India Automotive Speaker Market Size, Share, Trends and Forecast by Vehicle Type, Demand Category, Installation, and Region, 2025-2033

India Automotive Speaker Market Overview:

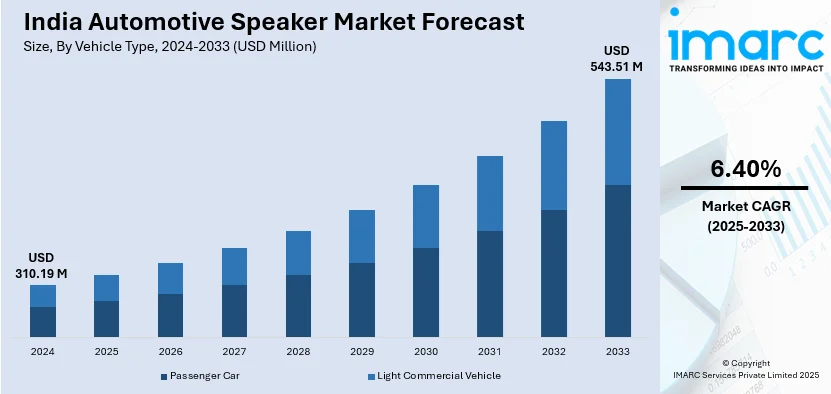

The India automotive speaker market size reached USD 310.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 543.51 Million by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. Rising demand for premium in-car entertainment, increasing adoption of connected vehicles, growing sales of passenger and luxury cars, advancements in AI-powered voice assistants, integration of wireless and Bluetooth-enabled speakers, expanding electric vehicle market, and consumer preference for high-quality audio systems are expanding the India automotive speaker market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 310.19 Million |

| Market Forecast in 2033 | USD 543.51 Million |

| Market Growth Rate 2025-2033 | 6.40% |

India Automotive Speaker Market Trends:

Growing Demand for Premium Audio Systems in Passenger Vehicles

The India automotive speaker market growth is driven by an increased demand for premium audio systems, driven by consumer preference for enhanced in-car entertainment. Automakers are collaborating with renowned audio brands like Bose, Harman Kardon, and JBL to integrate high-quality speakers into their vehicles. The rise in disposable incomes and increasing sales of luxury and mid-range vehicles are fueling this trend. Additionally, advancements in surround sound technology, noise cancellation, and wireless connectivity are reshaping the market. Notably, Uno Minda, a leading Tier 1 supplier of automotive solutions, launched new in-car speakers in the Indian aftermarkets, priced at Rs 4,990, which are available both online and offline in 2023. These speakers, developed in collaboration with Japanese sound technology company Onkyo, offer a 400W max power output, deeper bass, and can be paired with any car's audio system. As consumers seek immersive audio experiences, automotive manufacturers are prioritizing superior sound systems, leading to sustained growth in the automotive speaker segment in India.

To get more information on this market, Request Sample

Rise of Smart and Connected Vehicle Audio Solutions

The growing adoption of smart and connected vehicles in India is transforming the automotive speaker market. With the increasing integration of AI-based voice assistants, wireless connectivity, and infotainment systems, automakers are incorporating advanced speaker technologies to enhance user experience. For instance, SoundHound AI, Inc. announced on November 14, 2024, that its cutting-edge speech AI technology would be integrated into Kia automobiles in India, with compatibility for Hindi. By providing natural language voice commands for features like navigation, calls, and real-time information retrieval, this partnership, which is a component of Kia Connect, improves in-car experiences. Features such as Bluetooth-enabled speakers, hands-free voice commands, and smartphone integration are becoming standard. The expansion of electric vehicles (EVs) has also contributed to the demand for lightweight, energy-efficient speakers. As India moves towards a more digital and connected automotive ecosystem, this is positively impacting the India automotive speaker market outlook.

India Automotive Speaker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on vehicle type, demand category, and installation.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car and light commercial vehicle.

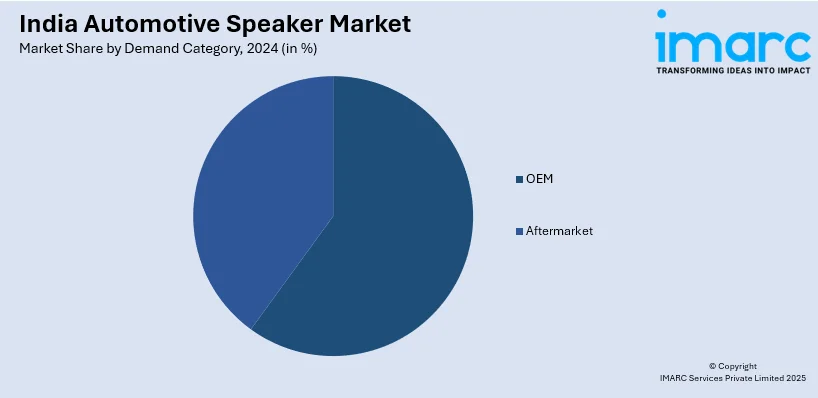

Demand Category Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the demand category have also been provided in the report. This includes OEM and aftermarket.

Installation Insights:

- Door

- Dashboard

- Rear Deck

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes door, dashboard, and rear deck.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Speaker Market News:

- On June 5, 2024, the XS-162GS and XS-160GS automobile speakers, designed especially for the Indian market to provide an outstanding audio experience, were released by Sony India. The XS-160GS is a 16 cm full-range speaker, while the XS-162GS is a 2-way coaxial speaker with a 16 cm MRC (Mica Reinforced Cellular) woofer and a 25 mm soft dome tweeter. Both types are built to endure India's varied climate, guaranteeing longevity and reliable operation. These speakers' wireless capabilities are not mentioned in the official announcement.

- On November 26, 2024, Mahindra debuted the 'Sonic Studio Experience' in its BE 6e and XEV 9e electric SUVs. It includes a 16-speaker Harman Kardon system with Dolby Atmos technology and a 1,400-watt output. Grammy-winning sound engineer Richard King and music maestro A.R. Rahman collaborated to create an immersive in-flight audio experience. The system also incorporates Harman Kardon's VenueScapes Live, recreating acoustics of iconic venues like Mumbai's Royal Opera House, enhancing the auditory journey for passengers.

India Automotive Speaker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle |

| Demand Categories Covered | OEM, Aftermarket |

| Installations Covered | Door, Dashboard, Rear Deck |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive speaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive speaker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive speaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive speaker market in India was valued at USD 310.19 Million in 2024.

The India automotive speaker market is projected to exhibit a CAGR of 6.40% during 2025-2033, reaching a value of USD 543.51 Million by 2033.

The market is driven by rising vehicle ownership, growing preference for enhanced in-car audio experiences, and demand for entertainment features in both budget and premium segments. As consumer expectations for connectivity and audio quality increase, manufacturers are incorporating advanced speaker systems. Trends in customization and aftermarket upgrades also contribute to sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)