India Battery Energy Storage Systems Market Size, Share, Trends and Forecast by Battery Type, Connection Type, and Region, 2026-2034

India Battery Energy Storage Systems Market Overview:

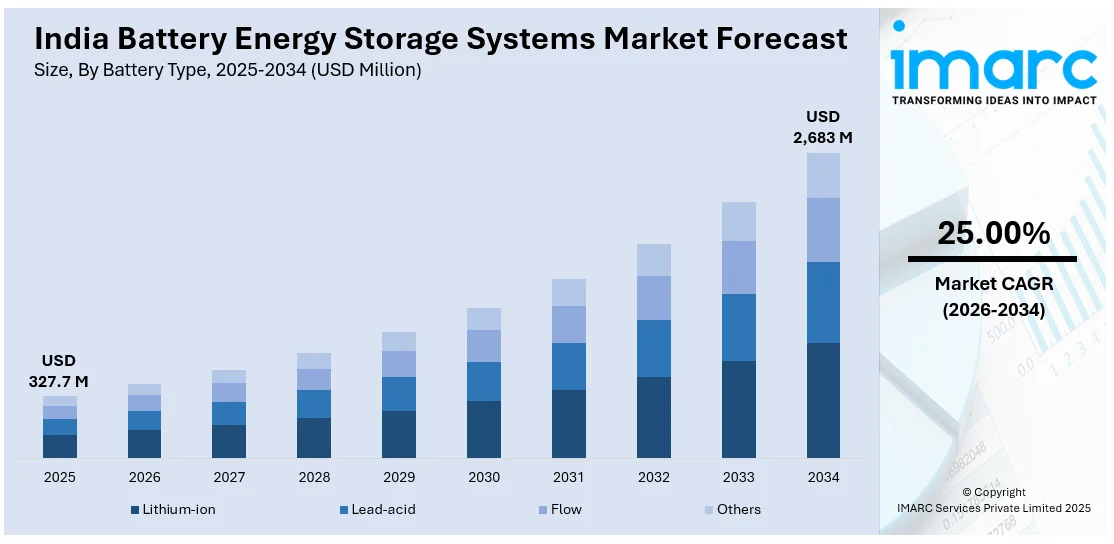

The India battery energy storage systems market size reached USD 327.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,683.0 Million by 2034, exhibiting a growth rate (CAGR) of 25.00% during 2026-2034. Rising renewable energy integration, increasing government incentives for energy storage, increasing grid reliability concerns, growing electric vehicle adoption, declining battery costs, advancements in lithium-ion technology, and expanding industrial and commercial applications are augmenting the India battery energy storage systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 327.7 Million |

| Market Forecast in 2034 | USD 2,683.0 Million |

| Market Growth Rate 2026-2034 | 25.00% |

India Battery Energy Storage Systems Market Trends:

Rising Demand for Energy Storage in Electric Vehicle (EV) Infrastructure

India electric vehicle (EV) ecosystem is driving significant demand for BESS solutions, particularly in charging infrastructure and vehicle-to-grid (V2G) applications. The expansion of EV charging stations requires grid-connected storage to manage load fluctuations and ensure stable power supply during peak demand, which is providing an impetus to India battery energy storage systems market growth. Fast-charging stations are deploying battery storage to reduce grid dependency and optimize power distribution. Battery swapping networks, gaining traction among two- and three-wheelers, are integrating modular storage solutions to enhance operational efficiency and reduce charging wait times. V2G technology, still in its nascent stages, is emerging as a potential solution for demand-side energy management, allowing EVs to feed surplus power back into the grid. Automakers and energy providers are exploring second-life battery applications, repurposing retired EV batteries for stationary storage, extending asset utilization, and lowering costs. According to an industry report, India is targeting 30% EV penetration by 2030. Therefore, energy storage adoption in the EV ecosystem will continue expanding, reinforcing the need for robust battery supply chains and efficient charging infrastructure.

