India Biodiesel Market Size, Share, Trends and Forecast by Feedstock, Application, Type, Production Technology, and Region, 2026-2034

India Biodiesel Market Summary:

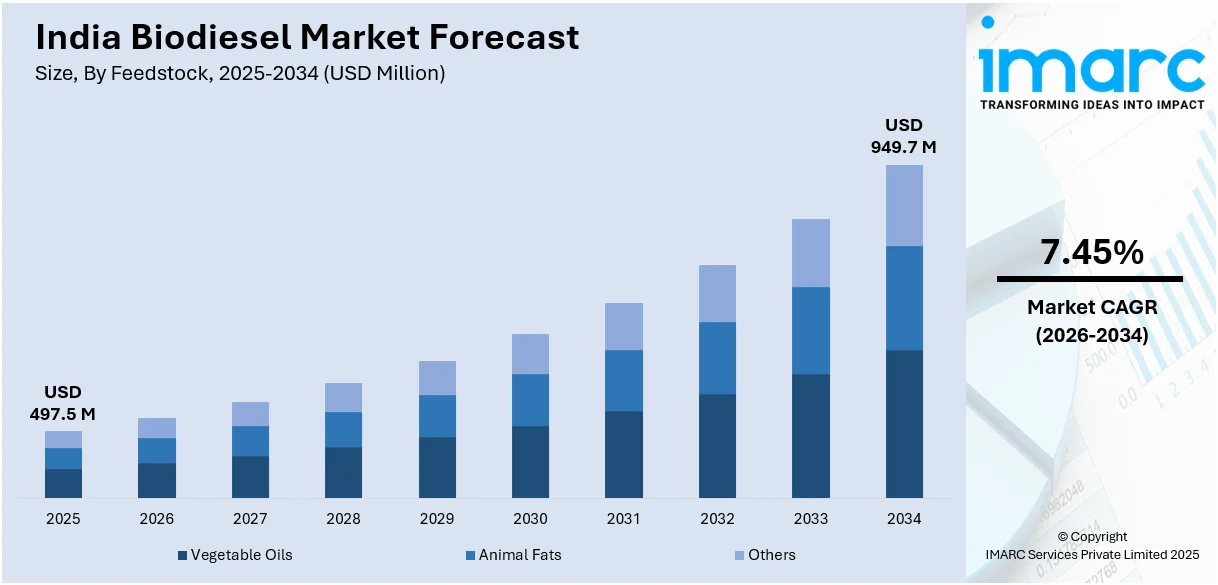

The India biodiesel market size was valued at USD 497.46 Million in 2025 and is projected to reach USD 949.74 Million by 2034, growing at a compound annual growth rate of 7.45% from 2026-2034.

The market is driven by increasing demand for sustainable and cleaner fuel alternatives, growing government initiatives promoting renewable energy adoption, and rising focus on reducing carbon emissions across transportation and industrial sectors. Supportive policy frameworks and environmental consciousness are encouraging biodiesel production expansion nationwide. The fuel application segment and vegetable oil feedstock category continue to shape the India biodiesel market share.

Key Takeaways and Insights:

- By Feedstock: Vegetable oils dominate the market with a share of 58% in 2025, driven by widespread availability of oilseed crops, established processing infrastructure, and cost-effective production methods that ensure consistent raw material supply for biodiesel manufacturing operations.

