India Biopolymers Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

India Biopolymers Market Overview:

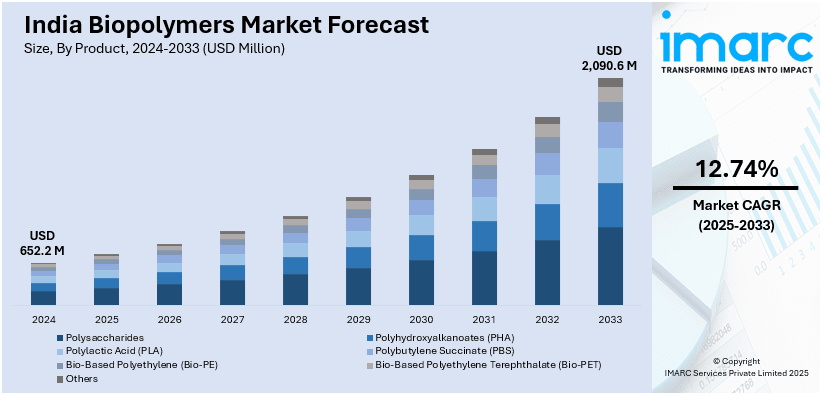

The India biopolymers market size reached USD 652.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,090.6 Million by 2033, exhibiting a growth rate (CAGR) of 12.74% during 2025-2033. The rising demand for sustainable packaging, supportive government initiatives promoting biodegradable materials, increasing consumer awareness of eco-friendly products, advancements in biopolymer production technologies, and growing applications in industries such as food packaging, agriculture, and healthcare, are some of the major factors expanding the India biopolymers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 652.2 Million |

| Market Forecast in 2033 | USD 2,090.6 Million |

| Market Growth Rate 2025-2033 | 12.74% |

India Biopolymers Market Trends:

Increasing Demand for Biodegradable and Compostable Packaging

The strict restrictions on single-use plastics in India are driving a shift toward biodegradable and compostable packaging materials, which is positively impacting the India biopolymer market outlook. According to an industry report, in India, almost 9.46 Million Tons of plastic trash were produced nationwide in 2023, with single-use plastics making up over 43% of the total. The growing environmental concerns over this rising plastic waste are accelerating the adoption of biopolymer-based alternatives across various industries. Additionally, government regulations, such as the Plastic Waste Management Rules, impose stringent controls on plastic usage, compelling businesses to adopt sustainable alternatives. Large consumer goods companies, food service chains, and e-commerce platforms are incorporating biopolymer-based packaging to meet regulatory compliance and sustainability goals. Biopolymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics are gaining traction due to their ability to break down under natural conditions without leaving microplastic residues. The food packaging industry, in particular, is witnessing an increase in demand for biopolymer-based films, trays, and pouches that provide similar functional properties to conventional plastic while ensuring environmental safety. Moreover, the increasing consumer preference for sustainable packaging solutions further reinforces the adoption of biopolymers, influencing product innovations and the expansion of domestic manufacturing capabilities.

To get more information on this market, Request Sample

Growing Investment in Bio-Based Raw Material Sourcing and Production

The increased investments in the development of bio-based raw materials derived from renewable sources such as corn starch, sugarcane, and agricultural residues is fueling the India biopolymer market growth. In line with this, domestic production is expanding as companies seek to reduce dependency on costly imports of biopolymers like PLA and PHA. Also, government-backed initiatives supporting bioeconomy development, coupled with subsidies for bio-refineries, are encouraging the establishment of local production facilities. Moreover, sugarcane-based bioplastics, in particular, are gaining importance due to India’s strong sugar industry. According to industry reports, about 4399.30 Lakh Tonnes (approximately 5.33 Million Tonnes) of sugarcane is expected to be produced in India in 2024–2025. This results in an abundant supply of feedstock for bio-based polymer synthesis. Companies are exploring innovative feedstock sources such as cellulose from crop residues and seaweed-based biopolymers to enhance cost efficiency and sustainability. The integration of biopolymer production with existing agro-industrial supply chains is helping streamline raw material availability while reducing overall carbon emissions. This shift is expected to create a competitive domestic market, allowing Indian manufacturers to meet the rising demand for bio-based materials in various sectors, including textiles, automotive, and consumer goods.

