India Boiler Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Boiler Water Treatment Chemicals Market Overview:

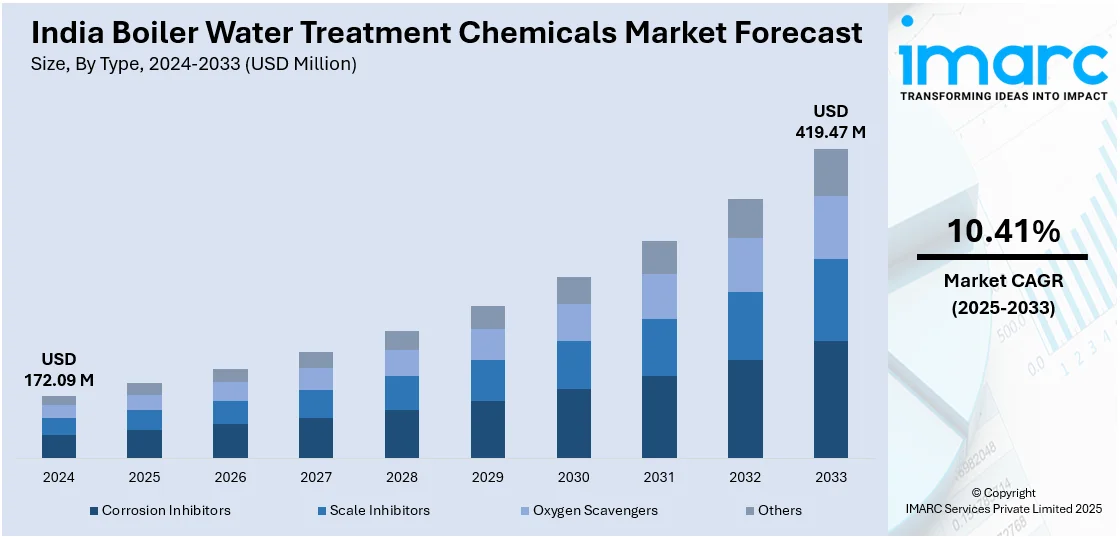

The India boiler water treatment chemicals market size reached USD 172.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 419.47 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The India boiler water treatment chemicals market is driven by rapid industrialization, expanding power generation capacity (including nuclear and thermal plants), elevating demand in the food and beverage sector, stringent environmental regulations, and higher adoption of high-efficiency boilers, all of which necessitate advanced water treatment solutions to prevent scaling, corrosion, and operational inefficiencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 172.09 Million |

| Market Forecast in 2033 | USD 419.47 Million |

| Market Growth Rate 2025-2033 | 10.41% |

India Boiler Water Treatment Chemicals Market Trends:

Expansion of the Power Generation Sector

India's power generation industry has been witnessing huge development, which has created a greater demand for boiler water treatment chemicals. Boilers are critical systems in thermal power plants, where they produce steam to generate electricity. In order to ensure the boilers' efficiency and lifetime, water treatment chemicals are required to avoid scaling, corrosion, and fouling. This rise in power generation capacity requires the addition of new boilers and the servicing of those in place, thus boosting the demand for boiler water treatment chemicals. Effective water treatment is essential for enabling maximum heat transfer, minimizing fuel consumption, and reducing maintenance expenses in power plants. As India keeps investing in expanding its power infrastructure to address increasing energy needs, the use of boiler water treatment chemicals is likely to grow proportionally, highlighting their pivotal position in the power generation industry.

To get more information on this market, Request Sample

Growth in the Food and Beverage Industry

Indian food and beverage sector has seen tremendous progress over the years, and boilers are an integral part of this industry, responsible for powering processes like cooking, sterilization, and cleaning. The quality of hot water and steam directly affects product quality and safety. For ensuring strict hygiene levels and avoiding contamination, the sector depends on boiler water treatment chemicals to make sure that boilers are working effectively and delivering quality steam. Based on industry reports, the rise in the number of food processing units and the focus on meeting international food safety standards have driven the demand for efficient water treatment solutions. As per the India Brand Equity Foundation (IBEF), the India food processing sector is projected to reach USD 1,274 Billion in 2027. This has helped the boiler water treatment chemicals market in the food and beverage industry to grow. With the increasing demand for processed and packaged foods among consumers, the reliance of the industry on efficient boiler operations escalates, further boosting the demand for specialty water treatment chemicals.

