India Bags Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, End User, and Region, 2025-2033

India Bags Market Overview:

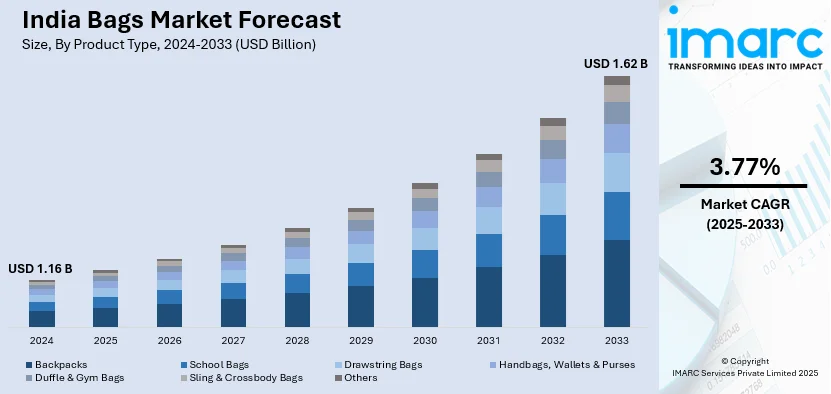

The India bags market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.62 Billion by 2033, exhibiting a growth rate (CAGR) of 3.77% during 2025-2033. The market is growing due to rising urbanization, fashion trends, e-commerce expansion, increasing disposable incomes, corporate gifting, eco-friendly bag demand, government plastic bans, school and travel needs, and premiumization in luggage and handbags.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 1.62 Billion |

| Market Growth Rate 2025-2033 | 3.77% |

India Bags Market Trends:

Rising Disposable Income and Changing Lifestyles

Higher disposable incomes and urbanization have fueled demand for premium and designer bags in India. Consumers are increasingly seeking stylish, functional, and durable bags for work, travel, and daily use. The growing trend of casual and luxury backpacks, sling bags, and handbags reflects evolving fashion preferences. With more Indians traveling for leisure and business, luggage sales have also increased. The rise of aspirational buying, exposure to global fashion trends through social media, and celebrity endorsements further boost premium bag purchases. Many brands are capitalizing on this trend by offering personalized and limited-edition collections to attract affluent consumers which is driving the India bags market growth. For instance, in December 2024, Snitch, a well-known name in the men's fashion industry, continued to push the boundaries of design and affordability with the introduction of its latest product category, bags. This premium line features a thoughtfully picked selection of bags meant to combine usefulness with immaculate style, meeting the needs of modern, fashion-forward men. Snitch intends to capitalize on this potential by filling a void in men's accessories, creating goods that elevate everyday style while improving functionality.

To get more information on this market, Request Sample

Government Regulations and Sustainability Trends

The Indian government’s regulations on plastic bags, including bans and penalties for single-use plastics, have accelerated the shift toward eco-friendly alternatives which is creating a positive India bags market outlook. For instance, in January 2025, Rashtriya Swayamsevak Sangh (RSS) Sah-Sarkaryavah Krishna Gopal inaugurated the "One Plate, One Bag" campaign in Sector 18 on the Old GT Road to replace plastic bags and disposable items. According to an RSS official, cloth bags, as well as steel plates and glasses, would be supplied at the Maha Kumbh to ensure that the world's largest religious congregation is plastic-free. Consumers and businesses are adopting biodegradable, cloth, jute, and recycled-material bags, creating opportunities for sustainable brands. Corporate social responsibility (CSR) initiatives by major retailers and brands further promote reusable and environmentally friendly bags. Additionally, growing awareness of climate change and sustainability has influenced consumer preferences, with demand rising for ethically sourced and durable materials. Brands investing in green innovations, such as plant-based or upcycled materials, are gaining traction in both urban and rural markets which is further fueling the India bags market share. Similarly, in April 2023, Rashki, a sustainable fashion business, collaborated with Atma Leather to create what it claims are India's first banana leather bags.

India Bags Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional/country level for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and end user.

Product Type Insights:

- Backpacks

- School Bags

- Drawstring Bags

- Handbags, Wallets & Purses

- Duffle & Gym Bags

- Sling & Crossbody Bags

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes backpacks, school bags, drawstring bags, handbags, wallets & purses, duffle & gym bags, sling & crossbody bags, and others.

Material Type Insights:

- Polyesters

- Nylon

- Leather

- Cotton Canvas

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes polyesters, nylon, leather, cotton canvas, and others.

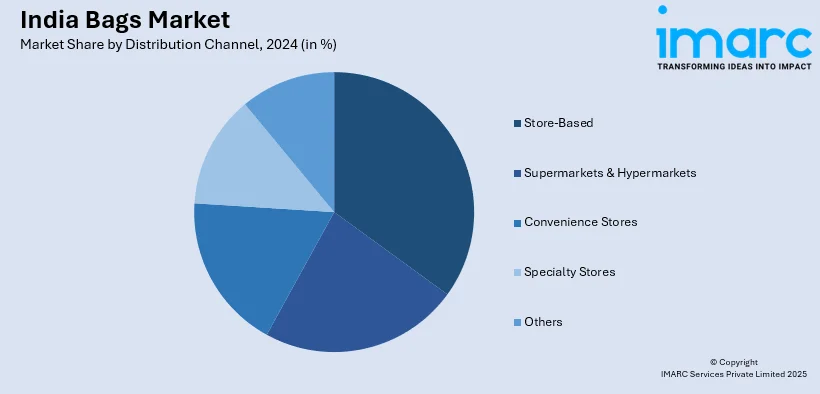

Distribution Channel Insights:

- Store-Based

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based, supermarkets & hypermarket, convenience stores, specialty stores, and others.

End User Insights:

- 5 to 12 Years

- 13 to 19 Years

- 20 Years & Above

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes 5 to 12 years, 13 to 19 years, and 20 years & above.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bags Market News:

- In October 2023, Myntra revealed a partnership with the Apparel Group to introduce Anne Klein's premium handbag collection to India's expanding luxury market. Anne Klein offers a diverse range of items globally, such as apparel, footwear, bags, and accessories.

- In July 2024, Arista Vault, the pioneer of smart baggage technology, offered the JARVIZ, its latest innovation. JARVIZ transforms travel into a seamless and enchanting experience, combining ease and cutting-edge technology.

India Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Backpacks, School Bags, Drawstring Bags, Handbags, Wallets & Purses, Duffle & Gym Bags, Sling & Crossbody Bags, Others |

| Material Types Covered | Polyesters, Nylon, Leather, Cotton Canvas, Others |

| Distribution Channels Covered | Store-Based, Supermarkets & Hypermarket, Convenience Stores, Specialty Stores, Others |

| End Users Covered | 5 To 12 Years, 13 To 19 Years, 20 Years & Above |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bags market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bags market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bags industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bags market in India was valued at USD 1.16 Billion in 2024.

The India bags market is projected to exhibit a CAGR of 3.77% during 2025-2033, reaching a value of USD 1.62 Billion by 2033.

The India bags market is driven by changing fashion trends, rising disposable incomes, and the growing demand for functional and stylish accessories. Urbanization, increased travel, and the rise of e-commerce also contribute to the market growth. Additionally, the growing focus on eco-friendly and sustainable materials is shaping individual preferences and expanding market opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)