India B2B Events Market Size, Share, Trends and Forecast by Platform, End User, and Region, 2026-2034

India B2B Events Market Summary:

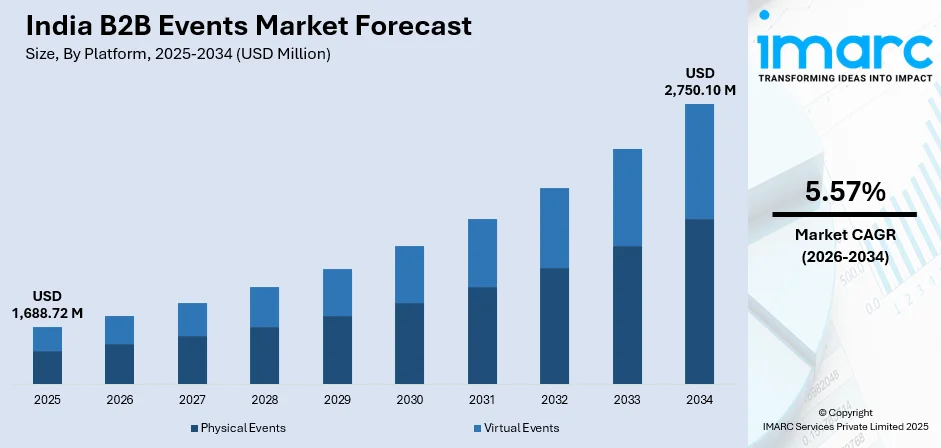

The India B2B events market size was valued at USD 1,688.72 Million in 2025 and is projected to reach USD 2,750.10 Million by 2034, growing at a compound annual growth rate of 5.57% from 2026-2034.

The India B2B events market is experiencing robust growth, driven by increasing corporate spending on marketing, networking initiatives, and brand-building activities across diverse industries. Rising disposable incomes, rapid urbanization, and the emergence of India as a preferred destination for international exhibitions and trade shows are fueling market expansion. The government's focus on developing world-class meetings, incentives, conferences, and exhibitions (MICE) infrastructure, coupled with the growing adoption of digital technologies and hybrid event formats, is transforming the business events landscape and enhancing attendee engagement across the India B2B events market share.

Key Takeaways and Insights:

-

By Platform: Physical events dominate the market with a share of 64% in 2025, owing to the irreplaceable value of face-to-face networking, tactile product demonstrations, and real-time business negotiations that digital formats cannot fully replicate.

-

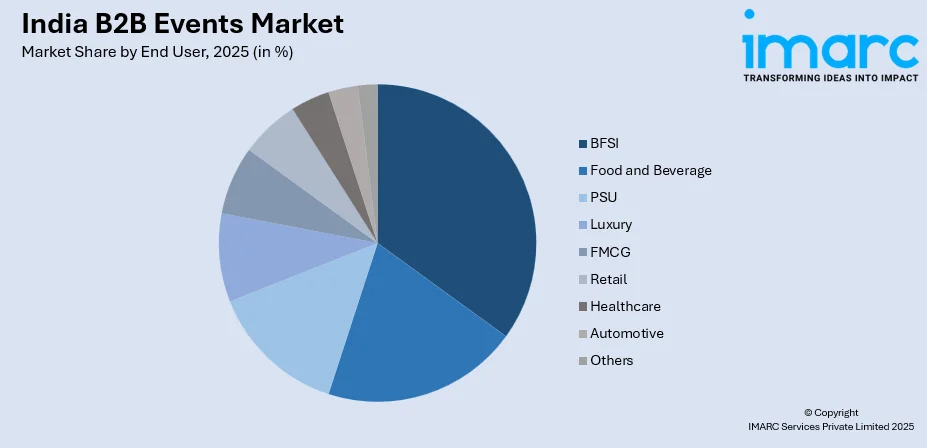

By End User: BFSI leads the market with a share of 19% in 2025. This dominance is driven by the sector's continuous digital transformation initiatives, regulatory compliance requirements, and the growing need for networking platforms that facilitate knowledge exchange and partnership development among financial institutions.

-

By Region: North India comprises the largest region with 30.8% share in 2025, driven by the concentration of government institutions, multinational corporate headquarters, and world-class exhibition venues in Delhi-NCR, along with superior transportation connectivity and hospitality infrastructure.

-

Key Players: Key players drive the India B2B events market by expanding service portfolios, adopting advanced event technologies, and forging strategic partnerships with international organizers. Their investments in digital platforms, hybrid solutions, and specialized industry-focused exhibitions strengthen market positioning and enhance client engagement across diverse sectors.

