India Ayurvedic Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

India Ayurvedic Wellness Market Overview:

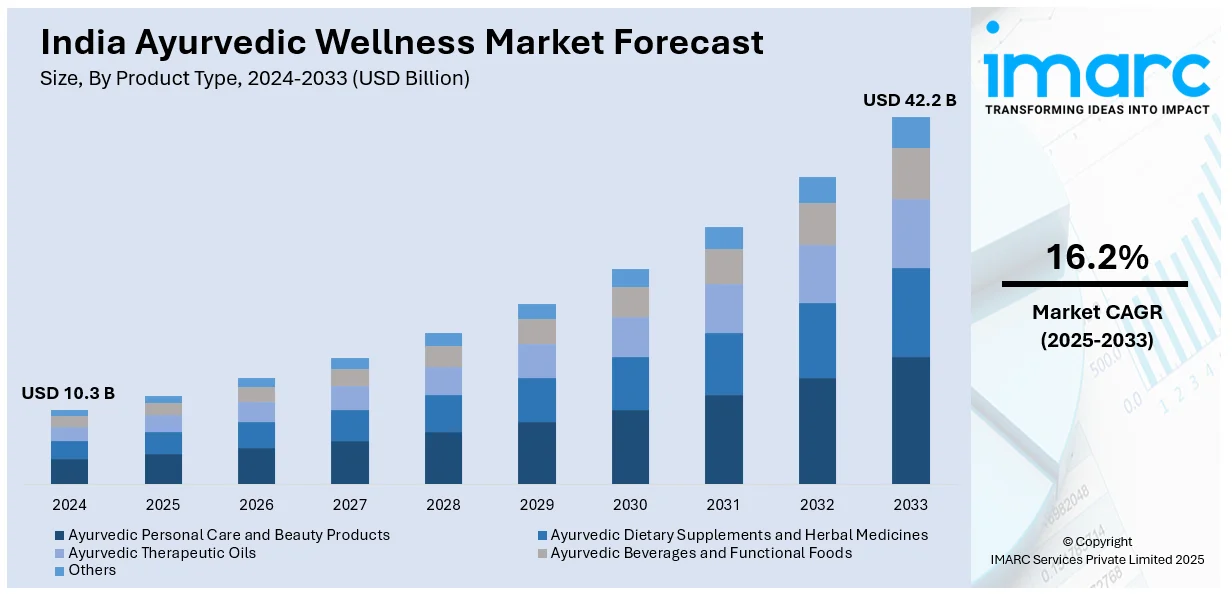

The India ayurvedic wellness market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.2 Billion by 2033, exhibiting a growth rate (CAGR) of 16.2% during 2025-2033. The rising consumer preference for natural and holistic healthcare, increasing government support for Ayurveda, growing awareness about preventive healthcare, expanding online and offline distribution channels, surging investments in Ayurvedic research and development (R&D), and the integration of Ayurveda with modern wellness trends are expanding the India ayurvedic wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.3 Billion |

| Market Forecast in 2033 | USD 42.2 Billion |

| Market Growth Rate 2025-2033 | 16.2% |

India Ayurvedic Wellness Market Trends:

Growing Consumer Preference for Natural and Herbal Products

The Indian Ayurvedic wellness market is witnessing a significant increase in demand as consumers increasingly prefer natural, chemical-free, and plant-based alternatives over synthetic products. This shift is driven by rising awareness regarding the health benefits of Ayurveda, concerns over synthetic ingredients, and the growing influence of holistic well-being. The popularity of Ayurvedic personal care and beauty products has risen sharply, with companies introducing innovative formulations such as herbal skincare, hair care, and organic cosmetics. Additionally, the COVID-19 pandemic has amplified the need for immunity-boosting solutions, leading to increased sales of Ayurvedic dietary supplements and herbal medicines. With government initiatives such as the AYUSH Ministry promoting traditional medicine and the rise of e-commerce platforms facilitating easy access to Ayurvedic products, therefore India Ayurvedic wellness market growth is expected to accelerate further. According to an industry report published on March 28, 2025, the WHO Global Traditional Medicine Centre in Jamnagar was established to promote global wellness and evidence-based research in traditional medicine. It also includes efforts to incorporate Ayurveda with contemporary medical procedures. In order to increase the export and international recognition of AYUSH goods and services, the Ministry has also created a Central Sector Scheme for International Cooperation. Additionally, to advance integrative healthcare, departments of integrative medicine have been operationalized at Lady Hardinge Medical College, Vardhman Mahavir Medical College, and Safdarjung Hospital in New Delhi. As consumer preferences continue evolving towards sustainability and wellness, Ayurvedic brands are poised to experience long-term expansion in India’s booming wellness industry.

To get more information on this market, Request Sample

Expansion of Ayurveda into Mainstream Healthcare

Ayurveda is gradually moving beyond traditional medicine and entering mainstream healthcare in India, driven by an increased focus on integrative treatments. Ayurvedic hospitals, wellness retreats, and clinics are experiencing higher footfalls as people seek alternative and complementary therapies for chronic illnesses, stress management, and lifestyle disorders. The government is actively promoting Ayurveda through policy support, including the establishment of AYUSH health centers and collaborations with pharmaceutical companies for Ayurvedic drug research. For instance, The Ministry of Ayush's Central Council for Research in Ayurvedic Sciences (CCRAS) released a report on March 25, 2025, detailing the development of cooperative networks for integrative and interdisciplinary research over the previous three years to promote evidence-based Ayurveda. To improve community involvement in public health research, programs like Mission Utkarsh and the Ekalavya Model Residential Schools (EMRS) initiative have been started. Furthermore, CCRAS is working on a number of clinical research initiatives, such as a phase II trial on Carctol-S for ovarian cancer and research on Ayurvedic treatments for disorders like Parkinson's disease and ADHD. Moreover, Ayurvedic therapeutic oils and functional foods are gaining traction as they seamlessly integrate into modern lifestyles. Spas and wellness centers are incorporating Ayurveda-based therapies such as Panchakarma and herbal massages, bolstering the sector's revenue. As the demand for preventive healthcare grows, India Ayurvedic wellness market outlook remains positive, with increased investments from global and domestic players fueling innovation, research, and the standardization of Ayurvedic treatments.

