India Biochip Market Size, Share, Trends and Forecast by Product Type, Fabrication Technique, Analysis Method, Application, End User, and Region, 2025-2033

India Biochip Market Overview:

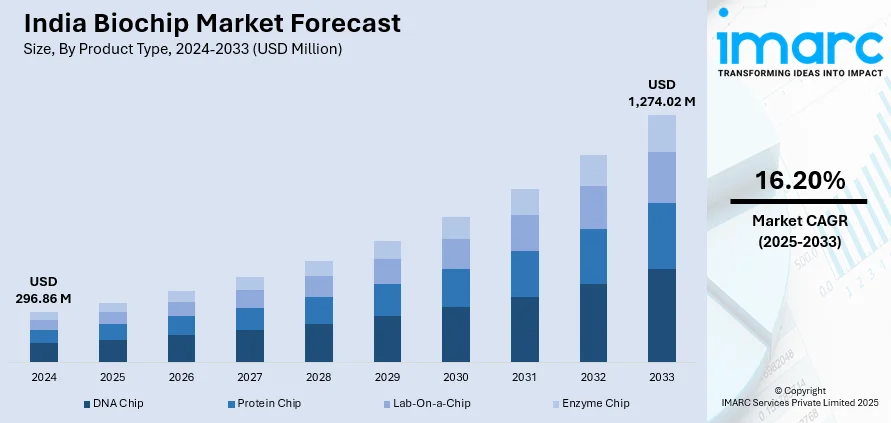

The India biochip market size reached USD 296.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,274.02 Million by 2033, exhibiting a growth rate (CAGR) of 16.20% during 2025-2033. The market is being driven by escalating demand for personalized medicine, rapid expansion of point-of-care diagnostics, increased government funding in the biotechnology sector, rising prevalence of chronic and infectious diseases, and advancements in microfluidics and nanotechnology that enable faster, more accurate, and cost-effective diagnostic and research applications across diverse healthcare settings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 296.86 Million |

| Market Forecast in 2033 | USD 1,274.02 Million |

| Market Growth Rate 2025-2033 | 16.20% |

India Biochip Market Trends:

Rising Demand for Personalized Medicine and Genomic Research

One of the major driving factors of the India biochip market is the growing focus on personalized medicine and genomics research. Since India's population is over 1.4 billion and is highly genetically diverse, there is vast potential for treatment methods that take into account individual genetic makeup. Biochips, especially DNA microarrays, are critical to sequencing, studying gene expression, and identifying genetic mutations. These technologies aid researchers and doctors in finding biomarkers, tracking disease development, and personalizing therapies according to a patient's individual genetic profile. The government and academia in India are making massive investments in genomics, as evident from efforts like the Genome India Project with the goal of sequencing more than 10,000 Indian genomes to decipher population-differentiated diseases. At the same time, the price of next-generation sequencing (NGS) technologies is decreasing gradually, and hence biochip-based diagnostics are becoming more affordable to a wider range of researchers and clinicians. Additionally, partnerships between biotech firms and hospitals are driving the implementation of biochips in oncology, rare diseases, and inherited disorders.

To get more information on this market, Request Sample

Expansion of Point-of-Care Diagnostics and Lab-on-a-Chip Technologies

Another driver of the India biochip market is the surge in demand for point-of-care (PoC) diagnostics and lab-on-a-chip technologies, particularly in rural and underserved areas. India's extensive and unevenly spread healthcare infrastructure presents a major challenge to traditional diagnostics, especially in remote locations. Biochips, when incorporated into small, portable diagnostic platforms, provide real-time results without the need for advanced laboratory facilities or highly skilled personnel. The COVID-19 pandemic significantly accelerated the need for fast, decentralized testing devices, driving investment and innovation in biochip-based PoC platforms. These platforms are capable of identifying pathogens, measuring blood chemistry, and screening for a range of health disorders within minutes, enabling timely medical interventions. Their application in the control of infectious diseases such as tuberculosis, dengue, and malaria, which continue to be prevalent in large sections of India, has been a game-changer. Startups and public-private collaborations are extensively funding lab-on-a-chip technologies, with the goal of developing affordable, disposable, and simple-to-use solutions. Government-sponsored health programs, such as Ayushman Bharat, are also promoting the inclusion of such technologies in primary healthcare services.

India Biochip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, fabrication technique, analysis method, application, and end user.