To get more information on this market Request Sample

Declining Battery Costs and Technological Advancements

The reduction of lithium-ion battery prices is making battery energy storage system (BESS) solutions more viable for large-scale deployment in India. Global battery costs are decreasing due to economies of scale, improved manufacturing efficiencies, and supply chain optimizations. According to industry reports, as of 2023, India's manufacturing capacity for lithium-ion batteries is currently standing at 18 GWh. Projections indicate that this capacity is anticipated to expand significantly to 145 GWh by the year 2030. The government's push for domestic battery production under the PLI scheme and investments in lithium refining, particularly in Jammu and Kashmir's lithium reserves, is expected to reduce costs further. In addition to this, alternative battery chemistries, such as sodium-ion and solid-state batteries, are gaining traction as potential solutions to address resource constraints and improve safety. The development of indigenous battery management systems (BMS) and artificial intelligence (AI)-based energy optimization software is enhancing efficiency, lifespan, and real-time monitoring. Moreover, continual innovations in thermal management, second-life battery applications, and advanced energy storage configurations are further refining system performance and enhancing India battery energy storage systems market outlook. As manufacturing scales up, localized production and technology improvements are expected to lower capital expenditures, increasing the economic feasibility of energy storage for utilities, commercial users, and residential applications.

India Battery Energy Storage Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on battery type and connection type.

Battery Type Insights:

- Lithium-ion

- Lead-acid

- Flow

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion, lead-acid, flow, and others.

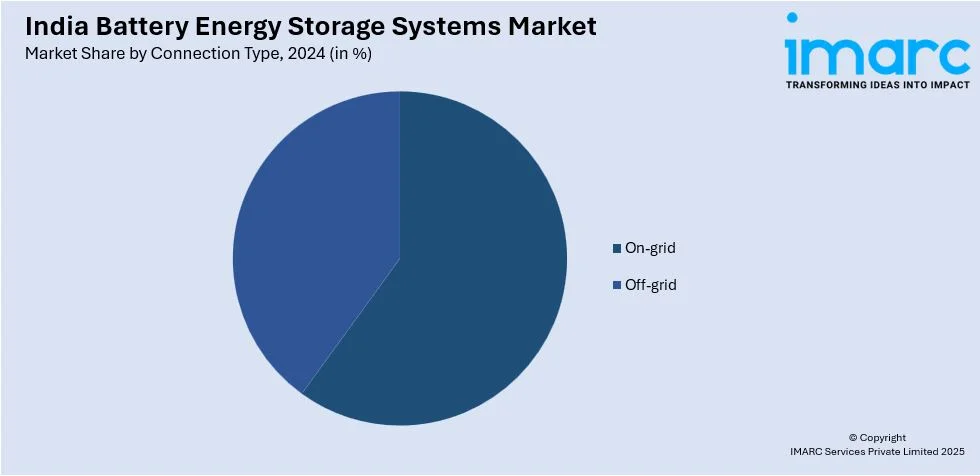

Connection Type Insights:

Access the comprehensive market breakdown Request Sample

- On-grid

- Off-grid

A detailed breakup and analysis of the market based on the connection type have also been provided in the report. This includes on-grid and off-grid.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Battery Energy Storage Systems Market News:

- On March 2025, country’s first large-scale commercial battery energy storage system (BESS) is scheduled to commence operations, located in Kilokri, South Delhi. This 20 MW/40 MWh battery cluster, integrated within the BSES Rajdhani Power Limited (BRPL) Kilokri substation, is designed to deliver four hours of power daily, two hours each during daytime and nighttime. The project represents a collaborative effort among BRPL, IndiGrid, and the Global Energy Alliance for People and Planet (GEAPP). This initiative represents a major step in India's efforts to integrate renewable energy and modernize its power infrastructure.

India Battery Energy Storage Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion, Lead-acid, Flow, Others |

| Connection Types Covered | On-grid, Off-grid |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India battery energy storage systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India battery energy storage systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India battery energy storage systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery energy storage systems market in India was valued at USD 327.7 Million in 2025.

The India battery energy storage systems market is projected to exhibit a CAGR of 25.00% during 2026-2034, reaching a value of USD 2,683.0 Million by 2034.

Key factors driving the India battery energy storage systems market include growing renewable energy adoption, rising need for grid stability, and government initiatives supporting energy transition. Increasing electricity demand, focus on energy reliability in remote areas, and declining battery costs are also accelerating market deployment across various sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)