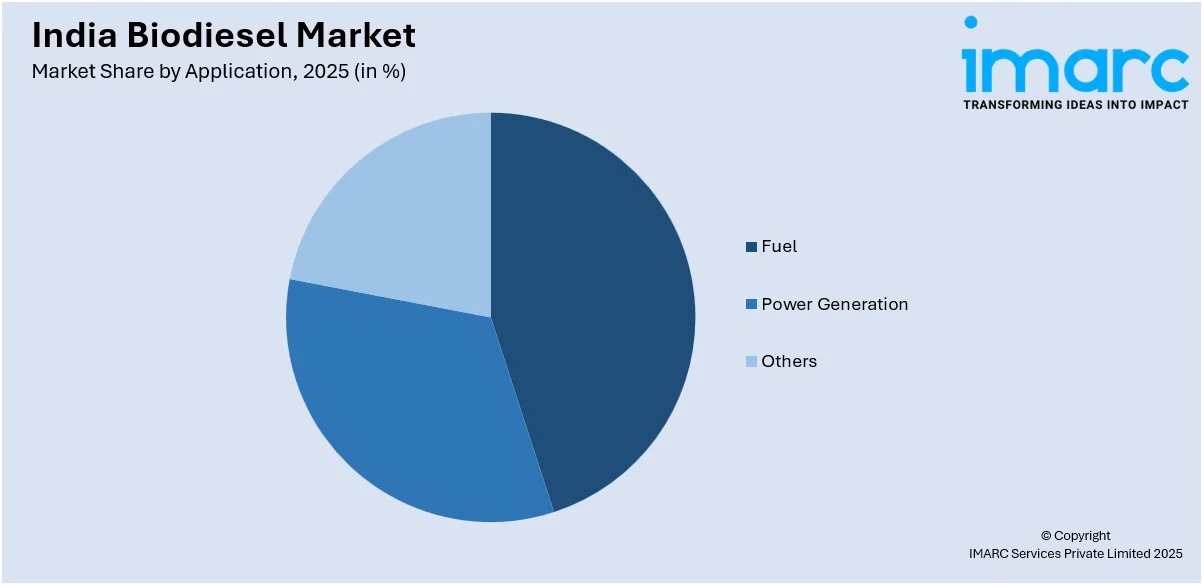

- By Application: Fuel leads the market with a share of 67% in 2025, owing to increasing blending mandates for transportation fuels, growing diesel consumption across commercial vehicles, and rising adoption of biodiesel in railways and logistics operations nationwide.

- By Type: B5 represents the largest segment with a market share of 40% in 2025, driven by compatibility with existing diesel engines without modifications, widespread acceptance among commercial fleet operators, and alignment with current government blending specifications.

- By Production Technology: Pyrolysis dominates the market with a share of 49% in 2025, owing to its ability to process diverse feedstock types, lower operational costs compared to conventional methods, and scalability advantages for commercial biodiesel production facilities.

- By Region: North India leads the market with a share of 28% in 2025, driven by significant agricultural activities in Punjab and Haryana providing abundant feedstock supply, established industrial infrastructure, and proactive state-level policies promoting biodiesel adoption.

- Key Players: The India biodiesel market exhibits moderate competitive intensity, with established energy corporations competing alongside emerging domestic manufacturers across various production capacities. Market participants are focusing on expanding production capabilities, securing sustainable feedstock supply chains, and developing strategic partnerships to strengthen their market positioning.

To get more information on this market Request Sample

The India biodiesel market is experiencing substantial momentum driven by multiple interconnected factors shaping the renewable energy landscape. Government commitment to reducing crude oil import dependency has positioned biodiesel as a strategic alternative fuel source within the national energy portfolio. Environmental consciousness among consumers and industrial stakeholders is accelerating the transition toward cleaner fuel alternatives that minimize carbon footprint across transportation and power generation applications. The National Policy on Biofuels has established clear blending targets and regulatory frameworks that provide market certainty for producers and investors. As per sources, in September 2025, Kotyark Industries won a ₹58.39 Crore government tender to supply 7,299 KL of biodiesel to IndianOil, HPCL, and BPCL, reinforcing domestic biodiesel procurement by oil marketing companies. Moreover, agricultural sector integration through oilseed cultivation programs ensures domestic feedstock availability while supporting rural economic development initiatives. Technological advancements in production processes are enhancing conversion efficiency and reducing operational costs, making biodiesel increasingly competitive against conventional petroleum fuels.

