India Baby Food and Infant Formula Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Baby Food and Infant Formula Market Size and Share:

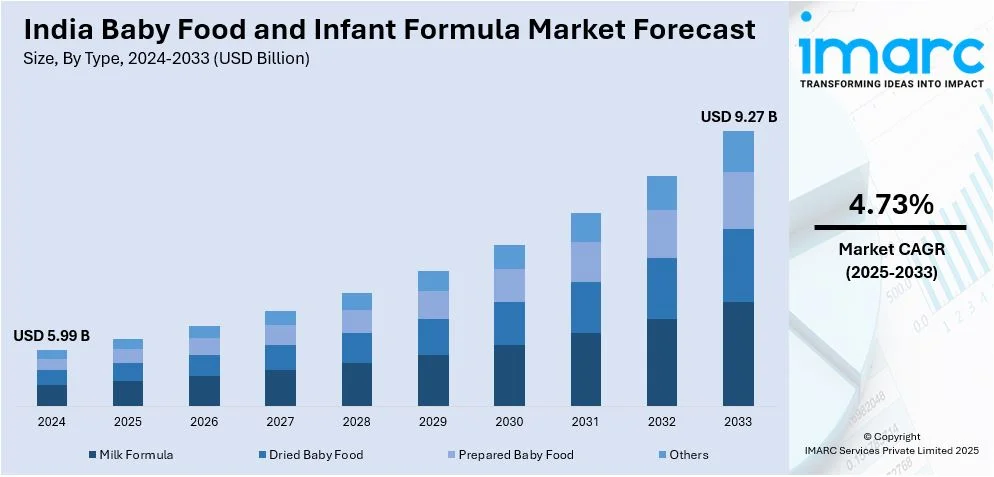

The India baby food and infant formula market size was valued at USD 5.99 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.27 Billion by 2033, exhibiting a CAGR of 4.73% from 2025-2033. The market share is expanding, driven by changing conventional family structures and lifestyles, especially in urban and tier-1 cities, increased penetration of digital media, improved maternal education, and wider availability of internet penetration, and proliferation of e-commerce websites.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.99 Billion |

|

Market Forecast in 2033

|

USD 9.27 Billion |

| Market Growth Rate 2025-2033 | 4.73% |

Product development innovation is impelling the growth of the market in India. Firms are increasingly spending on research and development (R&D) to produce formulations that resemble breast milk closely and adhere to global safety and quality standards. Improved packaging ensuring product safety and convenience, like resealable pouches and single-use sachets, have further strengthened consumer trust. Moreover, e-commerce growth is enhancing product accessibility, allowing parents from all geographies to easily buy global and local brands. Increased pressure from pediatricians and healthcare workers in shaping parent decisions is contributing to the market growth. Medical advice favoring formula feeding, particularly when breastfeeding is impossible because of medical conditions or issues with lactation, is offering a favorable India baby food and infant formula market outlook.

To get more information on this market, Request Sample

In addition, enhanced access to healthcare in rural and semi-urban areas, aided by government initiatives, is increasing market penetration and product awareness outside urban areas. Emerging awareness about early childhood nutrition is another key influence behind the growth of the market. Healthcare professionals, government initiatives, and campaigns have helped in the process of educating parents regarding the nutritional requirements of infants. Improved literacy and increased access to digital media have better educated parents regarding the long-term advantages of good nutrition during the initial days of life. Demand for high-quality, science-formulated infant food products that nurture physical and mental growth is growing as a result.

India Baby Food and Infant Formula Market Trends:

Shifting Family Dynamics

In India, the changing conventional family structures and lifestyles, especially in urban and tier-1 cities is driving the need for infant formulas. With the rise of nuclear families, the dependence on extended family members for child-rearing is declining. This change, combined with the growing employment of women, has generated an expanding need for easy and safe alternatives to home-cooked meals for infants. Working parents, who are frequently time-constrained, are more likely to embrace ready-to-feed infant food and baby formula products that provide convenience of preparation and nutritional guarantee. Urban consumers are also more likely to be accepting new retail formats and digital channels, which offer convenient access to a wide variety of baby nutrition products. This urban living shift, defined by rapid lifestyles and minimal caregiving assistance, is a major driver fueling the expansion and adoption of baby food and formula options in Indian homes. As per a government fact sheet released in 2025, women’s participation in employment associated activities increased 25% in 2024 from 21.8% in 2019. This is further driving the need for infant formulas.