Product Type Insights:

- DNA Chip

- Protein Chip

- Lab-On-a-Chip

- Enzyme Chip

The report has provided a detailed breakup and analysis of the market based on the product type. This includes DNA chip, protein chip, lab-on-a-chip, and enzyme chip.

Fabrication Technique Insights:

- Microarray

- Microfluidic

A detailed breakup and analysis of the market based on the fabrication technique have also been provided in the report. This includes microarray and microfluidic.

Analysis Method Insights:

- Electrophoresis

- Luminescence

- Mass Spectrometry

- Electrical Signals

- Magnetism

The report has provided a detailed breakup and analysis of the market based on the analysis method. This includes electrophoresis, luminescence, mass spectrometry, electrical signals, and magnetism.

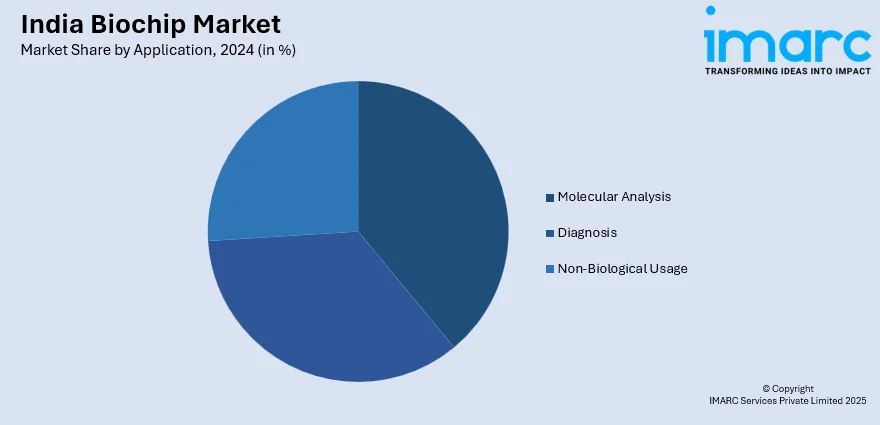

Application Insights:

- Molecular Analysis

- Hybridization

- Protein

- Immunological

- Biomolecules

- Biomarker

- Others

- Diagnosis

- Gene Diagnosis

- Oncology

- Inflammatory

- Others

- Non-Biological Usage

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes molecular analysis (hybridization, protein, immunological, biomolecules, biomarker, and others), diagnosis (gene diagnosis, oncology, inflammatory, and others), and non-biological usage.

End User Insights:

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostics Centers

- Academic and Research Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes pharmaceutical and biotechnology companies, hospitals and diagnostics centers, academic and research institutes, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biochip Market News:

- February 2025: IIT Madras launched India’s first comprehensive cancer genome database, aiming to enhance cancer research and treatment. The database compiles genomic data from Indian cancer patients, facilitating personalized medicine and targeted therapies. Such databases typically rely on advanced technologies like biochips for high-throughput genomic data collection and analysis, enabling efficient detection of genetic mutations associated with various cancers.

- September 2024: The Global Bio India 2024 event showcased the research conducted by 30 biotech startups and highlighted the development of India's bioeconomy. This surge in biotech innovation and economic expansion is propelling the Indian biochip market by fostering a conducive environment for research, development, and commercialization of biochip technologies.

- August 2024: ICAR-IIHR announced that it had developed 13 high-yielding, climate-resilient, and nutrient-rich crop varieties, including fruits like mango and guava rich in carotenoids and lycopene, respectively. Vegetable innovations feature iodine-rich okra resistant to yellow vein mosaic virus.

India Biochip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | DNA Chip, Protein Chip, Lab-On-a-Chip, Enzyme Chip |

| Fabrication Techniques Covered | Microarray, Microfluidic |

| Analysis Methods Covered | Electrophoresis, Luminescence, Mass Spectrometry, Electrical Signals, Magnetism |

| Applications Covered |

|

| End Users Covered | Pharmaceutical and Biotechnology Companies, Hospitals and Diagnostics Centers, Academic and Research Institutes, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biochip market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biochip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biochip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biochip market in India was valued at USD 296.86 Million in 2024.?

The India biochip market is projected to exhibit a CAGR of 16.20% during 2025-2033, reaching a value of USD 1,274.02 Million by 2033.

The market is driven by advancements in biotechnology, increasing demand for efficient diagnostics, and a rise in research activities. The growing focus on personalized medicine and genetic research, along with the need for improved healthcare solutions, further accelerates the market’s growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)