India Bariatric Surgical Devices Market Size, Share, Trends and Forecast by Product, Surgery, End User, and Region, 2025-2033

India Bariatric Surgical Devices Market Overview:

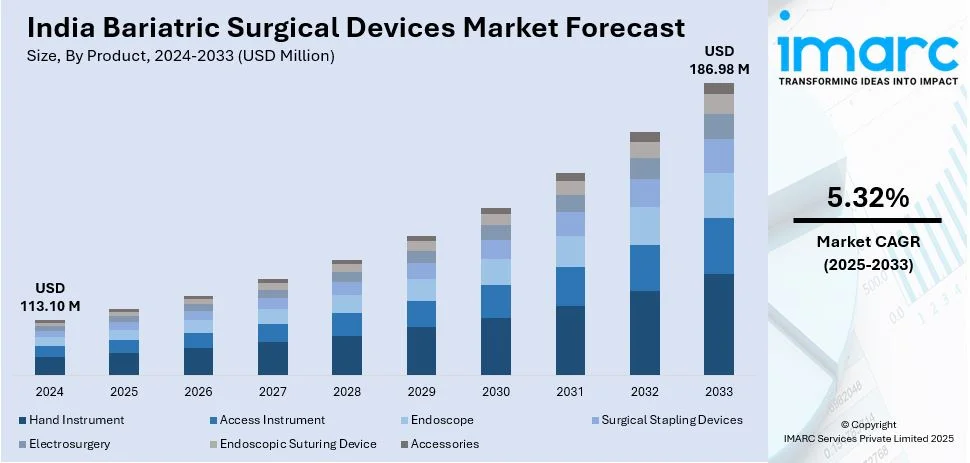

The India bariatric surgical devices market size reached USD 113.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 186.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is driven by rising obesity rates, increasing diabetes prevalence, growing medical tourism, ongoing technological advancements, supportive government initiatives, expanding healthcare infrastructure, and increasing awareness of minimally invasive (MI) weight-loss procedures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.10 Million |

| Market Forecast in 2033 | USD 186.98 Million |

| Market Growth Rate 2025-2033 | 5.32% |

India Bariatric Surgical Devices Market Trends:

Increasing Adoption of Minimally Invasive Bariatric Procedures

The increasing adoption of minimally invasive (MI) bariatric procedures is boosting the India bariatric surgical devices market share. These less invasive procedures include gastric bypass surgery and laparoscopic sleeve gastrectomy. In addition, the market moves forward due to patients who seek fast recovery periods and minimal complications, and shorter hospital stays. Moreover, the combination of advanced robotic surgery equipment with upgraded laparoscopic instruments is leading to better procedural achievements and enhanced patient results. For instance, in November 2024, AIIMS Rishikesh successfully conducted its inaugural robotic bariatric surgery, enabling a 51-year-old woman to lose 10 kg with minimal scarring and enhanced precision. Besides this, specialized medical centers and bariatric surgeons are becoming more accessible, driven by the increase in their availability. Furthermore, both patients and healthcare providers now choose less invasive, effective surgical solutions due to the increasing obesity-related comorbidities such as diabetes and cardiovascular diseases. Also, the healthcare insurance industry is expanding its coverage of bariatric surgeries, which makes these procedures possible for a wider range of patients. As a result, the rising patient awareness about long-term weight-loss solutions is fueling the India bariatric surgical devices market growth.

To get more information on this market, Request Sample

Growing Medical Tourism for Bariatric Surgery

India is emerging as a leading destination for medical tourism for bariatric surgery, attracting international patients with its affordable procedures, skilled surgeons, and world-class medical facilities. Bariatric surgery in India is significantly lower than in Western nations, at times one-third or even one-fourth of the cost, which makes it a preferred choice for Middle Eastern, African, and Southeast Asian patients. In line with this, accredited hospitals in cities like Delhi, Mumbai, Chennai, and Bangalore offer international-standard bariatric treatment, featuring advanced robotic-assisted surgeries and comprehensive post-operative support. According to reports, in July 2024, a private hospital in Pune hosted a training program for young surgeons to enhance their laparoscopic skills in bariatric surgery. The event featured over 150 experts, including renowned international faculty, bolstering India's reputation for medical excellence. Concurrently, the government of India is actively encouraging medical tourism through streamlined visa policies and schemes such as the 'Heal in India' initiative. Apart from this, the increasing obesity rates worldwide are boosting the need for cost-effective yet high-quality weight-loss surgeries, which is enhancing the India bariatric surgery devices market outlook, further solidifying the nation's standing as a prominent medical tourism destination.

