India Aviation Cyber Security Market Size, Share, Trends and Forecast by Solution Type, Deployment Type, Application, and Region, 2025-2033

India Aviation Cyber Security Market Overview:

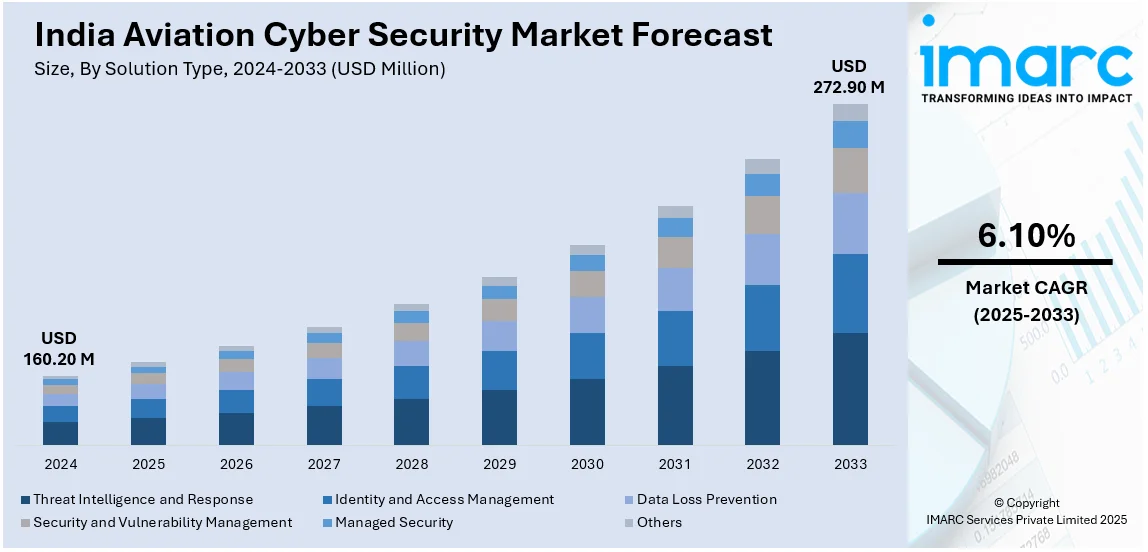

The India aviation cyber security market size reached USD 160.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 272.90 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The India aviation cyber security market is driven by increasing digitalization of airport operations, rising cyber threats targeting aviation infrastructure, and stringent regulatory mandates. Growing reliance on interconnected systems, adoption of cloud technologies, and emphasis on data protection further propel demand for advanced cybersecurity solutions to safeguard critical aviation networks and passenger information.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 160.20 Million |

| Market Forecast in 2033 | USD 272.90 Million |

| Market Growth Rate (2025-2033) | 6.10% |

India Aviation Cyber Security Market Trends:

Adoption of Zero Trust Security Architecture

India’s aviation sector is rapidly adopting Zero Trust Security models to address evolving cyber threats. With 96% of enterprises in India implementing Zero Trust architectures, the aviation industry is aligning with this shift to secure airports, airlines, ticketing systems, and operational technology networks. Traditional perimeter-based security is no longer adequate, making identity verification, continuous monitoring, and least-privilege access essential. The increasing digitalization of airport operations and third-party integrations has heightened cybersecurity risks, driving the need for strict access controls. Additionally, government-led cyber resilience initiatives are accelerating Zero Trust adoption across critical aviation infrastructure, minimizing insider threats and preventing lateral movement of malicious actors. This transition is vital for safeguarding India’s expanding and interconnected aviation ecosystem.

To get more information on this market, Request Sample

Integration of AI and Machine Learning for Threat Detection

Indian aviation entities are increasingly integrating artificial intelligence (AI) and machine learning (ML) tools to strengthen cybersecurity. A 2023 report by the Data Security Council of India (DSCI) revealed that 97% of Indian organizations have invested in AI and ML, highlighting a nationwide push toward advanced cybersecurity strategies. As cyber threats grow more sophisticated, AI-driven systems help detect anomalies, breaches, and unusual behavior in real time. These technologies enable predictive analytics, allowing early identification of zero-day attacks and advanced persistent threats. Airlines and airport authorities are deploying AI-based Security Information and Event Management (SIEM) systems to enhance incident response. AI-powered automation also improves compliance checks and reduces human error in threat assessments. With increasing reliance on digital infrastructure, AI and ML adoption is becoming essential for securing India’s aviation ecosystem.

Emphasis on Cybersecurity Compliance and Regulatory Frameworks

The Indian aviation cybersecurity market is witnessing a significant shift toward regulatory compliance and robust governance frameworks. Regulatory bodies such as the Directorate General of Civil Aviation (DGCA) and international standards like ICAO’s Aviation Cybersecurity Strategy are driving the need for structured cybersecurity protocols. Airlines and airport operators are now required to follow strict cybersecurity audits, risk assessments, and data protection policies. Enhanced emphasis on data privacy, especially with the enactment of India’s Digital Personal Data Protection Act, has further pushed aviation players to prioritize cybersecurity infrastructure. Compliance is not only seen as a regulatory necessity but also a competitive differentiator, encouraging investments in secure IT systems, employee training, and incident response capabilities to meet global aviation standards.

