India Battery Charger Market Size, Share, Trends and Forecast by Application, Category, Product Type, and Region, 2025-2033

India Battery Charger Market Overview:

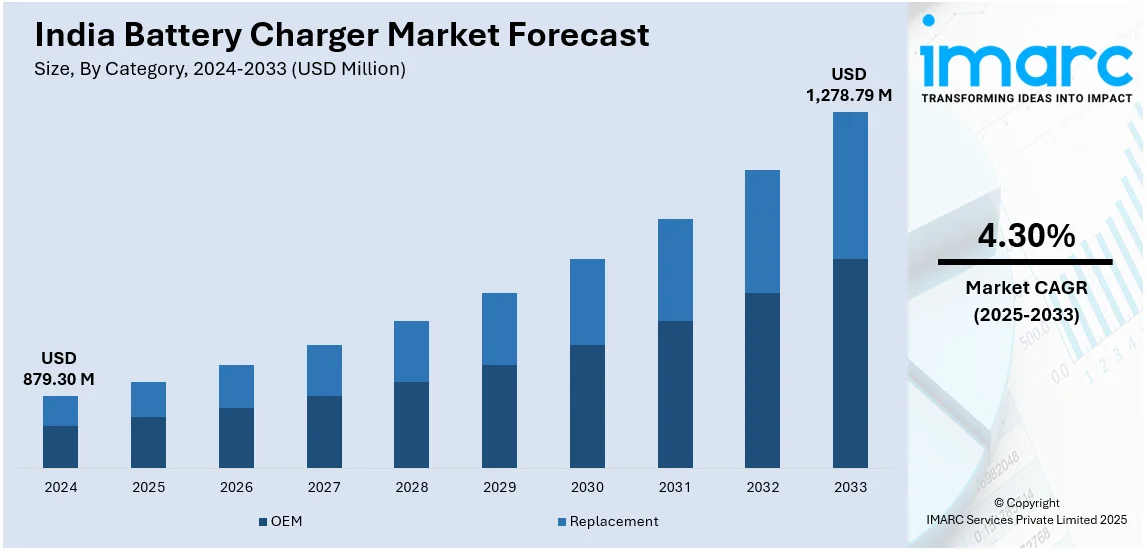

The India battery charger market size reached USD 879.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,278.79 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The increasing smartphone and laptop adoption, rising electric vehicle demand, growing reliance on portable electronics, advancements in fast-charging technology, government initiatives for e-mobility, expanding digitalization, and the push for energy-efficient and sustainable charging solutions are expanding the India battery charger market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 879.30 Million |

| Market Forecast in 2033 | USD 1,278.79 Million |

| Market Growth Rate (2025-2033) | 4.30% |

India Battery Charger Market Trends:

Rising Demand for Fast and Wireless Charging Technologies

The India battery charger market growth is driven by the increase in demand for fast and wireless charging solutions, driven by the widespread adoption of smartphones, laptops, and electric vehicles. Consumers now expect rapid charging capabilities, leading to advancements in Quick Charge and USB Power Delivery technologies. Additionally, the growing popularity of wireless charging for smartphones and wearable devices is boosting market expansion. For instance, At CES 2025, the Wireless Power Consortium declared on January 7, 2025, that Android devices will incorporate Qi2 magnetic wireless charging, which is similar to Apple's MagSafe, this year. The Qi2 standard will be supported by Samsung's Galaxy devices starting in 2025; the Galaxy S25 series is expected to be one of the first to use this technology. This innovation highlights a dedication to sustainability by encouraging more effective charging options for a variety of smartphone platforms. With manufacturers integrating GaN (Gallium Nitride) technology for faster and more efficient charging, the sector is poised for significant growth. Government policies promoting e-mobility and energy efficiency further accelerate the adoption of innovative charging solutions in India.

