India Bioethanol Market Size, Share, Trends and Forecast by Type, Fuel Blend, Generation, End Use Industry, and Region, 2025-2033

Market Overview:

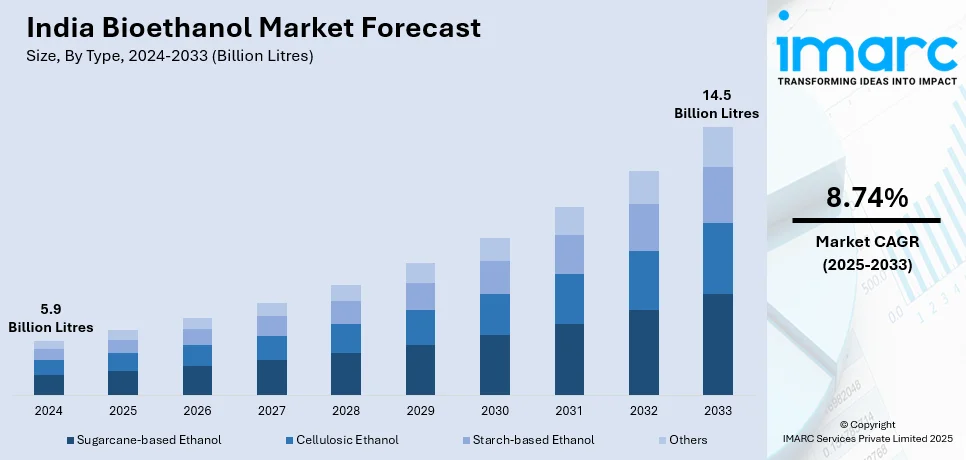

India bioethanol market size reached 5.9 Billion Litres in 2024. Looking forward, IMARC Group expects the market to reach 14.5 Billion Litres by 2033, exhibiting a growth rate (CAGR) of 8.74% during 2025-2033. The escalating demand for cleaner and more sustainable energy solutions is primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 5.9 Billion Litres |

| Market Forecast in 2033 | 14.5 Billion Litres |

| Market Growth Rate (2025-2033) | 8.74% |

Bioethanol is a transparent, colorless liquid derived from biomass through processes like hydrolysis and sugar fermentation, or through the chemical reaction of ethylene with steam. Its production involves eco-friendly methods, and it is characterized by biodegradability, lower toxicity, and a lack of environmental pollution when compared to traditional fuels. This has led to an increasing global interest in bioethanol as a substitute for petrol in road transport vehicles. A notable advantage is its compatibility with petrol without necessitating modifications to engine designs, resulting in diminished greenhouse gas (GHG) emissions and air pollution. As a consequence, bioethanol is gaining prominence as a sustainable and environmentally friendly alternative in the transportation sector across the country.

To get more information on this market, Request Sample

India Bioethanol Market Trends:

The India bioethanol market has emerged as a focal point within the nation's energy and environmental strategies, reflecting the increasing emphasis on sustainable alternatives in the transportation sector. One of the defining characteristics of bioethanol in the Indian market is its eco-friendly nature. Additionally, it is biodegradable, less toxic, and lacks the environmental pollution associated with conventional fuels. As a result, bioethanol is gaining traction as a petrol substitute for road transport vehicles across the country. Besides this, a key advantage is its seamless blending with petrol without requiring modifications to existing engine designs, resulting in a reduction of greenhouse gas (GHG) emissions and air pollution. The growth of the India bioethanol market is further fueled by the nation's commitment to environmental sustainability and the need to diversify its energy sources. Moreover, government initiatives and policies promoting the use of biofuels have stimulated investments and research in the bioethanol sector. Apart from this, with a focus on reducing dependency on fossil fuels and curbing environmental degradation, bioethanol presents a promising avenue for India's energy landscape. As the demand for cleaner and more sustainable energy solutions continues to rise, the India bioethanol market is poised for substantial expansion. The integration of bioethanol into the country's energy matrix aligns with the increasing efforts to transition towards greener and more environmentally responsible fuel alternatives, which is expected to boost the India bioethanol market size in the coming years.

India Bioethanol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, fuel blend, generation, and end use industry.

Type Insights:

- Sugarcane-based Ethanol

- Cellulosic Ethanol

- Starch-based Ethanol

- Others

The report has provided a detailed breakup and analysis of the market based on the type This Includes sugarcane-based ethanol, cellulosic ethanol, starch-based ethanol, and others.

Fuel Blend Insights:

- E10

- E20 and E25

- E70 and E75

- E85

- Others

A detailed breakup and analysis of the market based on the fuel blend have also been provided in the report. This includes E10, E20 and E25, E70 and E75, E85, and others.

Generation Insights:

- First Generation

- Second Generation

- Third Generation

The report has provided a detailed breakup and analysis of the market based on the generation. This includes first generation, second generation, and third generation.

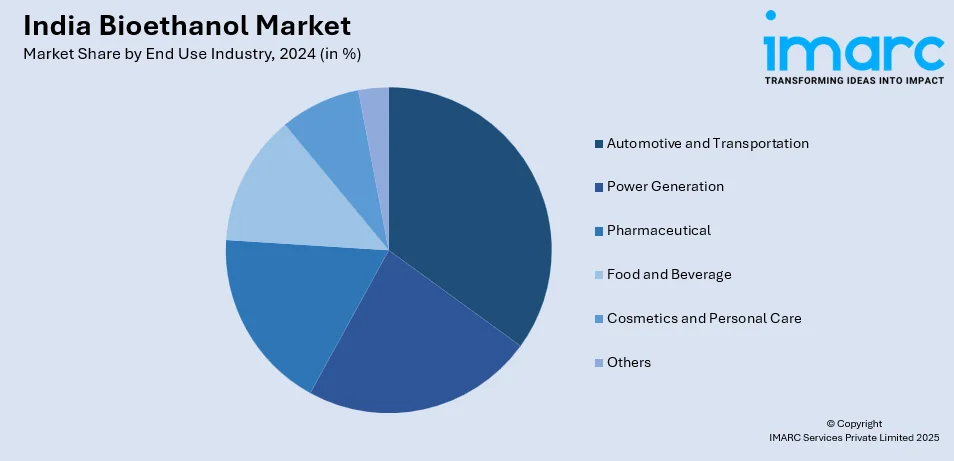

End Use Industry Insights:

- Automotive and Transportation

- Power Generation

- Pharmaceutical

- Food and Beverage

- Cosmetics and Personal Care

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive and transportation, power generation, pharmaceutical, food and beverage, cosmetics and personal care, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India bioethanol market share.

India Bioethanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Litres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sugarcane-based Ethanol, Cellulosic Ethanol, Starch-based Ethanol, Others |

| Fuel Blends Covered | E10, E20 and E25, E70 and E75, E85, Others |

| Generations Covered | First Generation, Second Generation, Third Generation |

| End Use Industries Covered | Automotive and Transportation, Power Generation, Pharmaceutical, Food and Beverage, Cosmetics and Personal Care, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bioethanol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bioethanol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bioethanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioethanol market in India reached 5.9 Billion Litres in 2024.

The bioethanol market in India is projected to exhibit a CAGR of 8.74% during 2025-2033, reaching 14.5 Billion Litres by 2033.

The bioethanol market in India is driven by government policies promoting ethanol blending in fuel, rising crude oil prices, and efforts to reduce carbon emissions. Access to abundant agricultural feedstocks like sugarcane and spoiled food grains aids production. Energy security objectives, rural economic growth, and biofuel infrastructure incentives also drive growth. Finally, private sector investment and second-generation ethanol technology improvements are spurring market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)