India Botulinum Toxin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Botulinum Toxin Market Size and Share:

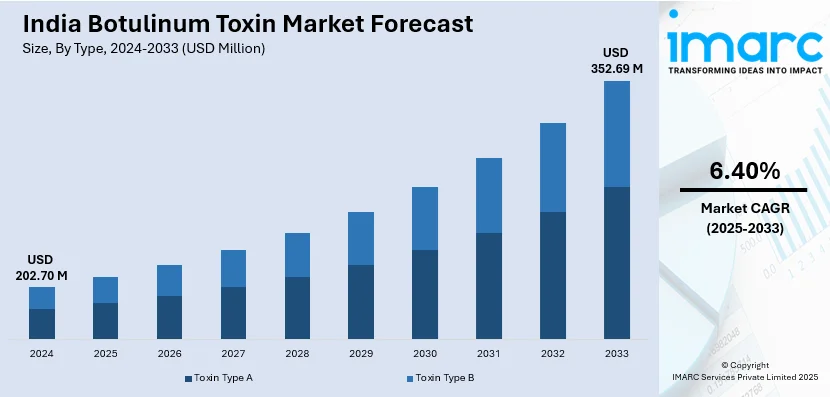

The India botulinum toxin market size reached USD 202.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 352.69 Million by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for aesthetic and non-surgical cosmetic procedures and the expanding medical applications beyond aesthetic use.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 202.70 Million |

| Market Forecast in 2033 | USD 352.69 Million |

| Market Growth Rate (2025-2033) | 6.40% |

India Botulinum Toxin Market Trends:

Rising Demand for Aesthetic and Non-Surgical Cosmetic Procedures

The India botulinum toxin market is witnessing significant growth due to the widespread adoption of aesthetic treatments and non-surgical cosmetic procedures. In metropolitan locations, consumers are increasingly interested in minimally invasive treatments to rectify signs of aging, which include the treatment of wrinkles and fine lines while restoring contoured features. For instance, India's aesthetic medicine industry has grown rapidly from $100 million in 2000 and is projected to reach $3.02 billion by 2029. There is a growing trend in celebrities getting more procedures done with botulinum toxins, which is being fueled by rising disposable incomes, social media influence, and changing beauty standards. This has led to an increase in acceptance regarding procedures performed on botulinum toxins. The medical aesthetics industry in India is currently thriving due to the growing number of dermatology and cosmetic surgery clinics that perform a wide variety of treatments using botulinum toxins. The accessibility of high-end botulinum products has, in addition, been enhanced by the growing presence of international aesthetic brands and partnerships with global dermatology firms. The demand is further driven by an increasing male clientele because more men are now seeking aesthetic enhancements to pretend to be youthful. In addition to this, emerging formulations of botulinum toxins, such as the ones that last longer and those that offer better precision, are driving the market growth further. Preventive treatment with botulinum toxins among young people is gaining acceptance and shaping the market, as those in their late twenties and thirties are choosing to undergo early interventions to delay the visible signs of aging.

To get more information on this market, Request Sample

Expanding Medical Applications Beyond Aesthetic Use

While aesthetic applications remain a key driver, the India botulinum toxin market is also witnessing growth due to its expanding use in therapeutic treatments. Botulinum toxin is increasingly being used for managing neurological disorders, chronic migraines, muscle spasticity, hyperhidrosis (excessive sweating), and temporomandibular joint (TMJ) disorders. For instance, in May 2024, in India, as per industry reports, approximately 211.25 million people experienced migraine-induced headaches, resulting in a loss of 5.8% of productive time, highlighting the significant economic and personal impact of the condition.

The growing awareness among medical professionals and patients regarding the therapeutic benefits of botulinum toxin has led to wider adoption in clinical settings. India’s healthcare sector is seeing a rise in neurological and musculoskeletal disorders, creating demand for botulinum toxin injections as an effective treatment option. The increasing number of FDA and CDSCO-approved indications for botulinum toxin is encouraging physicians to explore its applications in pain management and movement disorders. Additionally, government initiatives promoting advanced healthcare treatments and insurance coverage for therapeutic botulinum toxin procedures are expected to drive market expansion. Pharmaceutical companies and research institutions in India are actively conducting clinical trials to explore new therapeutic indications for botulinum toxin. This includes its potential applications in treating overactive bladder, depression, and post-stroke spasticity. As research continues to validate these emerging uses, the market is likely to see higher adoption rates in hospitals, specialty clinics, and rehabilitation centers, reinforcing botulinum toxin’s role as a multi-functional therapeutic agent.

India Botulinum Toxin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Toxin Type A

- Toxin Type B

The report has provided a detailed breakup and analysis of the market based on the type. This includes toxin type A and toxin type B.

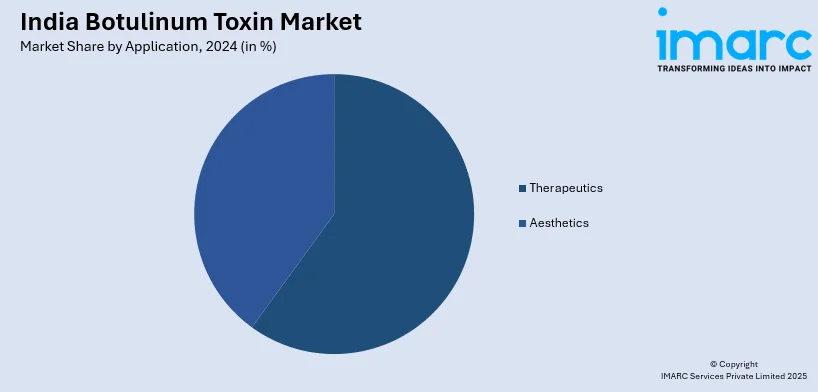

Application Insights:

- Therapeutics

- Aesthetics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes therapeutics and aesthetics.

End User Insights:

- Hospitals and Clinics

- Dermatology Clinics

- Spas and Cosmetic Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, dermatology clinics, and spas and cosmetic centers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Botulinum Toxin Market News:

- In December 2023, Gufic Biosciences introduced ‘Zarbot,’ a botulinum toxin type A injection with 10 ml normal saline for improved compliance. It offers better stability, with storage at 2-8 °C for 36 months and 14 days post-reconstitution.

India Botulinum Toxin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Toxin Type A, Toxin Type B |

| Applications Covered | Therapeutics, Aesthetics |

| End Users Covered | Hospitals and Clinics, Dermatology Clinics, Spas and Cosmetic Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India botulinum toxin market performed so far and how will it perform in the coming years?

- What is the breakup of the India botulinum toxin market on the basis of type?

- What is the breakup of the India botulinum toxin market on the basis of application?

- What is the breakup of the India botulinum toxin market on the basis of end user?

- What is the breakup of the India botulinum toxin market on the basis of region?

- What are the various stages in the value chain of the India botulinum toxin market?

- What are the key driving factors and challenges in the India botulinum toxin?

- What is the structure of the India botulinum toxin market and who are the key players?

- What is the degree of competition in the India botulinum toxin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India botulinum toxin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India botulinum toxin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India botulinum toxin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)