India Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2026-2034

India Bicycle Market Summary:

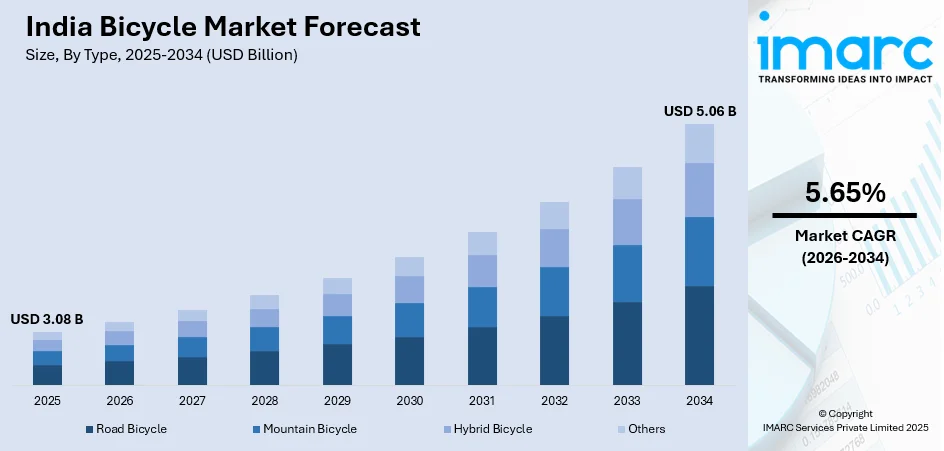

The India bicycle market size was valued at USD 3.08 Billion in 2025 and is projected to reach USD 5.06 Billion by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

The India bicycle market is experiencing robust expansion driven by increasing health consciousness among consumers, growing environmental awareness, and rising urban traffic congestion encouraging alternative transportation modes. Government initiatives promoting cycling infrastructure and sustainable mobility, combined with the emergence of fitness-focused cycling culture among urban populations, are significantly contributing to the India bicycle market share and accelerating adoption across diverse consumer segments.

Key Takeaways and Insights:

-

By Type: Road bicycle dominates the market with a share of 28.53% in 2025, driven by increasing adoption for daily commuting, fitness activities, and recreational cycling among urban and semi-urban populations.

-

By Technology: Conventional leads the market with a share of 72.24% in 2025, attributed to affordability, ease of maintenance, and widespread availability across urban and rural distribution networks.

-

By Price: Mid-range represents the largest segment with a market share of 71.91% in 2025, owing to optimal balance between quality features and affordability appealing to the expanding middle-class consumer base.

-

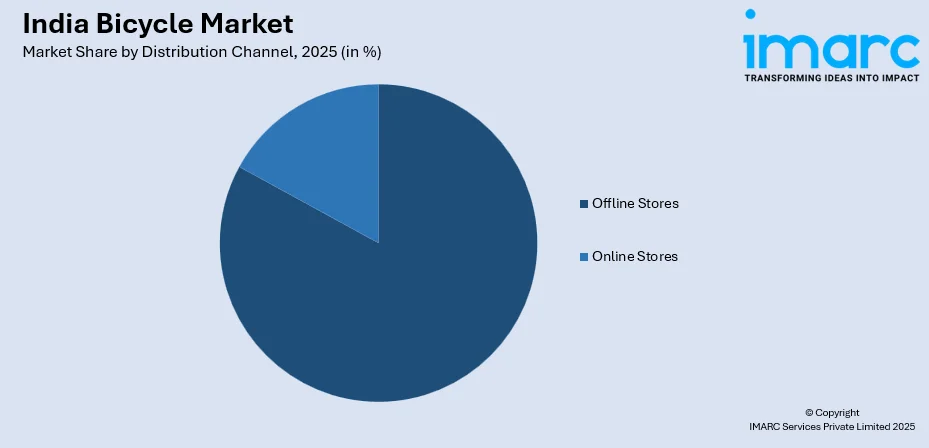

By Distribution Channel: Offline stores dominate with a share of 82.85% in 2025, fueled by consumer preference for physical product inspection, test rides, and personalized service before purchase.