India Boiler Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Corrosion Inhibitors

- Scale Inhibitors

- Oxygen Scavengers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes corrosion inhibitors, scale inhibitors, oxygen scavengers, and others.

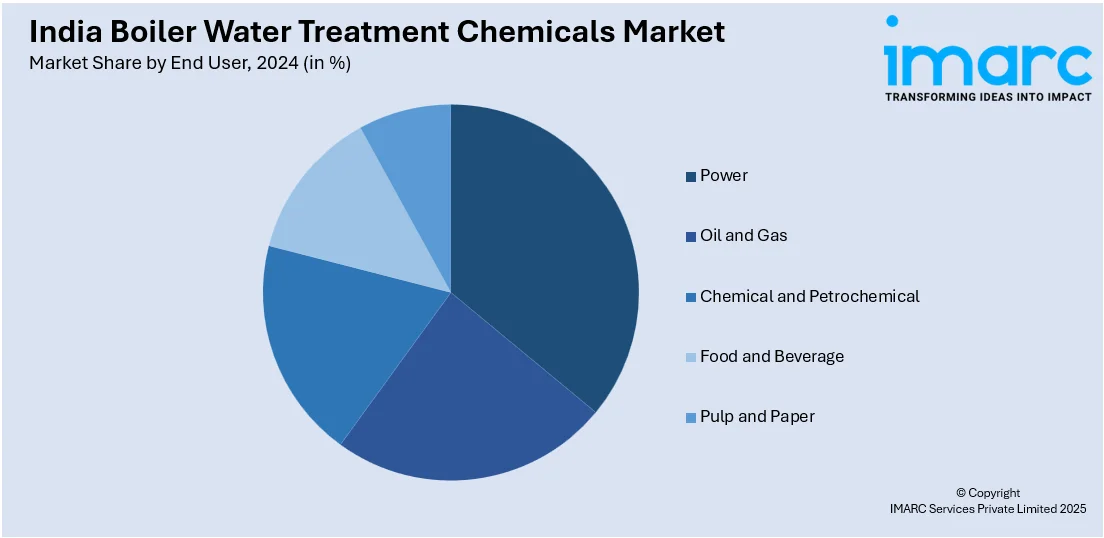

End User Insights:

- Power

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage

- Pulp and Paper

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes power, oil and gas, chemical and petrochemical, food and beverage, and pulp and paper.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Boiler Water Treatment Chemicals Market News:

- March 2025: India enhanced its nuclear power generation capacity to 35.3 GW with 25 operational reactors and plans more private sector investments. This expansion increased the use of steam turbines and boilers, requiring high-purity water treatment to prevent scaling and corrosion. As more nuclear plants operate and new ones are built, demand for boiler water treatment chemicals escalates to ensure efficient power generation.

- March 2025: India plans to invest $600 billion in its power sector over the next decade, focusing on high-value manufacturing and renewable energy. This substantial investment will lead to the construction of new power plants, propelling the use of boilers that require water treatment chemicals to maintain efficiency and prevent damage. Consequently, the demand for boiler water treatment chemicals in India is expected to increase significantly.

India Boiler Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Corrosion Inhibitors, Scale Inhibitors, Oxygen Scavengers, Others |

| End Users Covered | Power, Oil and Gas, Chemical and Petrochemical, Food and Beverage, Pulp and Paper |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India boiler water treatment chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the India boiler water treatment chemicals market on the basis of type?

- What is the breakup of the India boiler water treatment chemicals market on the basis of end user?

- What are the various stages in the value chain of the India boiler water treatment chemicals market?

- What are the key driving factors and challenges in the India boiler water treatment chemicals market?

- What is the structure of the India boiler water treatment chemicals market and who are the key players?

- What is the degree of competition in the India boiler water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India boiler water treatment chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India boiler water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India boiler water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)