Increasing Awareness About Infant Health and Nutrition

Rising consciousness about infant nutrition and overall health is bolstering the India baby food and infant formula market growth. With increased penetration of digital media, improved maternal education, and wider availability of internet penetration, parents are now better educated regarding the nutritional requirements of their offspring. Public awareness campaigns, pediatric recommendations, and government nutrition programs are playing a key role in propagating the word about the need for well-balanced diet during the initial years of life. This information is impacting consumer purchasing decisions, directing demand toward scientifically developed baby foods and enriched infant formulas providing focused health advantages, such as boosting immunity, brain development, and normal weight gain. Additionally, with increasing worries about malnutrition and growth faltering, particularly in rural and semi-urban areas, parents are going out of their way to secure trustworthy nutrition solutions. India ranked 105th out of 127 nations in the 2024 Global Hunger Index report.

Growth of Organized Retail and E-commerce Channels

The quick growth of organized retail and the proliferation of e-commerce websites have improved the availability and accessibility of infant formula and baby food products in India considerably. Supermarkets, hypermarkets, and pharmacy chains in urban and semi-urban areas now carry a large range of branded baby nutrition products, providing consumers with increased choice and product visibility. This is reinforced by the increasing visibility of internet-based shopping sites, which offer convenience, product comparison, discounts, and home delivery. The presence of rich product information, peer reviews, and doctor recommendations on the internet also facilitates wiser buying. In addition, online exclusives and subscription-based delivery models have enhanced customer loyalty and retention. The development of the retail industry has therefore been central to enhancing product distribution, particularly in areas that were hitherto not served by conventional retail networks. The IMARC Group states that the India e-commerce market size is expected to reach USD 650.4 Billion by 2033.

India Baby Food and Infant Formula Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India baby food and infant formula market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

Milk formula stands as the largest component in 2024, holding 54.0% of the market. Milk formula, or infant formula, is a specially prepared alternative to breast milk that is designed for consumption by infants below 12 months of age. It is scientifically prepared to replicate the nutrient content of human breast milk to supply the necessary nutrients, including proteins, carbohydrates, fats, vitamins, and minerals required to promote the development and growth of an infant. Milk formula is generally prepared from processed cow's milk suitable for infants, though plant-based and special forms are also prepared for people with dietary needs or allergies. The demand for milk formula is growing in India with rising urbanization, working women, and improving awareness about infant nutrition. The market is also boosted by the presence of a wide range of product types, such as stage-specific versions and those supplemented with DHA, probiotics, and prebiotics.

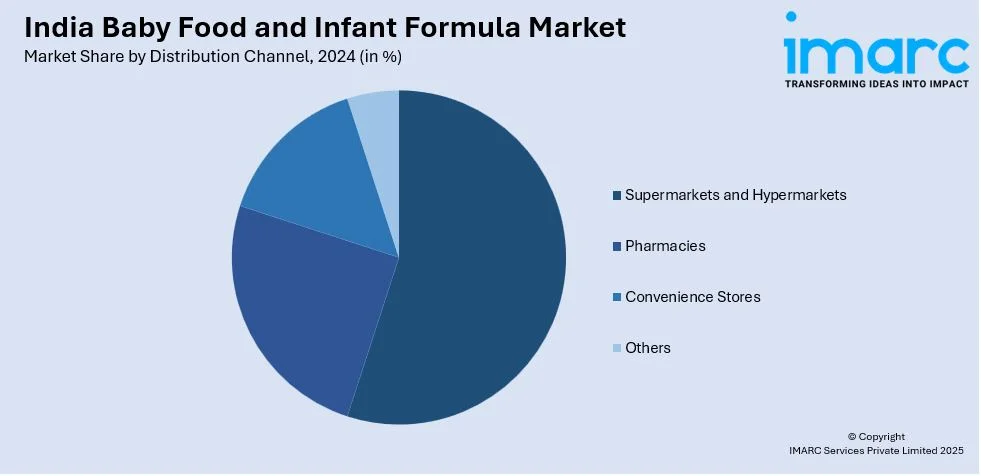

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Others

Supermarkets and hypermarkets hold 45.8% of the market share. Supermarkets and hypermarkets are important channels in the distribution and visibility of infant formula and baby food products in India. Such organized retail stores provide a large range of brands, product varieties, and pack sizes in one location, hence easy to access for consumers looking for reliable and good quality baby nutrition. Found mostly duplicates of cities and semi-cities, these retail structures give convenient options for both local and global baby food brands, hence facilitating informed buying decisions. The structured format of these stores also facilitates appropriate storage, handling, and product display of sensitive products such as infant formula, thus maintaining product integrity. Promotion techniques, such as in-store promotions, loyalty schemes, and bundled packages also increase consumer interaction. Moreover, the availability of well-trained retail personnel to assist parents in making the right product choices enhances the confidence level among new customers.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

