India Bearings and Bushings Market Size, Share, Trends and Forecast by Product Type, Material Type, Application, Distribution Channel, and Region, 2025-2033

India Bearings and Bushings Market Overview:

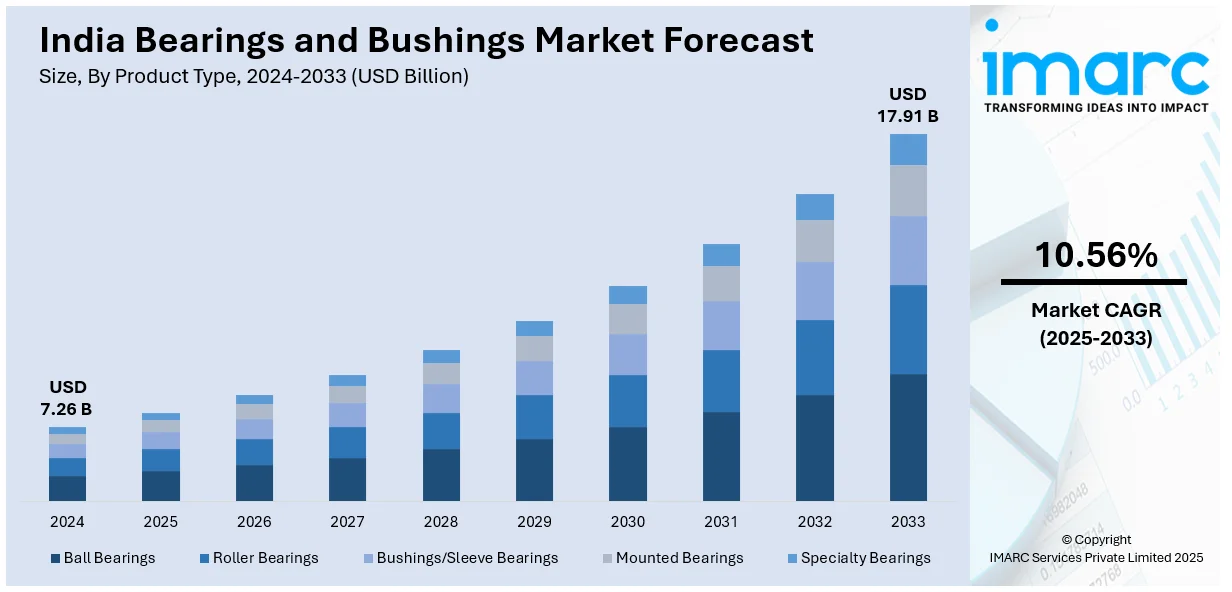

The India bearings and bushings market size reached USD 7.26 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.91 Billion by 2033, exhibiting a growth rate (CAGR) of 10.56% during 2025-2033. Expanding industrial and automotive activity, rising vehicle production, railway and metro projects, wind and thermal energy growth, automation in factories, and surging mining and construction equipment usage are driving the market growth. Moreover, agricultural mechanization, defense and aerospace development, Make in India-led local sourcing, energy-efficient system demand, and growth in machine tools are supporting the market growth. Furthermore, burgeoning need for high-performance, low-maintenance, and cost-effective components and product innovations to meet evolving customer and industry requirements are factors propelling the India bearings and bushings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.26 Billion |

| Market Forecast in 2033 | USD 17.91 Billion |

| Market Growth Rate 2025-2033 | 10.56% |

India Bearings and Bushings Market Trends:

Rising Vehicle Production and Sales

India's automobile production and sales are increasing steadily, and this is affecting the bearings and bushings market significantly. Two-wheelers, passenger vehicles, and commercial vehicles are being purchased by consumers in rural and semi-urban markets. This translates into increased demand for components such as bearings and bushings utilized in different sections of a vehicle, including wheels, engine, and steering. Bearings help reduce friction so that vehicle components move more smoothly, and bushings reduce vibration and noise. As the production of automobiles goes up, automobile manufacturers require more of these components to match production levels. Additionally, the growth in electric vehicles is another driving force behind the growth of the India bearings and bushings market because they employ various types of lightweight and low-friction components. With frequent introduction of new car models and growing emphasis on fuel efficiency and longevity, the automotive bearings and bushings market is likely to remain robust.

To get more information on this market, Request Sample

Expansion of Railway and Metro Infrastructure

India’s focus on expanding its railway and metro systems is becoming an important factor for the bearings and bushings market. The government is investing in new metro lines and rail projects like the bullet train and freight corridors. These large-scale transportation projects need a lot of strong, durable mechanical parts. Bearings are used in wheels, motors, and other moving parts, while bushings are needed to control vibrations and support loads. Moreover, the government’s push for local sourcing under ‘Make in India’ is also encouraging domestic production. Metro projects in cities are focused on safety, noise control, and energy saving, all of which depend on high-quality bearings. These ongoing public transport developments are helping component makers grow their business and meet demand from both government and private sector partners. In 2024, the Indian government allocated a record capital expenditure of ₹2.62 lakh crore to Indian Railways, marking a significant increase from previous years. This investment aims to enhance infrastructure, safety, and passenger experience, thereby driving demand for essential components like bearings and bushings in the railway sector.

