India Blockchain Market Size, Share, Trends and Forecast by Component, Provider, Type, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

India Blockchain Market Overview:

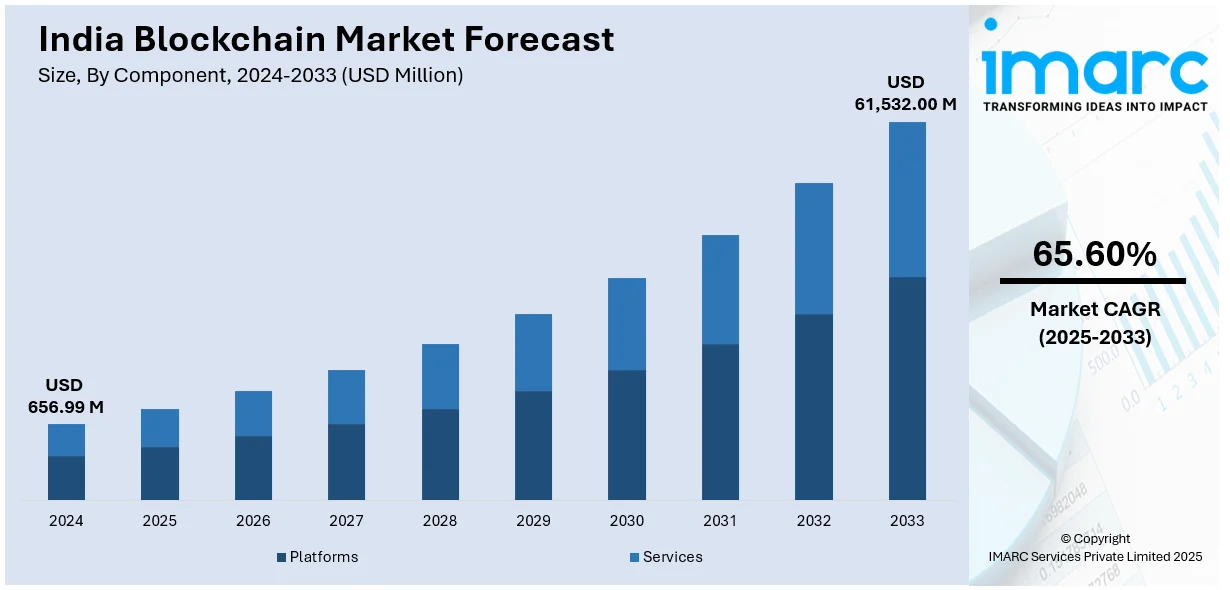

The India blockchain market size reached USD 656.99 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 61,532.00 Million by 2033, exhibiting a growth rate (CAGR) of 65.60% during 2025-2033. The market is driven by increasing adoption in financial services for secure transactions and cost efficiency, government initiatives promoting digital transformation, and the need for transparency in supply chains. The rising demand for decentralized solutions, fraud prevention, and operational optimization across industries further accelerates blockchain integration, fostering the India blockchain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 656.99 Million |

| Market Forecast in 2033 | USD 61,532.00 Million |

| Market Growth Rate (2025-2033) | 65.60% |

India Blockchain Market Trends:

Rising Adoption of Blockchain in Financial Services

The growing adoption of blockchain in the financial services sector across the country is significantly supporting the India blockchain market growth. Banks, fintech companies, and payment platforms are increasingly leveraging blockchain technology to enhance transparency, reduce fraud, and streamline operations. For instance, blockchain is being used for cross-border payments, trade finance, and digital identity verification, enabling faster and more secure transactions. The Reserve Bank of India (RBI) has also shown interest in blockchain, particularly for its central bank digital currency (CBDC) pilot project. This trend is further fueled by the government's push for digital transformation and the growing demand for decentralized financial solutions. On 30th July 2024, Reserve Bank of India (RBI) highlighted the introduction of eRupee Central Bank Digital Currency (CBDC) for enabling cross-border transactions in order to strengthen India's standing around the world and reshape the global office of the financial world in favor of the country, noting that eRupee can benefit digital trade regulations. Currently, in an advanced testing phase, the blockchain-linked rupee has garnered participation from 5 million users and 420,000 merchants. This step aligns with the growth in India's fintech sector and aims to ensure data security as well as facilitate growth in developing the digital skill set. As more financial institutions recognize the potential of blockchain to reduce costs and improve efficiency, the technology is expected to play a pivotal role in reshaping India's financial ecosystem in the coming years.