To get more information on this market Request Sample

The India B2B events market is witnessing transformative growth, as businesses increasingly recognize the strategic value of face-to-face engagement in driving commercial outcomes. The sector benefits from robust economic expansion, with India's GDP reaching approximately USD 3.75 Trillion in 2023, creating favorable conditions for corporate event spending across technology, manufacturing, healthcare, and financial services industries. Event organizers are leveraging artificial intelligence (AI) and data analytics to enhance attendee experiences. The market structure reflects moderate concentration, with established players commanding significant presence while specialized niche operators capture emerging opportunities in sector-specific exhibitions. Government initiatives supporting MICE infrastructure development, combined with rising foreign direct investment (FDI) inflows, are accelerating market professionalization. The convergence of physical and digital formats continues to reshape event design, enabling organizers to extend reach while maintaining the relationship-building advantages of in-person interactions.

India B2B Events Market Trends:

Integration of AI and Data Analytics

The adoption of AI is revolutionizing event management capabilities across the India B2B events market. As per IMARC Group, the India AI market size reached USD 1,251.79 Million in 2024. Event technology platforms are deploying AI-powered matchmaking engines, real-time analytics dashboards, and personalized content recommendations to enhance participant engagement. These intelligent systems enable organizers to optimize sponsor booth placements, predict attendee preferences, and deliver targeted networking opportunities. The shift towards data-driven event design is helping sponsors achieve improved return on investment (ROI) while creating immersive experiences that resonate with tech-savvy corporate audiences across metropolitan and emerging markets.

Expansion of Hybrid Event Formats

Hybrid event formats have evolved from temporary solutions to core business strategies for event organizers seeking to maximize audience reach. The integration of virtual components with physical exhibitions enables broader geographic participation while maintaining the essential face-to-face networking that characterizes successful B2B events. Leading platforms provide real-time analytics dashboards to sponsors, reporting engagement metrics by session and enabling post-event retargeting capabilities. This approach extends monetization windows and creates additional value propositions for exhibitors seeking comprehensive audience engagement solutions.

Government Support for MICE Infrastructure Development

Government initiatives are significantly accelerating the development of world-class exhibition and convention infrastructure across India. State-sponsored cultural tourism marketing programs and public-private partnerships (PPPs) are creating opportunities for B2B stakeholders in event technology, logistics, and digital ticketing services. The plan of establishing city-level convention promotion bureaus as independent bodies in 2026 is set to ease historical space constraints while attracting larger international exhibitions. This infrastructure push is professionalizing cultural and commercial events while enhancing monetization through multi-stakeholder participation frameworks.

Market Outlook 2026-2034:

The India B2B events market demonstrates strong growth potential, driven by favorable macroeconomic conditions, technological advancements, and evolving corporate engagement strategies. Industry stakeholders are increasingly recognizing the irreplaceable value of physical networking while embracing digital enhancements that extend event impact and measurability. The market generated a revenue of USD 1,688.72 Million in 2025 and is projected to reach a revenue of USD 2,750.10 Million by 2034, growing at a compound annual growth rate of 5.57% from 2026-2034. The convergence of infrastructure investments, rising corporate marketing budgets, and technological innovation positions India as an emerging hub for regional and international business events, creating substantial opportunities for organizers, exhibitors, and service providers across the value chain.

India B2B Events Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Platform |

Physical Events |

64% |

|

End User |

BFSI |

19% |

|

Region |

North India |

30.8% |

Platform Insights:

- Physical Events

- Virtual Events

Physical events dominate with a market share of 64% of the total India B2B events market in 2025.

Physical events continue to command the largest share of the India B2B events market, reflecting the enduring importance of face-to-face interactions in facilitating high-value business negotiations and relationship building. Corporate buyers and exhibitors consistently prioritize in-person engagements for tactile product demonstrations, live machinery showcases, and real-time contract discussions that digital platforms cannot fully replicate. The segment demonstrates resilience despite digital alternatives, supported by measurable advantages in lead generation quality and deal conversion rates.

Major events attract thousands of exhibitors and visitors, creating concentrated networking opportunities that accelerate business development cycles. In February 2024, Bharat Tex brought together 3,500 exhibitors across nearly 2 Million square feet, attracting over 100,000 visitors and demonstrating the continued vitality of large-scale physical B2B events. Organizers are enhancing physical experiences with digital overlays, including AI-powered matchmaking and mobile apps that optimize attendee journeys while preserving core face-to-face value propositions.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- PSU

- Luxury

- BFSI

- FMCG

- Retail

- Healthcare

- Automotive

- Others

BFSI leads with a share of 19% of the total India B2B events market in 2025.

