India Blood Bags Market Size, Share, Trends and Forecast by Product Type, Application, Material, Capacity, End User, and Region, 2025-2033

India Blood Bags Market Size and Share:

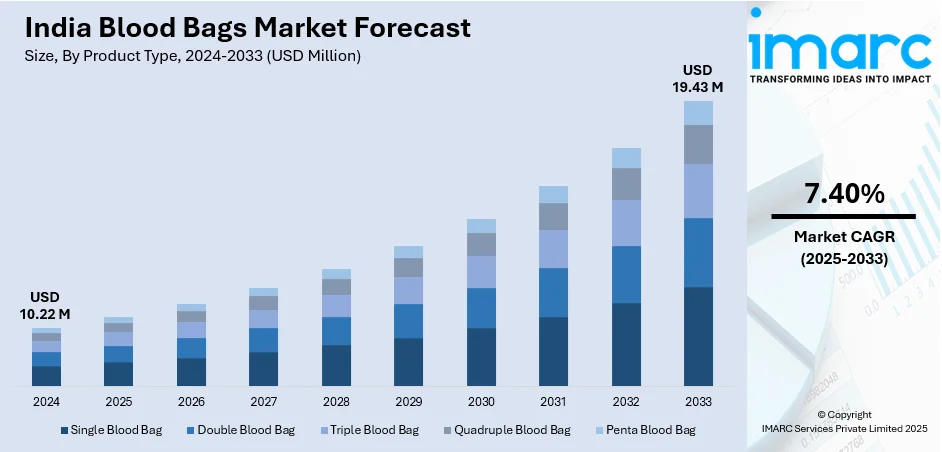

The India blood bags market size reached USD 10.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 19.43 Million by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033 The market is driven by increasing blood donation awareness, rising demand for blood transfusions, advancements in blood storage technology, and government initiatives promoting blood safety. Additionally, growing healthcare infrastructure, the prevalence of chronic diseases, and emergency medical needs further boost the India blood bags market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.22 Million |

| Market Forecast in 2033 | USD 19.43 Million |

| Market Growth Rate (2025-2033) | 7.40% |

India Blood Bags Market Trends:

Advancements in Blood Storage Technology

Innovations in blood collection, processing, and storage technologies are significantly improving the efficiency and safety of blood transfusions. Healthcare establishments are increasing their blood storage adoption rates due to single, double, triple, and quadruple blood bag developments that improve separation quality and storage capabilities. Additionally, the integration of barcoding and RFID tracking systems ensures better traceability, reduced contamination risks, and enhanced inventory management in blood banks and hospitals. These advancements in blood preservation techniques and storage solutions are crucial in ensuring safe blood supply, thereby driving demand for technologically advanced blood bags and fueling the India blood bags market share. For instance, in March 2023, Indian researchers created a new blood bag that uses unique polymers to identify chemical patterns linked to blood deterioration, extending its shelf life to 51 days and maintaining transfusion-worthiness. Pravin Kumar Vemula and his colleagues at the Institute for Stem Cell Biology and Regenerative Medicine (inStem), located in Bengaluru, created the innovative blood bag. It specifically interacts with damage-associated molecular patterns (DAMPs) and stops them from interacting with blood cells.

To get more information on this market, Request Sample

Government Initiatives and Healthcare Infrastructure Development

The Indian government has launched several initiatives to enhance blood safety, improve donation rates, and upgrade healthcare facilities. Programs such as the National Blood Policy and National Blood Transfusion Council (NBTC) promote voluntary blood donation and regulate blood transfusion services. Investments in modernizing hospitals, expanding blood banks, and implementing strict quality standards have increased the adoption of safe and contamination-free blood bags. Additionally, financial support for public and private healthcare sectors is improving access to blood storage facilities, further driving demand for high-quality, pathogen-free blood bags in India, thereby creating a positive India blood bags market outlook. For instance, in May 2023, The Union Health Ministry, in partnership with the Indian Council of Medical Research (ICMR), successfully carried out a blood bag delivery trial run using drones as part of its iDrone project, in keeping with the country's goal of growing the drone ecosystem in India. Together, Lady Hardinge Medical College (LHMC), ICMR, New Delhi, Government Institute of Medical Sciences (GIMS), Greater Noida, and Jaypee Institute of Information Technology (JIIT), Noida, conducted the trial run as part of a groundbreaking validation study for the first time in the nation. Ten units of whole blood samples from LHMC and GIMS were in visual line of sight during the first testing flight.