Growth in Wind and Thermal Energy Sectors

The growing wind and thermal energy sectors in India are pushing up the demand for bearings and bushings. Wind turbines need large and strong bearings to keep the blades, gearboxes, and generators running smoothly in tough conditions. These turbines run for long hours and face weather extremes, so they need reliable parts. Thermal power plants also use bearings in equipment like turbines and motors, which operate at high speeds and temperatures. Bushings are also important in these systems to reduce vibration and help with proper alignment of parts. As India works to increase its power generation capacity and improve efficiency, the demand for good quality and long-lasting components is rising. Several energy companies and equipment manufacturers are now sourcing these parts locally, which is creating growth opportunities for Indian bearing producers.

India Bearings and Bushings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, application, and distribution channel.

Product Type Insights:

- Ball Bearings

- Cylindrical Roller Bearings

- Tapered Roller Bearings

- Spherical Roller Bearings

- Roller Bearings

- Bushings/Sleeve Bearings

- Mounted Bearings

- Specialty Bearings

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ball bearings (cylindrical roller bearings, tapered roller bearings, and spherical roller bearings), roller bearings, bushings/sleeve bearings, mounted bearings, and specialty bearings.

Material Type Insights:

- Metal Bearings and Bushings

- Ceramic Bearings

- Polymer-Based Bearings and Bushings

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes metal bearings and bushings, ceramic bearings, and polymer-based bearings and bushings.

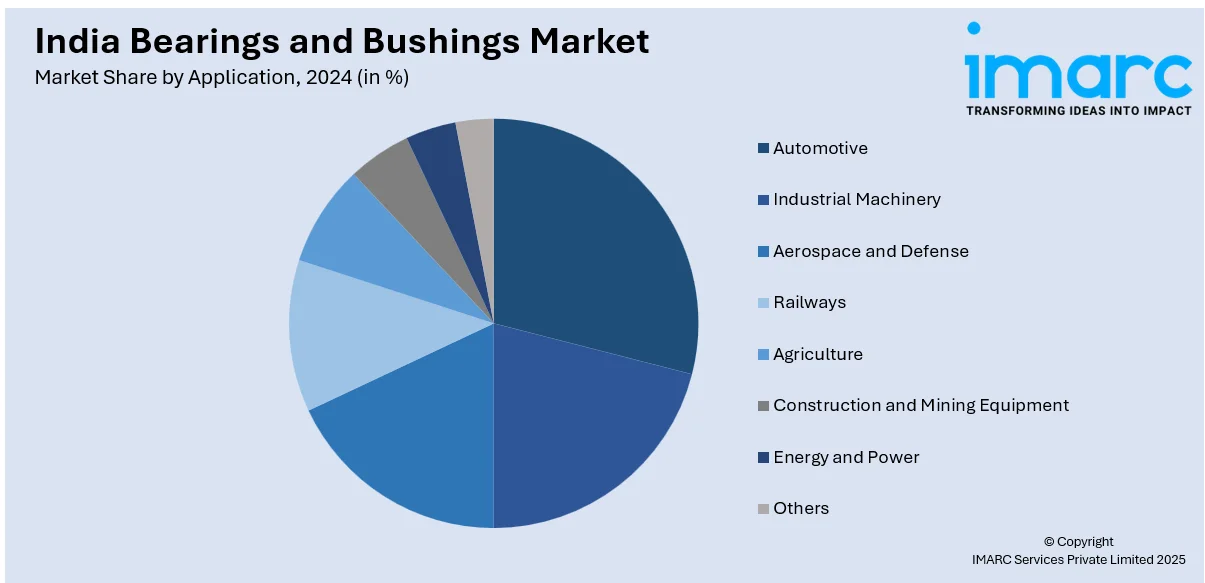

Application Insights:

- Automotive

- Industrial Machinery

- Aerospace and Defense

- Railways

- Agriculture

- Construction and Mining Equipment

- Energy and Power

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, industrial machinery, aerospace and defense, railways, agriculture, construction and mining equipment, energy and power, and others.

Distribution Channel Insights:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes original equipment manufacturers (OEMs) and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bearings and Bushings Market News:

- In 2024, National Engineering Industries Ltd. (NEI), under the NBC Bearings brand, inaugurated a new manufacturing facility in Bagru, Rajasthan. This expansion aims to bolster production capacity and meet growing demand in the automotive and industrial sectors.

- In 2023, Spanish multinational Fersa Group acquired a majority stake in India's Delux Bearings, enhancing its global strategy in powertrain components and intelligent mobility solutions.

India Bearings and Bushings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Material Types Covered | Metal Bearings and Bushings, Ceramic Bearings, Polymer-Based Bearings and Bushings |

| Applications Covered | Automotive, Industrial Machinery, Aerospace and Defense, Railways, Agriculture, Construction and Mining Equipment, Energy and Power, Others |

| Distribution Channels Covered | Original Equipment Manufacturers (OEMs), Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bearings and bushings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bearings and bushings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bearings and bushings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bearings and bushings market in India was valued at USD 7.26 Billion in 2024.

The India bearings and bushings market is projected to exhibit a CAGR of 10.56% during 2025-2033, reaching a value of USD 17.91 Billion by 2033.

The market is driven by the rising need for low-friction components in mechanical systems, growing industrial automation, and increased machinery deployment across sectors. Bearings and bushings support load distribution and rotational motion, making them essential in various applications. The market benefits from expanding manufacturing activities, evolving machinery standards, and demand for reliable performance under high-stress conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)