India Automotive Lighting Market Size, Share, Trends and Forecast by Technology, Vehicle Type, Sales Channel, Application, and Region, 2025-2033

Market Overview:

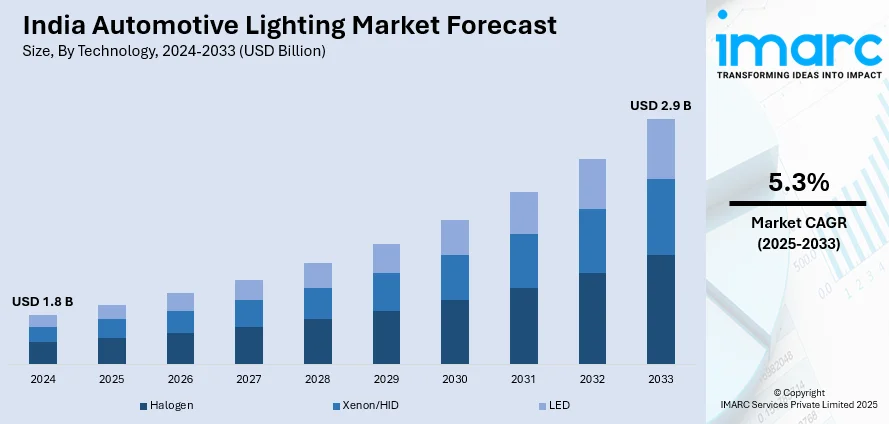

India automotive lighting market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The ongoing advancements in lighting technologies, such as LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode), which contribute to improved efficiency, visibility, and design possibilities, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.8 Billion |

|

Market Forecast in 2033

|

USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 5.3% |

Automotive lighting refers to the integrated systems designed to illuminate vehicles for visibility, safety, and aesthetic purposes. Headlights, taillights, and auxiliary lights constitute key components in this system. Headlights play a pivotal role in providing forward visibility for drivers, ensuring safe navigation during low-light conditions. Taillights, positioned at the rear of vehicles, enhance visibility to other road users, especially in braking situations. Additionally, automotive lighting includes turn signals, fog lights, and interior lighting, contributing to comprehensive vehicle illumination. Recent advancements in automotive lighting technology include the widespread adoption of LED and xenon lights, offering energy efficiency and improved brightness. Moreover, adaptive lighting systems adjust the direction and range of headlights based on driving conditions, enhancing safety. Automotive lighting not only serves functional purposes but also contributes to the vehicle's overall design, reflecting the industry's continuous pursuit of safety, efficiency, and aesthetics in modern automobile engineering.

To get more information on this market, Request Sample

India Automotive Lighting Market Trends:

The automotive lighting market in India is experiencing significant growth, driven by several key factors. Firstly, the increasing emphasis on safety in the automotive industry has spurred the demand for advanced lighting technologies. LED and adaptive lighting systems, for instance, enhance visibility and contribute to overall road safety. Additionally, stringent government regulations mandating the incorporation of energy-efficient lighting solutions have steered automakers towards adopting innovative lighting technologies. Moreover, the growing consumer preference for aesthetically pleasing and distinctive vehicle designs has fueled the demand for advanced lighting designs and features. Manufacturers are incorporating dynamic lighting elements and customizable options to cater to consumer preferences. Furthermore, the rise of electric vehicles (EVs) has presented new opportunities for the automotive lighting market. EV manufacturers are leveraging lighting technologies to enhance the unique characteristics of electric vehicles, contributing to the overall market expansion. Furthermore, the integration of smart lighting systems and connectivity features in modern vehicles is playing a pivotal role in driving market growth. The convergence of lighting with other automotive technologies, such as autonomous driving and advanced driver-assistance systems (ADAS), has created a synergistic effect, propelling the automotive lighting market forward. In conclusion, a combination of safety regulations, consumer preferences, the electric vehicle trend, and technological integration are acting as powerful drivers in the dynamic landscape of the automotive lighting market in India.

India Automotive Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, vehicle type, sales channel, and application.

Technology Insights:

- Halogen

- Xenon/HID

- LED

The report has provided a detailed breakup and analysis of the market based on the technology. This includes halogen, xenon/HID, and LED.

Vehicle Type Insights:

- Passenger Vehicle

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger vehicle and commercial vehicle.

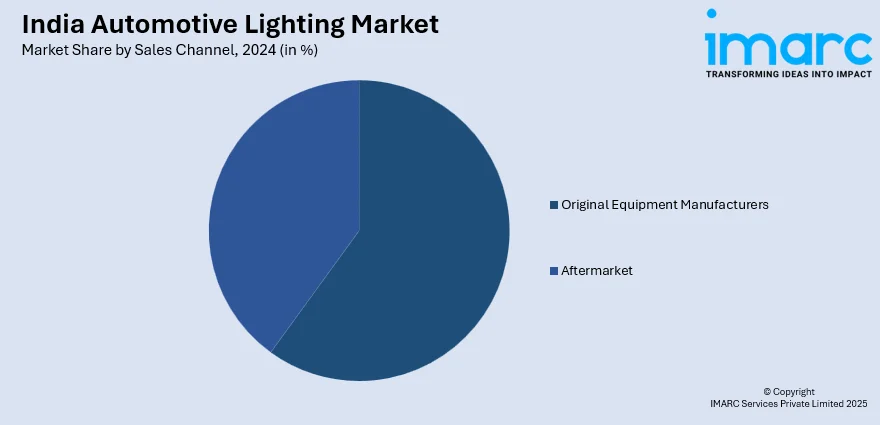

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturers and aftermarket.

Application Insights:

- Front Lighting/Headlamps

- Rear Lighting

- Side Lighting

- Interior Lighting

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes front lighting/headlamps, rear lighting, side lighting, and interior lighting.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Halogen, Xenon/HID, LED |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Applications Covered | Front Lighting/Headlamps, Rear Lighting, Side Lighting, Interior Lighting |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive lighting market in India was valued at USD 1.8 Billion in 2024.

The India automotive lighting market is projected to exhibit a CAGR of 5.3% during 2025-2033, reaching a value of USD 2.9 Billion by 2033.

The market is being led by growing vehicle manufacture, roadway safety needs, and the shift to power-efficient light emitting diode (LED) technology. People are highly looking for aesthetic and adaptive lights. Safety regulations by the government, technology improvement in headlamps and signaling, and the expanding electric vehicle (EV) ecosystem also speed up lighting evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)