India Biochar Market Size, Share, Trends and Forecast by Feedstock Type, Technology Type, Product Form, Application, and Region, 2026-2034

India Biochar Market Overview:

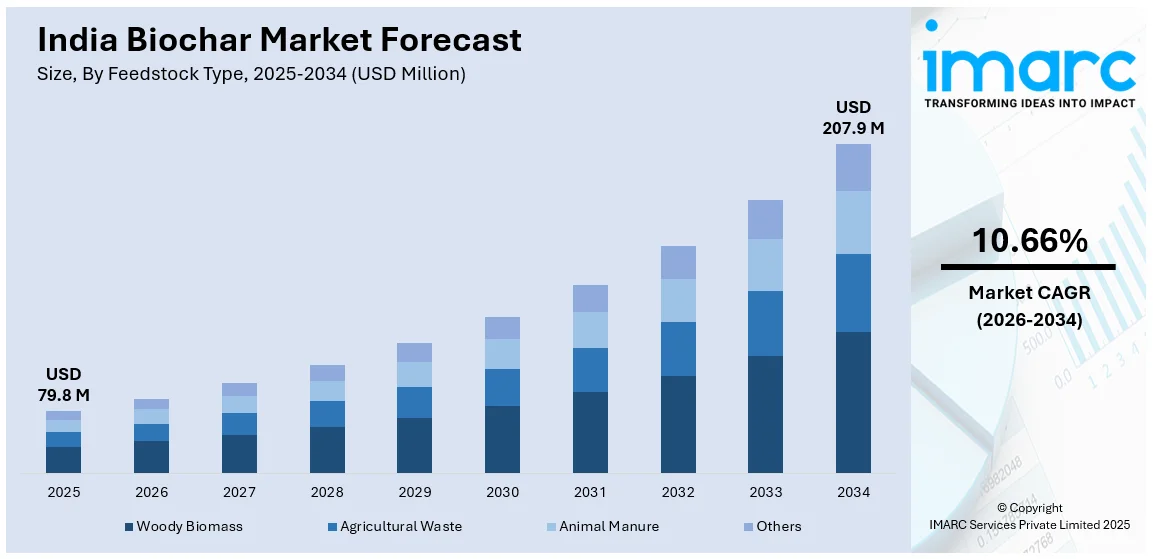

The India biochar market size reached USD 79.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 207.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.66% during 2026-2034. The market is growing due to increasing demand for sustainable soil enhancement, carbon sequestration, and waste management solutions, driven by government initiatives, rising agricultural adoption, and interest in bio-based alternatives, with key applications in farming, forestry, and environmental remediation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.8 Million |

| Market Forecast in 2034 | USD 207.9 Million |

| Market Growth Rate 2026-2034 | 10.66% |

India Biochar Market Trends:

Rising Adoption of Biochar in Sustainable Agriculture

The rising adoption of biochar in sustainable agriculture is boosting the India biochar market share. The application of biochar bolsters soil health through its ability to enhance water retention along with better aeration and microbial operation. This further helps farmers minimize their use of chemical fertilizers. Biochar emerges as a preferred sustainable soil amendment because of increasing soil degradation issues that affect agricultural productivity. Moreover, the integration of biochar into farming systems receives extra support through government programs which back organic farming and carbon sequestration initiatives. Various research studies and pilot projects focus on demonstrating biochar applications for different Indian soils under diverse climatic zones. Besides this, Indian farmers have identified the advantages to reduce greenhouse gas (GHG) emissions while simultaneously combating the effects of climate change. For instance, in November 2024, IIT(ISM) Dhanbad signed an MoU with sustainability startup sentra.world to research the application of biochar in steel manufacturing. This collaboration aims to utilize surplus biomass to produce biochar, potentially reducing emissions by up to 40% and curbing stubble burning, thereby advancing sustainable practices in steelmaking processes nationwide. Furthermore, biochar adoption in Indian agriculture is growing because of spreading awareness and decreasing production costs. This is creating sustainable improvements in environmental conservation, crop production, securing the national food supply and promoting healthier soils, thus impelling the India biochar market growth.

To get more information on this market Request Sample

Increasing Government and Private Sector Investments

The Indian biochar industry is experiencing increasing capital investments from both public sector and private companies that aim to increase production levels and commercial activities. Through National Mission for Sustainable Agriculture (NMSA) and National Bio-Energy Mission, the Indian government supports biochar production to capture carbon and manage waste materials. Additionally, the increasing incentives and subsidies directed toward bio-based products are fostering the adoption of biochar in the country. The potential of biochar also draws interest from private companies and startup businesses who investigate its various uses from soil remediation to water filtering and renewable energy production. For example, in November 2024, Tata Steel became the first Indian steel manufacturer to incorporate biochar into its production process, replacing approximately 30,000 tons of fossil fuel. This move has the potential to reduce over 50,000 tons of CO₂ emissions annually, underscoring Tata Steel's commitment to environmental sustainability and setting a precedent for the industry. In confluence with this, academic institutions along with industry players have started new research partnerships which advance production methods of biochar through improved techniques like pyrolysis and gasification while reducing costs and improving efficiency. As a result, biochar stands as a promising carbon-negative technology for sustainable development goals (SDGs) which has gained rising global attention, attracting additional investments and policy backing for India's bio-economy, thereby enhancing the India biochar market outlook.

