India Automotive Speed Alert System Market Size, Share, Trends and Forecast by Vehicle Type, Product Type, Sales Channel, and Region, 2026-2034

India Automotive Speed Alert System Market Overview:

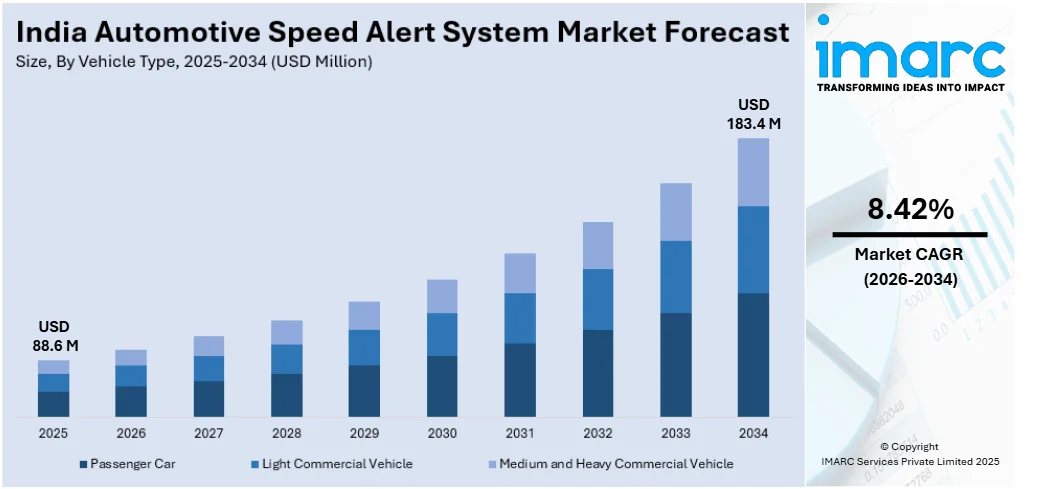

The India automotive speed alert system market size reached USD 88.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 183.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.42% during 2026-2034. Government mandates for vehicle safety, rising road accident concerns, increasing adoption of ADAS, growing vehicle sales, technological advancements in telematics, and consumer demand for in-vehicle safety features to enhance driver awareness and accident prevention are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 88.6 Million |

| Market Forecast in 2034 | USD 183.4 Million |

| Market Growth Rate 2026-2034 | 8.42% |

India Automotive Speed Alert System Market Trends:

Expansion of High-Speed Road Infrastructure

India is rapidly developing its highway network, with a significant increase in high-speed corridors to improve connectivity and support economic growth. Investments in large-scale road projects are enabling faster transportation, reducing congestion, and facilitating trade efficiency. The expansion of expressways and multi-lane highways is enhancing logistics, benefiting industries reliant on quick transit. Government initiatives are accelerating road construction and integrating advanced technology for better traffic management and safety. This infrastructure growth is also fostering demand for high-performance vehicles and intelligent transportation systems. With increased focus on connectivity, faster routes between key economic hubs are emerging, improving accessibility for both businesses and consumers. This shift underscores a broader move toward a more modernized and efficient national transportation network. In 2024, the Ministry of Road Transport and Highways reported that India's National Highway network expanded by 60%, reaching 146,195 km, up from 91,287 km in 2014. This growth includes an increase in high-speed corridors from 93 km to 2,474 km. The government also approved eight major high-speed corridor projects totaling 936 km, with an investment of INR 50,655 Crore, aiming to enhance connectivity and stimulate economic development nationwide.

To get more information on this market Request Sample

Growing Integration of Speed Alert Systems in Vehicles

Automakers are increasingly incorporating high-speed alert systems into their models to enhance road safety and comply with evolving regulations. These systems notify drivers when they exceed predefined speed limits, reducing accident risks and promoting responsible driving behavior. Regulatory mandates, such as AIS-145 safety norms, are driving widespread adoption, ensuring that vehicles come equipped with essential warning mechanisms. As safety technology advances, these alerts are becoming more intuitive, integrating with navigation systems and adaptive cruise control for real-time monitoring. The push for enhanced vehicle safety is not only shaping new model designs but also influencing consumer preferences, with buyers seeking vehicles that prioritize both safety and compliance. This shift reflects a growing emphasis on intelligent driving assistance across the industry. For instance, in May 2024, Maruti Suzuki launched the 2024 Swift in India, equipped with a high-speed alert system that notifies drivers when they exceed certain speed thresholds, enhancing road safety. This feature aligns with India's AIS-145 safety norms, reflecting the automotive industry's commitment to integrating advanced safety technologies.

