India Blockchain in Healthcare Market Size, Share, Trends and Forecast by Network Type, Application, End Use, and Region, 2025-2033

India Blockchain in Healthcare Market Overview:

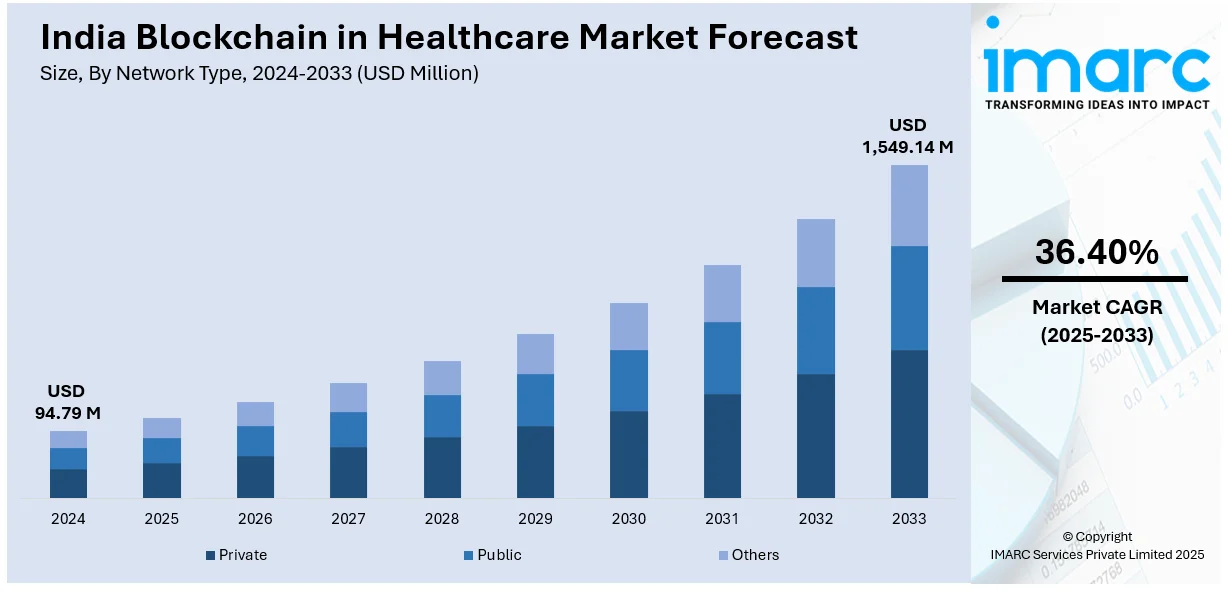

The India blockchain in healthcare market size reached USD 94.79 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,549.14 Million by 2033, exhibiting a growth rate (CAGR) of 36.40% during 2025-2033. The market is driven by the augmenting need for enhanced data security, interoperability, and efficient patient record management. Rising concerns over counterfeit drugs, regulatory push for transparency, and the growing adoption of digital health solutions further propel India blockchain in healthcare market share. Blockchain's ability to ensure tamper-proof data and streamline operations accelerates its adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 94.79 Million |

| Market Forecast in 2033 | USD 1,549.14 Million |

| Market Growth Rate (2025-2033) | 36.40% |

India Blockchain in Healthcare Market Trends:

Increasing Adoption of Blockchain for Data Security and Interoperability

The increasing adoption of blockchain technology to enhance data security and interoperability is significantly supporting the India blockchain in healthcare market growth. With the growing digitization of healthcare records, there is an increasing need to protect sensitive patient data from cyber threats and breaches. By 2033, cyberattack targeting India is expected to jump to 1 trillion per year and further to 17 trillion per year by 2047. In 2023 alone, over 79 million occurrences were noted, whereas 500 million attempted assaults had been blocked in the first quarter of 2024. These trends show that the country is facing increasing cyber threats and data breaches. Moreover, in early 2024, Indians incurred losses of more than ₹1,750 Crore (approximately USD 213.41 Million) due to cybercriminals, highlighting the urgent need for robust security measures to ensure the use case of the country’s digital ecosystem. Blockchain’s decentralized and immutable nature ensures that data remains secure, transparent, and tamper-proof. Additionally, the technology facilitates seamless data sharing across healthcare providers, labs, and pharmacies, improving interoperability in a fragmented healthcare ecosystem. This is particularly crucial in India, where the healthcare system often struggles with inefficiencies due to disparate systems. As a result, hospitals, telemedicine platforms, and healthtech startups are increasingly integrating blockchain to streamline operations, reduce fraud, and build trust among patients and stakeholders.

To get more information on this market, Request Sample

Rising Demand for Blockchain in Drug Traceability and Supply Chain Management

Another key trend creating a positive India blockchain in healthcare market outlook is the rising demand for blockchain solutions in drug traceability and supply chain management. Counterfeit drugs are a major concern in India, posing significant risks to patient safety and public health. Blockchain technology enables end-to-end traceability of pharmaceutical products, ensuring authenticity and transparency throughout the supply chain. On 20th April 2024, IIT Bombay partnered with Blockchain for Impact (BFI) with the objective of leveraging blockchain technology to make the healthcare sector in India more accessible and affordable for citizens by improving the availability of medical services and the affordability of pharmaceutical products. With these 900,000 investments over three years, this partnership aims to address critical health issues, including improving supply chain transparency and the timely delivery of medicines. This move aligns with the growing adoption of blockchain applications in India's healthcare, addressing the need for innovative public health solutions and strengthening the pharmaceutical supply chain. By recording every transaction on an immutable ledger, stakeholders can verify the origin, quality, and movement of drugs, reducing the prevalence of counterfeit medicines. This trend is further fueled by government initiatives and regulatory push for stricter compliance in the pharmaceutical industry. As a result, pharmaceutical companies, distributors, and healthcare providers are increasingly adopting blockchain to enhance supply chain efficiency, ensure regulatory compliance, and safeguard patient health.