-

By End User: Men hold the largest share at 54.26% in 2025, supported by traditional cycling culture and higher participation rates in commuting and recreational cycling activities.

-

By Region: North India dominates with a market share of 33% in 2025, driven by concentrated manufacturing hubs, high population density, and established bicycle retail networks across major urban centers.

-

Key Players: The India bicycle market features a competitive landscape with established domestic manufacturers commanding significant market presence alongside international premium brands. Key players focus on product innovation, distribution network expansion, and strategic partnerships to strengthen market positioning.

To get more information on this market Request Sample

The India bicycle market has evolved from a traditional transportation-focused industry to a diversified sector encompassing commuting, fitness, recreation, and sporting applications. The market benefits from India's position as one of the world's largest bicycle manufacturing bases, with established production clusters supporting both domestic consumption and export activities. Reinforcing this trend, retail major Walmart began sourcing India-made bicycles in partnership with Hero Ecotech, underlining the global demand for Indian bicycle manufacturing capabilities. Consumer preferences are shifting toward bicycles offering enhanced features, durability, and aesthetic appeal, driving manufacturers to innovate across product categories. The ecosystem encompasses conventional bicycles, electric variants, and specialized models catering to mountain biking, road racing, and urban mobility needs. Infrastructure developments including dedicated cycling tracks and bike-sharing programs in smart cities are strengthening the foundation for sustained market expansion across metropolitan and tier-II urban centers.

India Bicycle Market Trends:

Rising Adoption of Electric Bicycles

The electric bicycle segment is gaining substantial traction as consumers seek efficient alternatives for urban commuting that combine physical activity with motorized assistance. eBikeGo, one of India’s leading electric mobility brands, opened a new Acer Electric Vehicles retail outlet in New Delhi in 2025 to showcase a range of e-bicycles and expand its pan-India presence, reflecting growing commercial focus on e-bike adoption in key urban markets. Pedal-assisted e-bikes are particularly popular among urban commuters who appreciate the balance between exercise and convenience for navigating congested city roads.

Growing Premium and Performance Bicycle Segment

The premium bicycle segment is experiencing accelerated growth as fitness-conscious consumers and cycling enthusiasts invest in high-quality bicycles offering superior performance characteristics. Avon Newage Cycles launched Cambio as a dedicated premium bicycle brand in India, producing German-engineered models with advanced components to cater to lifestyle-oriented cyclists across the country, highlighting rising industry focus on the premium category. International brands are expanding their presence in the Indian market, introducing advanced road bikes, mountain bikes, and hybrid models featuring lightweight frames, precision components, and sophisticated gear systems.

Integration of Smart Technologies and Connected Features

Smart bicycle technologies in India are increasingly leveraging IoT connectivity, GPS tracking, and mobile app integration as key differentiators. These advancements allow cyclists to monitor performance metrics such as speed, distance, and calories burned, while also providing real-time route tracking. Additionally, integrated anti-theft features enhance security, giving riders peace of mind. Through smartphone interfaces, users can seamlessly manage all these functions, combining convenience, safety, and performance monitoring in a single, connected cycling experience that appeals to tech-savvy consumers.

Market Outlook 2026-2034:

The India bicycle market outlook remains positive, supported by favorable demographic trends, increasing health awareness, and government initiatives promoting sustainable transportation. The expansion of cycling infrastructure including dedicated lanes and public bike-sharing systems in smart cities is expected to encourage broader adoption. Growing environmental consciousness and rising fuel costs are reinforcing bicycles' appeal as economical and eco-friendly mobility solutions. The electric bicycle segment presents significant growth potential as battery costs decline and charging infrastructure improves. Rural and semi-urban markets offer expansion opportunities as distribution networks extend beyond metropolitan centers. The market generated a revenue of USD 3.08 Billion in 2025 and is projected to reach a revenue of USD 5.06 Billion by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

India Bicycle Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Road Bicycle | 28.53% |

| Technology | Conventional | 72.24% |

| Price | Mid-Range | 71.91% |

| Distribution Channel | Offline Stores | 82.85% |

| End User | Men | 54.26% |

| Region | North India | 33% |

Type Insights:

- Road Bicycle

- Mountain Bicycle

- Hybrid Bicycle

- Others

The road bicycle dominates with a market share of 28.53% of the total India bicycle market in 2025.