India Biochar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on feedstock type, technology type, product form, and application.

Feedstock Type Insights:

- Woody Biomass

- Agricultural Waste

- Animal Manure

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock type. This includes woody biomass, agricultural waste, animal manure, and others.

Technology Type Insights:

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes slow pyrolysis, fast pyrolysis, gasification, hydrothermal carbonization, and others.

Product Form Insights:

- Coarse and Fine Chips

- Fine Powder

- Pellets, Granules and Prills

- Liquid Suspension

The report has provided a detailed breakup and analysis of the market based on the product form. This includes coarse and fine chips, fine powder, pellets, granules and prills, and liquid suspension.

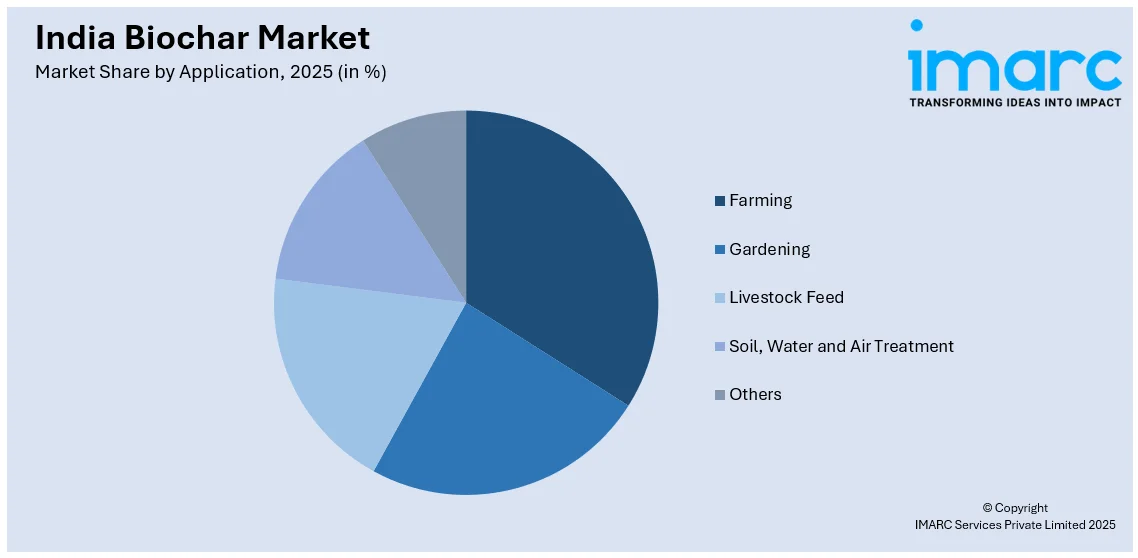

Application Insights:

Access the comprehensive market breakdown Request Sample

- Farming

- Gardening

- Livestock Feed

- Soil, Water and Air Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes farming, gardening, livestock feed, soil, water, and air treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biochar Market News:

- In January 2025, Google entered into a significant agreement to purchase 100,000 tons of carbon removal credits by 2030 from Varaha, an Indian company that converts agricultural waste into biochar. This investment not only supports carbon sequestration efforts but also enhances soil health, thereby promoting sustainable agricultural practices in India.

- In October 2024, the Steel Authority of India Limited (SAIL) partnered with global mining company BHP to explore the use of hydrogen and biochar in reducing carbon emissions at SAIL's blast furnace plants. This initiative aligns with India's climate commitments and addresses the steel industry's substantial contribution to national emissions.

India Biochar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Woody Biomass, Agricultural Waste, Animal Manure, Others |

| Technology Types Covered | Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others |

| Product Forms Covered | Coarse and Fine Chips, Fine Powder, Pellets, Granules and Prills, Liquid Suspension |

| Applications Covered | Farming, Gardening, Livestock Feed, Soil, Water, and Air Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biochar market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biochar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biochar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India biochar market was valued at USD 79.8 Million in 2025.

The India biochar market is projected to exhibit a CAGR of 10.66% during 2026-2034, reaching a value of USD 207.9 Million by 2034.

The India biochar market is driven by growing emphasis on sustainable agriculture, soil health improvement, and carbon sequestration. Increased awareness of regenerative farming, government support for climate-smart practices, and rising demand for organic fertilizer alternatives boost adoption. Additionally, abundant agricultural waste feedstock and environmental regulations further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)