India Biodiesel Market Trends:

Expansion of Used Cooking Oil Collection Networks

The biodiesel industry is witnessing a significant shift toward circular economy principles through the systematic collection and processing of used cooking oil from hotels, restaurants, and households. Government initiatives are establishing dedicated collection infrastructure across major urban centers, creating organized supply chains for waste oil procurement. As per sources, in July 2025, FSSAI extended provisional enrolment of 63 Non-Food Production units under the RUCO initiative, enabling systematic collection of used cooking oil for biodiesel production across India. Further, this feedstock diversification reduces dependence on virgin vegetable oils while addressing environmental concerns related to improper waste oil disposal. Processing facilities are being upgraded to handle varying quality grades of collected cooking oil, ensuring consistent biodiesel output quality.

Integration of Advanced Production Technologies

The market is experiencing accelerated adoption of advanced production methodologies that enhance biodiesel yield and quality parameters. As per sources, Aemetis’ Universal Biofuels India plant secured a $150 million biodiesel supply allocation from government-controlled OMCs, supplying 40 Million Gallons under cost-plus contracts over one year. Moreover, continuous flow reactor systems are replacing traditional batch processing units, enabling higher throughput volumes and improved process control. Catalyst recovery and recycling technologies are being implemented to reduce production costs and minimize chemical waste generation. Enzymatic transesterification methods are gaining traction as environmentally friendly alternatives to conventional chemical processes. Quality assurance systems incorporating real-time monitoring ensure consistent product specifications meeting national and international standards for automotive fuel applications.

Rural Agricultural Integration and Feedstock Diversification

Biodiesel production is increasingly integrating with rural agricultural ecosystems through dedicated non-edible oilseed cultivation programs on marginal lands. Farmers are being encouraged to cultivate energy crops that do not compete with food production while generating supplemental income streams. According to sources, in December 2025, India’s National Biofuel Policy promoted biodiesel production by encouraging indigenous Tree-Borne Oil feedstocks like Karanja, Neem, Mahua, and Pongamia, boosting farmer income and rural employment. Further, contract farming arrangements are emerging between biodiesel producers and agricultural cooperatives, ensuring stable feedstock supply and fair pricing mechanisms. Research institutions are developing improved crop varieties optimized for oil content and regional climatic conditions. This agricultural integration strengthens rural livelihoods while establishing decentralized feedstock production networks across diverse geographic regions.

Market Outlook 2026-2034:

The India biodiesel market is positioned for sustained revenue growth throughout the forecast period, supported by favorable regulatory frameworks and increasing environmental consciousness. Market revenue expansion will be driven by progressive blending mandate implementations, expanding production capacities, and growing adoption across transportation and industrial applications. Infrastructure development for feedstock collection and distribution networks will enhance supply chain efficiency and market accessibility. Government procurement programs and price support mechanisms are expected to provide revenue stability for producers while encouraging capacity investments. The market generated a revenue of USD 497.46 Million in 2025 and is projected to reach a revenue of USD 949.74 Million by 2034, growing at a compound annual growth rate of 7.45% from 2026-2034.

India Biodiesel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Feedstock |

Vegetable Oils |

58% |

|

Application |

Fuel |

67% |

|

Type |

B5 |

40% |

|

Production Technology |

Pyrolysis |

49% |

|

Region |

North India |

28% |

Feedstock Insights:

- Vegetable Oils

- Animal Fats

- Others

Vegetable oils dominate with a market share of 58% of the total India biodiesel market in 2025.

Vegetable oils lead India biodiesel market, supported by established agricultural supply chains and processing infrastructure across major oilseed-producing states. Soybean, palm, and rapeseed oils serve as primary feedstock sources, with domestic cultivation programs expanding dedicated acreage for biodiesel-grade oilseed production. As per sources, in December 2025, Indian buyers secured over 150,000 tons per month of South American soybean oil for April to July 2026 deliveries, supporting feedstock diversification for biodiesel production. Furthermore, the processing industry has developed sophisticated refining capabilities to convert crude vegetable oils into high-quality biodiesel meeting stringent fuel specifications. Government procurement mechanisms ensure fair pricing, encouraging farmers to increase oilseed cultivation for industrial applications.

