India Biogas Upgradation Market Size, Share, Trends, and Forecast by Technology, and Region, 2025-2033

India Biogas Upgradation Market Overview:

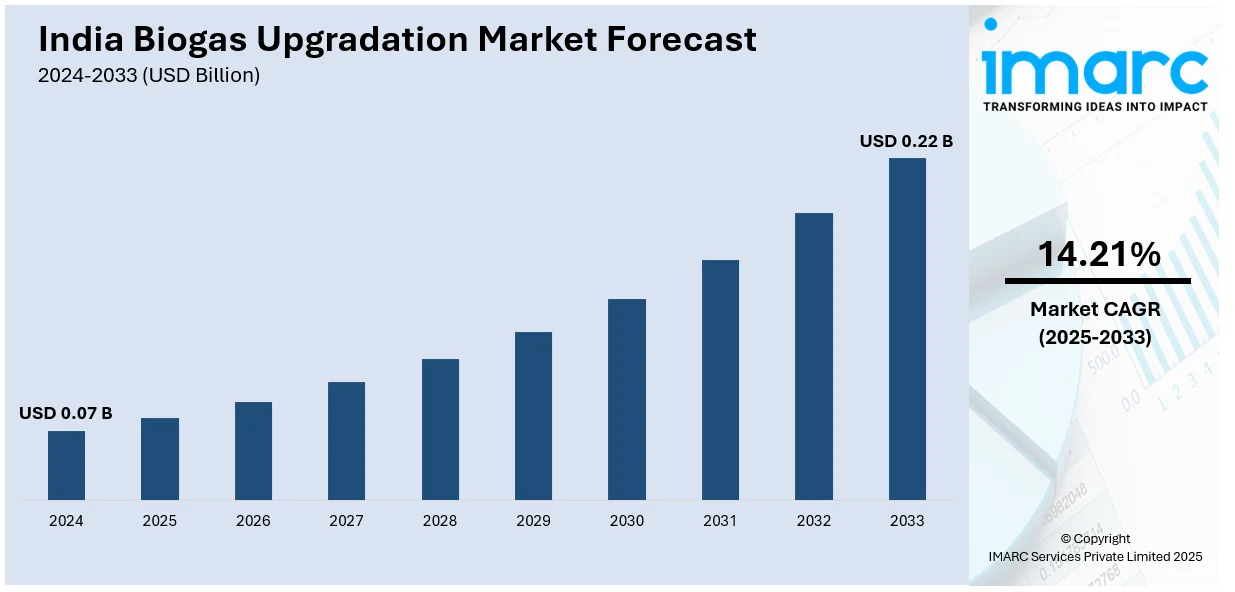

The India biogas upgradation market size reached USD 0.07 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.22 Billion by 2033, exhibiting a growth rate (CAGR) of 14.21% during 2025-2033. The market is growing rapidly due to magnifying waste-to-energy projects, technology developments, and policies supporting clean energy. Renewable natural gas (RNG) demand is also increasing with the help of improvements in upgradation technologies and monetary incentives, ensuring long-term market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.07 Billion |

| Market Forecast in 2033 | USD 0.22 Billion |

| Market Growth Rate 2025-2033 | 14.21% |

India Biogas Upgradation Market Trends:

Growth in Waste-to-Energy Projects and Urban Biogas Initiatives

The spurt in the development of waste-to-energy (WTE) plants in India is a key growth driver of the biogas upgradation industry. India's growing population and urbanization have made managing waste a mounting problem, especially in urban regions. In order to combat this, the government and private companies have stepped up initiatives to develop biogas plants to process organic waste into quality biogas. For instance, as per industry reports, the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme launched by Indian government aims to establish 5,000 compressed biogas (CBG) plants by 2030, representing the government's growing emphasis on biogas upgradation initiatives. Additionally, these plants not only help in waste management but also contribute to the production of renewable natural gas (RNG), addressing energy shortages. Upgrading biogas to RNG is an essential step in enhancing its value and making it suitable for various applications, including industrial energy consumption and transportation fuel. Moreover, as cities push for sustainable solutions, biogas upgradation technologies are becoming integral to the success of WTE projects.

