India Blockchain in Supply Chain Market Size, Share, Trends and Forecast by Application, Provider, Vertical, and Region, 2025-2033

India Blockchain in Supply Chain Market Overview:

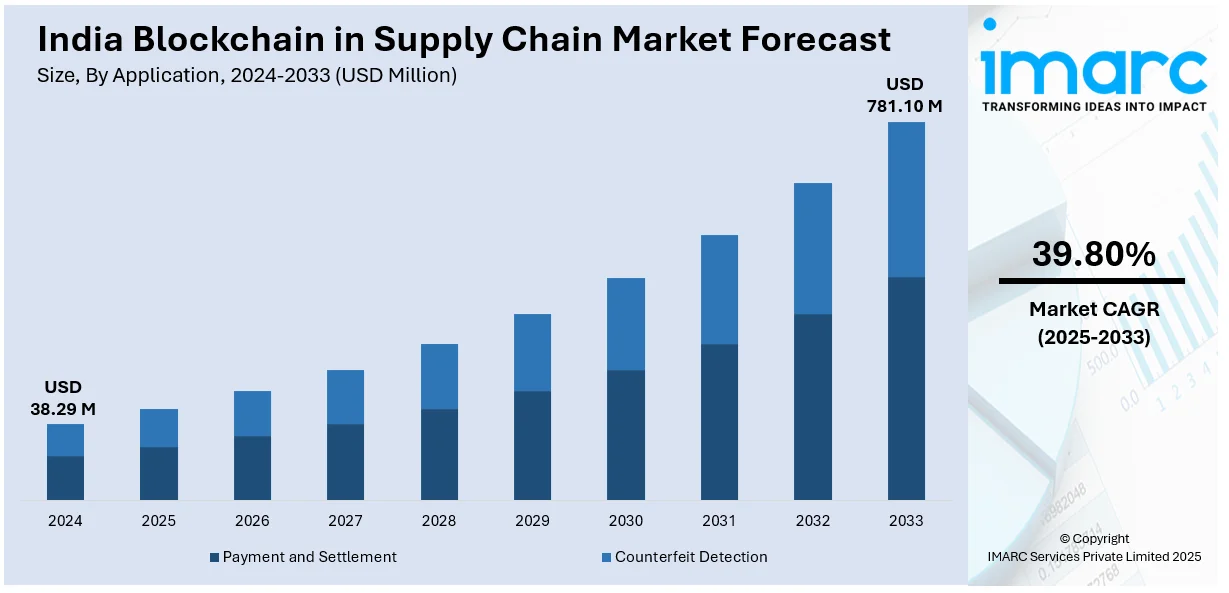

The India blockchain in supply chain market size reached USD 38.29 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 781.10 Million by 2033, exhibiting a growth rate (CAGR) of 39.80% during 2025-2033. Increasing demand for supply chain transparency, rising adoption in logistics and procurement, government initiatives promoting blockchain integration, enhanced security and traceability, growing use in pharmaceuticals and agriculture, and corporate collaborations are expanding the India blockchain in supply chain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.29 Million |

| Market Forecast in 2033 | USD 781.10 Million |

| Market Growth Rate 2025-2033 | 39.80% |

India Blockchain in Supply Chain Market Trends:

Increasing Adoption of Blockchain for Supply Chain Transparency

The India blockchain in supply chain market growth is driven by the rising demand for transparency and traceability across industries. For instance, an article published on January 31, 2025, emphasized blockchain technology's revolutionary potential in the engineering field outside of its connection to cryptocurrency. By guaranteeing real-time access to unmodified data for all stakeholders, the decentralized ledger system improves collaboration and helps to avoid disputes over design changes and intellectual property. Additionally, by lowering fraud, guaranteeing adherence to industry standards, and offering transparent tracking of goods and components, blockchain simplifies supply chains. Businesses are integrating blockchain to ensure real-time tracking of goods, reduce fraud, and improve security in logistics and procurement processes. The technology enables immutable record-keeping, ensuring data integrity and reducing disputes between suppliers and buyers. Sectors such as pharmaceuticals, agriculture, and retail are leading this adoption, driven by regulatory compliance and consumer demand for ethical sourcing. As blockchain adoption expands, Indian enterprises are leveraging smart contracts to automate transactions, improve efficiency, and enhance overall supply chain visibility.

To get more information on this market, Request Sample

Government and Corporate Initiatives Driving Blockchain Integration

Government initiatives and corporate collaborations are fueling the growth of blockchain in India’s supply chain sector. For instance, the Ministry of Electronics and Information Technology (MeitY) unveiled the Vishvasya-Blockchain Technology Stack on September 4, 2024. This Blockchain-as-a-Service (BaaS) platform aims to improve the efficiency, security, and transparency of digital service delivery. The National Informatics Centre (NIC) Data Centers in Hyderabad, Pune, and Bhubaneswar host this stack, guaranteeing reliable and expandable service delivery. NBFLite, a lightweight blockchain platform, and Praamaanik, a blockchain-enabled solution for mobile application origin verification, were both introduced by MeitY. Policies such as the National Blockchain Strategy and digital transformation projects by enterprises are accelerating adoption. Companies are partnering with blockchain solution providers to streamline operations, enhance cybersecurity, and improve efficiency. The use of blockchain in customs clearance, cross-border trade, and vendor management is gaining traction, ensuring reduced paperwork and faster transactions. Additionally, pilot projects by Indian logistics firms and multinational corporations indicate a growing interest in large-scale blockchain deployment, paving the way for a more resilient and efficient supply chain ecosystem, thereby positively impacting the India blockchain in supply chain market outlook.