The BFSI sector dominates end user segmentation in the India B2B events market, driven by the industry's rapid digital transformation and continuous need for knowledge exchange platforms. Financial institutions increasingly utilize summits, conclaves, and technology exhibitions to explore emerging solutions in AI, blockchain, cybersecurity, and regulatory compliance. The sector's focus on customer experience enhancement, risk management frameworks, and operational efficiency creates sustained demand for specialized networking forums. The India fintech industry, valued at USD 121.4 Billion in 2024, generates substantial event activities across digital banking and payment innovation themes.

Banking and financial services organizations leverage B2B events for vendor evaluation, partnership development, and competitive intelligence gathering across evolving technology landscapes. Major BFSI summits attract senior executives, technology officers, and compliance specialists seeking insights into digital disruption strategies and regulatory navigation approaches. The sector's substantial marketing budgets and emphasis on thought leadership positioning support premium event formats featuring keynote sessions, panel discussions, and interactive workshops. Event platforms, specifically designed for BFSI audiences, continue to expand, with multiple annual summits addressing topics, ranging from fraud detection to sustainable finance frameworks.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 30.8% share of the total India B2B events market in 2025.

North India commands the largest regional share in the India B2B events market, anchored by Delhi-NCR's concentration of world-class exhibition infrastructure, government institutions, and multinational corporate headquarters. The region benefits from landmark venues, including Bharat Mandapam and Yashobhoomi, which together represent Asia's one of the largest convention and exhibition complexes. Yashobhoomi, inaugurated in September 2023 with development costs projected at INR 5,400 Crore, covers a total area of 73,000 square meters and features 15 convention centers capable of accommodating 11,000 attendees simultaneously. Superior transportation connectivity, including dedicated metro access and proximity to international airports, enhances accessibility for domestic and international participants.

The region's strategic importance as India's political and administrative capital attracts government-sponsored exhibitions, policy conclaves, and diplomatic business forums that generate substantial event activities. Major trade fairs across sectors, including textiles, electronics, automotive, and consumer goods, consistently choose Delhi-NCR venues for flagship editions, leveraging the region's established vendor ecosystems and hospitality infrastructure. The concentration of industry associations, trade promotion councils, and export bodies in the national capital further reinforces North India's position as the primary hub for large-scale B2B events targeting both domestic and international audiences.

Market Dynamics:

Growth Drivers:

Why is the India B2B Events Market Growing?

Rising Corporate Spending on Marketing and Brand Activation

Corporate marketing budgets are expanding significantly across Indian enterprises, with increasing allocation towards experiential engagement platforms that deliver measurable business outcomes. Organizations recognize the unique value proposition of B2B events in facilitating qualified lead generation, accelerating sales cycles, and strengthening brand positioning within target industries. The shift from traditional advertising towards experience-based marketing creates sustained demand for trade exhibitions, corporate conclaves, and industry-specific networking forums. Companies across the technology, manufacturing, healthcare, and financial services sectors prioritize event participation as essential components of integrated marketing strategies, driving consistent growth in exhibitor registrations and sponsorship revenues across major exhibitions. The emphasis on ROI measurement encourages organizers to develop sophisticated analytics capabilities that quantify engagement outcomes, propelling the market expansion.

World-Class MICE Infrastructure Development

Government-led infrastructure investments are transforming India's capability to host large-scale international exhibitions and conferences. The inauguration of world-class venues equipped with modern amenities, advanced connectivity, and flexible configurations addresses historical capacity constraints that limited market growth. Purpose-built convention centers featuring fiber connectivity, modular halls, and comprehensive logistics support enable organizers to stage concurrent events while monetizing ancillary services effectively. PPPs facilitate venue development across metropolitan and emerging tier-two cities, distributing growth opportunities beyond traditional hubs. Improved air connectivity, metro rail expansion, and upgraded urban transport systems further enhance delegate accessibility and event attractiveness. In November 2025, India's domestic passenger traffic increased by 7% year-on-year (YoY) to reach 15.2 Million. Digital integration within venues supports hybrid event formats, expanding global participation while maximizing physical attendance value.

