India Base Transceiver Station Market Size, Share, Trends and Forecast by Component, Network Technology, Deployment, End-User, and Region, 2025-2033

India Base Transceiver Station Market Overview:

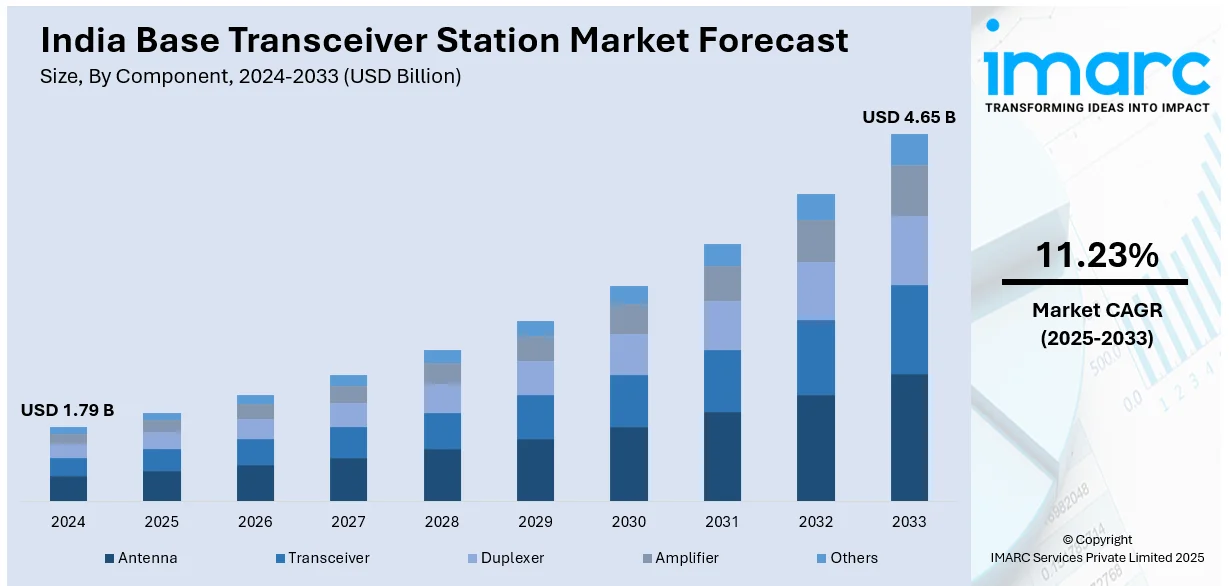

The India base transceiver station market size reached USD 1.79 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.65 Billion by 2033, exhibiting a growth rate (CAGR) of 11.23% during 2025-2033. The India base transceiver station market share is expanding, driven by the growing reliance on enhanced mobile connectivity for communication, entertainment, and business, along with the rising number of high-rise buildings and underground structures, leading to more expenditure on distributed antenna systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.79 Billion |

| Market Forecast in 2033 | USD 4.65 Billion |

| Market Growth Rate 2025-2033 | 11.23% |

India Base Transceiver Station Market Trends:

Growing smartphone penetration

The rising smartphone penetration is offering a favorable India base transceiver station market outlook. According to industry reports, India's mobile user base was projected to hit 1.42 Billion by 2024, and 80 percent of people were expected to have a 4G connection. With affordable smartphones flooding the market and internet plans becoming cheaper, millions of individuals are coming online, increasing the load on existing telecom networks. As a result, telecom operators are rapidly broadening their infrastructure by installing more base transceiver station units to improve network coverage and handle the growing data traffic. The shift toward 4G and the rollout of 5G networks are further driving the demand for advanced base stations that can support faster and more stable connections. Streaming services, online education, and digital payments are also adding pressure on telecom providers to strengthen their networks, leading to continuous base transceiver station installations. Additionally, businesses are adopting cloud services, video conferencing, and remote work models, all of which require seamless mobile connectivity, making base transceiver station expansion a necessity. Government initiatives to improve digital infrastructure and bridge the digital divide are attracting investments in base stations. With smartphone adoption rising and mobile data usage increasing, the market in India is set for strong and steady growth.

To get more information on this market, Request Sample

Increasing expenditure on urbanization projects

The rising investments in urbanization projects are impelling the India base transceiver station market growth. With rapid urban development, the demand for reliable mobile connectivity is increasing, encouraging telecom companies to enhance their network infrastructure by setting up more base transceiver station units. As new residential complexes, commercial hubs, and smart cities are emerging, seamless mobile coverage is becoming essential for communication, business operations, and digital services. Government-led initiatives like Smart Cities Mission and infrastructure expansion projects are creating opportunities for telecom providers to deploy advanced base transceiver station technology to support high-speed data transmission. Under the Indian Union Budget 2024-25, the Finance Minister unveiled the Pradhan Mantri Awas Yojana-Urban 2.0, providing INR 2.2 Lakh Crore in central support over five years to build 1 Crore more homes. Through this scheme, the housing requirements of 1 Crore urban poor and middle-class families were to be met with a funding of INR 10 lakh crore. The rising number of high-rise buildings and underground structures is also creating the need for additional network coverage, leading to more investments in small cell base transceiver stations and distributed antenna systems. Additionally, public transport systems, such as metro rail expansions and smart transportation projects, require robust mobile connectivity, promoting the installation of base transceiver stations along transit routes.