India Blockchain in Supply Chain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application, provider, and vertical.

Application Insights:

- Payment and Settlement

- Counterfeit Detection

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment and settlement and counterfeit detection.

Provider Insights:

- Application and Solution Provider

- Middleware Provider

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes application and solution provider and middleware provider.

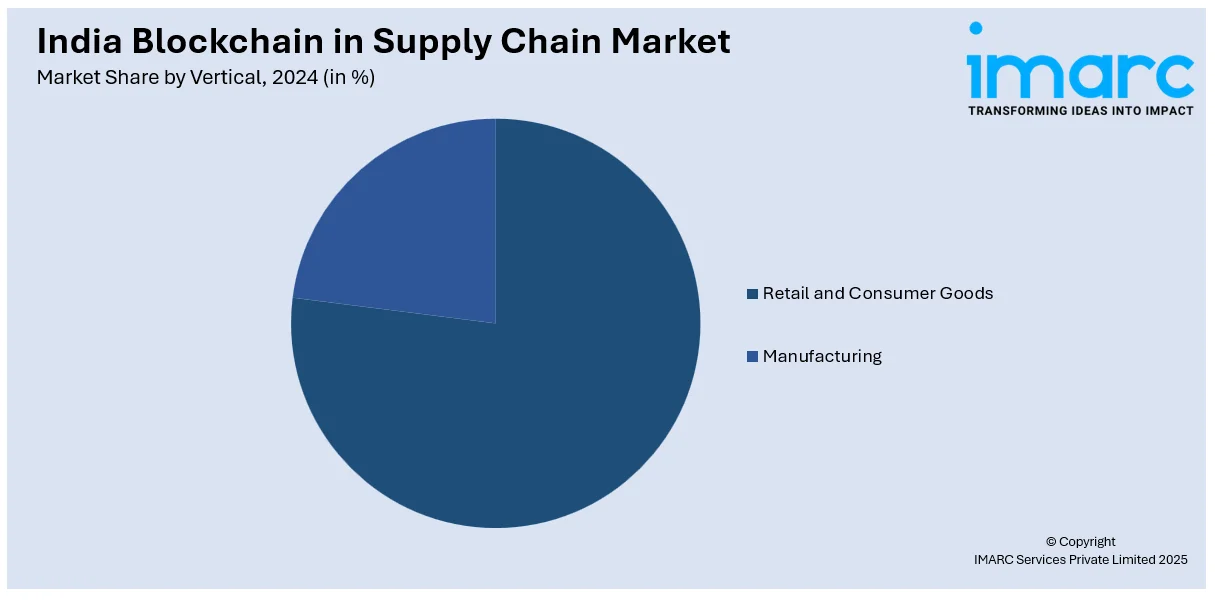

Vertical Insights:

- Retail and Consumer Goods

- Manufacturing

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes retail and consumer goods and manufacturing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blockchain in Supply Chain Market News:

- On February 8, 2025, a leading blockchain development firm, Nadcab Labs, declared that it is dedicated to incorporating sustainability into blockchain technology. Acknowledging worries about how blockchain networks affect the environment, the company is creating carbon-neutral blockchain solutions, energy-efficient protocols, and eco-friendly projects to match blockchain innovation with international sustainability objectives. Their strategy involves integrating carbon offset mechanisms into blockchain networks, deploying low-energy consensus mechanisms like Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS), and assisting environmentally friendly decentralized applications (DApps) that are centered on green supply chains and renewable energy.

- On January 25, 2025, India's KPMG and The Hashgraph Group AG (THG) announced a strategic partnership to encourage enterprise adoption of blockchain and Distributed Ledger Technologies (DLT) across a range of industry sectors. The goal of this partnership is to expedite the integration of blockchain solutions by utilizing Hedera's enterprise-grade DLT network and platform capabilities. The alliance is also expected to address key enterprise challenges, including supply chain management, sustainability, digital identity (DID), digital product passports (DPP), and asset tokenization, thereby enhancing operational efficiency and security.

India Blockchain in Supply Chain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Payment And Settlement, Counterfeit Detection |

| Providers Covered | Application and Solution Provider, Middleware Provider |

| Verticals Covered | Retail And Consumer Goods, Manufacturing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India blockchain in supply chain market performed so far and how will it perform in the coming years?

- What is the breakup of the India blockchain in supply chain market on the basis of application?

- What is the breakup of the India blockchain in supply chain market on the basis of provider?

- What is the breakup of the India blockchain in supply chain market on the basis of vertical?

- What is the breakup of the India blockchain in supply chain market on the basis of region?

- What are the various stages in the value chain of the India blockchain in supply chain market?

- What are the key driving factors and challenges in the India blockchain in supply chain market?

- What is the structure of the India blockchain in supply chain market and who are the key players?

- What is the degree of competition in the India blockchain in supply chain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blockchain in supply chain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blockchain in supply chain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blockchain in supply chain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)