India Battery Energy Management Systems Market Size, Share, Trends and Forecast by Component, Topology, Battery Type, Application, and Region, 2025-2033

India Battery Energy Management Systems Market Overview:

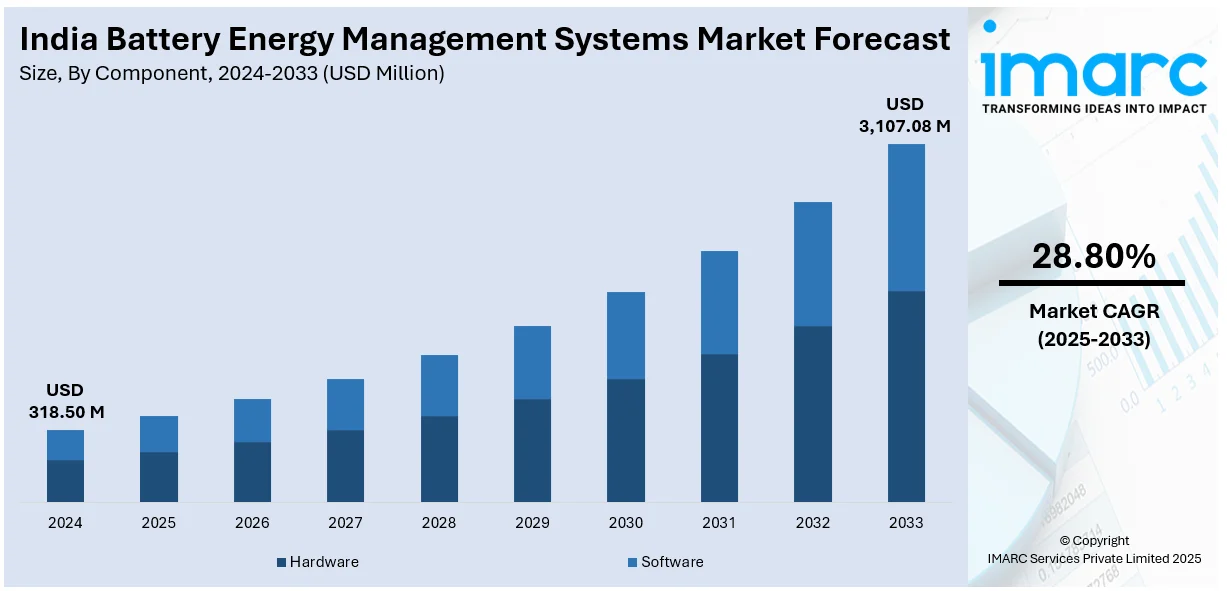

The India battery energy management systems market size reached USD 318.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,107.08 Million by 2033, exhibiting a growth rate (CAGR) of 28.80% during 2025-2033. The rising adoption of electric vehicles (EVs) and advancements in battery storage technologies are driving the demand for battery energy management systems in India. Enhanced energy storage efficiency, improved battery performance, and technological innovations are optimizing energy usage, reducing costs, and supporting sustainable energy transitions. The India battery energy management systems market share is expected to grow significantly as these factors continue to catalyze the demand for efficient and reliable battery solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 318.50 Million |

| Market Forecast in 2033 | USD 3,107.08 Million |

| Market Growth Rate 2025-2033 | 28.80% |

India Battery Energy Management Systems Market Trends:

Growing EV Adoption

The swift rise in EV adoption in India is influencing the demand for battery energy management systems. As an increasing number of individuals and companies switch to EVs, the demand for effective energy storage options, for charging systems and vehicle batteries, is growing significantly. Battery energy management systems assist in maximizing battery lifespan, improving charging efficiency, and regulating energy flow to guarantee EV batteries are charged at ideal levels, which enhances their performance and durability. The growth of EV infrastructure in India, backed by governmental incentives and policies, is catalyzing the demand for advanced energy management solutions. As per India Brand Equity Foundation (IBEF), the sales of EVs in India experienced a notable rise in January 2025, achieving a growth of 19.4% month-on-month and 17.1% year-on-year, totaling 169,931 units. This increase reflects the rising acceptance and usage of EVs, which is further driving the demand for improved battery management systems. Furthermore, the Indian EV battery sector is anticipated to increase significantly, with forecasts suggesting an increase from US$ 16.77 billion in 2023 to US$ 27.70 billion by 2028. This fast advancement in the EV industry highlights the essential function of battery energy management systems in facilitating the shift to sustainable transport, promoting effective battery utilization, and aiding the ongoing development of EV infrastructure nationwide.

To get more information on this market, Request Sample

Advancements in Battery Storage Technologies

Technological progress in battery storage for enhancing energy storage efficiency, reliability, and cost-effectiveness is bolstering the India battery energy management systems market growth. Advancements like enhanced battery compositions, extended life spans, and quicker charging features are making battery storage options more feasible and attainable. These innovations are allowing energy storage systems to manage greater capacities at reduced costs, promoting widespread use in both commercial and residential areas. The capacity to accumulate larger quantities of energy with enhanced efficiency is reducing operational expenses, rendering these systems more feasible for extensive applications. A significant instance of these advancements is Aeidth Technologies’ introduction of the improved battery management system (BMS) in 2025, tailored for energy storage systems (ESS) and battery energy storage systems (BESS). This BMS accommodates up to 1500V DC and can be scaled for megawatt-level uses, featuring advanced elements like modular 3-tier architecture, AI-driven diagnostics, and active cell balancing. These attributes improve safety, dependability, and energy efficiency, positioning it as a suitable choice for extensive energy storage applications. Furthermore, the BMS is manufactured in India and complies with international standards, tailored for local grid conditions. These technological advancements in battery management serve an essential function in improving the efficiency and scalability of energy storage systems, fueling market expansion and fostering the global transition to sustainable energy practices.

