India Bioherbicides Market Size, Share, Trends and Forecast by Crop Type, Source, Mode of Application, Mode of Action, Formulation, and Region, 2025-2033

India Bioherbicides Market Overview:

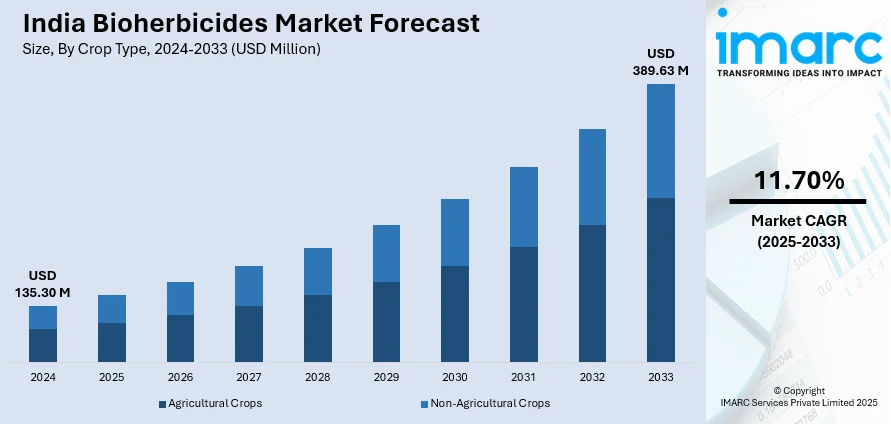

The India bioherbicides market size reached USD 135.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 389.63 Million by 2033, exhibiting a growth rate (CAGR) of 11.70% during 2025-2033. The growth of India's bioherbicides market is driven by increasing environmental awareness among farmers, government initiatives promoting organic farming, and the rising demand for eco-friendly alternatives to chemical pesticides. Additionally, expanding organic farming practices and the escalating need for sustainable agriculture are also bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 135.30 Million |

| Market Forecast in 2033 | USD 389.63 Million |

| Market Growth Rate 2025-2033 | 11.70% |

India Bioherbicides Market Trends:

Expansion of Organic Farming Practices

The increasing shift towards organic farming is significantly propelling the demand for bioherbicides in India. Farmers are increasingly embracing organic practices to cater to the surging consumer preference for chemical-free produce and to leverage various government incentives. The Indian government has been actively promoting organic agriculture through initiatives, such as the Paramparagat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development for the North Eastern Region (MOVCDNER), with a cumulative allocation to support chemical-free farming practices. This strong policy support has led to a notable expansion in organic farming, with India now accounting for around 4.7 million hectares of organic farmland, positioning it among the global leaders in organic agriculture. Consequently, the elevating need for effective and environmentally friendly weed management solutions, such as bioherbicides, has intensified. Additionally, India is home to the highest number of organic producers in the world, with approximately 2.4 million individuals engaged in organic farming, further underscoring the critical role of bioherbicides in sustainable agriculture.

To get more information on this market, Request Sample

Technological Advancements and Investments in Bioherbicide Development

Technological advancements are playing a crucial role in accelerating the adoption of bioherbicides in India by enhancing their efficacy, formulation, and application methods. Breakthroughs in genetic engineering and biotechnology have led to the development of next-generation bioherbicides capable of effectively targeting a broader spectrum of weed species. Notably, fungi such as Fusarium oxysporum and Alternaria cuscutacidae have shown promising results against challenging weeds like Opuntia and Cuscuta. Innovations have also improved bioherbicide formulations and delivery systems, making them more user-friendly and efficient for farmers. The rise of microbial bioherbicides, formulated with live microorganisms such as bacteria and fungi, offering broader weed control, which is especially valuable in India’s varied agro-climatic zones. The integration of these advanced bioherbicides into holistic weed management systems has further fueled their uptake, as farmers seek sustainable and eco-friendly solutions. Additionally, industry investments are bolstering market growth.

India Bioherbicides Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on crop type, source, mode of application, mode of action, and formulation.

