India Ball Valves Market Size, Share, Trends and Forecast by Material, Type, Size, Application, and Region, 2025-2033

India Ball Valves Market Overview:

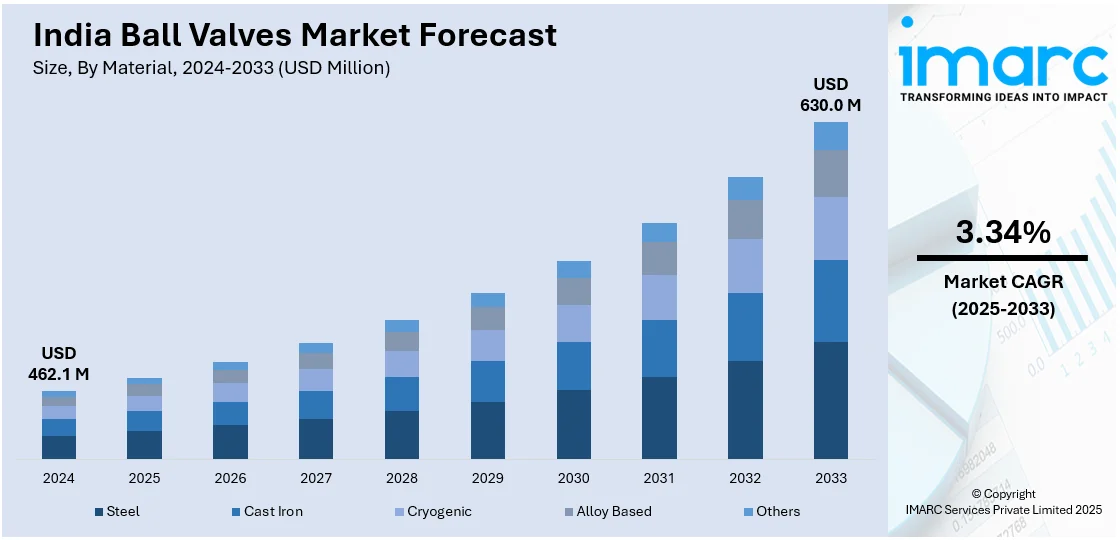

The India ball valves market size reached USD 462.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 630.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.34% during 2025-2033. Rapid industrialization, expanding oil and gas infrastructure, increasing demand for efficient fluid control systems, implementation of government initiatives in water treatment and power generation, rising investments in manufacturing and construction sectors, continual technological advancements, and the growing need for automation in various industries are some of the major factors augmenting the India ball valves market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 462.1 Million |

| Market Forecast in 2033 | USD 630.0 Million |

| Market Growth Rate 2025-2033 | 3.34% |

India Ball Valves Market Trends:

Growth in the Oil & Gas and Petrochemical Sectors

India's expanding oil and gas industry, fueled by increasing energy demand, is positively influencing India ball valve market outlook. According to an industry report, India currently serves as a refining center, boasting 23 refineries. The sector is projected to draw in an investment of USD 25 Billion for exploration and production. The expansion of the oil and gas sector is significantly driving the demand for high-performance ball valves. The government's focus on increasing domestic oil and gas production under initiatives such as the hydrocarbon exploration and licensing policy (HELP) is encouraging investments in refineries, pipelines, and LNG terminals, significantly increasing the need for robust and efficient ball valves. Ball valves are essential in controlling fluid flow across upstream, midstream, and downstream operations, ensuring safety and reliability in high-pressure environments. The expansion of city gas distribution (CGD) networks and the rising adoption of liquefied natural gas (LNG) as a cleaner fuel are further contributing to market growth. The increasing emphasis on environmental sustainability leads to the higher requirement for low-emission, fire-safe, and high-temperature-resistant ball valves.

To get more information on this market, Request Sample

Expanding Water and Wastewater Treatment Infrastructure

The rapid urbanization and industrial growth in India are driving significant investments in water and wastewater treatment infrastructure. According to industry reports, India ranks as the fifth largest market for water and wastewater treatment globally, with a valuation of around USD 11 Billion. This market is projected to exceed USD 18 Billion by 2026. The growth of water and wastewater treatment infrastructure is leading to an increased demand for high-performance ball valves. The Indian government's initiatives, such as the Jal Jeevan Mission and Smart Cities Mission, emphasize improved water supply systems, efficient sewage treatment, and better water resource management, thereby creating a substantial market for corrosion-resistant and durable ball valves. The need for stringent water quality control, coupled with the rising concerns over water scarcity, urges municipal corporations and industrial units to adopt advanced treatment technologies. Ball valves are essential in regulating water flow in desalination plants, wastewater recycling facilities, and sewage treatment plants. In addition to this, the increasing usage of energy-efficient and low-leakage ball valves in water distribution networks is helping to minimize water losses. Furthermore, the leading market players in the country are focusing on manufacturing polymer-coated and stainless-steel ball valves to withstand harsh environments and chemical exposure, further facilitating India ball valve market growth.