India Blockchain in Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on network type, application, and end use.

Network Type Insights:

- Private

- Public

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes private, public, and others.

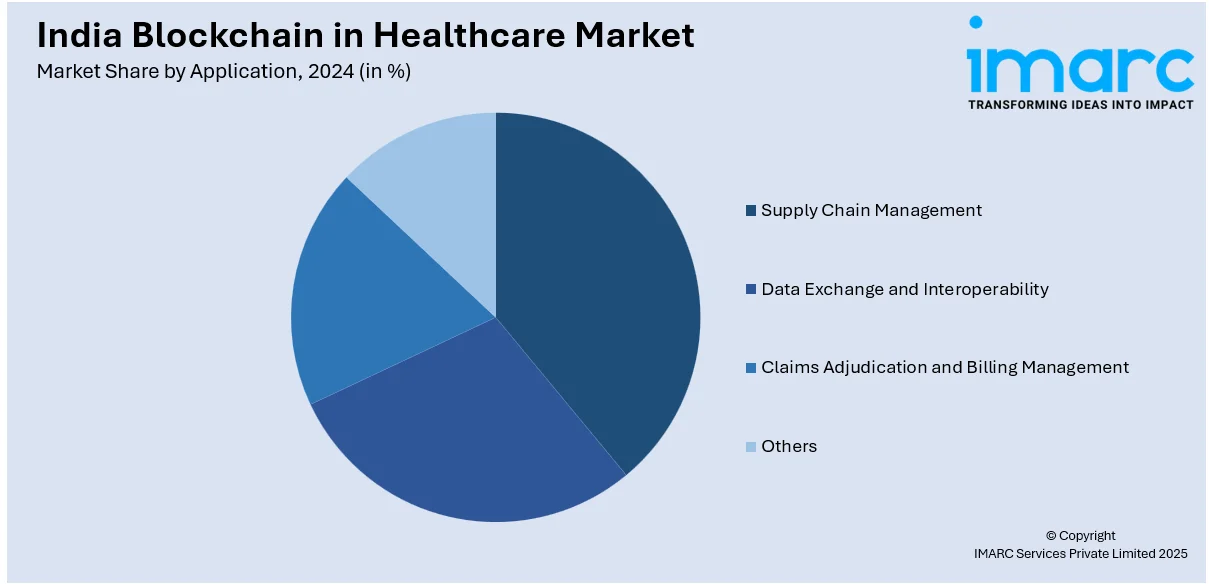

Application Insights:

- Supply Chain Management

- Data Exchange and Interoperability

- Claims Adjudication and Billing Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes supply chain management, data exchange and interoperability, claims adjudication and billing management, and others.

End Use Insights:

- Healthcare Providers

- Healthcare Payers

- Biopharmaceutical and Medical Device Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes healthcare providers, healthcare payers, biopharmaceutical and medical device companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blockchain in Healthcare Market News:

- March 03, 2025: PwC India launched the ‘Emerging Tech Startup Challenge’ to offer mentorship to 15 startups focused on blockchain, AI, and other emerging technologies, with a focus on sectors such as healthcare, retail, and financial services. The three-month program will provide pro-bono consulting and mentorship that can refine solutions and accelerate market entry in the face of growing blockchain implementations in Indian health systems. This initiative plans to tap sectors that involve healthcare supply chains, management of patient data, and pharmaceutical traceability, all reinforcing India's leadership in blockchain-based healthcare solutions.

- September 25, 2024: BRIC-THSTI, a research organization under the Biotechnology Research and Innovation Council, Department of Biotechnology, Ministry of Science and Technology, Government of India, partnered with Blockchain For Impact (BFI) as part of the BFI-BIOME Virtual Network Programme to fast-track biomedical research and innovation in India, with a specific focus on local healthcare solutions. Propelling the razor target is the fact that this joint effort consorts with India's goal of being self-reliant in the area of healthcare by leveraging blockchain technology for more straightforwardness in research and causing it to be secure in terms of data. India's healthcare and allied industries can benefit from such a project as it strengthens India's position as a blockchain hub, facilitating development in patient data management and translational biomedical research.

- July 15, 2024: Algorand Foundation has partnered with Lok Swasthya SEWA to launch a blockchain based Digital Health Passport, which will cater to 34,000 households and 200,000 individuals in the country. This initiative, a secure and tamper-proof solution for storing health information, will help informal women workers gain access to healthcare facilities and social safety nets. This initiative aligns with the growing adoption of blockchain in India's healthcare sector to enhance transparency and efficiency in patient data and healthcare services management.

India Blockchain in Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Network Types Covered | Private, Public, Others |

| Applications Covered | Supply Chain Management, Data Exchange and Interoperability, Claims Adjudication and Billing Management, Others |

| End Uses Covered | Healthcare Providers, Healthcare Payers, Biopharmaceutical and Medical Device Companies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blockchain in healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blockchain in healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blockchain in healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in India was valued at USD 94.79 Million in 2024.

The blockchain in healthcare market in India is projected to exhibit a CAGR of 36.40% during 2025-2033, reaching a value of USD 1,549.14 Million by 2033.

The augmenting need for enhanced data security, interoperability, and efficient patient record management, rising concerns over counterfeit drugs, regulatory push for transparency, and the growing adoption of digital health solutions are driving the India blockchain in healthcare market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)