Road bicycles have established market leadership driven by their versatility for both commuting and fitness applications across diverse Indian consumer segments. These bicycles feature lightweight construction, efficient gear systems, and aerodynamic designs optimized for paved surfaces commonly found in urban and suburban environments. In 2025, DLyft India LLP expanded its brand portfolio with the launch of Roadgiant Bikes, a new bicycle offering aimed at redefining accessibility and catering to riders of all ages in India, reflecting ongoing product diversification in the road and urban bike segment.

The road bicycle segment's expansion reflects changing consumer priorities toward health-conscious transportation choices and active lifestyle pursuits. Manufacturers are responding with diverse product offerings spanning entry-level commuter models to performance-oriented variants targeting serious cycling enthusiasts. Urban infrastructure improvements including smoother road surfaces and dedicated cycling paths are enhancing the appeal and practicality of road bicycles for daily use across metropolitan centers.

Technology Insights:

- Electric

- Conventional

The conventional leads with a share of 72.24% of the total India bicycle market in 2025.

Conventional bicycles continue dominating the Indian market owing to their affordability, mechanical simplicity, and established consumer familiarity across urban and rural populations. These human-powered bicycles require minimal maintenance, offer reliable performance without dependency on electrical charging infrastructure, and remain accessible to price-sensitive consumers across diverse economic segments. In December 2025, the Assam government launched a statewide bicycle distribution initiative to provide bicycles to over 3 lakh students to improve school attendance and mobility in rural areas, highlighting both the social relevance and continued demand for conventional cycles in everyday life.

The conventional segment benefits from deeply rooted cycling culture in India where bicycles serve essential transportation functions for working populations, students, and rural communities. Manufacturers continue innovating within this segment by introducing improved materials, enhanced braking systems, and comfortable designs while maintaining competitive pricing. The segment's sustainability depends on its ability to offer value-oriented products meeting diverse consumer needs from basic commuting to recreational cycling applications.

Price Insights:

- Premium

- Mid-Range

- Low-Range

The mid-range dominates with a market share of 71.91% of the total India bicycle market in 2025.

Mid-range bicycles have captured substantial market share by offering optimal value propositions balancing quality, features, and affordability for India's expanding middle-class consumer base. This segment encompasses bicycles featuring durable construction, reliable components, and modern styling that satisfy consumer expectations for performance and aesthetics without premium pricing. The growing aspirational consumer segment seeks products that represent value upgrades from basic models while remaining within household budget constraints.

The mid-range segment's strength reflects evolving consumer preferences toward quality-conscious purchasing decisions in the bicycle market. Manufacturers compete through feature differentiation, warranty offerings, and brand positioning to capture this lucrative market space. The segment benefits from rising disposable incomes enabling consumers to invest in bicycles offering enhanced durability, comfort, and riding experience compared to economy alternatives.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Offline Stores

The offline stores leads with a share of 82.85% of the total India bicycle market in 2025.

Offline retail channels maintain overwhelming dominance in bicycle distribution, reflecting consumer preferences for physical product evaluation, test riding opportunities, and personalized service during the purchase process. Traditional bicycle shops, multi-brand retailers, and branded showrooms offer expertise in product selection, proper sizing, and assembly services that enhance the buying experience. The tactile nature of bicycle purchases, where fit, comfort, and handling characteristics significantly influence decisions, favors in-store shopping experiences. In January 2025, AlphaVector’s Ninety One Cycles crossed 3 million bicycles sold in India, supported by many retail stores across 500 cities that provide assembly, servicing, and post‑purchase support, underscoring the importance and reach of offline distribution networks in driving both sales and customer satisfaction.

