India Automotive Safety Systems Market Size, Share, Trends and Forecast by System Type, Vehicle Type, End User, and Region, 2025-2033

India Automotive Safety Systems Market Overview:

The India automotive safety systems market size reached USD 3.86 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.43 Billion by 2033, exhibiting a growth rate (CAGR) of 7.55% during 2025-2033. The market is driven by the rising vehicle safety regulations, increasing consumer awareness and advancements in autonomous and driver-assist technologies. Demand for lane departure warning systems, on-board safety features and evolving vehicle standards and aftermarket are also contributing positively to the India automotive safety systems market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.86 Billion |

| Market Forecast in 2033 | USD 7.43 Billion |

| Market Growth Rate 2025-2033 | 7.55% |

India Automotive Safety Systems Market Trends:

Rising Adoption of Advanced Driver Assistance Systems

The rising adoption of Advanced Driver Assistance Systems (ADAS) in India's automotive safety market is driven by growing concerns over road safety, increasing vehicle automation and stringent government regulations. For instance, in January 2025, the Government of India announced its plans to mandate advanced driver-assistance systems in new heavy trucks and buses to enhance safety. Minister of Road Transport & Highways highlighted features like electronic stability control automated emergency braking and driver drowsiness detection as key measures to prevent accidents. ADAS includes features such as lane departure warning, automatic emergency braking (AEB), adaptive cruise control, blind-spot detection and traffic sign recognition. These technologies enhance driver awareness, reduce human error and prevent accidents. Automakers are integrating ADAS across vehicle segments from premium cars to mid-range models making advanced safety features more accessible. The adoption of radar, LiDAR and AI-based vision systems is improving real-time hazard detection and driving assistance. Rising consumer demand for connected and autonomous vehicles is further fueling ADAS implementation. India's push for smart transportation infrastructure supports the expansion of ADAS by improving vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication enhancing overall road safety and traffic management. These factors are strengthening the India automotive safety systems market outlook, driving innovations and regulatory advancements in the sector.

To get more information on this market, Request Sample

Expansion of Electric Vehicles (EVs)

The expansion of electric vehicles (EVs) in India is driving the need for specialized safety system integration addressing unique challenges such as battery safety, thermal management and regenerative braking. According to the report published by IBEF, India's EV market is booming with over 50% of 3-wheelers, 5% of 2-wheelers and 2% of cars sold in 2024 being electric. Projected to grow from US$ 16.77 billion in 2023 to US$ 27.70 billion by 2028 the market aims for 80 million EVs on the road by 2030. With 12,146 charging stations currently 1.32 million are needed by 2030. EV-specific safety measures include battery monitoring systems (BMS), fire-resistant battery enclosures and automatic shutdown mechanisms to prevent overheating or short circuits. Regenerative braking systems are becoming standard improving vehicle efficiency while enhancing safety by reducing reliance on traditional braking systems. Crash protection for high-voltage components ensures occupant safety in collisions. Government regulations and safety norms for EV battery performance, fire resistance and impact protection are further pushing automakers to adopt advanced safety technologies. AI-powered predictive maintenance and real-time monitoring enhance EV safety minimizing risks of failures. As EV adoption grows manufacturers are investing in autonomous emergency braking (AEB), lane-keeping assist and stability control ensuring comprehensive protection for drivers and passengers. These advancements are contributing to the expansion of the India automotive safety systems market share, reinforcing safety innovation and regulatory compliance.

India Automotive Safety Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on system type, vehicle type and end user.

System Type Insights:

- Lane Departure Warning System

- Other On-Board Safety Systems

The report has provided a detailed breakup and analysis of the market based on the system type. This includes lane departure warning system and other on-board safety systems.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger car and commercial vehicle.

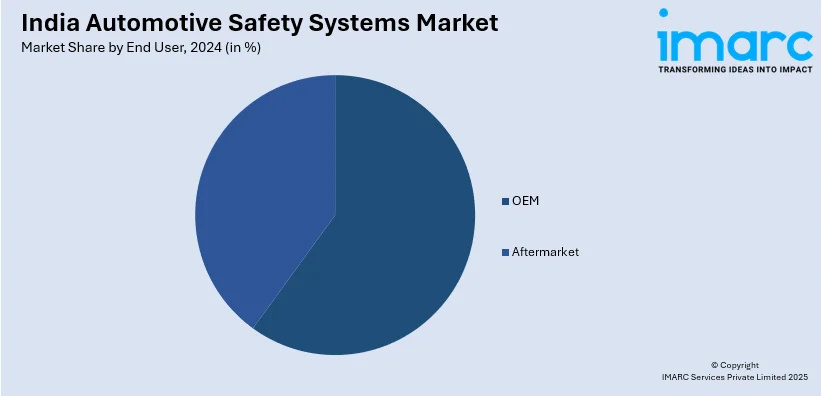

End User Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Safety Systems Market News:

- In February 2025, Bharat NCAP announced its plans to launch a new testing protocol, Bharat NCAP 2.0 in 2027 to include assessments for Advanced Driver Assistance Systems (ADAS). The initiative, driven by the Automotive Research Association of India, aims to address India-specific road safety challenges, focusing on localizing testing protocols and enhancing vehicle safety, especially given the high rate of driver-related accidents in the country.

- In November 2024, Uno Minda announced the launch of the Car DVR 2.0 in India, equipped with Level 2 ADAS to enhance road safety. The device features 1080p recording alerts for lane departures and close following distances and is also compatible with Android systems. It is also dust- and water-resistant.

India Automotive Safety Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Lane Departure Warning System, Other On-Board Safety Systems |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive safety systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive safety systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive safety systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive safety systems market in India was valued at USD 3.86 Billion in 2024.

The India automotive safety systems market is projected to exhibit a CAGR of 7.55% during 2025-2033, reaching a value of USD 7.43 Billion by 2033.

The market for automotive safety systems in India is propelled by more stringent government safety regulations, a growing consumer need for crash protection features, and increased vehicle affordability. Enhanced awareness about both passenger and pedestrian safety, combined with automakers' focus on advanced driver-assistance systems (ADAS), also drives the uptake of these technologies in both passenger and commercial vehicle categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)