India Automotive Refinish Coatings Market Size, Share, Trends, and Forecast by Resin Type, Product Type, Technology, Vehicle Type, and Region, 2025-2033

India Automotive Refinish Coatings Market Overview:

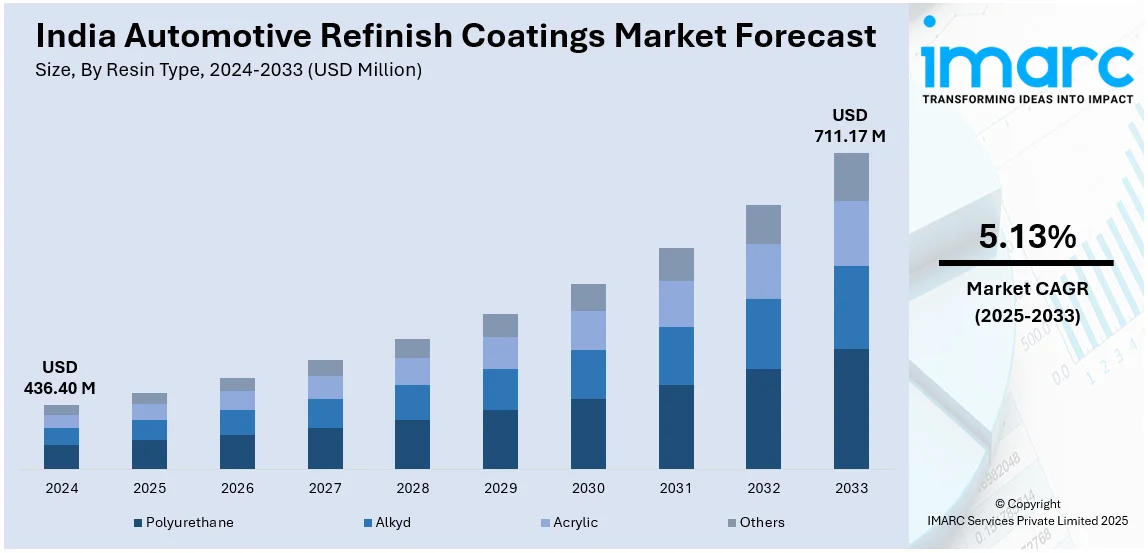

The India automotive refinish coatings market size reached USD 436.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 711.17 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The market is witnessing significant growth, driven by the increasing shift towards waterborne coatings and significant technological advancements in coating products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 436.40 Million |

| Market Forecast in 2033 | USD 711.17 Million |

| Market Growth Rate 2025-2033 | 5.13% |

India Automotive Refinish Coatings Market Trends:

Shift Towards Waterborne Coatings

Growing tendency towards waterborne coatings is emerging as one of the prominent trends in India automotive refinish coatings market. As environmental factors increase and governmental pressures intensify, both manufacturers and users are opting water-based insulate coating systems more than solvent-based coating systems. Waterborne coatings emit lesser volatile organic compounds (VOC), which are environment friendly and comply with the stringent air quality standards laid down by the authorities. Government initiatives also support the trend in reducing pollution and promoting sustainable practices in industrial productions. Apart from the environmental aspects, these coatings also deliver durability, better color accuracy, and aesthetic improvements, which are key in refinish for automobiles. Waterborne paint uptake is still on the rise as refinish professionals and vehicle owners look to greener and more high-performance solutions. Major coating manufacturer in India has invested heavily in the development of advanced waterborne formulations that deliver better results at competitive prices. For instance, in February 2024, Arkema showcased sustainable paint and coating solutions at Paint India, highlighting Synaqua® bio-based waterborne resins with up to 97% renewable content, combining alkyd performance with water-based formulation benefits, focusing on decarbonization. The demand for waterborne coatings is also influenced by increasing consumer awareness and demand for green products, which is expected to drive growth in the automotive refinish coatings market over the coming years.

To get more information on this market, Request Sample

Technological Advancements in Coating Products

Technological advancements in coating products are significantly shaping the automotive refinish coatings market in India. The industry has seen continuous innovation in the development of advanced coating technologies, such as nano-coatings, UV-cured coatings, and high-solid formulations. These innovations focus on enhancing the durability, performance, and aesthetic qualities of refinish coatings, providing long-term protection against environmental factors such as UV radiation, corrosion, and scratches. Nano-coatings, for example, offer superior resistance to dirt, water, and other contaminants, leading to improved maintenance and reduced cost over time. Additionally, UV-cured coatings, which use ultraviolet light to accelerate the curing process, enable faster application and better surface hardness, making them ideal for the fast-paced automotive refinish industry. High-solid coatings, which contain a higher percentage of solid content and require fewer solvents, are gaining traction due to their superior coverage, reduced environmental impact, and compliance with stricter VOC regulations. As the Indian automotive market continues to grow, demand for these advanced coatings is expected to increase, with vehicle owners and refinish professionals seeking high-quality solutions that offer cost-effectiveness, durability, and sustainability. For instance, in March 2025, Mitsui Chemicals India announced opening of the Coating Technical Center in Gurugram on February 18, 2025, to enhance technical support and R&D for coatings and engineering materials, aiding customers in product development. To keep pace with competition and changing customer expectations, manufacturers of automotive refinish coating have directed their resources into research and development.