India Base Transceiver Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, network technology, deployment, and end-user.

Component Insights:

- Antenna

- Transceiver

- Duplexer

- Amplifier

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes antenna, transceiver, duplexer, amplifier, and others.

Network Technology Insights:

- 2G

- 3G

- 4G

- 5G

A detailed breakup and analysis of the market based on the network technology have also been provided in the report. This includes 2G, 3G, 4G, and 5G.

Deployment Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes indoor and outdoor.

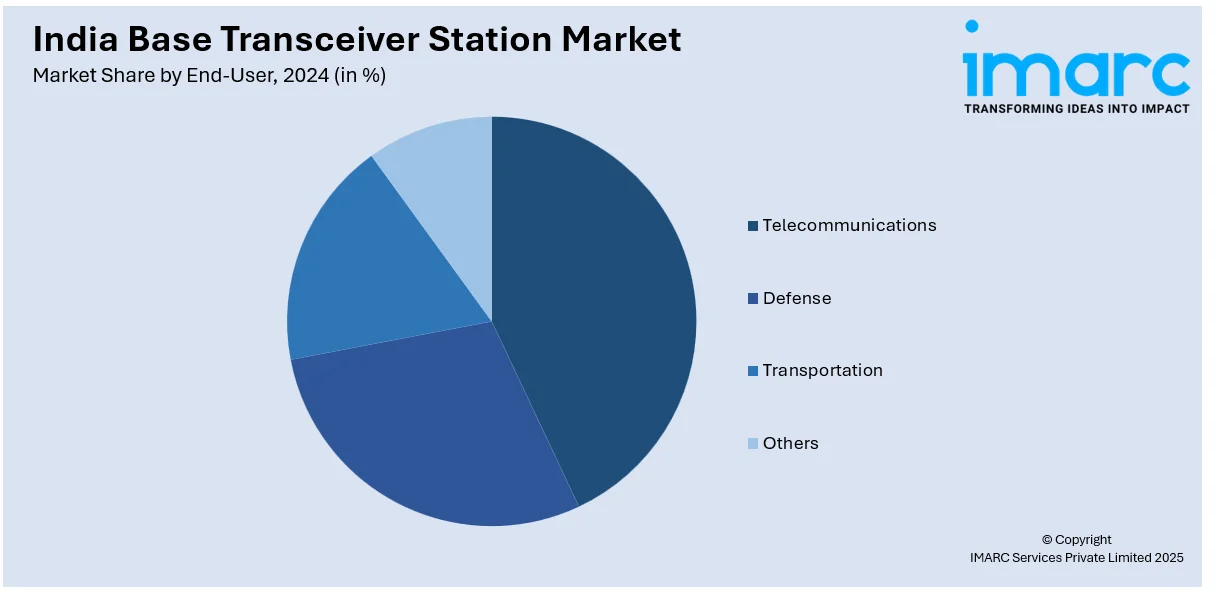

End-User Insights:

- Telecommunications

- Defense

- Transportation

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes telecommunications, defense, transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Base Transceiver Station Market News:

- In August 2024, the Department of Telecommunications (DoT) announced that the total of 5G radios or base transceiver stations set up across India exceeded 450,000. Along with this, executives from telecommunications companies, Reliance Jio and Bharti Airtel, revealed they were planning to enter a stage of consolidation, as the majority of tower installations were finalized.

- In October 2023, the Siachen Warriors set up the inaugural BSNL base transceiver station at the forward locations of the highest combat zone In India. It was intended to improve mobile communication for soldiers stationed at over 15,500 feet. BSNL also aimed to install mobile towers in various locations, including Nelong and Jadung villages in Uttarkashi, Uttarakhand.

India Base Transceiver Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Antenna, Transceiver, Duplexer, Amplifier, Others |

| Network Technologies Covered | 2G, 2G, 4G, 5G |

| Deployments Covered | Indoor, Outdoor |

| End-Users Covered | Telecommunications, Defense, Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India base transceiver station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India base transceiver station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India base transceiver station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India base transceiver station market was valued at USD 1.79 Billion in 2024.

The India base transceiver station market is projected to exhibit a CAGR of 11.23% during 2025-2033, reaching a value of USD 4.65 Billion by 2033.

The India base transceiver station market is driven by expanding 4G and 5G networks, rising smartphone usage, and growing data demand. Government programs like Digital India boost rural connectivity. Telecom operators invest in energy-efficient BTS infrastructure to improve coverage and reduce costs, accelerating market growth across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)