India Battery Energy Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, topology, battery type, and application.

Component Insights:

- Hardware

- Battery Monitoring Unit

- Battery Control Unit

- Communication Network

- Others

- Software

- Supervisory Control and Data Acquisition

- Advance Distribution Management Solution

- Outage Management System

- Generation Management System

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (battery monitoring unit, battery control unit, communication network, and others) and software (supervisory control and data acquisition, advance distribution management solution, outage management system, generation management system, and others).

Topology Insights:

- Distributed

- Centralized

- Modular

A detailed breakup and analysis of the market based on the topology have also been provided in the report. This includes distributed, centralized, and modular.

Battery Type Insights:

- Lithium-ion Batteries

- Lead Acid Batteries

- Nickel Cadmium Batteries

- Sodium Sulfur Batteries

- Sodium-ion Batteries

- Flow Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion batteries, lead acid batteries, nickel cadmium batteries, sodium sulfur batteries, sodium-ion batteries, flow batteries, and others.

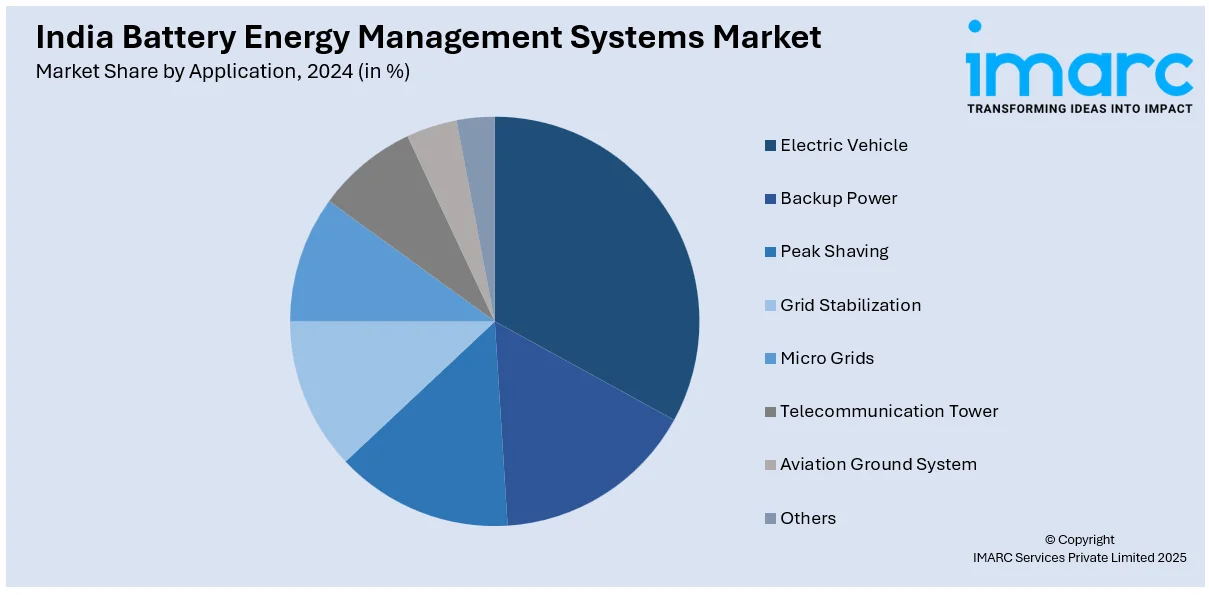

Application Insights:

- Electric Vehicle

- Backup Power

- Peak Shaving

- Grid Stabilization

- Micro Grids

- Telecommunication Tower

- Aviation Ground System

- Renewable Energy

- Standalone Solar

- Solar Diesel Hybrid

- Wind Energy

- Solar Wind Hybrid

- Others

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes electric vehicle, backup power, peak shaving, grid stabilization, micro grids, telecommunication tower, aviation ground system (renewable energy, standalone solar, solar diesel hybrid, wind energy, solar wind hybrid, and others), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Battery Energy Management Systems Market News:

- In May 2025, AmpereHour Energy and IndiGrid commissioned India’s first regulatory-approved 20 MW / 40 MWh battery energy storage system in Delhi under a long-term BESPA with BRPL. The system supports 100,000 residents with daily 4-hour backup using renewable energy. It reduces CO₂ emissions by 65 tons/day and enhances grid reliability.

- In March 2025, Xbattery launched BharatBMS, India’s first indigenously developed high-voltage battery management system for homes, EV fleets, factories, and solar systems. It features advanced safety, real-time monitoring, and adaptive cell balancing to extend battery life by up to 15%. Designed for scalability, BharatBMS supports diverse battery applications with a unified, cost-effective architecture.

India Battery Energy Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Topologies Covered | Distributed, Centralized, Modular |

| Battery Types Covered | Lithium-ion Batteries, Lead Acid Batteries, Nickel Cadmium Batteries, Sodium Sulfur Batteries, Sodium-ion Batteries, Flow Batteries, Others |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India battery energy management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India battery energy management systems market on the basis of component?

- What is the breakup of the India battery energy management systems market on the basis of topology?

- What is the breakup of the India battery energy management systems market on the basis of battery type?

- What is the breakup of the India battery energy management systems market on the basis of application?

- What is the breakup of the India battery energy management systems market on the basis of region?

- What are the various stages in the value chain of the India battery energy management systems market?

- What are the key driving factors and challenges in the India battery energy management systems?

- What is the structure of the India battery energy management systems market and who are the key players?

- What is the degree of competition in the India battery energy management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India battery energy management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India battery energy management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India battery energy management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)