India Automotive Refinish Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on resin type, product type, technology, and vehicle type.

Resin Type Insights:

- Polyurethane

- Alkyd

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, alkyd, acrylic, and others.

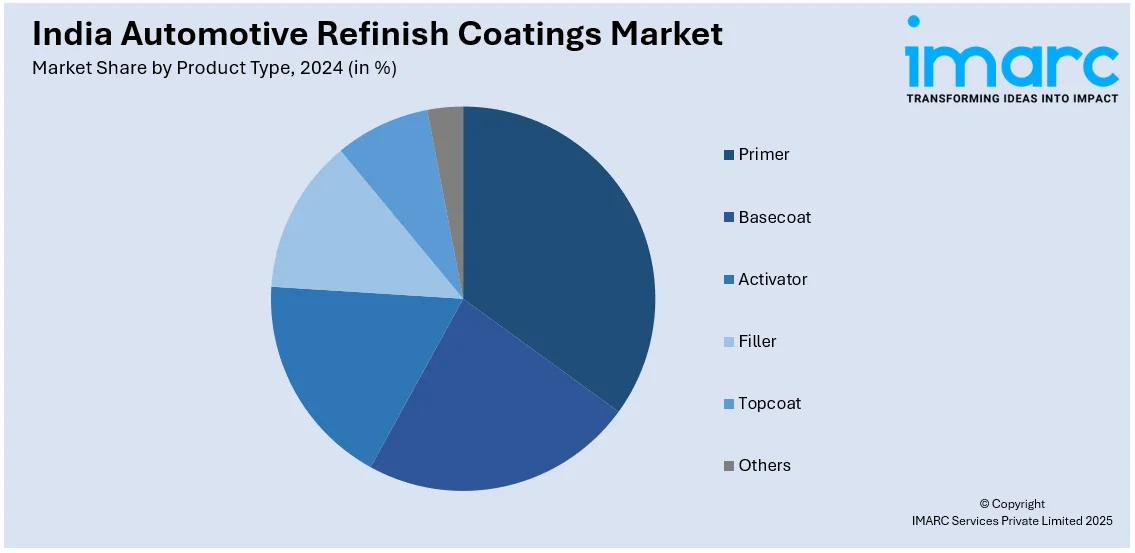

Product Type Insights:

- Primer

- Basecoat

- Activator

- Filler

- Topcoat

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes primer, basecoat, activator, filler, topcoat, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- UV-cured

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes solvent-borne, water-borne, and UV-cured.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Others

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Refinish Coatings Market News:

- On March 11, 2025, BASF, in collaboration with Mahindra & Mahindra, Seva Sahayog Foundation, and Don Bosco Industrial Training Institute, announced the launch of the 'Women in Refinish' CSR program. This initiative empowers underprivileged women by offering training and opportunities to pursue careers in the refinish coatings industry.

- In October 2023, Nippon Paint India announced its plans to achieve INR 1000 crore revenue in its auto refinish business by 2026, marking 15 years in India. The company plans growth through network expansion, new product launches, and organic growth.

India Automotive Refinish Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Alkyd, Acrylic, Others |

| Product Types Covered | Primer, Basecoat, Activator, Filler, Topcoat, Others |

| Technologies Covered | Solvent-borne, Water-borne, UV-cured |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive refinish coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive refinish coatings market on the basis of resin type?

- What is the breakup of the India automotive refinish coatings market on the basis of product type?

- What is the breakup of the India automotive refinish coatings market on the basis of technology?

- What is the breakup of the India automotive refinish coatings market on the basis of vehicle type?

- What is the breakup of the India automotive refinish coatings market on the basis of region?

- What are the various stages in the value chain of the India automotive refinish coatings market?

- What are the key driving factors and challenges in the India automotive refinish coatings?

- What is the structure of the India automotive refinish coatings market and who are the key players?

- What is the degree of competition in the India automotive refinish coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive refinish coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive refinish coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive refinish coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)