India Automotive Electronics Market Size, Share, Trends and Forecast by Component, Vehicle Type, Distribution Channel, Application, and Region, 2025-2033

India Automotive Electronics Market Overview:

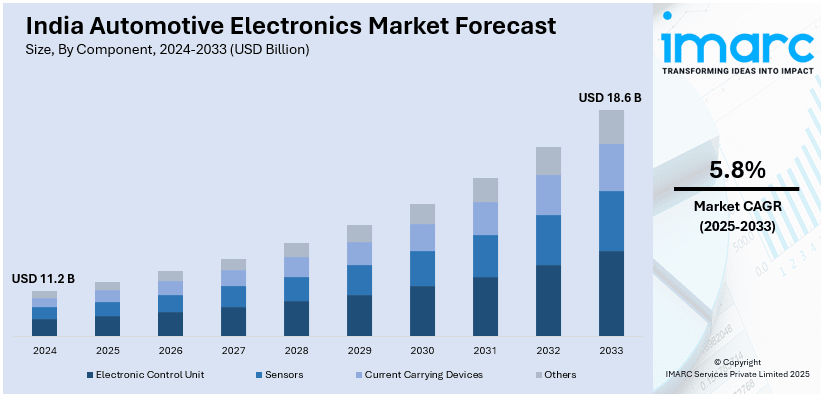

The India automotive electronics market size reached USD 11.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.8% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for advanced driver assistance systems in passenger vehicles and surge in electric vehicle electronics and battery management systems (BMS).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.2 Billion |

| Market Forecast in 2033 | USD 18.6 Billion |

| Market Growth Rate (2025-2033) | 5.8% |

India Automotive Electronics Market Trends:

Rising Demand for Advanced Driver Assistance Systems (ADAS) in Passenger Vehicles

The rising awareness of consumers, increase in disposable incomes with rise in income levels by the government rules on safety on roads are further contributing to the growth in the adoption of Advanced Driver Assistance Systems (ADAS) in India automotive electronics. Features such as adaptive cruise control, lane departure warning, automatic emergency braking, and blind-spot detection are increasingly in demand, especially in premium and mid-segment passenger vehicles. For instance, in March 2024, Honda Cars India announced surpassing 50,000 ADAS-enabled vehicles, advancing its ‘Safety for Everyone’ vision and aiming to eliminate traffic-related fatalities involving Honda vehicles by 2050, as stated in its media release. Government initiatives such as the Bharat NCAP (New Car Assessment Program) are pushing automakers to integrate safety technologies that enhance vehicle crashworthiness and occupant protection. Furthermore, the Ministry of Road Transport and Highways (MoRTH) has been actively working on making electronic stability control (ESC) and autonomous braking systems mandatory in upcoming models. The expansion of autonomous and connected vehicle ecosystems is also contributing to ADAS penetration. Automakers and Tier 1 suppliers are investing in sensor fusion, LiDAR, and radar-based safety features, enabling real-time hazard detection and accident prevention. As costs decline due to localization efforts and economies of scale, ADAS adoption is expected to expand beyond premium vehicles into mass-market segments, making India a key growth hub for automotive electronics innovation.

To get more information on this market, Request Sample

Surge in Electric Vehicle (EV) Electronics and Battery Management Systems (BMS)