India Aviation Cyber Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on solution type, deployment type, and application.

Solution Type Insights:

- Threat Intelligence and Response

- Identity and Access Management

- Data Loss Prevention

- Security and Vulnerability Management

- Managed Security

- Others

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes threat intelligence and response, identity and access management, data loss prevention, security and vulnerability management, managed security, and others.

Deployment Type Insights:

- Cloud-Based

- On-Premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based, and on-premises.

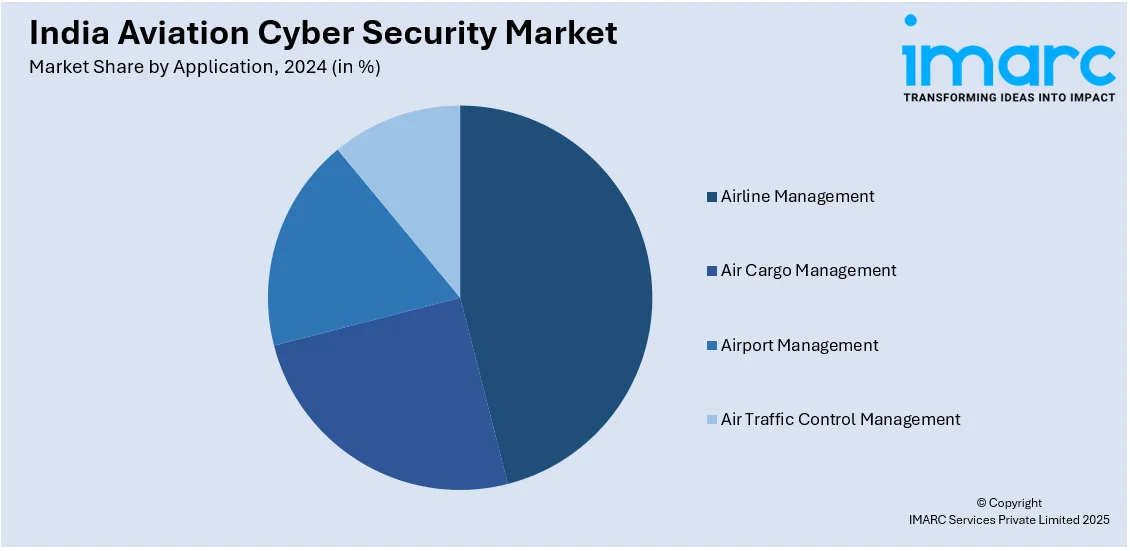

Application Insights:

- Airline Management

- Air Cargo Management

- Airport Management

- Air Traffic Control Management

The report has provided a detailed breakup and analysis of the market based on the application. This includes airline management, air cargo management, airport management, and air traffic control management.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Aviation Cyber Security Market News:

- In February 2025, Noida International Airport partnered with Kyndryl, the world’s largest IT infrastructure services provider, to develop its AI-powered IT systems and strengthen cybersecurity. As a greenfield airport, NIA aims to deliver a seamless travel experience through advanced digital infrastructure. Kyndryl will manage the airport’s modern technology environment and provide 24/7 support, ensuring operational efficiency and enhanced passenger services through cutting-edge digital tools and robust cybersecurity solutions.

- In September 2024, SITA launched its Managed Network Access Control (NAC) solution to enhance cybersecurity in airport and airline networks. The system strengthens LAN and WLAN infrastructure by adding verification layers and segmenting networks, ensuring compliance with industry standards. Designed to counter rising cyber threats, it provides real-time visibility and control over network access. SITA NAC aims to safeguard critical aviation infrastructure while maintaining operational efficiency and protecting essential passenger services.

India Aviation Cyber Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Threat Intelligence and Response, Identity and Access Management, Data Loss Prevention, Security and Vulnerability Management, Managed Security, Others |

| Deployment Types Covered | Cloud-Based, On-Premises |

| Applications Covered | Airline Management, Air Cargo Management, Airport Management, Air Traffic Control Management |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India aviation cyber security market performed so far and how will it perform in the coming years?

- What is the breakup of the India aviation cyber security market on the basis of solution type?

- What is the breakup of the India aviation cyber security market on the basis of deployment type?

- What is the breakup of the India aviation cyber security market on the basis of application?

- What is the breakup of the India aviation cyber security market on the basis of region?

- What are the various stages in the value chain of the India aviation cyber security market?

- What are the key driving factors and challenges in the India aviation cyber security market?

- What is the structure of the India aviation cyber security market and who are the key players?

- What is the degree of competition in the India aviation cyber security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aviation cyber security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aviation cyber security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aviation cyber security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)