India Automotive Glass for Windshield Market Size, Share, Trends and Forecast by Product Type, Glass Type, Vehicle Type, Distribution Channel, and Region, 2025-2033

India Automotive Glass for Windshield Market Overview:

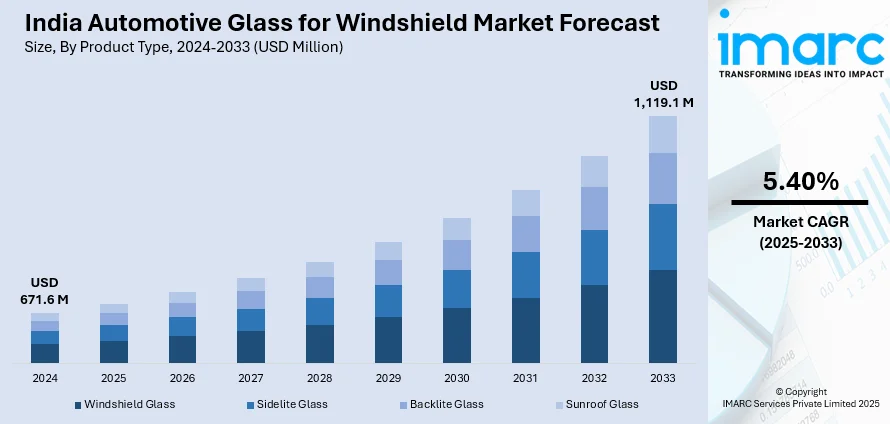

The India automotive glass for windshield market size reached USD 671.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,119.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The market is expanding steadily, driven by rising vehicle production, increasing safety regulations, and demand for advanced glazing technologies. Growth in electric vehicles and premium cars is boosting the adoption of laminated and smart windshields. These trends are positively influencing product innovation and OEM demand, shaping the India automotive glass for windshield market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 671.6 Million |

| Market Forecast in 2033 | USD 1,119.1 Million |

| Market Growth Rate 2025-2033 | 5.40% |

India Automotive Glass for Windshield Market Trends:

Growth in Automotive Production and Sales

India’s expanding automotive sector is a primary driver of the windshield glass market. Rising income levels, urbanization, and increased mobility needs are boosting vehicle demand across passenger, commercial, and electric segments. As vehicle production grows, so does the demand for high-quality windshields that meet safety and performance standards. According to the IBEF, in FY25, the market shares of two-wheelers and passenger cars were 75.04% and 21.38%, respectively. During FY25 (April-September), the aggregate output of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles amounted to 1,56,22,388 units. With 1,00,000 EVs sold in CY24 compared to 82,688 in CY23, India achieved a notable milestone. OEMs are ramping up capacity to meet domestic and export requirements, creating a strong pull for windshield suppliers. Additionally, government initiatives like “Make in India” and production-linked incentive (PLI) schemes for the automobile sector are further stimulating manufacturing activity. This upward trend directly translates to increased consumption of automotive glass, making production volume a key India automotive glass for windshield market growth factor.

To get more information on this market, Request Sample

Stringent Safety Regulations and Standards

The Indian government’s tightening of automotive safety regulations has significantly influenced windshield design and material standards. Rules mandating the use of laminated glass for front windshields and crash safety compliance have increased demand for durable, high-performance glazing solutions. Automakers are now required to integrate features like better impact resistance and shatterproof glass, especially in passenger vehicles. This shift is prompting both OEMs and aftermarket players to upgrade their offerings. Moreover, the increased adoption of airbags and structural reinforcements around windshields further pushes the need for compliant, strong glass. These evolving safety norms ensure that windshield glass is no longer a basic component but a critical safety feature.

Technological Advancements and Smart Features

Modern windshields are evolving from passive components to multifunctional surfaces integrated with advanced technologies. Features like heads-up displays (HUDs), rain sensors, solar control glazing, acoustic insulation, and embedded cameras for ADAS (Advanced Driver Assistance Systems) are becoming increasingly popular, especially in premium and electric vehicles. The trend toward smart, connected cars is compelling manufacturers to invest in high-quality, tech-enabled glass solutions. In India, OEMs are gradually incorporating such features to meet evolving consumer expectations and global standards. These innovations enhance driver comfort, safety, and energy efficiency, leading to rising demand for technologically advanced windshield glass, particularly in the mid-to-high-end vehicle segments.

India Automotive Glass for Windshield Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, glass type, vehicle type, and distribution channel.

Product Type Insights:

- Windshield Glass

- Sidelite Glass

- Backlite Glass

- Sunroof Glass

The report has provided a detailed breakup and analysis of the market based on the product type. This includes windshield glass, sidelite glass, backlite glass, and sunroof glass.

Glass Type Insights:

- Tempered Glass

- Laminated Glass

- Float Glass

- UVA/UVB Coated Glass

A detailed breakup and analysis of the market based on the glass type have also been provided in the report. This includes tempered glass, laminated glass, float glass, and UVA/UVB coated glass.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Heavy-Duty Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, two-wheelers, and heavy-duty vehicles

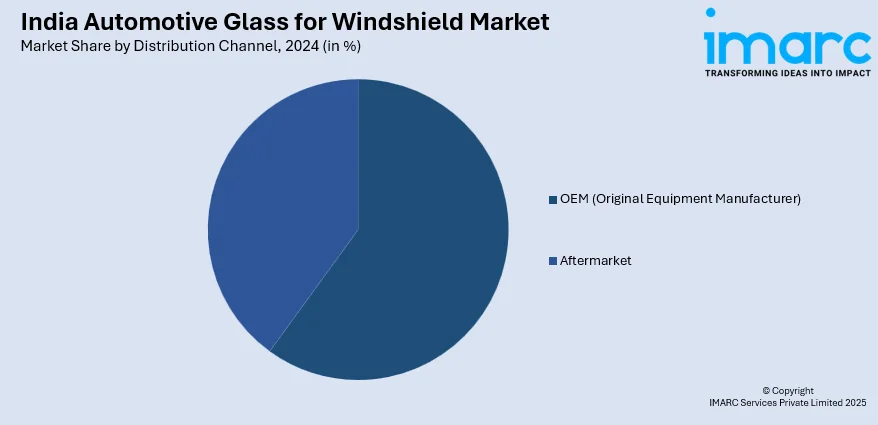

Distribution Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Glass for Windshield Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Windshield Glass, Sidelite Glass, Backlite Glass, Sunroof Glass |

| Glass Types Covered | Tempered Glass, Laminated Glass, Float Glass, UVA/UVB Coated Glass |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles |

| Distribution Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive glass for windshield market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive glass for windshield market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive glass for windshield industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive glass for windshield market in India was valued at USD 671.6 Million in 2024.

The India automotive glass for windshield market is projected to exhibit a CAGR of 5.40% during 2025-2033, reaching a value of USD 1,119.1 Million by 2033.

The India automotive glass for windshield market is driven by rising vehicle production, increasing preference for advanced safety features, stricter government safety regulations, growth in premium and electric vehicles (EVs), and technological advancements in laminated and tempered glass to enhance durability, visibility, and passenger protection.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)