India Ayurvedic Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Ayurvedic Personal Care and Beauty Products

- Ayurvedic Dietary Supplements and Herbal Medicines

- Ayurvedic Therapeutic Oils

- Ayurvedic Beverages and Functional Foods

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ayurvedic personal care and beauty products, ayurvedic dietary supplements and herbal medicines, ayurvedic therapeutic oils, ayurvedic beverages and functional foods, and others.

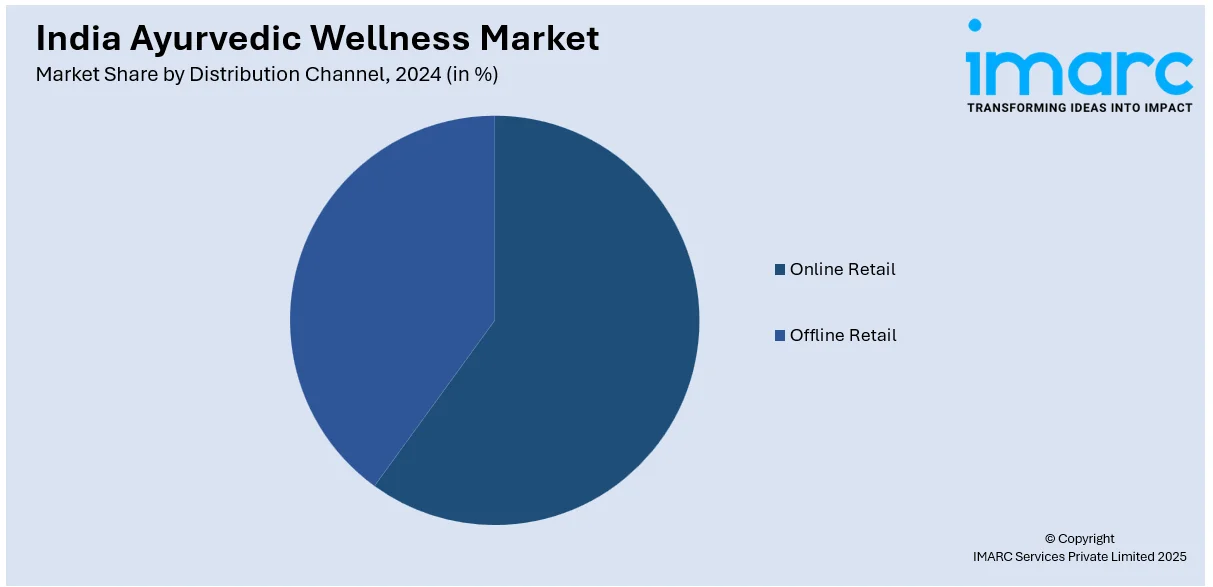

Distribution Channel Insights:

- Online Retail

- Offline Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail and offline retail.

End User Insights:

- Individual Consumers

- Spas and Wellness Centers

- Ayurvedic Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual consumers, spas and wellness centers, ayurvedic hospitals and clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ayurvedic Wellness Market News:

- On December 27, 2024, Rise Wellness Pvt. Ltd. launched Nivam Ayurvedic Wellness, aiming to revolutionize wellness tourism in India by offering innovative Ayurvedic therapies. The flagship center will open in Gachibowli, Hyderabad in January 2025, with plans for expansion across multiple cities and rural areas by 2026. Also, Nivam aims to establish luxurious Ayurvedic resorts in 2026.

- On February 17, 2025, Giosun Healthcare Private Limited displayed more than 700 natural wellness items at the Bombay Exhibition Centre's International Private Label & Contract Manufacturing (IPLCM) Expo 2025. Notable inventions included the Mintdrops Tooth Tabs, which have been clinically shown to enhance gum health by 70% in a month and reduce dental plaque by 35% in a week, and the Re-enact Body Mists, an alcohol-free fragrance line that comes in five aromas, including Sandalwood and Nargis. The company also launched One & Eight VG Tone Up, a vaginal hygiene product that shown an 85% improvement in consumers within seven days, and Ginisca Balm, Spray, and Roll-On for pain relief.

India Ayurvedic Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ayurvedic Personal Care and Beauty Products, Ayurvedic Dietary Supplements and Herbal Medicines, Ayurvedic Therapeutic Oils, Ayurvedic Beverages and Functional Foods, Others |

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Individual Consumers, Spas and Wellness Centers, Ayurvedic Hospitals and Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ayurvedic wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the India ayurvedic wellness market on the basis of product type?

- What is the breakup of the India ayurvedic wellness market on the basis of distribution channel?

- What is the breakup of the India ayurvedic wellness market on the basis of end user?

- What is the breakup of the India ayurvedic wellness market on the basis of region?

- What are the various stages in the value chain of the India ayurvedic wellness market?

- What are the key driving factors and challenges in the India ayurvedic wellness market?

- What is the structure of the India ayurvedic wellness market and who are the key players?

- What is the degree of competition in the India ayurvedic wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ayurvedic wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ayurvedic wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ayurvedic wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)