India Ayurvedic Medicine Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

India Ayurvedic Medicine Market Overview:

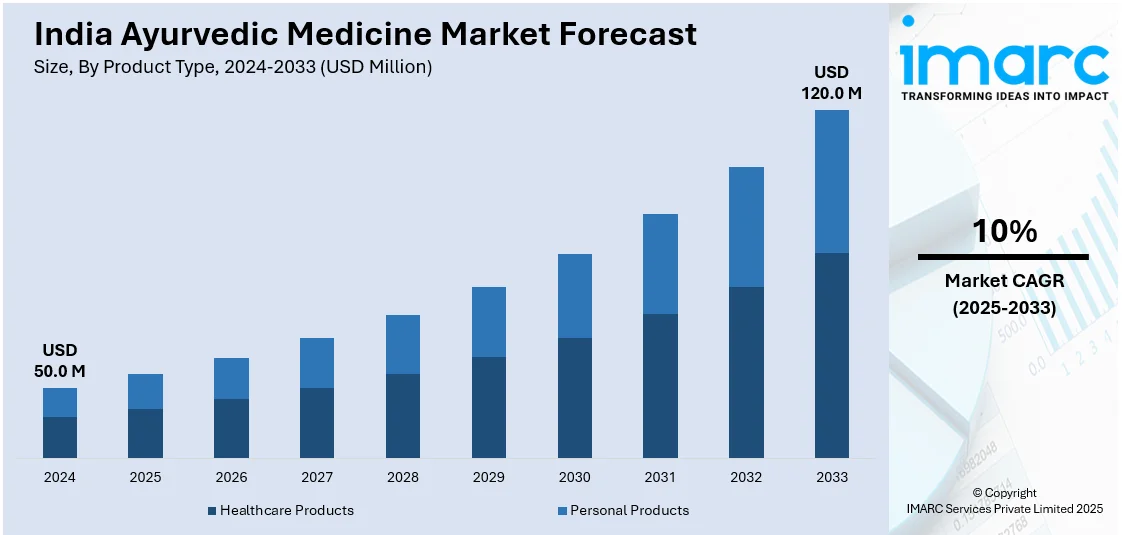

The India Ayurvedic medicine market size reached USD 50.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 120.0 Million by 2033, exhibiting a growth rate (CAGR) of 10% during 2025-2033. The increasing consumer preference for natural, herbal products, rising awareness regarding holistic healthcare, government support through initiatives like Ayush, growing demand for immunity-boosting supplements, expanding e-commerce penetration, and the proliferation of Ayurvedic wellness centers, clinics, and personalized health solutions are some of the major factors augmenting the India Ayurvedic market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.0 Million |

| Market Forecast in 2033 | USD 120.0 Million |

| Market Growth Rate 2025-2033 | 10% |

India Ayurvedic Medicine Market Trends:

Growing Consumer Preference for Natural and Herbal Products

The increasing preference for natural and herbal products in India is creating a positive India Ayurvedic medicine market outlook. According to an industry report, over 70% (1.1 Billion) of Indian people continue to practice these non-allopathic medical systems. Additionally, consumers are becoming more health-conscious and seeking chemical-free, plant-based remedies that offer holistic healing, which is providing an impetus to the market. Ayurvedic medicines, made from herbs, roots, and natural minerals, are viewed as safer options than allopathic drugs, especially for lifestyle and chronic diseases. In addition, increasing awareness about the long-term consequences of synthetic drugs is propelling individuals to shift toward traditional medical systems. In addition, marketing efforts emphasizing the advantages of Ayurvedic products like turmeric, ashwagandha, and neem further instill consumer confidence. In cities, the use of Ayurvedic personal care and wellness products is increasing due to the clean-label trend and the demand for organic products. The growth of online platforms and e-commerce facilitates easier access to Ayurvedic products, with consumers having the ability to discover customized solutions through online consultations. This trend not only increases the domestic market but also helps to enhance the export of Indian Ayurvedic brands on a global level, thus consolidating the sector's growth trend.

To get more information on this market, Request Sample

Increasing Government Support and Policy Initiatives

The Indian government is playing a pivotal role in promoting the Ayurvedic medicine market through regulatory support and policy initiatives, which is contributing to the India Ayurvedic medicine market growth. The Ministry of Ayush (Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy) is actively supporting the development and standardization of Ayurvedic products. In addition to this, the implementation of schemes such as the National Ayush Mission (NAM) aims to enhance healthcare services by promoting the usage of traditional systems of medicine, especially in rural areas. According to an industry report, from 2014–15 to 2023–24, the National Ayush Mission (NAM) supported the establishment of 16 new Ayush educational institutions in addition to supporting the supply of essential Ayush medicines to 996 Ayush hospitals and 12405 Ayush dispensaries annually on average. Also, the government is making easier entry of Ayurveda into mainstream medical systems possible by initiating the setup of Ayush hospitals, wellness centers, and independent research institutions. Moreover, financial incentives, subsidies, and simplification of funding access are supporting startups and incumbent pharma companies to diversify their Ayurvedic ranges. The implementation of Good Manufacturing Practices (GMP) and quality control is enhancing product authenticity and confidence on the part of the consumers. Besides this, strategic partnerships with private firms for clinical research and Ayurvedic formulation standardization further prove the viability of such products. Notably, on February 24, 2025, Health Reactive India reported that recent human clinical trials showed that its Ayurvedic medicine, Body Revival, significantly improved the quality of life for cancer patients. The study documented decreased side effects from chemotherapy as well as improvements in the patients' appetite, liver enzyme levels, tumor biomarkers, and everyday functioning. This fusion of contemporary science and Ayurveda seeks to transform cancer treatment by promoting healing and improving general health. Apart from this, promotion by governments raises international awareness, which leads to faster exports to nations that accept Ayurveda as an alternative healthcare system.