India Automotive Speed Alert System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on vehicle type, product type, and sales channel.

Vehicle Type Insights:

- Passenger Car

- Light Commercial Vehicle

- Medium and Heavy Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, light commercial vehicle, and medium and heavy commercial vehicle.

Product Type Insights:

- Optical Vehicle Speed Sensor

- Hall-Type Vehicle Speed Sensor

- Magnetic-Electric Vehicle Speed Sensor

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes optical vehicle speed sensor, hall-type vehicle speed sensor, and magnetic-electric vehicle speed sensor.

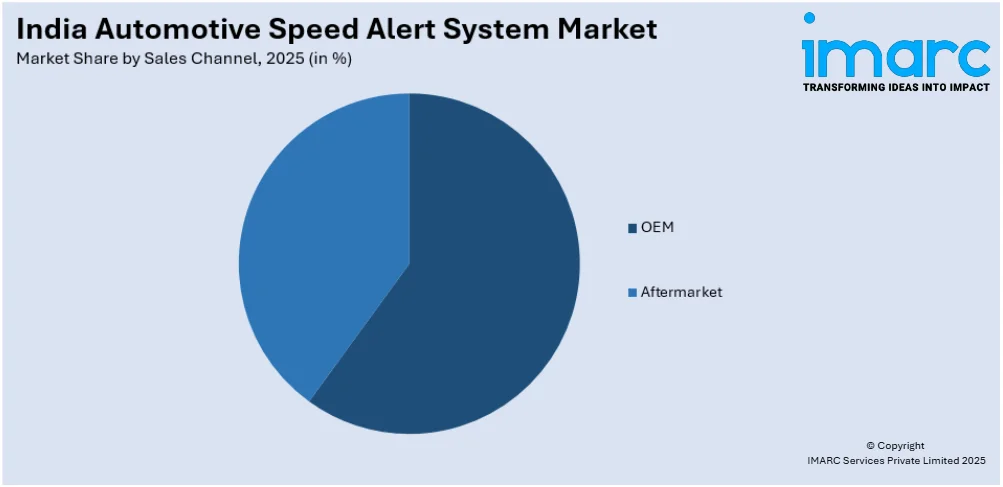

Sales Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Speed Alert System Market News:

- In January 2025, HERE Technologies and Pioneer Corporation unveiled connected solutions aimed at enhancing two-wheeler safety and navigation in India at the Bharat Mobility Expo 2025. These innovations include real-time speed limit alerts, hazard warnings, and optimized routing, addressing the country's high rate of two-wheeler accidents. By integrating advanced navigation with safety features, the collaboration seeks to improve rider awareness and reduce accidents, aligning with India's focus on road safety and the growing demand for intelligent transportation systems.

- In February 2024, Rosmerta Technologies introduced an AI-based driver monitoring and alert system for fleet operators at the Bharat Mobility Global Expo 2024. This system offers real-time video tracking, AI-driven driver behavior analysis, and in-cabin alerts for trucks. It features dual cameras, IR blasters, GPS with SIM connectivity, and G-sensors to monitor acceleration and braking. One camera observes road conditions, while the other monitors driver actions, ensuring compliance with traffic rules, including speed limits.

India Automotive Speed Alert System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Medium and Heavy Commercial Vehicle |

| Product Types Covered | Optical Vehicle Speed Sensor, Hall-Type Vehicle Speed Sensor, Magnetic-Electric Vehicle Speed Sensor |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive speed alert system market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive speed alert system market on the basis of vehicle type?

- What is the breakup of the India automotive speed alert system market on the basis of product type?

- What is the breakup of the India automotive speed alert system market on the basis of sales channel?

- What are the various stages in the value chain of the India automotive speed alert system market?

- What are the key driving factors and challenges in the India automotive speed alert system?

- What is the structure of the India automotive speed alert system market and who are the key players?

- What is the degree of competition in the India automotive speed alert system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive speed alert system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive speed alert system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive speed alert system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)