India Aviation Fuel Market Size, Share, Trends and Forecast by Fuel, Aircraft, End Use, and Region, 2025-2033

Market Overview:

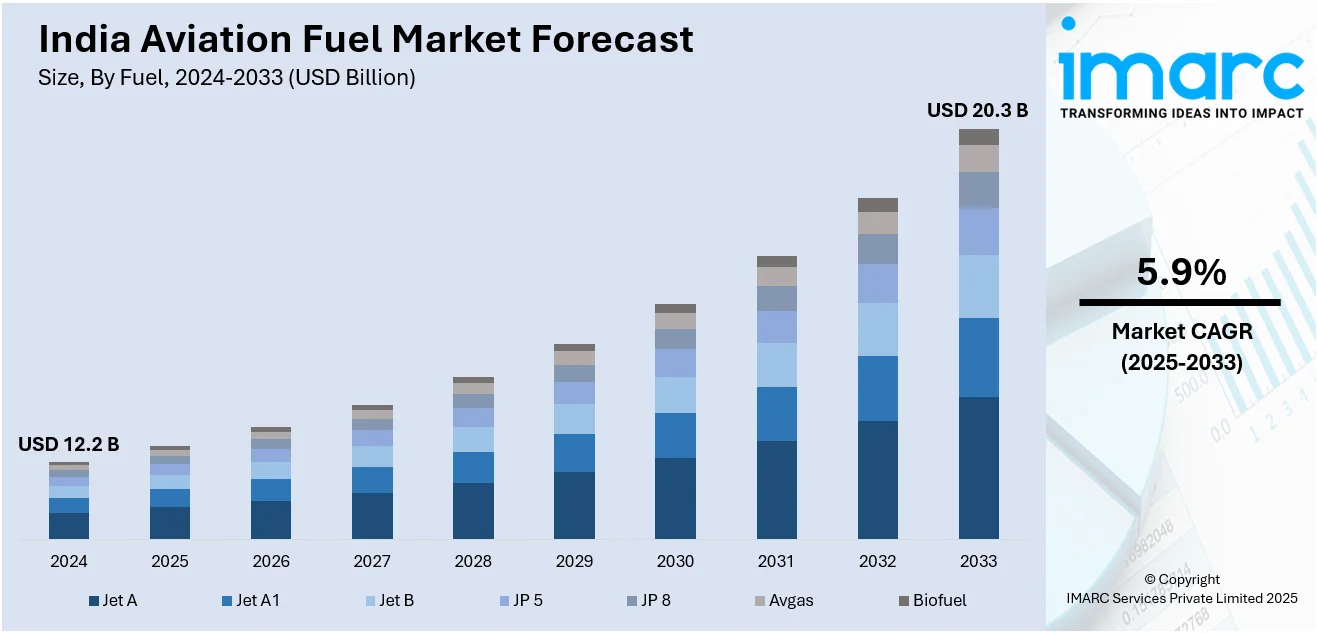

India aviation fuel market size reached USD 12.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The increasing advances in aircraft technology and design, which lead to more fuel-efficient engines and aircraft, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.2 Billion |

|

Market Forecast in 2033

|

USD 20.3 Billion |

| Market Growth Rate 2025-2033 | 5.9% |

Aviation fuel, commonly known as aviation gasoline or jet fuel, is a specialized type of fuel designed for use in aircraft engines. It is a highly refined, stable, and combustible liquid that provides the energy necessary for the propulsion of airplanes. Jet fuel, the most common type of aviation fuel, is derived from crude oil through a complex refining process. It must meet stringent quality and safety standards to ensure optimal performance and reliability in aviation engines. The two primary types of jet fuel are Jet A and Jet A-1, with slight variations in freezing point and other specifications. Aviation fuel undergoes rigorous testing to ensure it meets the demanding requirements of aviation, including high altitudes, variable temperatures, and safety considerations, making it a critical component for the safe and efficient operation of aircraft.

To get more information on this market, Request Sample

India Aviation Fuel Market Trends:

The aviation fuel market in India is experiencing robust growth, primarily driven by escalating regional air travel demand. With the steady rise in passenger numbers, airlines are expanding their fleets, necessitating a parallel surge in aviation fuel consumption. Moreover, advancements in aircraft technology, such as the development of more fuel-efficient engines, are contributing to increased efficiency and reduced fuel consumption per flight. This, in turn, propels the aviation fuel market forward. Additionally, the growing focus on environmental sustainability is shaping the aviation industry's fuel preferences. Governments and regulatory bodies are advocating for cleaner and more sustainable fuel alternatives, stimulating research and investments in sustainable aviation fuels (SAFs). The emphasis on reducing carbon emissions and mitigating the environmental impact of air travel is fostering innovation in alternative fuels derived from renewable sources. Furthermore, geopolitical factors and fluctuations in crude oil prices play a pivotal role in shaping the dynamics of the aviation fuel market. The market is sensitive to geopolitical tensions that can disrupt the supply chain and affect fuel prices. As the aviation industry remains integral to economic development, the interplay of these diverse factors continues to drive and reshape the regional aviation fuel market landscape.

India Aviation Fuel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fuel, aircraft, and end use.

Fuel Insights:

- Jet A

- Jet A1

- Jet B

- JP 5

- JP 8

- Avgas

- Biofuel

The report has provided a detailed breakup and analysis of the market based on the fuel. This includes jet A, jet A1, jet B, JP 5, JP 8, avgas, and biofuel.

Aircraft Insights:

- Fixed Wings

- Rotorcraft

- Others

A detailed breakup and analysis of the market based on the aircraft have also been provided in the report. This includes fixed wings, rotorcraft, and others.

End Use Insights:

.webp)

- Commercial

- Military

- Private

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes commercial, military, private, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India aviation fuel market share.

India Aviation Fuel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuels Covered | Jet A, Jet A1, Jet B, JP 5, JP 8, Avgas, Biofuel |

| Aircrafts Covered | Fixed Wings, Rotorcraft, Others |

| End Uses Covered | Commercial, Military, Private, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India aviation fuel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India aviation fuel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India aviation fuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aviation fuel market in India was valued at USD 12.2 Billion in 2024.

The aviation fuel market in India is projected to exhibit a (CAGR) of 5.9% during 2025-2033, reaching a value of USD 20.3 Billion by 2033.

The India aviation fuel market is driven by rising air passenger traffic, growing airline fleets, and increasing domestic and international flight routes. Growing aircraft operations, government efforts to develop airport facilities, and fuel efficiency standards are fueling demand. The economic growth, tourism, and opening of the aviation policy also led to the growing consumption of aviation fuel in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)