India Blood Bags Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, material, capacity, and end user.

Product Type Insights:

- Single Blood Bag

- Double Blood Bag

- Triple Blood Bag

- Quadruple Blood Bag

- Penta Blood Bag

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single blood bag, double blood bag, triple blood bag, quadruple blood bag, and penta blood bag.

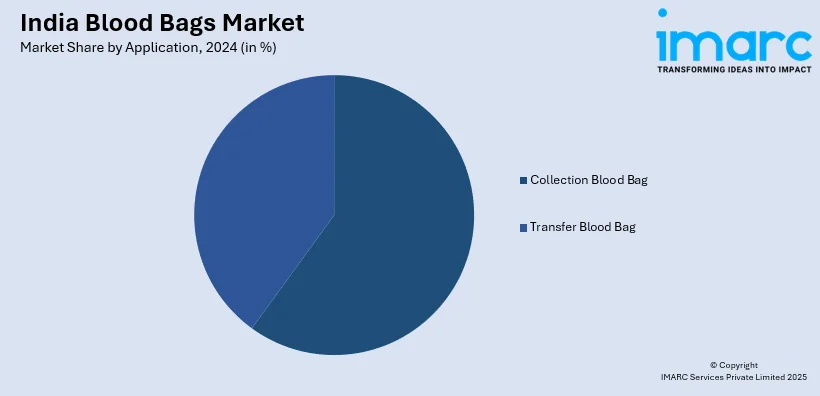

Application Insights:

- Collection Blood Bag

- Transfer Blood Bag

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes collection blood bag and transfer blood bag.

Material Insights:

- Poly Vinyl Chloride Blood Bag

- Polyethylene Terephthalate Blood Bag

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes poly vinyl chloride blood bag, polyethylene terephthalate blood bag, and others.

Capacity Insights:

- 100ml Blood Bag

- 150ml Blood Bag

- 250ml Blood Bag

- 300ml Blood Bag

- 350ml Blood Bag

- 400ml Blood Bag

- 450ml Blood Bag

- 500ml Blood Bag

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes 100ml blood bag,150ml blood bag, 250ml blood bag, 300ml blood bag, 350ml blood bag, 400ml blood bag, 450ml blood bag, and 500ml blood bag.

End User Insights:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Blood Banks

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, clinics, ambulatory surgical centers, blood banks, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blood Bags Market News:

- In June 2024, Health Minister Veena George announced that a new mechanism will be implemented in the state's blood collecting system. A cutting-edge blood bag traceability system that can follow blood from collection to donation is being put into place. This system makes use of vein-to-vein traceability technology, which makes it possible to precisely determine the temperature and prevent blood loss beyond the expiration period.

- In January 2024, a drone transported a single unit of blood for an anaemic pregnant woman to the Tangi community health centre (CHC) in Khurda district, marking its inaugural flight for delivering medicines and similar supplies from AIIMS Bhubaneswar. For the first time, a drone was used to effectively deliver a blood bag to a patient. In terms of incorporating technology into our healthcare system, it marks a substantial advancement.

India Blood Bags Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single Blood Bag, Double Blood Bag, Triple Blood Bag, Quadruple Blood Bag, Penta Blood Bag |

| Applications Covered | Collection Blood Bag, Transfer Blood Bag |

| Materials Covered | Poly Vinyl Chloride Blood Bag, Polyethylene Terephthalate Blood Bag, Others |

| Capacities Covered | 100ml Blood Bag,150ml Blood Bag, 250ml Blood Bag, 300ml Blood Bag, 350ml Blood Bag, 400ml Blood Bag, 450ml Blood Bag, 500ml Blood Bag |

| End Users Covered | Hospitals, Clinics, Ambulatory Surgical Centers, Blood Banks, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India blood bags market performed so far and how will it perform in the coming years?

- What is the breakup of the India blood bags market on the basis of product type?

- What is the breakup of the India blood bags market on the basis of application?

- What is the breakup of the India blood bags market on the basis of material?

- What is the breakup of the India blood bags market on the basis of capacity?

- What is the breakup of the India blood bags market on the basis of end user?

- What is the breakup of the India blood bags market on the basis of region?

- What are the various stages in the value chain of the India blood bags market?

- What are the key driving factors and challenges in the India blood bags market?

- What is the structure of the India blood bags market and who are the key players?

- What is the degree of competition in the India blood bags market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blood bags market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blood bags market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blood bags industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)