Economic Growth and Business Networking Expansion

India's robust economic expansion creates favorable conditions for B2B event growth across diverse industry verticals. Rising FDI, domestic entrepreneurship, and corporate expansion activities generate sustained demand for platforms facilitating business matchmaking and partnership development. The manufacturing sector's growth under production-linked incentive schemes drives heavy-machinery exhibitions, industrial automation fairs, and technology showcases that require physical venues for product demonstrations. Retail sector expansion creates opportunities for consumer goods exhibitions while healthcare industry growth supports pharmaceutical and medical device trade shows. The correlation between economic activities and event participation ensures market resilience across business cycles, with organizers developing specialized content addressing sector-specific growth opportunities and regulatory developments affecting participant industries. Additionally, increasing participation from startups seeking market visibility and investor engagement further expands exhibitor bases and attendee footfalls across regional and national B2B events.

Market Restraints:

What Challenges the India B2B Events Market is Facing?

Skilled Workforce Shortage and Training Gaps

The India B2B events market faces significant challenges from skilled labor shortages that affect event execution quality and operational efficiency. The gap between demand for trained professionals and available qualified candidates creates inconsistencies in service delivery standards. Many individuals enter the industry through informal channels without structured training, limiting capability for managing complex large-scale exhibitions. Skilled-labor shortages lengthen installation timelines, squeezing margins for organizers and exhibitors.

Venue Capacity Constraints in Major Cities

Despite infrastructure investments, major metropolitan centers continue to experience venue shortages that constrain market growth potential. Demand for exhibition space frequently exceeds supply during peak seasons, creating scheduling conflicts and limiting opportunities for new event launches. Urban traffic congestion complicates logistics coordination for exhibitors transporting equipment and materials. These infrastructure gaps particularly affect mid-sized events unable to access premium venues while lacking scale economies to justify satellite location expenses.

Complex Regulatory Environment Across States

The B2B events industry contends with complex regulations varying significantly between states, particularly regarding permits for large gatherings and compliance requirements. High compliance costs alongside differing goods and services tax (GST) frameworks and labor laws add operational challenges for organizers operating across multiple jurisdictions. Interstate e-way bill formalities create additional paperwork and detention fees for goods transportation. The regulatory burden often leads to delays impacting overall sector efficiency while discouraging smaller organizers from scaling operations nationally.

Competitive Landscape:

The India B2B events market exhibits a moderately concentrated competitive structure, characterized by the presence of both established multinational organizers and dynamic domestic players. Global groups leverage international event portfolios and technological capabilities to attract multinational exhibitors seeking consistent brand experiences across geographies. Domestic operators differentiate through deep local market knowledge, regulatory expertise, and vendor network relationships cultivated over decades. Competition increasingly centers on technology capabilities, with players deploying AI-driven matchmaking engines and comprehensive analytics platforms to demonstrate exhibitor value. Recent leadership appointments by international organizers reflect strategies to localize management and enhance client relationships within specific industry verticals. Strategic acquisitions and partnership formations continue to reshape competitive dynamics as participants pursue scale advantages.

Recent Developments:

-

In September 2025, the Government of Uttar Pradesh and India Exposition Mart Ltd (IEML) were set to conduct UP International Trade Show 2025, which served as the principal B2B and B2C event, showcasing the state’s impressive industrial development, entrepreneurial vigor, and international business opportunities. This large trade exhibition acted as an influential venue for industries, startups, exporters, and business leaders to present their innovations, forge partnerships, and investigate new market possibilities on national and global scales.

-

In September 2025, Cosmoprof India Ltd announced that Cosmoprof India is set to take place at the Jio World Convention Centre in Mumbai from December 4 to 6, 2025, reinforcing its position as the leading international B2B beauty event in India. The event provides global stakeholders the chance to experience the vibrancy of the Indian beauty market and seek new business opportunities throughout the entire industry supply chain.

India B2B Events Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Million USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Platforms Covered |

Physical Events, Virtual Events |

|

End Users Covered |

Food and Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, Others |

|

Regions Covered |

North India, South India, East India, West India |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India B2B events market size was valued at USD 1,688.72 Million in 2025.

The India B2B events market is expected to grow at a compound annual growth rate of 5.57% from 2026-2034 to reach USD 2,750.10 Million by 2034.

Physical events dominated the market with a share of 64%, driven by the irreplaceable value of face-to-face networking and tactile product demonstrations for high-value business negotiations.

Key factors driving the India B2B events market include rising corporate spending on experiential marketing, government investments in world-class MICE infrastructure, and robust economic growth fueling business networking activities.

Major challenges include skilled workforce shortages affecting execution quality, venue capacity constraints in metropolitan centers, complex regulatory requirements varying across states, and competition from digital marketing channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)