The segment benefits from well-established storage and transportation infrastructure facilitating efficient feedstock logistics to production facilities nationwide. Research initiatives focus on improving oil extraction efficiency and developing higher-yielding crop varieties suitable for diverse agro-climatic conditions. This feedstock category provides production flexibility, enabling manufacturers to source raw materials from multiple vegetable oil types based on seasonal availability and pricing dynamics. Abundant agricultural resources position vegetable oils as the preferred sustainable feedstock for expanding biodiesel production capacities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fuel

- Power Generation

- Others

Fuel leads with a share of 67% of the total India biodiesel market in 2025.

The fuel dominates India's biodiesel consumption landscape, driven by government blending mandates for transportation diesel and growing demand from commercial vehicle operators nationwide. Railways, public transport systems, and logistics companies are increasingly adopting biodiesel blends to reduce operational emissions and comply with environmental regulations. The segment benefits from expanding distribution infrastructure through oil marketing companies establishing dedicated biodiesel supply points across major transportation corridors. According to sources, in March 2025, India’s state-owned OMCs launched a biodiesel procurement tender for 200 Million Liters for FY 2025–26, supporting the government’s goal of increasing biodiesel blending in diesel. Moreover, commercial fleet operators recognize significant cost savings through alternative fuel adoption programs.

Fleet operators appreciate biodiesel's compatibility with existing diesel engines, eliminating requirements for expensive vehicle modifications while achieving emission reduction objectives effectively. Government procurement mandates for public sector vehicles create stable demand channels, encouraging substantial production capacity investments across the industry. Quality certification frameworks ensure biodiesel fuels meet performance standards comparable to petroleum diesel, building consumer confidence in alternative fuel adoption. The transportation sector's substantial diesel consumption provides significant market expansion potential as blending ratios progressively increase nationwide.

Type Insights:

- B100

- B20

- B10

- B5

B5 exhibits a clear dominance with a 40% share of the total India biodiesel market in 2025.

B5 maintains market leadership as the preferred formulation balancing renewable content with practical engine compatibility considerations for diverse applications. This blend ratio ensures seamless integration with existing diesel infrastructure without requiring specialized handling, storage, or dispensing equipment modifications at retail outlets. Vehicle manufacturers provide comprehensive warranty coverage for B5 fuel usage, encouraging widespread adoption among commercial and personal vehicle operators concerned about potential engine performance impacts. Regulatory alignment with current blending specifications supports market dominance. As per sources, in March 2025, India was projected to require $287 Million in investment to achieve a B5 biodiesel blend by 2030, supporting infrastructure and feedstock development for nationwide adoption.

B5 serves as an accessible entry point for biodiesel adoption, allowing consumers to experience alternative fuel benefits with minimal operational changes required. Distribution through existing petroleum retail networks ensures convenient accessibility for end-users across urban and rural geographies throughout the country. Progressive consumer acceptance of B5 formulations creates pathways for higher blend ratio adoption as market familiarity and infrastructure capabilities expand significantly. Quality consistency in B5 products builds confidence for transitioning toward increased biodiesel utilization rates nationwide.

Production Technology Insights:

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

Pyrolysis leads with a market share of 49% of the total India biodiesel market in 2025.

Pyrolysis commands India biodiesel market, offering remarkable feedstock flexibility and operational efficiency advantages over conventional transesterification methods employed traditionally. As per sources, in May 2025, Gujarat approved continuous tyre pyrolysis plants, lifting a long‑standing ban and enabling sustainable waste‑to‑fuel conversion that can support diversified biodiesel feedstock production. Further, the thermal decomposition process enables processing of diverse raw materials including waste oils, agricultural residues, and mixed feedstock streams that challenge traditional production approaches significantly. Production facilities utilizing pyrolysis achieve competitive operating costs through integrated energy recovery systems and substantially reduced chemical input requirements. This technology addresses feedstock availability constraints while maintaining consistent output quality standards.

