India Bituminous Roofing Sheet Market Size, Share, Trends and Forecast by Type, Sales Channel, and Region, 2025-2033

India Bituminous Roofing Sheet Market Overview:

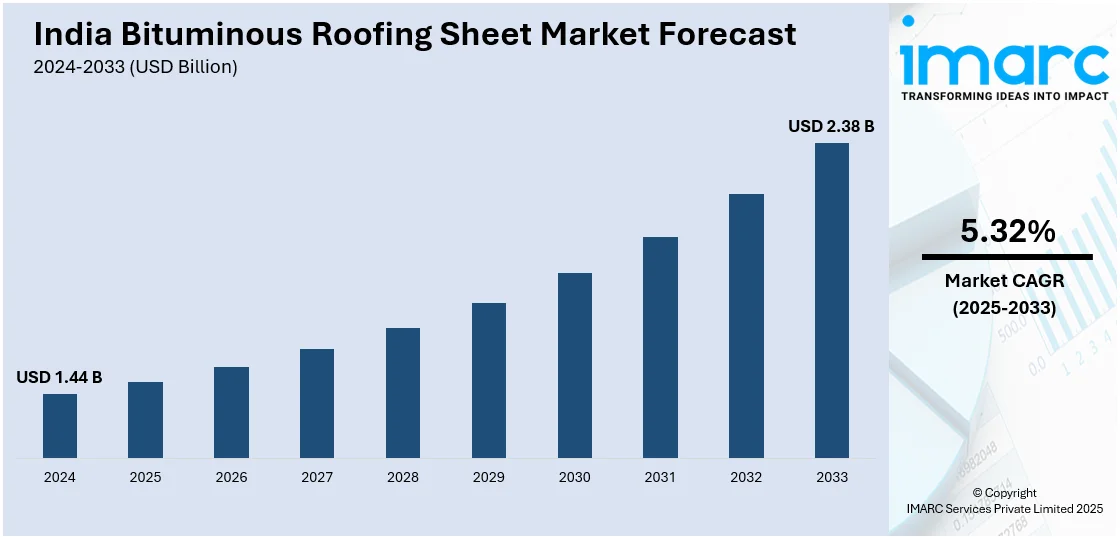

The India bituminous roofing sheet market size reached USD 1.44 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.38 Billion by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is experiencing significant growth, driven by infrastructure development, rural housing schemes, industrial growth, cost-effective and weather-resistant materials, and increasing product adoption in both residential and commercial construction sectors nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.44 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Market Growth Rate 2025-2033 | 5.32% |

India Bituminous Roofing Sheet Market Trends:

Growing Infrastructure Development

Growing infrastructure development is a major driver of the India bituminous roofing sheet market. With continued investment in housing, transportation, and industrial construction across both urban and rural regions, the demand for durable, weather-resistant, and cost-effective roofing solutions is on the rise. The India bituminous roofing sheet market growth is particularly supported by government-backed projects such as smart cities, metro rail systems, and industrial corridors, which require robust roofing for stations, sheds, and auxiliary structures. According to the report published by the Press Information Bureasu, the Government of India approved 12 industrial smart city projects, with a total cost of INR 28,602 crore for trunk infrastructure development. Key projects span various corridors, including DMIC, CBIC, and AKIC, with construction timelines of 36-48 months following the appointment of EPC contractors. Bituminous sheets are favored for their thermal insulation, resistance to harsh climatic conditions, and easy installation—making them suitable for large-scale, time-sensitive projects. Their use in warehouses, cold storage units, and prefabricated structures further expands their footprint in the construction ecosystem. As infrastructure initiatives continue to ramp up, the India bituminous roofing sheet market outlook remains positive, with consistent demand expected across sectors over the coming years.

