India Boiler Water Treatment Plant Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

India Boiler Water Treatment Plant Market Overview:

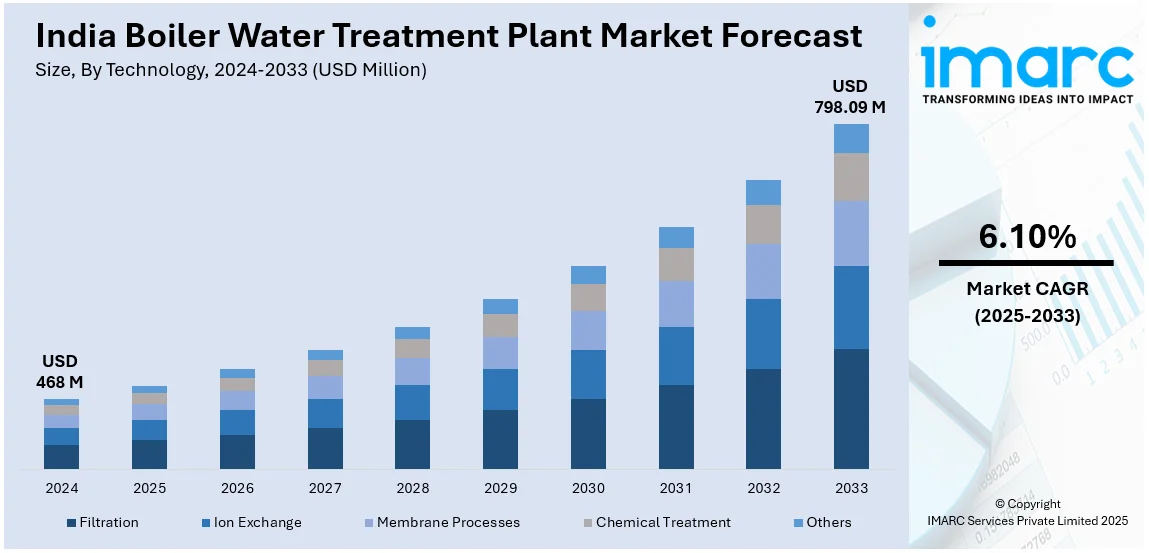

The India boiler water treatment plant market size reached USD 468 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 798.09 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. Government policies encouraging water conservation, recycling, and financial incentives for sustainable water management are driving industries to adopt advanced boiler water treatment systems, catalyzing the market demand for efficient water reuse and reducing the environmental impact of industrial operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 468 Million |

| Market Forecast in 2033 | USD 798.09 Million |

| Market Growth Rate (2025-2033) | 6.10% |

India Boiler Water Treatment Plant Market Trends:

Government Initiatives Supporting Industrial Water Reuse

The governing body is encouraging water conservation and the reuse of industrial water by implementing policies and providing financial incentives, which is increasing the need for effective boiler water treatment systems. For instance, in 2024, Gujarat introduced a fresh wastewater recycling policy to tackle freshwater shortages, emphasizing the compulsory utilization of treated wastewater by industries and businesses for non-potable applications. The policy additionally featured incentives for the treatment and recycling of water. This initiative formed a component of the state's wider efforts to encourage sustainable water management and tackle health problems resulting from water pollution. Such state initiatives are urging industries to adopt sophisticated treatment methods to minimize freshwater use and wastewater release. Industries are required to implement sustainable water management practices, which involve recycling and reusing treated water in boiler operations. Monetary assistance via subsidies and tax incentives is additionally motivating firms to invest in efficient water treatment infrastructure. Moreover, state-supported research projects are promoting technological progress in industrial water treatment, thereby enhancing the accessibility of efficient systems. The emphasis on lowering the environmental impact of industrial water consumption is speeding up the implementation of closed-loop treatment systems, which guarantee minimal waste production. These financial and regulatory factors are greatly aiding the growth of the boiler water treatment plant market in numerous industrial sectors.