The infant formula and baby food industry in South India is experiencing significant growth as a result of the confluence of rising health consciousness, rising urbanization, and effective coverage by organized retail. Tamil Nadu, Karnataka, Kerala, and Andhra Pradesh states have registered increased acceptance of packaged infant nutrition products in response to rising literacy levels and enhanced access to healthcare. Urban areas such as Bengaluru, Chennai, and Hyderabad have an increasing number of dual-income families, resulting in the escalating demand for easy and nutritionally rich baby food options. In addition, South India is highly demanding of organic and plant-based infant nutrition, which is in line with the traditionally health-focused consumer behavior in the region. The growing number of e-commerce websites and pharmacies in urban and tier-2 cities has also increased the accessibility of branded baby food and formula. With the inflating disposable incomes and consciousness about developmental nutrition, South India remains a potential regional market in the larger Indian infant nutrition market.

Competitive Landscape:

Leading players in market are using multi-pronged strategies to gain market strength and propel growth. Top players are investing massively in research and development (R&D) to innovate with formulations closely similar to breast milk and target specific health conditions, including lactose intolerance and allergies. Such players are also building up their portfolios with organic, fortified, and stage-wise options for nutrition to cater to the needs of diverse consumers. Collaborations with hospitals, pediatricians, and maternity clinics on strategic levels are bolstering brand credentials and fueling product recommendations, thereby driving the India baby food and infant formula market demand. In addition, players are making use of digital marketing, influencer partnerships, and focused social media campaigns to reach young, tech-savvy parents. Strengthened distribution channels and digital commerce platforms in tier-2 and tier-3 cities also feature as part of the strategic priority. This, along with local marketing, competitive pricing, and localized initiatives, is making companies tap the increasingly expanding infant nutrition market of India.

The report provides a comprehensive analysis of the competitive landscape in the India baby food and infant formula market with detailed profiles of all major companies, including:

- Nestlé India

- Abbott

- Nutricia

- Mead Johnson & Company, LLC

- Danone India

- FrieslandCampina

- Amway India Enterprises Pvt. Ltd.

Latest News and Developments:

- October 2024: Nestlé India announced the launch of "no refined sugar" variants of its infant food Cerelac, following criticism for added sugar in the product. Out of the 21 Cerelac variants, 14 will be sugar-free, with 7 available now available in the market.

- August 2024: Happa Foods became the first Indian brand to export baby purees, entering six countries, including Kuwait, Oman, Maldives, Kenya, Seychelles, and the UAE. The expansion marked a milestone for India's baby food industry, showcasing its capability to produce high-quality, organic products that compete globally, beyond catering to the Indian diaspora.

- September 2024: Nutriwiz launched Fortified Multi-nutrient Milk Mixes with 34 essential micronutrients to combat deficiencies among pregnant women and children. Introduced at ISF 2024, the affordable mixes aimed to provide 80% of daily nutrition needs in a single glass of milk, supporting better health and development across socio-economic groups.

- January 2024: Danone India launched AptaGrow, a toddler nutrition product with 37 nutrients, including 100% milk protein, calcium, vitamins A, C, D, DHA, iron, folic acid, etc. Designed for children aged 3-6 years, AptaGrow supports growth, immunity, and brain development.

India Baby Food and Infant Formula Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Nestlé India, Abbott, Nutricia, Mead Johnson & Company, LLC, Danone India, FrieslandCampina, Amway India Enterprises Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India baby food and infant formula market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India baby food and infant formula market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India baby food and infant formula industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India baby food and infant formula market was valued at USD 5.99 Billion in 2024.

The market is driven by urbanization, rising women employment, increased awareness about infant nutrition, growing acceptance of formula feeding due to medical advice, and expanding e-commerce and organized retail infrastructure across urban and rural regions.

The India baby food and infant formula market is projected to exhibit a CAGR of 4.73% during 2025-2033, reaching a value of USD 9.27 Billion by 2033.

Milk formula accounted for the largest share in the India baby food and infant formula market in 2024, representing 54.0% of the market. Its dominance is driven by growing urbanization, working mothers, and increasing awareness of infant nutritional needs.

Supermarkets and hypermarkets held the largest distribution channel share in 2024, comprising 45.8% of the market. Their wide product range, organized retail format, and accessibility across urban and semi-urban regions have made them the preferred purchasing channel for baby nutrition products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)