The fast expansion of the electric vehicle (EV) market in India has been triggering huge demand for automotive electronics, especially regarding Battery Management Systems (BMS), power electronics, and motor control units. With the government foreseeing a rapid increase in the adoption of EVs through schemes such as FAME II and PLI, automobile manufacturers and component firms are investing heavily in EV-specific electronic components. For instance, according to industry reports, in FY 2024, India’s EV market increased 80% YoY, given that an increasing customer interest in EVs was stimulated by the growing charging infrastructure, greater awareness of sustainability, and advances in EV technology, pushing electric mobility closer to mainstream acceptance. Battery Management Systems (BMS) are gaining prominence as they optimize battery performance, enhance safety, and extend battery life. Given India’s diverse climate conditions, advanced BMS solutions that regulate temperature, voltage, and current are crucial for ensuring the longevity and efficiency of lithium-ion batteries used in two-wheelers, passenger vehicles, and commercial EVs. Additionally, charging infrastructure electronics such as DC fast chargers, vehicle-to-grid (V2G) integration systems, and onboard chargers are seeing increased investment. Domestic manufacturing of semiconductors, power inverters, and charging control units is also gaining traction, reducing dependency on imports. As automakers focus on developing cost-effective yet high-performance EV electronics, the market is expected to witness sustained growth, positioning India as a key player in global EV technology advancements.

India Automotive Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, vehicle type, distribution channel, and application.

Component Insights:

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes electronic control unit, sensors, current carrying devices, and others.

Vehicle Type Insights:

- Light Commercial Vehicles

- Passenger Vehicles

- Heavy Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes light commercial vehicles, passenger vehicles, heavy commercial vehicles, and others

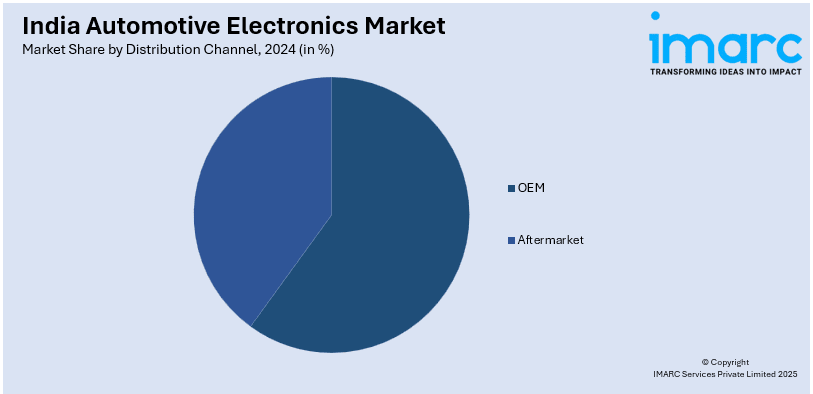

Distribution Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket.

Application Insights:

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes ADAS, infotainment, body electronics, safety systems, and powertrain.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive electronics Market News:

- In March 2025, Infineon Technologies Asia Pacific Pte Ltd and The Automotive Research Association of India (ARAI) signed an MoU to develop advanced semiconductor solutions for India's automotive sector, focusing on EV inverters, vehicle control units, and ADAS technologies like Automated Emergency Braking (AEB), Blind Spot Detection (BSD), and Lane Keep Assist (LKA) to accelerate EV and autonomous driving adoption.

- In January 2025, SEG Automotive introduced advanced e-mobility solutions for India and global markets, featuring 800-volt components and Light Electric Mobility (LEM) solutions for two-, three-, and four-wheelers. The high-voltage platform supports up to 800 volts and 150 kW, offering flexible component and system solutions with integrated electronics and software.

India Automotive electronics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Electronic Control Unit, Sensors, Current Carrying Devices, Others |

| Vehicle Types Covered | Light Commercial Vehicles, Passenger Vehicles, Heavy Commercial Vehicles, and Others |

| Distribution Channels Covered | OEM, Aftermarket |

| Applications Covered | ADAS, Infotainment, Body Electronics, Safety Systems, Powertrain |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive electronics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive electronics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive electronics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive electronics market in India was valued at USD 11.2 Billion in 2024.

The India automotive electronics market is projected to exhibit a CAGR of 5.8% during 2025-2033, reaching a value of USD 18.6 Billion by 2033.

The India automotive electronics market is driven by factors such as growing vehicle production, increasing demand for advanced safety and infotainment systems, government regulations promoting electric vehicles (EVs), and technological advancements in autonomous driving. Additionally, rising urban developments is contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)