To get more information on this market, Request Sample

Rising Investments in Infrastructure and Industrial Projects

In 2025, Samuthra Infrastructure Pvt. Ltd. declared its foray into the industrial and business park industry with a $10 billion investment strategy spanning 10 states in India. This initiative seeks to generate more than 2 lakh jobs, enhance India's manufacturing environment, and draw in international investments. The initial stage of development will concentrate on Tamil Nadu, featuring parks aimed at bolstering sectors such as automotive, electronics, textiles, and IT. The growth of industrial infrastructure and significant project investments throughout India are driving the need for boiler water treatment facilities. The establishment of new power stations, production units, and industrial hubs necessitates effective boiler systems to facilitate steam and electricity production. As industries expand their operations, maintaining steady water quality for boiler systems is essential to prevent equipment damage, energy losses, and interruptions in production. The government's support for infrastructure enhancement via programs such as Make in India and industrial corridor initiatives is generating a spike in the need for water treatment solutions. Furthermore, private sector funding in rapidly growing industries is bolstering the market growth. Extensive projects necessitate tailored and high-capacity treatment solutions, resulting in a rise in the use of sophisticated water purification and conditioning systems.

India Boiler Water Treatment Plant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Filtration

- Ion Exchange

- Membrane Processes

- Chemical Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes filtration, ion exchange, membrane processes, chemical treatment, and others.

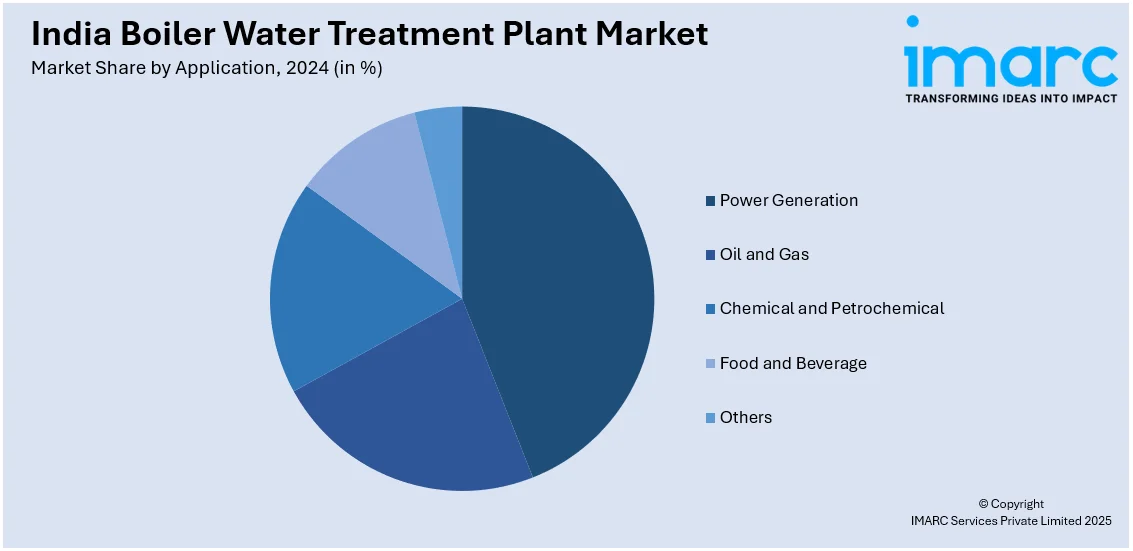

Application Insights:

- Power Generation

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, oil and gas, chemical and petrochemical, food and beverage, and others.

End User Insights:

- Industrial

- Commercial

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes industrial, commercial, and institutional.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Boiler Water Treatment Plant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Filtration, Ion Exchange, Membrane Processes, Chemical Treatment, Others |

| Applications Covered | Power Generation, Oil and Gas, Chemical and Petrochemical, Food and Beverage, Others |

| End Users Covered | Industrial, Commercial, Institutional |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India boiler water treatment plant market performed so far and how will it perform in the coming years?

- What is the breakup of the India boiler water treatment plant market on the basis of technology?

- What is the breakup of the India boiler water treatment plant market on the basis of application?

- What is the breakup of the India boiler water treatment plant market on the basis of end user?

- What is the breakup of the India boiler water treatment plant market on the basis of region?

- What are the various stages in the value chain of the India boiler water treatment plant market?

- What are the key driving factors and challenges in the India boiler water treatment plant market?

- What is the structure of the India boiler water treatment plant market and who are the key players?

- What is the degree of competition in the India boiler water treatment plant market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India boiler water treatment plant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India boiler water treatment plant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India boiler water treatment plant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)