To get more information on this market, Request Sample

Rural Housing Push

The rural housing push, led by large-scale government initiatives like Pradhan Mantri Awas Yojana (PMAY), is playing a crucial role in expanding the use of bituminous roofing sheets across India. For instance, in the 2024-25 budget, the Government of India allocated ₹3,06,137 crore for constructing over 2 crore rural houses under the Pradhan Mantri Awaas Yojana-Gramin (PMAY-G) from FY 2024-25 to FY 2028-29. Since 2016, 2.69 crore houses have been built, benefiting nearly 10 crore individuals. These programs aim to provide affordable and durable housing to economically weaker sections, especially in rural and semi-urban regions. Bituminous sheets, being lightweight, low-cost, and quick to install, are well-suited for such projects. Their resistance to heat and rain makes them ideal for rural climates, where exposure to harsh weather is common and infrastructure support is limited. The ease of transportation and minimal requirement for skilled labor further add to their appeal in remote areas. As PMAY and similar schemes continue to gain momentum, the demand for bituminous roofing sheets is expected to grow steadily. This rising demand is contributing significantly to the India bituminous roofing sheet market share, particularly in the rural segment.

India Bituminous Roofing Sheet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and sales channel.

Type Insights:

- Styrene-Butadiene-Styrene (SBS) Modified Bituminous Roofing

- Atactic Polypropylene (APP) Modified Bituminous Roofing

The report has provided a detailed breakup and analysis of the market based on the type. This includes styrene-butadiene-styrene (SBS) modified bituminous roofing and atactic polypropylene (APP) modified bituminous roofing.

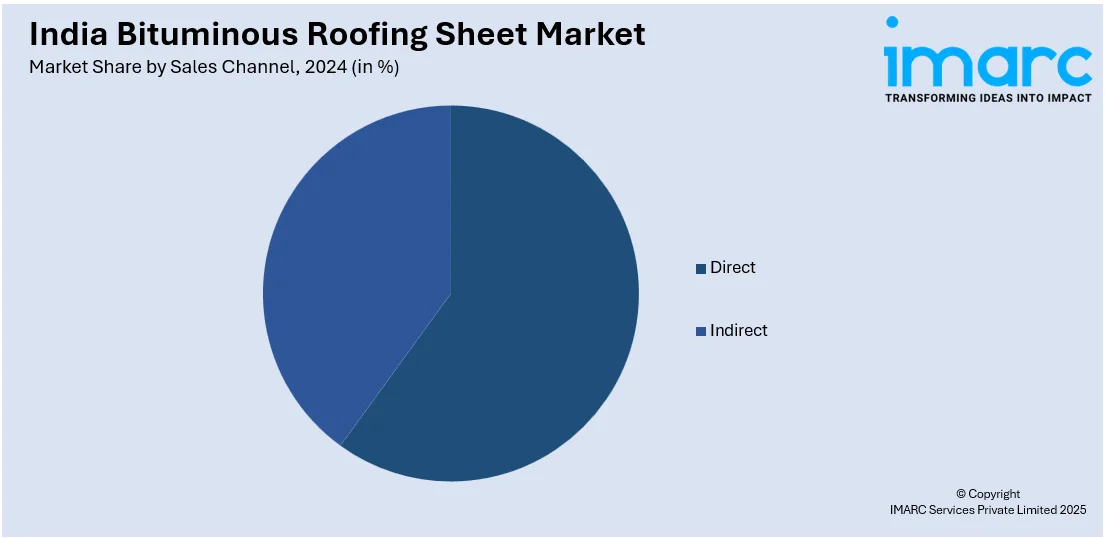

Sales Channel Insights:

- Direct

- Indirect

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct and indirect.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bituminous Roofing Sheet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Styrene-Butadiene-Styrene (SBS) Modified Bituminous Roofing, Atactic Polypropylene (APP) Modified Bituminous Roofing |

| Sales Channels Covered | Direct, Indirect |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India bituminous roofing sheet market performed so far and how will it perform in the coming years?

- What is the breakup of the India bituminous roofing sheet market on the basis of type?

- What is the breakup of the India bituminous roofing sheet market on the basis of sales channel?

- What is the breakup of the India bituminous roofing sheet market on the basis of region?

- What are the various stages in the value chain of the India bituminous roofing sheet market?

- What are the key driving factors and challenges in the India bituminous roofing sheet?

- What is the structure of the India bituminous roofing sheet market and who are the key players?

- What is the degree of competition in the India bituminous roofing sheet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bituminous roofing sheet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bituminous roofing sheet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bituminous roofing sheet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)