India Ayurvedic Skincare Market Size, Share, Trends and Forecast by Product Type, Form, Gender, Distribution Channel, and Region, 2025-2033

India Ayurvedic Skincare Market Overview:

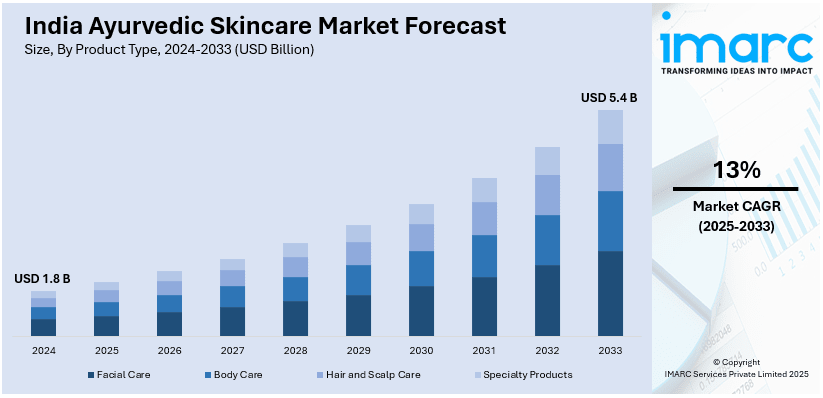

The India ayurvedic skincare market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13% during 2025-2033. The increasing consumer preference for natural, herbal products, growing awareness of Ayurveda’s benefits, rising disposable incomes, expanding urbanization, product innovation, effective marketing campaigns, e-commerce growth, celebrity endorsements, government support, and the influence of traditional wellness practices in modern skincare routines are some of the major factors augmenting India Ayurvedic skincare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate 2025-2033 | 13% |

India Ayurvedic Skincare Market Trends:

Product Innovation and Brand Expansion

The rapid innovations as brands diversify their product portfolios to cater to evolving consumer preferences is positively impacting the India Ayurvedic skincare market outlook. Traditional Ayurvedic formulations are now available in modern formats, including serums, masks, face oils, and cleansing balms. Companies are also integrating Ayurvedic herbs with contemporary skincare ingredients like hyaluronic acid, vitamin C, and niacinamide, thereby creating hybrid products that offer the best of both worlds. For instance, on January 29, 2025, Vedic Pride introduced a groundbreaking face cleanser that integrates Ayurvedic principles with advanced stem cells and nanotechnology. This innovative product aims to rejuvenate the skin at a cellular level by promoting regeneration and enhancing hydration. The cleanser is free from harmful chemicals and packaged sustainably, reflecting the company's commitment to natural and eco-friendly skincare solutions. Apart from this, Ayurvedic brands are also partnering with dermatologists and research organizations to confirm product effectiveness in clinical trials, increasing consumer confidence. Growth in high-end and luxury Ayurvedic skincare brands is further boosting market appeal, targeting both local and foreign consumers. Direct-to-consumer (D2C) brands are also doing well, making available personalized skincare consultations online to prescribe appropriate Ayurvedic regimens. Additionally, ongoing innovations in eco-friendly packaging with recyclable materials, biodegradable stickers, and refillable packs are also on the rise, which is bolstering the market. Besides this, traditional FMCG players and startups are also aggressively increasing their Ayurvedic product portfolios, driving market growth through ongoing product innovation and enhanced availability.

To get more information on this market, Request Sample

E-commerce and Omnichannel Expansion

E-commerce expansion is a significant driver facilitating the India Ayurvedic skincare market growth, offering consumers convenient access to a wide variety of products. Online marketplaces and D2C brand websites provide detailed product information, ingredient transparency, and consumer reviews, which enhances the buying experience. In addition to this, many Ayurvedic skincare brands are using digital platforms for targeted marketing through influencer collaborations, interactive content, and virtual skincare consultations. According to an industry report, in the last ten years, rural areas have seen a sharp increase in digital connectivity. The Telecom Regulatory Authority of India (TRAI) reports that the number of rural internet users increased from 357.99 Million to 398.35 Million by the end of March 2024. As a result, millions of rural consumers now have greater access to the internet, fostering a thriving e-commerce ecosystem. This digital transformation has unlocked new opportunities for Ayurvedic skincare brands to tap into previously underserved rural markets. While e-commerce remains a strong channel, many brands are adopting an omnichannel approach by expanding their presence in physical retail stores, exclusive brand outlets, and Ayurvedic wellness centers. This hybrid strategy allows consumers to experience products in person while also enjoying the convenience of online shopping. Tier-II and Tier-III cities are also witnessing increased penetration of Ayurvedic skincare through regional e-commerce platforms and localized marketing campaigns.