The offline channel's strength is reinforced by after-sales service requirements including maintenance, repairs, and warranty claims that benefit from local dealer relationships. Regional distribution networks ensure product availability across geographic markets while enabling manufacturers to maintain quality control over customer experiences. The segment continues evolving through experiential retail formats, enhanced showroom environments, and integration of digital technologies to complement traditional sales approaches.

End User Insights:

- Men

- Women

- Kids

The men dominates with a market share of 54.26% of the total India bicycle market in 2025.

The men's segment leads the market driven by higher participation rates in cycling for commuting, fitness, and recreational purposes across age groups. Traditional cultural patterns associating cycling with male transportation have established strong baseline demand, while growing fitness consciousness is driving increased adoption among health-focused male consumers. The segment encompasses diverse bicycle types from utility commuter models to performance-oriented road and mountain bicycles catering to varying preferences.

The men's segment benefits from established cycling infrastructure and social acceptance, enabling comfortable adoption across urban and rural contexts. Manufacturers offer extensive product portfolios addressing male consumer preferences for performance, durability, and styling characteristics. Growing participation in competitive cycling events and recreational cycling groups is expanding demand for specialized bicycles within this demographic segment, while marketing campaigns and influencer endorsements further drive awareness and brand loyalty.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India exhibits a clear dominance with a 33% share of the total India bicycle market in 2025.

North India's market leadership stems from its concentration of major bicycle manufacturing clusters, which have historically served both domestic and export markets. The region benefits from high population density across key states, established distribution networks, and a strong retail presence in urban and semi-urban centers. Consumer demand is driven by diverse applications including daily commuting, student transportation, and growing recreational cycling adoption in metropolitan areas.

Market expansion in North India is supported by improving cycling infrastructure, government promotion of non-motorized transportation, and rising health awareness among urban populations. States are implementing smart city initiatives that incorporate cycling lanes and bike-sharing programs to encourage adoption. Proximity to manufacturing hubs ensures competitive pricing and ready product availability. These factors strengthen North India’s position as the leading market for bicycle consumption.

Market Dynamics:

Growth Drivers:

Why is the India Bicycle Market Growing?

Rising Health Consciousness and Fitness Culture

Growing awareness of health benefits associated with regular physical activity is driving increased bicycle adoption among fitness-conscious Indian consumers. Cycling offers cardiovascular exercise, weight management benefits, and stress reduction that appeal to health-focused urban populations seeking convenient fitness solutions. The government’s Fit India Sundays on Cycle campaign, launched in December 2024, engaged around 200,000 cycling enthusiasts across over 4,600 locations nationwide by mid‑2025, highlighting how community‑centric cycling initiatives are promoting fitness, health, and active lifestyles. This trend is particularly pronounced among working professionals and younger demographics who incorporate cycling into wellness routines, driving demand for quality bicycles suited to fitness applications.

Environmental Awareness and Sustainable Mobility Preferences

Increasing environmental consciousness among Indian consumers is positioning bicycles as preferred sustainable transportation alternatives to motorized vehicles. Growing concerns about air pollution, carbon emissions, and climate change are motivating environmentally responsible transportation choices. In August 2025, the Meghalaya government launched Shillong’s first Public Bicycle Sharing (PBS) system as part of its Urban Mobility Policy to promote non‑motorised transport and reduce dependence on fossil‑fuel vehicles, targeting at least 35% of city travel by walking and cycling. Government policies promoting green mobility and restrictions on vehicular emissions in urban areas reinforce bicycles' appeal as eco-friendly commuting solutions. Environmental and economic benefits of cycling drive adoption across diverse consumer segments.

