to the NCR, and access to skilled engineering talent support large-scale component production. Robust road, rail, and logistics infrastructure further enhances the region’s attractiveness for automotive manufacturing investments.

Additionally, North India benefits from proactive state-level industrial policies, availability of land, and established export connectivity through ports and freight corridors. Rising investments in EV manufacturing, especially around NCR and adjoining states, are expanding demand for advanced automotive components. The presence of research centers, testing facilities, and strong aftermarket demand also strengthens the region’s leadership, positioning North India as a critical hub for both domestic consumption and export-oriented automotive component production.

Market Dynamics:

Growth Drivers:

Why is the India Automotive Components Market Growing?

Localization and ‘Make in India’ Manufacturing Push

The Indian market for automotive components is being considerably strengthened by government policies that support domestic manufacture. Reducing reliance on imports, strengthening supply chain resilience, and promoting domestic value creation are the goals of policies that promote localization. In order to control prices, reduce transportation risks, and adhere to local sourcing standards, automakers are increasingly sourcing components locally. In response, component makers are making investments in cutting-edge equipment, process automation, and OEM-compliant quality certifications. Localization includes electronics, safety systems, and powertrain components in addition to conventional mechanical pieces. In order to satisfy growing OEM demands, tier-1 and tier-2 suppliers are increasing their capabilities. Additionally, this manufacturing drive helps technology transfer, skill development, and job creation. India is becoming a major hub for the production of automobile components due to strong legislative support and industrial incentives.

Transition Towards EVs Hybrid Vehicles (HVs)

The gradual shift towards EVs and HVs is reshaping India’s automotive components landscape. As per IMARC Group, the India EV market size was valued at USD 3,712.15 Million in 2025. While internal combustion engine components continue to dominate current demand, EV adoption is creating new component categories, such as battery packs, thermal management systems, power electronics, and electric drivetrains. This transition expands the overall component market rather than replacing existing demand immediately. Suppliers investing early in EV-related technologies gain long-term strategic advantages. Automakers prefer localized EV component sourcing to manage costs and ensure scalability. HVs further sustain demand for both conventional and electric components simultaneously. The evolving powertrain mix encourages innovation, diversification, and higher value addition among component manufacturers. Over time, EV penetration will significantly increase the technological depth and revenue potential of the Indian automotive components market.

Technological Advancements and Industry 4.0 Adoption

Rapid adoption of advanced manufacturing technologies is driving efficiency and competitiveness across the automotive components market. Automation, robotics, computer numerical control (CNC) machining, and additive manufacturing are improving precision, consistency, and production speed. Industry 4.0 practices enable real-time monitoring, predictive maintenance, and optimized inventory management. Digital quality inspection systems reduce defects and enhance compliance with stringent OEM standards. These technologies allow manufacturers to scale operations while controlling costs and improving margins. Advanced manufacturing also shortens product development cycles, enabling faster response to evolving vehicle designs. As OEMs demand higher safety, performance, and sustainability standards, technology-led manufacturing continues to be a critical growth driver for the Indian automotive components industry. Additionally, increased use of data analytics and digital twins supports process optimization, energy efficiency, and continuous improvement across component manufacturing facilities.

Market Restraints:

What Challenges the India Automotive Components Market is Facing?

Volatility in Raw Material Prices

For automobile component producers, cost instability is created due to frequent changes in the pricing of steel, aluminum, copper, and alloys. Margins are strained since many suppliers work under long-term OEM contracts with little flexibility in pricing pass-through. Because smaller businesses have less negotiating strength, they are particularly vulnerable. The sector's profitability and financial sustainability are ultimately impacted by unpredictable input costs, which make pricing strategies, investment planning, and budgeting more difficult.

Supply Chain Disruptions and Import Dependency

Indian component manufacturers continue to rely on imports for electronics, semiconductors, and specialty materials despite the growing localization. Lead times are prolonged when supply flows are disrupted by global disruptions, shipping delays, and geopolitical tensions. These challenges disrupt just-in-time manufacturing models and increase inventory holding costs. Production timelines, customer obligations, and working capital efficiency are impacted by supply uncertainty, which causes operational stress throughout the value chain.

High Capital and Technology Investment Requirements

Meeting evolving OEM standards requires continuous investments in automation, precision machinery, and digital manufacturing systems. High capital expenditure and long payback periods pose challenges, especially for micro, small and medium enterprises (MSMEs) with limited access to affordable financing. Rising interest costs further restrict expansion plans. This financial pressure can delay technology upgrades, reduce competitiveness, and limit the ability to scale operations effectively.

Competitive Landscape:

The India automotive components market features a competitive landscape comprising established domestic manufacturers, global tier-one suppliers, and emerging specialized players. The sector includes numerous active companies, ranging from large corporations to micro enterprises, across manufacturing clusters nationwide. Competition is intensifying as manufacturers expand production capacities, invest in advanced technologies, and pursue strategic acquisitions to strengthen market positions. Companies are focusing on diversifying product portfolios, enhancing R&D capabilities, and forming joint ventures to access new technologies and markets. The emphasis on EV component manufacturing and export market development is reshaping competitive dynamics, encouraging innovations and operational excellence across the value chain.

India Automotive Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Two-Wheelers, Three-Wheelers, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Off the Road Vehicles |

| Components Covered | Engine Parts, Body and Chassis, Suspension and Brakes, Drive Transmission and Steering Parts, Electrical Parts and Equipments |

| Demand Categories Covered | OEM, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India automotive components market size was valued at USD 58.21 Billion in 2025.

The India automotive components market is expected to grow at a compound annual growth rate of 3.97% from 2026-2034 to reach USD 82.67 Billion by 2034.

Passenger cars dominated the market with a share of 35%, driven by rising urban population, expanding middle-class income levels, and growing preferences for personal mobility solutions offering comfort and fuel efficiency.

Key factors driving the India automotive components market include rising vehicle production volumes, supportive government policies, growing EV adoption, expanding export opportunities, and increasing localization of component manufacturing.

Major challenges include supply chain disruptions affecting raw material availability, dependency on imports for critical components, raw material price volatility, technology transition requirements, and substantial capital investments needed for EV component manufacturing capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)