To get more information on this market, Request Sample

Expanding Electric Vehicle Charging Infrastructure

The increasing adoption of electric vehicles (EVs) in India is fueling demand for advanced battery chargers, particularly home and public charging stations. The government's push for EV adoption, including FAME II incentives and infrastructure development initiatives, is accelerating market growth. Companies are investing in DC fast-charging and ultra-fast charging stations to support long-range EVs. Notably, leading EV charging and critical power solutions maker Exicom announced on January 28, 2025, that it and integrated e-mobility business ChargeZone would work together to build and install more than 500 high-power EV charging stations throughout India. By using renewable energy sources, this project seeks to improve the nation's infrastructure for electric vehicles and advance sustainability in transportation. The collaboration supports government goals to hasten the country's shift to emission-free transportation. Additionally, advancements in battery management systems (BMS) are improving charger efficiency and durability, which in turn is positively impacting India battery charger market outlook. The integration of renewable energy sources, such as solar-powered EV chargers, is gaining traction, aligning with India's sustainability goals. This trend is expected to revolutionize the battery charger market in the coming years.

India Battery Charger Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application, category, and product type.

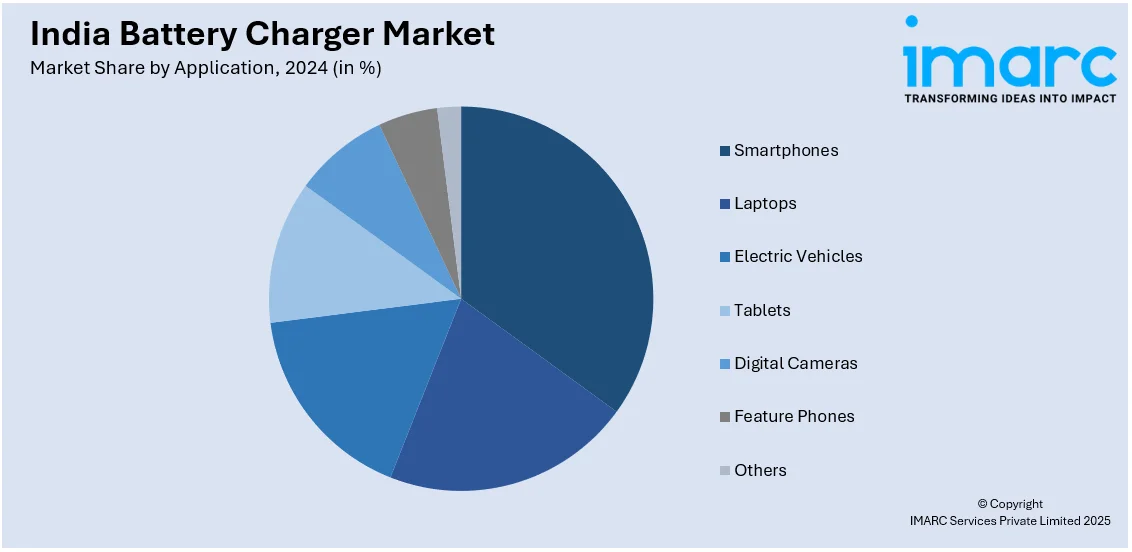

Application Insights:

- Smartphones

- Laptops

- Electric Vehicles

- Tablets

- Digital Cameras

- Feature Phones

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes smartphones, laptops, electric vehicles, tablets, digital cameras, feature phones, and others.

Category Insights:

- OEM

- Replacement

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes OEM and replacement.

Product Type Insights:

- Wired

- Wireless

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes wired and wireless.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Battery Charger Market News:

- On June 18, 2024, Clean Electric unveiled a ground-breaking battery solution for electric cars that enables a 12-minute full charge. By resolving significant problems with charging time and range anxiety, this advancement encourages the widespread usage of electric vehicles. By increasing charging efficiency, this innovation contributes to worldwide efforts to reduce carbon emissions and makes the transportation sector more sustainable.

India Battery Charger Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Smartphones, Laptops, Electric Vehicles, Tablets, Digital Cameras, Feature Phones, Others |

| Categories Covered | OEM, Replacement |

| Product Types Covered | Wired, Wireless |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India battery charger market performed so far and how will it perform in the coming years?

- What is the breakup of the India battery charger market on the basis of application?

- What is the breakup of the India battery charger market on the basis of category?

- What is the breakup of the India battery charger market on the basis of product type?

- What is the breakup of the India battery charger market on the basis of region?

- What are the various stages in the value chain of the India battery charger market?

- What are the key driving factors and challenges in the India battery charger?

- What is the structure of the India battery charger market and who are the key players?

- What is the degree of competition in the India battery charger market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India battery charger market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India battery charger market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India battery charger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)