To get more information on this market, Request Sample

Technological Advancements and Efficiency Improvements

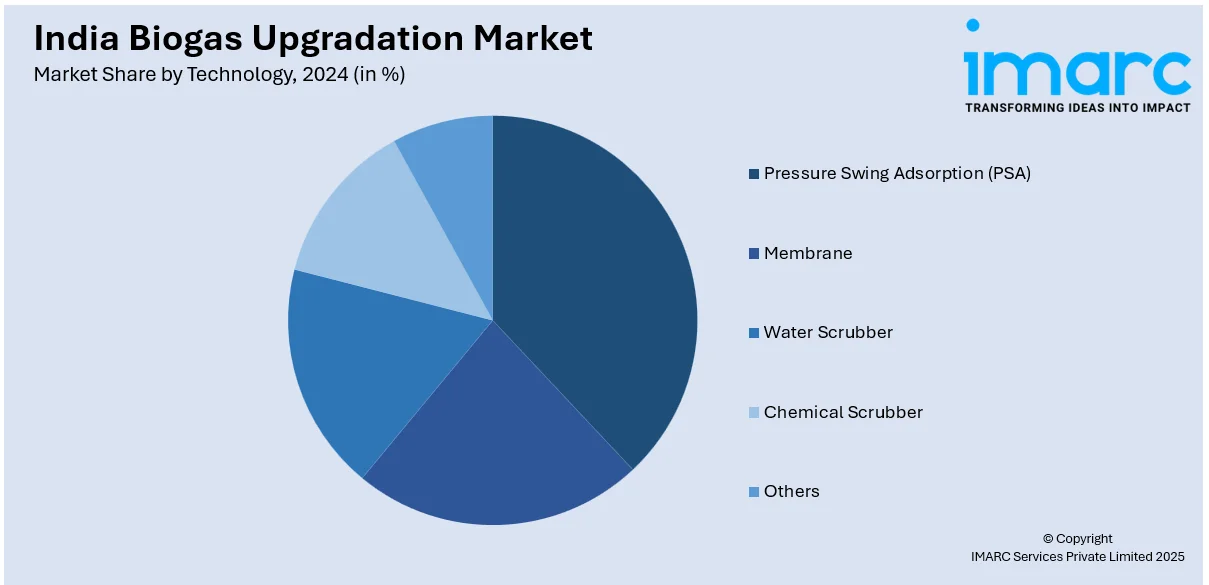

Advancements in biogas upgradation technologies are transforming India’s renewable energy landscape. Traditionally, biogas upgradation was limited to simple methods, but newer, more efficient technologies, such as water scrubbing, pressure swing adsorption (PSA), and membrane separation are now gaining traction. These technologies offer higher biogas purity levels and increased methane recovery, making the upgraded biogas more viable as a renewable energy source. In line with this, water scrubbing and PSA are particularly popular in India, as they are energy-efficient, cost-effective, and adaptable to the country’s diverse biogas sources. As the government and private players focus on improving the efficiency and cost-effectiveness of biogas upgradation, these innovations are expected to reduce operational costs and increase the adoption of biogas as a clean energy alternative. For instance, in June 2024, CSIR-IIP announced collaboration with ORSL, to implement Vacuum Swing Adsorption (VSA) technology for compressed biogas (CBG) production. This technology upgrades 350 m³/h of raw biogas into high-quality biomethane for industrial and transport applications. Moreover, the integration of automation and digital monitoring systems is enhancing the scalability and reliability of biogas upgradation plants, making them more accessible to a wider range of applications. This trend is essential as India moves towards more sustainable energy systems.

India Biogas Upgradation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology.

Technology Insights:

- Pressure Swing Adsorption (PSA)

- Membrane

- Water Scrubber

- Chemical Scrubber

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure swing adsorption (PSA), membrane, water scrubber, chemical scrubber, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biogas Upgradation Market News:

- In December 2024, Oil India announced signing of an MoU with Bhubaneswar Municipal Corporation to establish a compressed biogas plant in Bhubaneswar, processing 200 tpd of municipal waste. The project, with a Rs 150 crore investment, will initially produce 10-15 tpd biomethane gas.

- In October 2024, GAIL (India) Limited and VERBIO India Private Limited announced signing of an MoU to explore setting up Agricultural Residue-based Compressed Biogas (CBG) plants in India. This collaboration aims to promote sustainable energy solutions, utilize agricultural waste, and support farmers while reducing GHG emissions and enhancing energy security.

India Biogas Upgradation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure Swing Adsorption (PSA), Membrane, Water Scrubber, Chemical Scrubber, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India biogas upgradation market performed so far and how will it perform in the coming years?

- What is the breakup of the India biogas upgradation market on the basis of technology?

- What is the breakup of the India biogas upgradation market on the basis of region?

- What are the various stages in the value chain of the India biogas upgradation market?

- What are the key driving factors and challenges in the India biogas upgradation market?

- What is the structure of the India biogas upgradation market and who are the key players?

- What is the degree of competition in the India biogas upgradation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biogas upgradation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biogas upgradation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biogas upgradation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)