Government Initiatives Supporting Cycling Infrastructure

National and state government programs promoting cycling infrastructure development are creating enabling conditions for expanded bicycle adoption. Smart city initiatives incorporate dedicated cycling tracks, bike-sharing systems, and pedestrian-friendly urban planning that enhance cycling safety and convenience. Policy frameworks encouraging non-motorized transportation, including subsidies for bicycle purchases and workplace cycling incentives, are stimulating market demand. These infrastructure investments address historical barriers to cycling adoption including safety concerns and lack of dedicated facilities, progressively normalizing cycling as a mainstream urban mobility choice.

Market Restraints:

What Challenges the India Bicycle Market is Facing?

Inadequate Cycling Infrastructure in Most Cities

Despite improvement initiatives, most Indian cities lack comprehensive cycling infrastructure including dedicated lanes, secure parking, and traffic management accommodating cyclists. Safety concerns arising from mixed traffic conditions, aggressive driving patterns, and inadequate road space allocation discourage potential cyclists. The absence of end-to-end cycling connectivity limits bicycles' viability for practical commuting across significant distances in urban areas.

Challenging Climatic Conditions

India's diverse and often extreme climatic conditions present significant barriers to regular cycling adoption across different regions and seasons. Intense summer heat, monsoon rains, and high humidity levels make outdoor cycling uncomfortable and sometimes hazardous. These weather-related challenges constrain cycling primarily to favorable seasons and early morning or evening hours, limiting bicycles' utility as primary transportation modes.

Competition from Affordable Motorized Two-Wheelers

The availability of economical motorized two-wheelers, including entry-level scooters and motorcycles with accessible financing options, presents competitive pressure on bicycle demand for commuting applications. Motorized alternatives offer advantages in speed, range, and weather protection that appeal to consumers prioritizing convenience over health or environmental benefits. This competition is particularly relevant in semi-urban and rural markets where transportation distances and infrastructure conditions favor motorized mobility.

Competitive Landscape:

The India bicycle market features a competitive landscape characterized by established domestic manufacturers with extensive production capabilities and distribution networks competing alongside international premium brands targeting affluent consumer segments. Leading domestic players leverage manufacturing scale, brand recognition, and dealer relationships to maintain market positions across value and mid-range segments. International entrants focus on premium product categories, introducing advanced technologies and performance-oriented designs targeting cycling enthusiasts and fitness-conscious consumers. The competitive environment is evolving with new entrants in electric bicycle and direct-to-consumer segments challenging traditional market structures. Strategic initiatives encompass product innovation, distribution expansion, brand building, and service network development as manufacturers compete for market share across diverse consumer segments.

Recent Developments:

-

In December 2025, EMotorad launches T-Rex Smart e-cycle: Pune-based EMotorad has unveiled the T-Rex Smart, touted as India’s first smart connected e-cycle with built-in Bluetooth and GPS, app connectivity for tracking, geofencing, theft alerts, remote immobiliser and SOS features, marking a leap in connected bicycle tech for urban commuters.

India Bicycle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Road Bicycle, Mountain Bicycle, Hybrid Bicycle, Others |

| Technologies Covered | Electric, Conventional |

| Prices Covered | Premium, Mid-Range, Low-Range |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bicycle market size was valued at USD 3.08 Billion in 2025.

The India bicycle market is expected to grow at a compound annual growth rate of 5.65% from 2026-2034 to reach USD 5.06 Billion by 2034.

Road bicycle dominates the India bicycle market with a 28.53% share, driven by versatility for commuting and fitness applications, lightweight construction, and growing participation in recreational cycling and sporting events.

Key factors driving the India bicycle market include rising health consciousness and fitness culture, environmental awareness promoting sustainable mobility, and government initiatives supporting cycling infrastructure development across smart cities.

Major challenges include inadequate cycling infrastructure in most cities, challenging climatic conditions affecting year-round cycling viability, and competition from affordable motorized two-wheelers offering convenience advantages for commuting.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)