India Ayurvedic Skincare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, form, gender, and distribution channel.

Product Type Insights:

- Facial Care

- Body Care

- Hair and Scalp Care

- Specialty Products

- Anti-Aging

- Acne Solutions

The report has provided a detailed breakup and analysis of the market based on the product type. This includes facial care, body care, hair and scalp care, and specialty products (anti-aging and acne solutions).

Form Insights:

- Oils and Serums

- Creams and Lotions

- Powders

- Gels and Pastes

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes oils and serums, creams and lotions, powders, and gels and pastes.

Gender Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes men, women, and unisex.

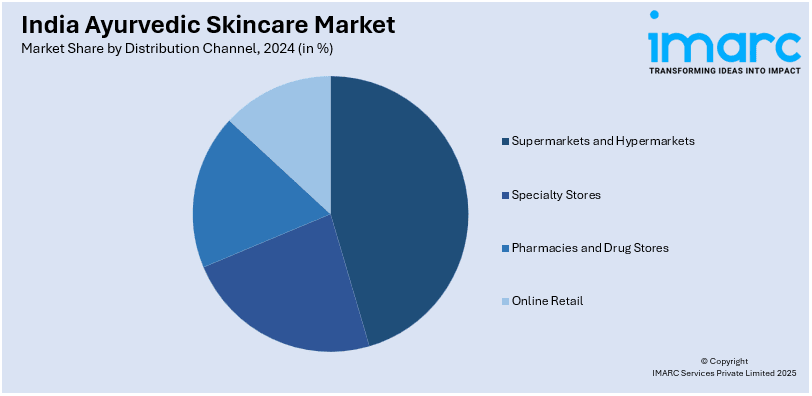

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies and Drug Stores

- Online Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, pharmacies and drug stores, and online retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ayurvedic Skincare Market News:

- On August 12, 2024, Kass, an Indian skincare brand, launched its face care range on Nykaa, integrating Ayurvedic traditions with modern skincare innovations. Founder and CEO Deepti Gujar Kulkarni emphasized that this partnership enables Kass to offer products that honor Indian heritage while meeting contemporary quality standards. Additionally, Kass plans to expand its presence by establishing kiosks in retail chains such as Westside, Lifestyle, and Pantaloons.

- On July 2, 2024, Vedix, a customized Ayurvedic personal care brand, partnered with Shoppers Stop, to launch its inaugural shop-in-shop store at Garuda Mall in Bengaluru. This collaboration introduces advanced hair and skin analyzers, providing customers with personalized product recommendations for enhanced efficacy. Additionally, Vedix unveiled 'Ayutree,' an IoT-enabled device that dispenses customized oil samples in real-time, further enhancing the personalized Ayurveda beauty experience.

India Ayurvedic Skincare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Forms Covered | Oils and Serums, Creams and Lotions, Powders, Gels and Pastes |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies and Drug Stores, Online Retail |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India Ayurvedic skincare market performed so far and how will it perform in the coming years?

- What is the breakup of the India Ayurvedic skincare market on the basis of product type?

- What is the breakup of the India Ayurvedic skincare market on the basis of form?

- What is the breakup of the India Ayurvedic skincare market on the basis of gender?

- What is the breakup of the India Ayurvedic skincare market on the basis of distribution channel?

- What is the breakup of the India Ayurvedic skincare market on the basis of region?

- What are the various stages in the value chain of the India Ayurvedic skincare market?

- What are the key driving factors and challenges in the India Ayurvedic skincare market?

- What is the structure of the India Ayurvedic skincare market and who are the key players?

- What is the degree of competition in the India Ayurvedic skincare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India Ayurvedic skincare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India Ayurvedic skincare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India Ayurvedic skincare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)