Crop Type Insights:

- Agricultural Crops

- Non-Agricultural Crops

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes agricultural crops and non-agricultural crops.

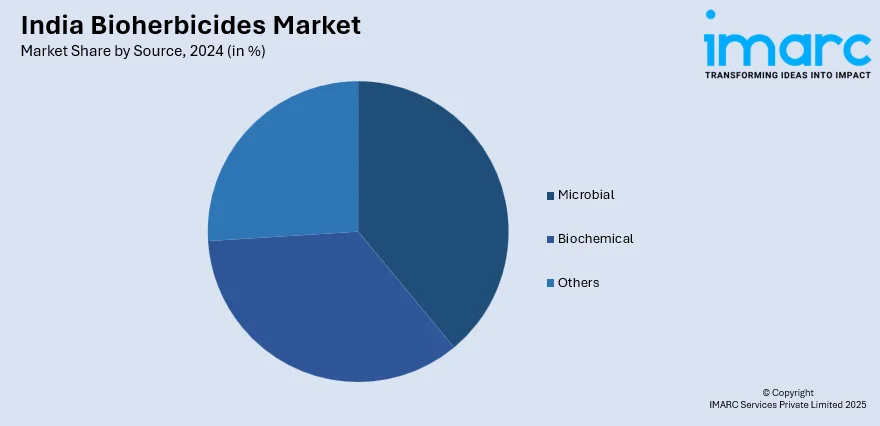

Source Insights:

- Microbial

- Biochemical

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes microbial, biochemical, and others.

Mode of Application Insights:

- Seed Treatment

- Soil Application

- Foliar

- Post-Harvest

The report has provided a detailed breakup and analysis of the market based on the mode of application. This includes seed treatment, soil application, foliar, and post-harvest.

Mode of Action Insights:

- MOA Involving Photosynthesis

- MOA Targeting Enzymes

- Others

A detailed breakup and analysis of the market based on the mode of action have also been provided in the report. This includes MOA involving photosynthesis, MOA targeting enzymes, and others.

Formulation Insights:

- Granular

- Liquid

- Others

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes granular, liquid, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bioherbicides Market News:

- October 2024: FMC introduced Ambriva herbicide for wheat-growers. The herbicide contains Isoflex Active, a group 13 herbicide that gives Indian farmers a new tool for resistance control. Studies have shown that Ambriva herbicide, which contains both Isoflex active and Metribuzin, has early post-emergence knock-down activity and residual control against Phalaris minor, protecting wheat during the critical crop-weed competition period.

- September 2024: Krishak Bharati Cooperative Limited (KRIBHCO) launched 'KRIBHCO Rhizosuper,' a bio-stimulant developed in partnership with Novonesis. This product enhances microbial activity in the soil, promoting robust plant growth and improving soil quality, thereby addressing challenges like reduced soil fertility faced by Indian farmers.

- July 2023: Harpe Bioherbicide Solutions received a USD 275,000 NSF grant to explore weed resistance. The award, which is part of the Small Business Innovation Research (SBIR) Phase I initiative, aims to create a natural bioherbicide platform for controlling weeds that are resistant to synthetic herbicides.

India Bioherbicides Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Agricultural Crops, Non-Agricultural Crops |

| Sources Covered | Microbial, Biochemical, Others |

| Mode of Applications Covered | Seed Treatment, Soil Application, Foliar, Post-Harvest |

| Mode of Actions Covered | MOA Involving Photosynthesis, MOA Targeting Enzymes, Others |

| Formulations Covered | Granular, Liquid, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bioherbicides market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bioherbicides market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bioherbicides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioherbicides market in India was valued at USD 135.30 Million in 2024.

The India bioherbicides market is projected to exhibit a CAGR of 11.70% during 2025-2033, reaching a value of USD 389.63 Million by 2033.

The India bioherbicides market is driven by growing environmental awareness, increasing adoption of sustainable and organic farming practices, and government support for eco-friendly agriculture. Rising demand for alternatives to chemical herbicides and a focus on soil health and crop safety are further encouraging the adoption of bioherbicide solutions across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)