India Bariatric Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, surgery, and end user.

Product Insights:

- Hand Instrument

- Access Instrument

- Endoscope

- Surgical Stapling Devices

- Electrosurgery

- Endoscopic Suturing Device

- Accessories

The report has provided a detailed breakup and analysis of the market based on the product. This includes hand instrument, access instrument, endoscope, surgical stapling devices, electrosurgery, endoscopic suturing device, and accessories.

Surgery Insights:

- Gastric Banding

- Sleeve Gastrectomy

- Gastric Bypass

- Biliopancreatic Diversion with A Diodenal Switch (Bdp-Ds)

- Endoscopy

A detailed breakup and analysis of the market based on the surgery have also been provided in the report. This includes gastric banding, sleeve gastrectomy, gastric bypass, biliopancreatic diversion with a duodenal switch (bdp-ds), and endoscopy.

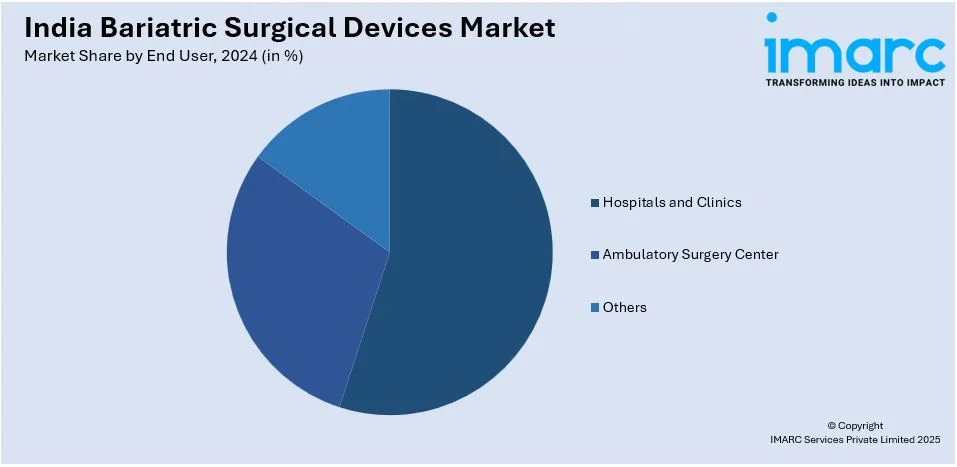

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgery Center

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, ambulatory surgery center, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bariatric Surgical Devices Market News:

- In October 2024, Krishna Institute of Medical Sciences (KIMS) Hospitals signed a Memorandum of Understanding (MoU) with Intuitive to establish 25 robotic surgery programs featuring da Vinci robotic-assisted surgical systems. This initiative focuses on expanding access to advanced minimally invasive surgical care in tier 2 and tier 3 cities across Maharashtra, Karnataka, Andhra Pradesh, and Telangana.

- In January 2024, SS Innovations International, Inc. announced a partnership with Medikabazaar to facilitate the sales of its SSi Mantra Surgical Robotic System across India. This collaboration aims to make advanced robotic surgery more accessible and affordable in the country.

India Bariatric Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Hand Instrument, Access Instrument, Endoscope, Surgical Stapling Devices, Electrosurgery, Endoscopic Suturing Device, Accessories |

| Surgeries Covered | Gastric Banding, Sleeve Gastrectomy, Gastric Bypass, Biliopancreatic Diversion with A Duodenal Switch (Bdp-Ds), Endoscopy |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Center, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bariatric surgical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bariatric surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bariatric surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bariatric surgical devices market in India was valued at USD 113.10 Million in 2024.

The India bariatric surgical devices market is projected to exhibit a CAGR of 5.32% during 2025-2033, reaching a value of USD 186.98 Million by 2033.

The growth of the India bariatric surgical devices market is driven by increasing obesity rates, rising awareness of weight management solutions, and the increasing occurrence of health problems associated with obesity, such as diabetes and heart diseases. Technological advancements in minimally invasive procedures and improved surgical devices are making these surgeries safer and more accessible, further boosting market demand. Additionally, rising disposable incomes and enhanced healthcare infrastructure contribute to the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)