India Automotive Voltage Regulator Market Size, Share, Trends and Forecast by Vehicle Type, Functionality, and Region, 2025-2033

India Automotive Voltage Regulator Market Overview:

The India automotive voltage regulator market size reached USD 121.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 215.44 Million by 2033, exhibiting a growth rate (CAGR) of 6.53% during 2025-2033. The market is driven by rising vehicle electrification, increasing demand for fuel-efficient and hybrid vehicles, advancements in automotive electronics, government initiatives promoting electric mobility, and stringent emission norms. Besides this, the widespread adoption of advanced driver assistance systems (ADAS) is also boosting the demand for voltage regulators.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 121.92 Million |

| Market Forecast in 2033 | USD 215.44 Million |

| Market Growth Rate 2025-2033 | 6.53% |

India Automotive Voltage Regulator Market Trends:

Increasing Adoption of Electric and Hybrid Vehicles

The Indian automotive industry is undergoing a dramatic transformation as it shifts toward electric and hybrid vehicles, which in turn is reshaping the demand for critical automotive voltage regulators. With the Indian EV market expected to grow at a CAGR of 57.23% from 2025 to 2033, driven primarily by the rapid adoption of electric two-wheelers, annual EV sales are projected to reach 10 million units by 2030. This surge is further fueled by the government's FAME-II scheme, which has earmarked INR 10,000 crore (USD 1.2 billion) to accelerate EV adoption, intensifying the need for efficient voltage regulators that stabilize battery fluctuations and protect sensitive vehicle electronics. Furthermore, the incorporation of modern battery management systems necessitates regulators that provide increased efficiency, decreased heat dissipation, and lower power losses. Investments in MOSFET-based voltage regulators are increasing since these components are critical to guaranteeing optimal energy management and battery longevity in India's expanding green vehicle ecosystem.

To get more information on this market, Request Sample

Technological Advancements in Automotive Electronics

The rapid integration of advanced electronics in modern vehicles is driving a growing demand for intelligent automotive voltage regulators that ensure stable power distribution across diverse systems. Today's vehicles incorporate a wide range of electronic components such as ADAS, infotainment, electric power steering, and telematics, making efficient voltage regulation critical to prevent power fluctuations and potential electronic failures. The Indian automotive electronics market is set for robust growth as the inclusion of numerous sensors, controllers, and processors necessitates improved voltage management. For instance, SEG Automotive has launched advanced e-mobility solutions featuring 800-volt components and Light Electric Mobility (LEM) options for two, three, and four wheelers, supporting up to 800 volts and 150 kW for flexible, integrated system solutions. Additionally, smart voltage regulators with onboard diagnostics (OBD-II) monitor battery health and detect faults in real time, while AI-driven digital regulators enable dynamic adjustments. Furthermore, by 2025, 48V mild-hybrid systems are expected in over 15% of new vehicles, further boosting demand for sophisticated multi-stage regulators.

India Automotive Voltage Regulator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type and functionality.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicle

- Medium and Heavy Commercial Vehicles

- Two-Wheeler

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicle, medium and heavy commercial vehicles, and two-wheeler.

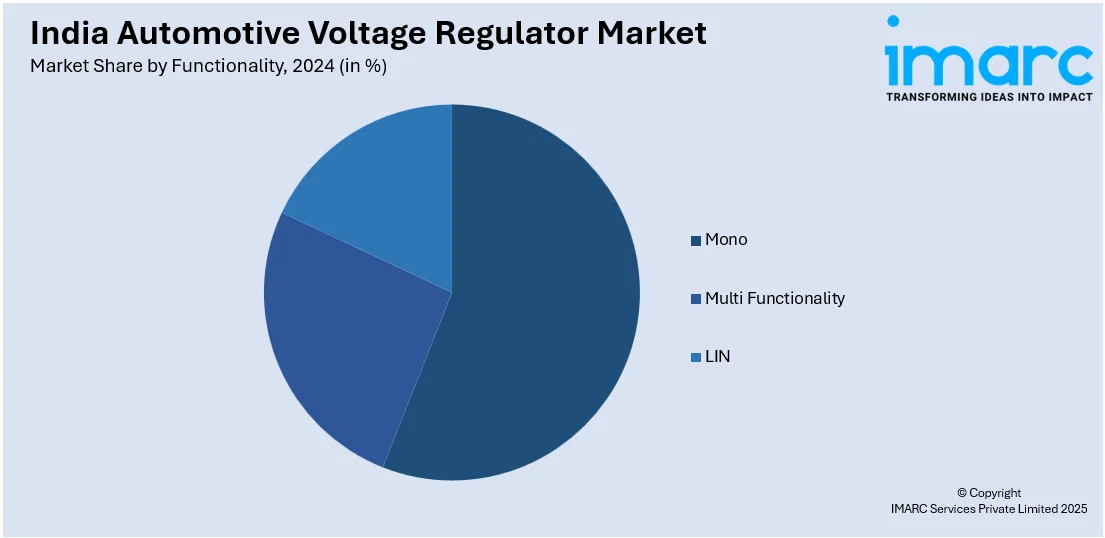

Functionality Insights:

- Mono

- Multi Functionality

- LIN

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes mono, multi functionality, and LIN.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Automotive Voltage Regulator Market News:

- March 2025: CG Power and Industrial Solutions introduced 'Fluxtron,' a series of high-efficiency medium voltage induction motors designed to enhance energy efficiency and sustainability in industrial operations. These motors offer superior performance, reduced energy consumption, and seamless compatibility with Variable Frequency Drives (VFDs) for precise speed and torque control. While 'Fluxtron' motors are engineered for various industrial applications, the article does not specify their use in automotive voltage regulation.

- February 2025: ABB India expanded its low voltage flameproof motor range, introducing models with power ratings from 37kW to 500kW, designed for hazardous environments in industries like Oil & Gas and Chemicals. These motors, available in IE2, IE3, and IE4 efficiency classes, operate in temperatures from -20°C to +60°C, enhancing safety and energy efficiency in explosive settings.

India Automotive Voltage Regulator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicle, Medium and Heavy Commercial Vehicles, Two-Wheeler |

| Functionalities Covered | Mono, Multi Functionality, LIN |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India automotive voltage regulator market performed so far and how will it perform in the coming years?

- What is the breakup of the India automotive voltage regulator market on the basis of vehicle type?

- What is the breakup of the India automotive voltage regulator market on the basis of functionality?

- What are the various stages in the value chain of the India automotive voltage regulator market?

- What are the key driving factors and challenges in the India automotive voltage regulator?

- What is the structure of the India automotive voltage regulator market and who are the key players?

- What is the degree of competition in the India automotive voltage regulator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India automotive voltage regulator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India automotive voltage regulator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India automotive voltage regulator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)