India Ayurvedic Medicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and application.

Product Type Insights:

- Healthcare Products

- Ayurvedic Nutraceuticals

- Ayurvedic Medicines

- Dietary Supplements

- Personal Products

- Oral Care

- Hair Care and Fragrances

- Cosmetics and Skin care

The report has provided a detailed breakup and analysis of the market based on the product type. This includes healthcare products (Ayurvedic nutraceuticals, Ayurvedic medicines, and dietary supplements) and personal products (oral care, hair care and fragrances, and cosmetics and skincare).

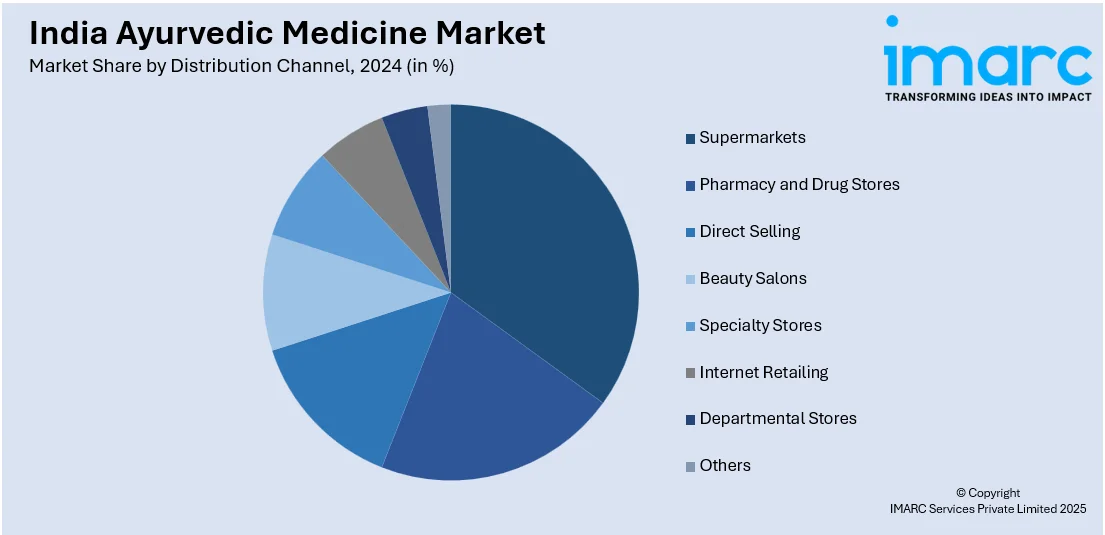

Distribution Channel Insights:

- Supermarkets

- Pharmacy and Drug Stores

- Direct Selling

- Beauty Salons

- Specialty Stores

- Internet Retailing

- Departmental Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets, pharmacy and drug stores, direct selling, beauty salons, specialty stores, internet retailing, departmental stores, and others.

Application Insights:

- Skin Diseases

- Cardiovascular

- Autoimmune Diseases

- Cancer

- Mental Health

- Nervous System Disorders

- Respiratory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes skin diseases, cardiovascular, autoimmune diseases, cancer, mental health, nervous system disorders, respiratory disorders, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ayurvedic Medicine Market News:

- On April 12, 2024, Qi Ayurveda inaugurated its operations in Coimbatore, introducing a range of haircare products formulated with traditional Ayurvedic ingredients. The product line includes herbal shampoos, conditioners, and hair oils designed to promote scalp health and hair growth. This launch represents Qi Ayurveda's strategic expansion into the South Indian market, aiming to cater to consumers seeking natural and holistic haircare solutions.

India Ayurvedic Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets, Pharmacy and Drug Stores, Direct Selling, Beauty Salons, Specialty Stores, Internet Retailing, Departmental Stores, Others |

| Applications Covered | Skin Diseases, Cardiovascular, Autoimmune Diseases, Cancer, Mental Health, Nervous System Disorders, Respiratory Disorders, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Ayurvedic medicine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Ayurvedic medicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Ayurvedic medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India Ayurvedic medicine market was valued at USD 50.0 Million in 2024.

The India Ayurvedic medicine market is projected to exhibit a CAGR of 10% during 2025-2033, reaching a value of USD 120.0 Million by 2033.

India's Ayurvedic medicine market is driven by deep-rooted cultural acceptance, government support through AYUSH initiatives, and rising demand for natural and preventive healthcare. Growing consumer awareness, increased global interest in wellness, and expanding e-commerce channels also fuel growth. Innovation and standardization are further enhancing credibility and market penetration domestically and internationally.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)