Technological refinements have enhanced pyrolysis product quality, producing biodiesel meeting stringent fuel specifications required for transportation applications across diverse vehicle categories. Scalability advantages enable both small-scale rural installations and large commercial facilities based on regional feedstock availability patterns and demand requirements. Environmental benefits include reduced waste generation compared to chemical conversion processes and potential for carbon-negative operations through biomass processing. Ongoing research focuses on catalyst development and process optimization to further improve yield efficiency and product consistency.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 28% of the total India biodiesel market in 2025.

North India maintains regional market leadership through concentrated agricultural production capabilities, established industrial infrastructure, and supportive state-level policies actively promoting biodiesel adoption. Punjab and Haryana contribute significantly through dedicated oilseed cultivation programs and established processing facilities serving both regional and national markets effectively. Proximity to major consumption centers in the National Capital Region creates substantial logistical advantages for biodiesel distribution and accelerated market development. Strong agricultural foundations ensure reliable feedstock supply chains throughout production cycles.

State governments in the region have implemented proactive policies including subsidized feedstock procurement programs, attractive production incentives, and mandatory biodiesel usage requirements in government vehicle fleets. According to reports, in October 2024, Punjab unveiled its State Biofuels Policy aiming to meet 20 percent of the state’s fuel demand through biofuels, utilizing 50 percent agricultural waste and operating four CBG projects totalling 85 tonne per day (TPD). Furthermore, agricultural diversification programs encourage farmers to dedicate marginal lands for energy crop cultivation, strengthening regional feedstock supply chains considerably. Industrial clusters provide skilled workforce availability and supporting infrastructure essential for biodiesel production expansion activities. The region's successful market development serves as a replicable model for biodiesel adoption acceleration across other parts of India.

Market Dynamics:

Growth Drivers:

Why is the India Biodiesel Market Growing?

Comprehensive Government Policy Support and Regulatory Frameworks

The National Policy on Biofuels establishes clear blending targets and implementation timelines that provide market certainty for investors and producers. Government mandates requiring progressive biodiesel incorporation in transportation fuels create guaranteed demand channels supporting production capacity investments. As per sources, in August 2025, Government reduced excise duties on petrol and diesel, diversified crude imports, and promoted biofuels and alternative energy to shield consumers from global crude oil price fluctuations. Moreover, financial incentives including subsidies for refinery establishment, tax exemptions, and preferential pricing mechanisms reduce entry barriers for new market participants. State-level policies complement national frameworks through additional incentives, land allocation for feedstock cultivation, and public procurement commitments. Regulatory clarity regarding feedstock specifications, quality standards, and blending requirements enables standardized production approaches across the industry.

Energy Security Imperatives and Import Dependency Reduction

India's substantial petroleum import requirements create strategic vulnerabilities to global supply disruptions and price volatility impacting economic stability. Biodiesel production from domestic feedstocks provides indigenous fuel supply diversification, reducing foreign exchange expenditure on crude oil imports. National energy security frameworks position biofuels as essential components of the diversified energy portfolio supporting self-reliance objectives. Diesel consumption growth projections across transportation and industrial sectors intensify pressure on petroleum imports, amplifying the strategic importance of domestic biodiesel production. Economic benefits extend beyond import substitution through rural employment generation, agricultural income enhancement, and industrial development in underserved regions.

Environmental Consciousness and Emission Reduction Commitments

Escalating concerns regarding air quality degradation in urban centers drive demand for cleaner-burning fuel alternatives that reduce harmful exhaust emissions. India's climate commitments under international frameworks necessitate transportation sector decarbonization, positioning biodiesel as an immediate-term emission reduction solution. Biodiesel combustion produces substantially lower particulate matter, sulfur oxides, and hydrocarbon emissions compared to petroleum diesel, improving local air quality. According to sources, in September 2025, under FSSAI’s RUCO programme, Coimbatore collected 245 kilolitres of used cooking oil from 444 food businesses, converting 192 kilolitres into biodiesel for Indian Oil Corporation. Further, corporate sustainability initiatives increasingly mandate alternative fuel adoption for logistics operations, fleet management, and industrial processes. Public awareness campaigns highlighting health impacts of vehicular emissions accelerate consumer preference shifts toward renewable fuel options.