India Ball Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on material, type, size, and application.

Material Insights:

- Steel

- Cast Iron

- Cryogenic

- Alloy Based

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes steel, cast iron, cryogenic, alloy based, and others.

Type Insights:

- Trunnion-Mounted

- Floating

- Rising Stem

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes trunnion-mounted, floating, and rising stem.

Size Insights:

- <1”

- 1”−5”

- 6”–24”

- 25”–50”

- >50’’

The report has provided a detailed breakup and analysis of the market based on the size. This includes <1”, 1”−5”, 6”–24”, 25”–50”, and >50’’.

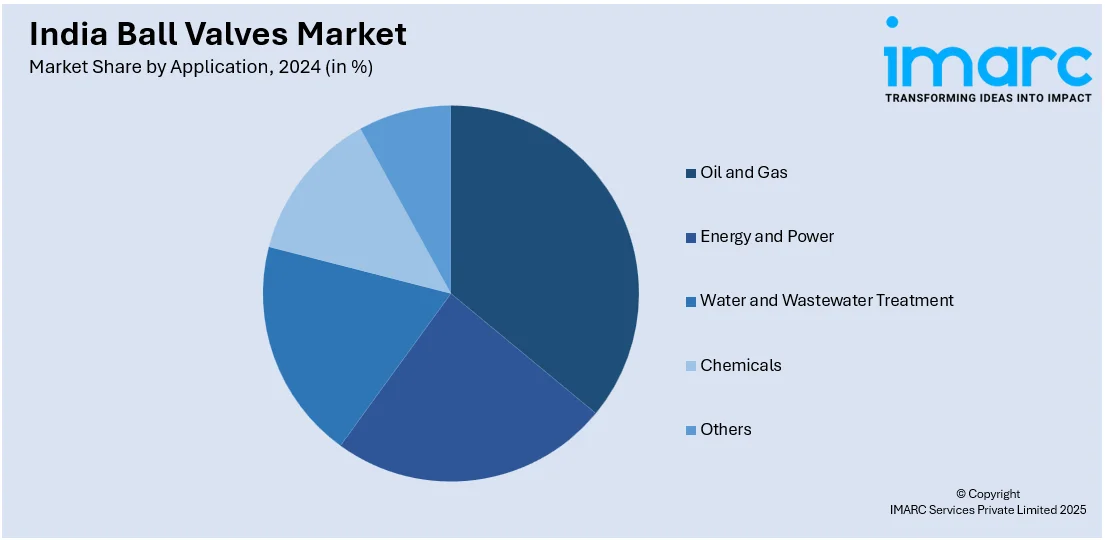

Application Insights:

- Oil and Gas

- Energy and Power

- Water and Wastewater Treatment

- Chemicals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, energy and power, water and wastewater treatment, chemicals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ball Valves Market News:

- On August 17, 2024, Novel Valves India Pvt. Ltd. introduced India's first IBR-approved 3-way ball valve. This valve, constructed from high-grade stainless steel or carbon steel, offers robust resistance to corrosion and wear, ensuring durability in demanding industrial environments. Its design facilitates versatile flow control, allowing for diversion, mixing, or complete shut-off with a simple quarter-turn operation. The Indian Boiler Regulations (IBR) certification attests to its adherence to stringent safety and reliability standards, making it suitable for applications in steam systems, chemical processing, and water treatment plants.

- On January 21, 2025, AMPO POYAM VALVES announced its collaboration with Numaligarh Refinery Limited (NRL) in Assam, India, to supply advanced valves for the modernization of NRL's Delayed Coker Unit (DCU). This initiative is part of NRL's strategic plan to enhance its refining capacity from 3.0 to 9.0 million metric tons per annum (MMTPA). AMPO POYAM VALVES will design and manufacture various specialized valves, including 4-way switch plug valves, ball valves up to 12", and motor-operated lift plug isolation valves tailored for severe service applications within the DCU.

India Ball Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Steel, Cast Iron, Cryogenic, Alloy Based, Others |

| Types Covered | Trunnion-Mounted, Floating, Rising Stem |

| Sizes Covered | <1”, 1”−5”, 6”–24”, 25”–50”, >50’’ |

| Applications Covered | Oil and Gas, Energy and Power, Water and Wastewater Treatment, Chemicals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ball valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ball valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ball valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ball valves market in India was valued at USD 462.1 Million in 2024.

The India ball valves market is projected to exhibit a CAGR of 3.34% during 2025-2033, reaching a value of USD 630.0 Million by 2033.

Major drivers of the India ball valves market are accelerating industrialization, growing investments in oil and gas facilities, and increasing water treatment projects. Rising demand for efficient flow control systems for industries like chemicals, power generation, and pharmaceuticals is also driving demand. Moreover, smart valve technologies and infrastructure development initiatives driven by the government are propelling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)