India Barcode Scanners and Printers Market Size, Share, Trends and Forecast by Type, Application, Product Type, and Region, 2025-2033

India Barcode Scanners and Printers Market Overview:

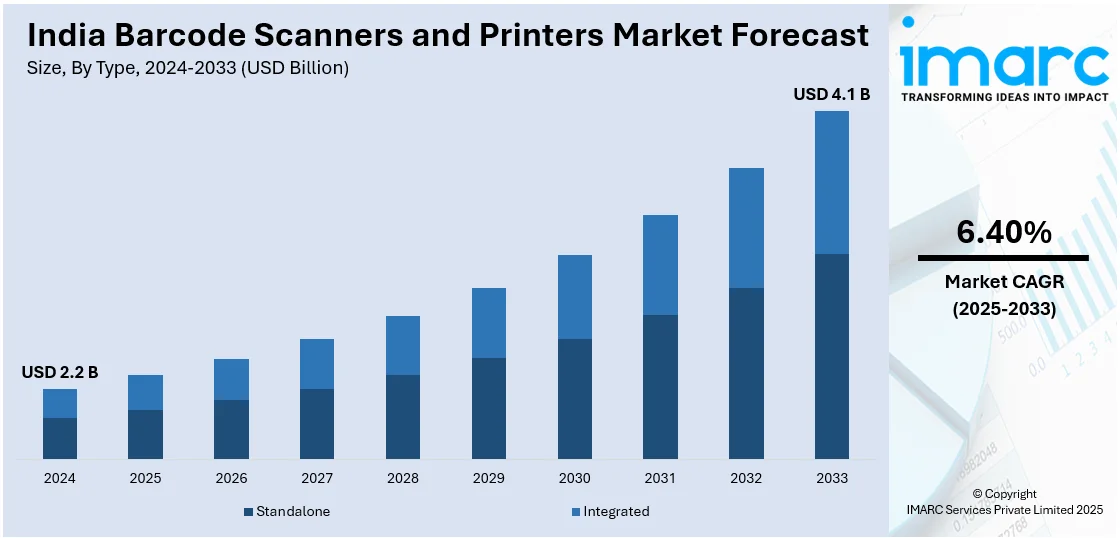

The India barcode scanners and printers market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The market is driven by rapid expansion in the retail and e-commerce sectors, technological advancements in logistics, government initiatives promoting digital transactions, increased automation in manufacturing, omnichannel retail integration, demand for real-time inventory tracking, supply chain optimization, warehouse modernization, and the rise of organized retail chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Market Growth Rate 2025-2033 | 6.40% |

India Barcode Scanners and Printers Market Trends:

Manufacturing Sector Expansion

India's manufacturing industry has shown incredible resilience and improvement in recent times, contributing immensely to the need for barcode technology. The Gross Value Added (GVA) in manufacturing rose by 26.6% compared to the previous year, while industrial output rose by more than 35% in terms of value during the same period, as per the Annual Survey of Industries (ASI) 2021-22. This rapid industrial development has brought about a greater requirement for effective inventory control and streamlined processes. Barcode scanners and printers are key to realizing these goals by promoting precision and minimizing human mistakes in goods tracking. As the production facilities grow and become more sophisticated, the necessity for barcode systems becomes unavoidable to sustain competitiveness and operational effectiveness. Additionally, the ASI report indicates that basic metals, pharmaceuticals, motor vehicles, food products, and chemicals sectors contributed to around 56% of overall GVA in manufacturing. The multifaceted development across these industries reflects the widespread adoption of barcode technologies to respond to the varied requirements of production and supply chain management.

To get more information on this market, Request Sample

Retail Industry Evolution

The Indian retail industry has seen tremendous change, with the proliferation of organized retail stores and the emergence of e-commerce websites. This change has made it imperative for the industry to embrace cutting-edge technologies to handle large inventories and provide smooth customer experiences. Barcode scanners and printers are part of contemporary retail operations, improving speedy checkouts, correct prices, and efficient stock control. Their use helps retailers enhance operational effectiveness and client satisfaction. Government programs promoting electronic transactions and formalization of the economy have further driven retail adoption of barcode systems. With retailers joining such programs, demand for barcode technology keeps increasing as a sign of the industry embracing modernization and better service provision. Moreover, the vibrant development in India's retail industries is a driving force behind the elevating market for barcode scanners and printers. The quest for operational excellence and customer engagement reinforces the growing use of barcode technologies in these industries. The pursuit of operational excellence and customer interaction encourages the increased deployment of barcode technologies across these markets. As data-driven insights start to inform a greater percentage of business decisions, barcode systems remain pivotal in achieving real-time tracing and effective stock management. This leads to diminished wastage, improved supply chain transparency, and efficient processes. Moreover, since consumers want rapid services and better experiences, barcodes give stores the capability of fulfilling these aspirations.

