India BOPP Films Market Size, Share, Trends and Forecast by Type, Thickness, Production Process, Application, and Region, 2025-2033

India BOPP Films Market Overview:

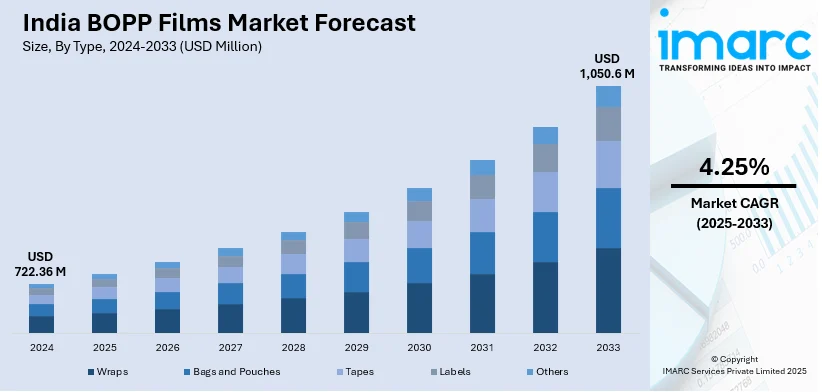

The India BOPP films market size reached USD 722.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,050.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The rising demand for flexible packaging in food, pharmaceuticals, and consumer goods, growth in e-commerce, advancements in film technology, increasing sustainability focus, government initiatives promoting plastic recycling, and expanding applications in labeling and industrial sectors are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 722.36 Million |

| Market Forecast in 2033 | USD 1,050.6 Million |

| Market Growth Rate (2025-2033) | 4.25% |

India BOPP Films Market Trends:

Rising Demand for High-Performance Sustainable Packaging

The shift toward eco-friendly packaging solutions is accelerating, driven by the need for materials that offer both sustainability and functionality. Packaging films made from advanced polypropylene formulations are gaining prominence, particularly for dry goods. These materials provide enhanced barrier properties while reducing environmental impact. Manufacturers are optimizing production by consolidating processes in single locations, ensuring efficiency and quality consistency. This approach supports the growing global focus on sustainable packaging alternatives that meet regulatory and consumer expectations. The adoption of such solutions is expanding across major markets, including the Americas, Europe, India, and ASEAN, as industries seek to balance performance with sustainability. The move toward recyclable, high-barrier films is reshaping packaging strategies across multiple sectors. For example, in March 2024, Toppan Inc., alongside its Indian subsidiary Toppan Speciality Films Private Limited, introduced GL-SP, a barrier film utilizing biaxially oriented polypropylene (BOPP) as its base. This product caters to the growing demand for sustainable packaging, particularly for dry contents, across markets in the Americas, Europe, India, and the ASEAN region. By overseeing the entire production process, from resin formulation to film formation, at a single location, Toppan ensures consistent quality and efficiency.

To get more information on this market, Request Sample

Expanding Production Capacity for Flexible Packaging Solutions

The demand for high-performance flexible packaging materials is driving significant investments in production expansion. Manufacturers are scaling up biaxially oriented polypropylene (BOPP) film capacity to meet rising requirements across various industries, including food, consumer goods, and industrial applications. Large-scale production facilities are being developed to enhance supply chain efficiency, reduce costs, and cater to both domestic and international markets. Increasing output at single-location plants allows companies to streamline operations while ensuring consistent product quality. With the growing need for durable, lightweight, and recyclable packaging materials, production facilities are being optimized to handle higher volumes and advanced film formulations. This shift is shaping the future of packaging, reinforcing the focus on sustainability, efficiency, and innovation in material science. For instance, in December 2021, Cosmo Films announced its plans to invest approximately EUR 40 Million to expand its biaxially oriented polypropylene (BOPP) film production at its Aurangabad, Maharashtra facility. This expansion aims to increase the plant's capacity by 60,000 tons per year, making it the world's largest single-location BOPP facility by 2025.

India BOPP Films Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, thickness, production process, and application.

Type Insights:

- Wraps

- Bags and Pouches

- Tapes

- Labels

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wraps, bags and pouches, tapes, labels, and others.

Thickness Insights:

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More than 45 Microns

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes below 15 microns, 15-30 microns, 30-45 microns, and more than 45 microns.

Production Process Insights:

- Tenter

- Tubular

The report has provided a detailed breakup and analysis of the market based on the production process. This includes tenter and tubular.

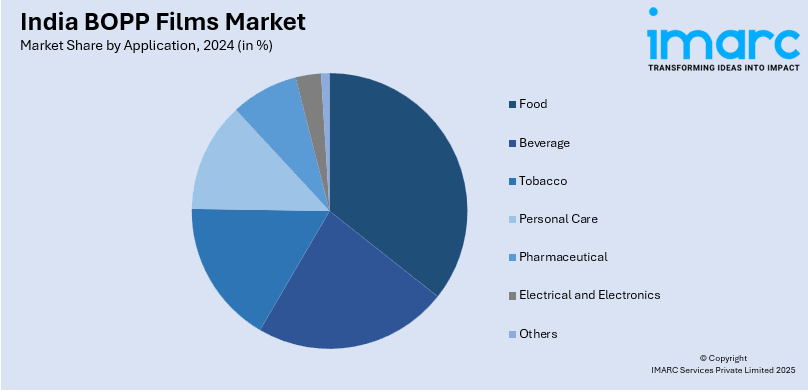

Application Insights:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food, beverage, tobacco, personal care, pharmaceutical, electrical and electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India BOPP Films Market News:

- In September 2024, Jindal Poly Films announced its plans to build a new biaxially oriented polypropylene (BOPP) film plant in Nashik, India, with a 60,000-ton annual capacity. The INR 2.5 Billion investment is slated to commence operations in the latter half of 2025. Currently, Jindal's Nashik site boasts capacities of 294,000 tons per year for BOPP, 170,000 tons for BOPET, and 33,000 tons for cast polypropylene (CPP) films.

- In June 2024, the B.C. Jindal Group reaffirmed its commitment to global packaging operations by restructuring under a unified leadership team. Over the past decade, the group has invested significantly in specialized packaging films, operating plants in the US, Italy, Belgium, Germany, and France. A recent investment in a BOPP/BOPE production line at its Brindisi, Italy plant is set to boost capacity by 25%.

India BOPP Films Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wraps, Bags and Pouches, Tapes, Labels, Others |

| Thickness Covered | Below 15 Microns, 15-30 Microns, 30-45 Microns, More than 45 Microns |

| Production Process Covered | Tenter, Tubular |

| Applications Covered | Food, Beverage, Tobacco, Personal Care, Pharmaceutical, Electrical and Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India BOPP films market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India BOPP films market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India BOPP films industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The BOPP films market in India was valued at USD 722.36 Million in 2024.

The India BOPP films market is projected to exhibit a CAGR of 4.25% during 2025-2033, reaching a value of USD 1,050.6 Million by 2033.

The India BOPP films market grows steadily with strong demand from flexible packaging, labeling, and industrial uses. Light weight, moisture resistance, and recyclability appeal to manufacturers and end users alike. Local production capacity expansion and shifting user habits support higher employment, while competitive pricing and technological upgrades help producers maintain supply and meet quality expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)