To get more information on this market, Request Sample

Blockchain Integration in Supply Chain and Logistics

Another key trend creating a positive India blockchain market outlook is its integration into supply chain and logistics operations. Companies are adopting blockchain to enhance traceability, reduce inefficiencies, and ensure authenticity in supply chains. Industries such as agriculture, pharmaceuticals, and retail are leveraging blockchain to track the movement of goods, verify product origins, and combat counterfeiting. For example, blockchain is being used to monitor the supply of agricultural produce from farms to consumers, ensuring food safety and quality. The government's focus on initiatives such as "Make in India" and the promotion of e-commerce has further accelerated this trend. In India, the number of e-commerce users is projected to reach 501.6 million by the year 2029, with user penetration's more stable approach from 22.1% in 2024 to 34.0%. The average revenue per user (ARPU) is predicted to be INR 14,121. The Government e-Marketplace (GeM) recorded its highest-ever gross merchandise value (GMV) of USD 201.1 Billion in the fiscal year 2022-23. As businesses seek to build trust and transparency in their operations, blockchain is emerging as a critical tool for optimizing supply chain management and meeting the growing demands of a digital economy.

India Blockchain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, provider, type, deployment mode, organization size, and vertical.

Component Insights:

- Platforms

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platforms, and services (professional services and managed services).

Provider Type Insights:

- Application Provider

- Infrastructure Provider

- Middleware Provider

A detailed breakup and analysis of the market based on the provider type have also been provided in the report. This includes application provider, infrastructure provider, and middleware provider.

Type Insights:

- Public

- Private

- Hybrid

- Consortium

The report has provided a detailed breakup and analysis of the market based on the type. This includes public, private, hybrid, and consortium.

Deployment Mode Insights:

- On-Premises

- Cloud

- Hybrid

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises, cloud, and hybrid.

Organization Size Insights:

- SMES

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMES and large enterprises.