India Barcode Scanners and Printers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and product type.

Type Insights:

- Standalone

- Integrated

The report has provided a detailed breakup and analysis of the market based on the type. This includes standalone and integrated.

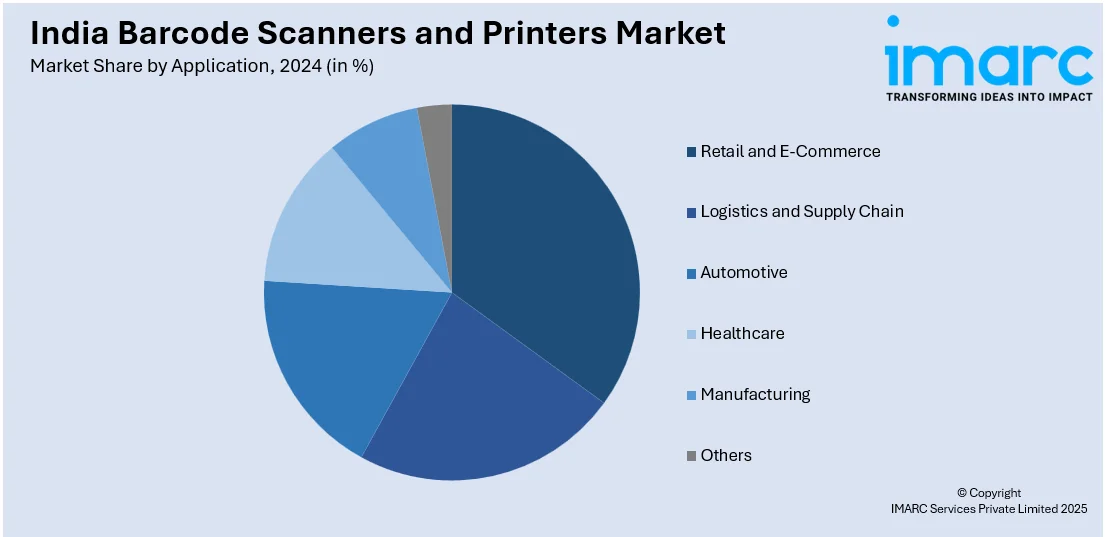

Application Insights:

- Retail and E-Commerce

- Logistics and Supply Chain

- Automotive

- Healthcare

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail and e-commerce, logistics and supply chain, automotive, healthcare, manufacturing, and others.

Product Type Insights:

- Portable

- Fixed Position

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes portable and fixed position.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Barcode Scanners and Printers Market News:

- January 2025: POS Central's foray into India fortifies the demand for barcode technology across retail and hospitality industries. The firm introduces sophisticated POS systems, consisting of barcode scanners and printers, designed to suit businesses of all sizes. This expansion serves India's emerging digital economy, facilitating easier operations in sales and inventory management, propelling barcode scanners and printers market. In addition, the cost-effectiveness and scalability of POS Central's solutions complement the escalating demand for efficiency among Indian companies.

- November 2024: AgozTech's newly introduced vehicle cradle holder for handheld scanners improves the productivity of logistics and warehouse processes by promoting secure, safe, and convenient use of scanners in motion. Its support for leading scanner brands such as Zebra and Honeywell allow smoother processes, particularly for warehouse and delivery personnel.

India Barcode Scanners and Printers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standalone, Integrated |

| Applications Covered | Retail and E-Commerce, Logistics and Supply Chain, Automotive, Healthcare, Manufacturing, Others |

| Product Types Covered | Portable, Fixed Position |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India barcode scanners and printers market performed so far and how will it perform in the coming years?

- What is the breakup of the India barcode scanners and printers market on the basis of type?

- What is the breakup of the India barcode scanners and printers market on the basis of application?

- What is the breakup of the India barcode scanners and printers market on the basis of product type?

- What are the various stages in the value chain of the India barcode scanners and printers market?

- What are the key driving factors and challenges in the India barcode scanners and printers market?

- What is the structure of the India barcode scanners and printers market and who are the key players?

- What is the degree of competition in the India barcode scanners and printers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India barcode scanners and printers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India barcode scanners and printers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India barcode scanners and printers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)