Market Restraints:

What Challenges the India Biodiesel Market is Facing?

Feedstock Supply Constraints and Price Volatility

Limited domestic oilseed production creates feedstock availability challenges that constrain biodiesel manufacturing capacity utilization. Seasonal agricultural variations cause supply fluctuations impacting production planning and cost management for biodiesel manufacturers. Competition with food industry applications for vegetable oils creates pricing pressures affecting biodiesel production economics. Underdeveloped collection infrastructure for used cooking oil and waste fats limits access to alternative feedstock sources that could diversify supply chains.

Infrastructure Development Requirements

Insufficient biodiesel storage and distribution infrastructure limits market accessibility beyond major metropolitan regions. Retail dispensing facilities require modifications to handle biodiesel blends, creating investment barriers for fuel station operators. Transportation logistics for feedstock collection from dispersed agricultural sources increase operational costs for production facilities. Quality testing and certification infrastructure remains inadequate to support expanded production volumes across geographically distributed facilities.

Consumer Awareness and Acceptance Challenges

Limited consumer understanding of biodiesel benefits and performance characteristics slows voluntary adoption beyond mandated requirements. Misconceptions regarding engine compatibility and maintenance impacts create hesitancy among vehicle operators considering alternative fuels. Inconsistent product quality experiences in early market development phases have generated skepticism requiring ongoing confidence-building efforts. Educational initiatives require sustained investment to overcome information gaps hindering broader market acceptance.

Competitive Landscape:

The India biodiesel market features a moderately competitive landscape with participants ranging from established petroleum corporations to emerging domestic producers focused on regional markets. Market competition centers on feedstock procurement capabilities, production efficiency, and distribution network reach rather than product differentiation given standardized fuel specifications. Strategic partnerships between producers and oil marketing companies are reshaping market dynamics by ensuring offtake commitments and distribution access. Vertical integration strategies involving feedstock cultivation, processing, and distribution are emerging among larger participants seeking supply chain control. Technology licensing arrangements are enabling smaller producers to access advanced processing capabilities without substantial capital investments.

Recent Developments:

In August 2024, M11 Industries inaugurated India’s first fully integrated biodiesel plant in Coastal Karnataka, converting used cooking oil into premium biodiesel. The facility, with 450 TPD capacity, includes advanced refining and distillation units, marking a major milestone in the country’s renewable energy and sustainable fuel initiatives.

India Biodiesel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Feedstocks | Vegetable Oils, Animal Fats, Others |

| Applications Covered | Fuel, Power Generation, Others |

| Types Covered | B100, B20, B10, B5 |

| Production Technologies Covered | Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India biodiesel market size was valued at USD 497.46 Million in 2025.

The India biodiesel market is expected to grow at a compound annual growth rate of 7.45% from 2026-2034 to reach USD 949.74 Million by 2034.

Vegetable oils held the largest market share, driven by established agricultural supply chains, widespread oilseed cultivation programs, sophisticated processing infrastructure, and government policies promoting domestic feedstock production for biodiesel manufacturing applications.

Key factors driving the India biodiesel market include comprehensive government policy support with blending mandates, energy security imperatives driving import substitution efforts, environmental consciousness spurring cleaner fuel adoption, and expanding feedstock availability through agricultural integration programs.

Major challenges include feedstock supply constraints and price volatility, insufficient storage and distribution infrastructure development, limited consumer awareness regarding biodiesel benefits, inconsistent quality perceptions, underdeveloped used cooking oil collection networks, and competition with food industry for vegetable oil supplies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)