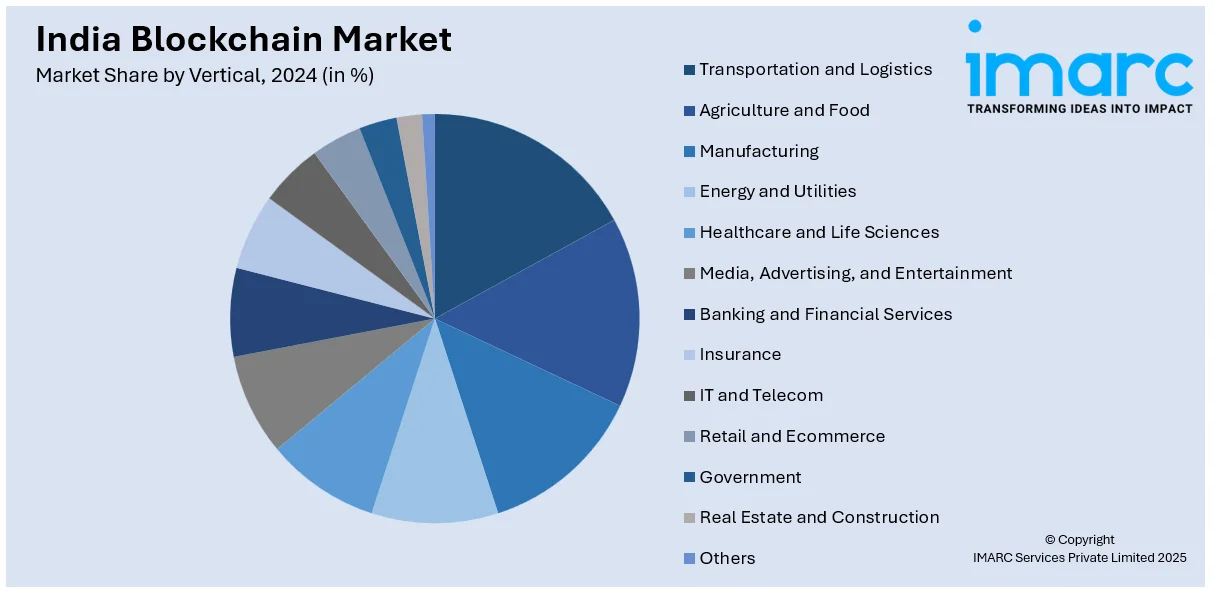

Vertical Insights:

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Media, Advertising, and Entertainment

- Banking and Financial Services

- Insurance

- IT and Telecom

- Retail and Ecommerce

- Government

- Real Estate and Construction

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes transportation and logistics, agriculture and food, manufacturing, energy and utilities, healthcare and life sciences, media, advertising, and entertainment, banking and financial services, insurance, IT and telecom, retail and ecommerce, government, real estate and construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blockchain Market News:

- September 13, 2024: India's Information Technology Ministry unveiled the 'Vishvasya' Blockchain Stack to Accessible Blockchain-as-a-Service Nationwide. This initiative includes the National Blockchain Framework, which consists of two permission-based blockchain frameworks and is hosted in National Informatics Center (NIC) data centers in Bhubneshwar, Pune and Hyderabad. The full suite of initiatives aims to address the challenges around the adoption of blockchain in India and it'll improve the blockchain ecosystem in India.

- April 29, 2024: Cashaa, a cryptocurrency firm registered in the United Kingdom, announced plans to launch a full-fledged crypto wallet across seven markets, including India. This wallet allows users to buy, store, earn, and secure loans in crypto, aiming to enhance the use of Cashaa's native token, CAS. This move comes despite the challenges it faces in the Indian crypto space, which include high taxes and regulatory hurdles.

- April 15, 2024: Officially registered as CIFDAQ Blockchain Ecosystem Ind Limited, CIFDAQ launched its blockchain ecosystem in India. It is headquartered in Mumbai, with offices in Delhi, Bengaluru, and Kolkata. This fintech company aims to provide businesses and individuals with empowerment through its range of solutions, all while promoting transparency and security in the digital finance ecosystem.

India Blockchain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Providers Covered | Application Provider, Infrastructure Provider, Middleware Provider |

| Types Covered | Public, Private, Hybrid, Consortium |

| Deployment Modes Covered | On-Premises, Cloud, Hybrid |

| Organization Sizes Covered | SMES, Large Enterprises |

| Verticals Covered | Transportation and Logistics, Agriculture and Food, Manufacturing, Energy and Utilities, Healthcare and Life Sciences, Media, Advertising, and Entertainment, Banking and Financial Services, Insurance, IT and Telecom, Retail and Ecommerce, Government, Real Estate and Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blockchain market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blockchain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blockchain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India blockchain market was valued at USD 656.99 Million in 2024.

The India blockchain market is projected to exhibit a CAGR of 65.60% during 2025-2033, reaching a value of USD 61,532.00 Million by 2033.

Key factors driving India’s blockchain market include increasing adoption in finance, supply chain, and logistics; government focus on digital transformation and regulatory frameworks; rising demand for secure and transparent transactions; growth in fintech startups; incorporation in healthcare and identity management; and widespread enterprise interest in reducing fraud and optimizing operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)