India Biopolymers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, application, and end use.

Product Insights:

- Polysaccharides

- Cellulose Acetate

- Others

- Polyhydroxyalkanoates (PHA)

- Polylactic Acid (PLA)

- Polybutylene Succinate (PBS)

- Bio-Based Polyethylene (Bio-PE)

- Bio-Based Polyethylene Terephthalate (Bio-PET)

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes polysaccharides (cellulose and others), polyhydroxyalkanoates (PHA), polylactic acid (PLA), polybutylene succinate (PBS), bio-based polyethylene (bio-PE), bio-based polyethylene terephthalate (bio-PET), and others.

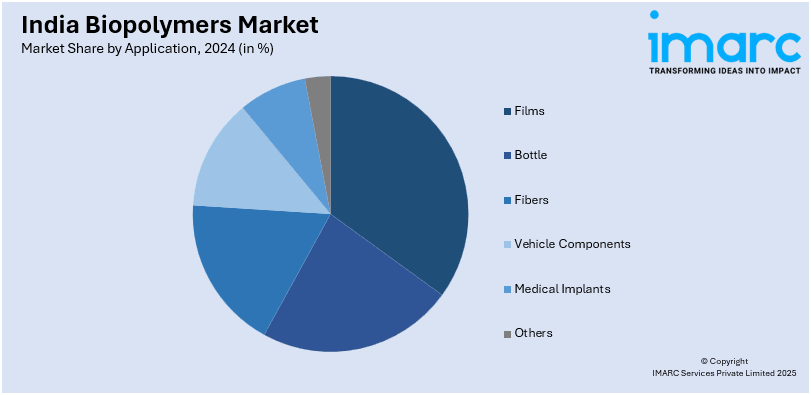

Application Insights:

- Films

- Bottle

- Fibers

- Vehicle Components

- Medical Implants

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes films, bottle, fibers, vehicle components, medical implants, and others.

End Use Insights:

- Packaging

- Consumer Goods

- Automotive

- Textiles

- Agriculture

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes packaging, consumer goods, automotive, textiles, agriculture, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biopolymers Market News:

- On October 13, 2024, Union Minister Dr. Jitendra Singh inaugurated India's first Demonstration Facility for Biopolymers at Jejuri, Pune, via virtual link from New Delhi. This pioneering facility, developed by Praj Industries, focuses on producing Polylactic Acid (PLA) bioplastic, underscoring India's commitment to sustainable solutions and addressing global plastic pollution. Dr. Singh highlighted that India's bioeconomy surpassed USD 150 Billion in 2023, with projections to reach USD 300 Billion by 2030.

- On February 24, 2025, Chief Minister Yogi Adityanath inaugurated India's first biopolymer manufacturing unit in Kumbhi, Lakhimpur district, Uttar Pradesh. This facility will produce polylactic acid (PLA), which is a biodegradable polymer made from tapioca, corn, and sugar, among other renewable resources. The project, valued at INR 2,880 Crore (about USD 329.76 Million), is expected to commence operations in December 2026 and will utilize renewable energy sources to ensure sustainable production practices.

India Biopolymers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Films, Bottle, Fibers, Vehicle Components, Medical Implants, Others |

| End Uses Covered | Packaging, Consumer Goods, Automotive, Textiles, Agriculture, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biopolymers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biopolymers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biopolymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopolymers market in India was valued at USD 652.2 Million in 2024.

The India biopolymers market is projected to exhibit a CAGR of 12.74% during 2025-2033, reaching a value of USD 2,090.6 Million by 2033.

The India biopolymers market is primarily driven by growing environmental concerns, demand for sustainable alternatives, and increasing government support for green technologies. Advancements in biopolymer production and a rising preference for eco-friendly packaging further supporting the market growth. Additionally, user awareness about the harmful effects of traditional plastics contributes to the shift towards biopolymers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)