India Baby Diapers Market Size, Share, Trends and Forecast by Product Type, Sales Channel, and Region, 2025-2033

India Baby Diapers Market Overview:

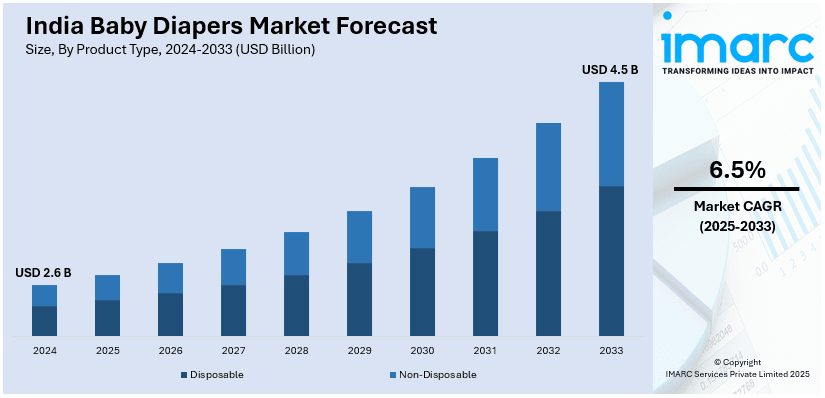

The India baby diapers market size reached USD 2.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% during 2025-2033. The market is experiencing significant growth mainly due to rising urbanization, increasing disposable income, and growing hygiene awareness. Growing demand for premium and eco-friendly diapers, along with innovations in absorbency and skin-friendly materials are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 6.5% |

India Baby Diapers Market Trends:

Shift Towards Premium and Eco-Friendly Diapers

The India baby diapers market is witnessing a shift toward premium and eco-friendly options as parents become more conscious of their babies' health and environmental impact. Biodegradable diapers made from plant-based fibers, organic cotton, and chemical-free absorbents are gaining traction, reducing exposure to harmful substances. Many parents now prioritize skin-friendly diapers free from chlorine, phthalates, and artificial fragrances, minimizing diaper rash risks. With rising disposable incomes and changing consumer preferences, demand for sustainable alternatives is increasing. Companies are investing in innovations such as compostable materials, bamboo-based diapers, and water-based inks for packaging. This shift is gradually influencing India baby diapers market share, with premium and eco-friendly brands capturing a growing portion of the market. Several brands are responding to this demand by launching eco-conscious products and awareness campaigns to strengthen their presence in the premium segment. For instance, in April 2023, Organic baby care brand Allter launched its campaign ‘Every Mother is a Protector’ with Dia Mirza as brand ambassador. Focused on eco-friendly products, Allter aims to revolutionize baby care with sustainable bamboo diapers and wipes, promoting a greener lifestyle for families while addressing the industry's lack of innovation. Regulatory support for sustainability and the push for plastic-free products further drive adoption, making eco-conscious diapers a key segment in the market’s evolving landscape.

To get more information on this market, Request Sample

Growing Urbanization and Rising Disposable Income

Rapid urbanization and rising disposable incomes are key drivers of diaper adoption in India. The Economic Survey 2023-24 predicts that over 40% of India's population will reside in urban areas by 2030, according to NITI Aayog. A Periodic Labour Force Survey (July 2020 - June 2021) revealed migration patterns: 55% internal migrants, with 10.2% rural-to-rural, 18.9% rural-to-urban, and 15.9% urban-to-urban. As more families migrate to urban areas, lifestyle changes and increased exposure to modern childcare practices contribute to higher diaper usage. India baby diapers market growth is being fueled by dual-income households, increased spending power, and greater awareness of hygiene benefits. With busy urban lifestyles, parents seek convenience-driven solutions, boosting demand for disposable and premium diaper variants. Expanding retail networks, including supermarkets, pharmacies, and e-commerce platforms, further enhance accessibility. Moreover, growing health consciousness among parents is leading to a preference for diapers with advanced absorbency, skin-friendly materials, and eco-friendly options. Government initiatives supporting maternal and infant health, along with a rising birth rate in certain demographics, add momentum to the market. These factors collectively shape the India baby diapers market outlook and indicate sustained expansion.

India Baby Diapers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and sales channel.

Product Type Insights:

- Disposable

- Non-Disposable

The report has provided a detailed breakup and analysis of the market based on the product type. This includes disposable and non-disposable.

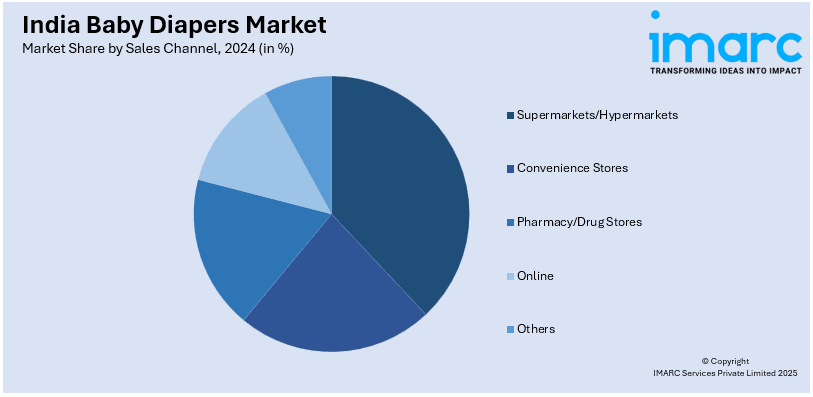

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Pharmacy/Drug Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, pharmacy/drug stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Baby Diapers Market News:

- In January 2025, MamyPoko Pants launched the #HarBabyKaPehlaDiaper campaign aimed at new mothers, promoting their redesigned pant-style diapers for newborns. The campaign emphasizes deep absorption for up to 12 hours and includes influencer partnerships. A digital film highlights the brand’s commitment to comfort, safety, and enhancing first experiences for babies.

- In January 2024, Pampers launched an enhanced range of premium care diapers featuring 360-degree cottony softness and anti-rash protection. The event offered parents a multi-sensory experience and highlighted the diaper's benefits for day and night comfort for babies.

India Baby Diapers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Disposable, Non-Disposable |

| Sales Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Pharmacy/Drug Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India baby diapers market performed so far and how will it perform in the coming years?

- What is the breakup of the India baby diapers market on the basis of product type?

- What is the breakup of the India baby diapers market on the basis of sales channel?

- What is the breakup of the India baby diapers market on the basis of region?

- What are the various stages in the value chain of the India baby diapers market?

- What are the key driving factors and challenges in the India baby diapers market?

- What is the structure of the India baby diapers market and who are the key players?

- What is the degree of competition in the India baby diapers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India baby diapers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India baby diapers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India baby diapers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)