India Brake Pads, Shoes and Linings Market Size, Share, Trends and Forecast by Vehicle Type, Demand Category, Brake Type, and Region, 2025-2033

India Brake Pads, Shoes and Linings Market Overview:

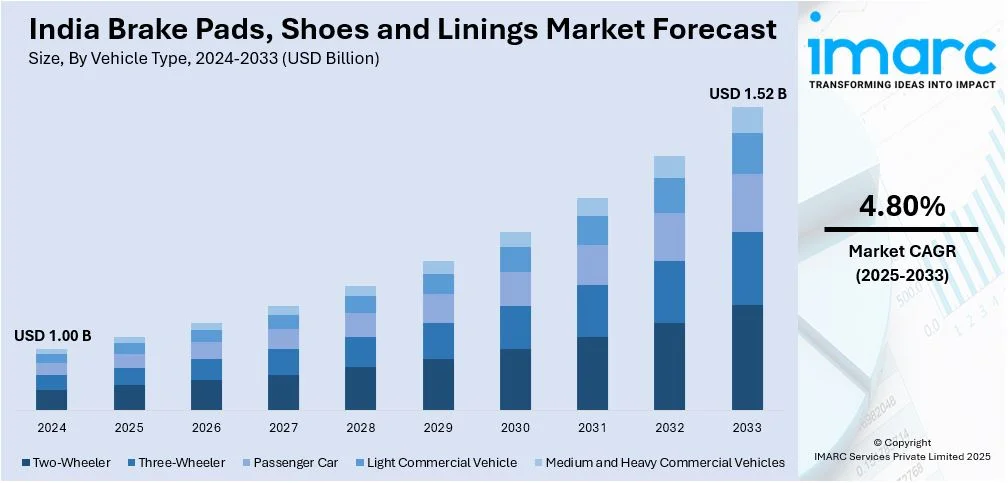

The India brake pads, shoes and linings market size reached USD 1.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.52 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The India brake pads, shoes and linings market share is expanding, driven by the increasing production of commercial vehicles that experience higher wear and tear due to heavy usage, along with the rising awareness about the importance of well-maintained braking systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.00 Billion |

| Market Forecast in 2033 | USD 1.52 Billion |

| Market Growth Rate (2025-2033) | 4.80% |

India Brake Pads, Shoes and Linings Market Trends:

Increasing vehicle production and sales

The rising vehicle production and sales are fueling the India brake pads, shoes and linings market growth. With the high middle-class population and increasing disposable incomes, more people are buying vehicles, driving the demand for essential braking components. According to industry reports, in 2024, the passenger vehicle (PV) segment, including cars, utility vehicles (UVs), and vans, experienced a rise of 4.2%, reaching 4.3 Million units, supported by sales of sports utility vehicles (SUVs). Automakers are ramping up output to satisfy this demand, resulting in a direct rise in the demand for brake components. As more vehicles enter the market, the need for aftermarket replacement parts increases since brake pads, shoes and linings wear out over time and must be replaced on a regular basis for safety. Commercial vehicles, which have greater wear and tear owing to frequent use, are driving the demand. The introduction of electric vehicles (EVs) is also having a favorable impact on the market, as manufacturers prioritize regenerative braking systems while still requiring high-quality brake pads, shoes and linings. Furthermore, the increased use of disc brakes in two-wheelers and passenger cars is leading to market expansion, as they require more frequent replacements than traditional drum brakes.

To get more information on this market, Request Sample

Rising emphasis on road safety

The growing focus on road safety is offering a favorable India brake pads, shoes and linings market outlook. With rising road accidents, both government regulations and user attitudes are shifting towards better vehicle safety measures. Stricter norms are enabling manufacturers to produce high-quality braking components that improve vehicle stopping power and reduce accidents. Regular vehicle inspections and safety awareness campaigns are also encouraging drivers to replace worn-out brake pads, shoes, and linings on time. In November 2024, the Citizen Consumer and Civic Action Group (CAG) organized a road safety awareness initiative in Chennai to emphasize the increasing road deaths in Tamil Nadu and promote safer driving habits among young people in India. Fleet operators and commercial vehicle owners are prioritizing better braking systems to ensure passenger and cargo safety, further driving the demand. Additionally, the growing number of high-speed vehicles on highways makes advanced braking systems necessary, creating the need for durable and efficient brake components. As more people opt for periodic vehicle maintenance and road safety standards continue to tighten, the demand for reliable brake pads, shoes, and linings is increasing in India.

India Brake Pads, Shoes and Linings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, demand category, and brake type.

Vehicle Type Insights:

- Two-Wheeler

- Three-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Medium and Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two-wheeler, three-wheeler, passenger car, light commercial vehicle, and medium and heavy commercial vehicles.

Demand Category Insights:

.webp)

- OEM

- Replacement

A detailed breakup and analysis of the market based on the demand category have also been provided in the report. This includes OEM and replacement.

Brake Type Insights:

- Brake Pads

- Brake Shoes

- Brake Linings

The report has provided a detailed breakup and analysis of the market based on the brake type. This includes brake pads, brake shoes, and brake linings.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Brake Pads, Shoes and Linings Market News:

- In January 2025, Uno Minda, a leading Tier 1 automotive parts manufacturer, announced the introduction of ‘Perfomaxx’ brake pad series for the Indian aftermarket, which incorporated advanced rubber metal rubber (RMR) technology and improved safety specifications. The heavy duty organic brake pads with shim marked an important enhancement to the company’s PV product lineup.

- In January 2025, ZF Aftermarket revealed the enhancement of TRW brake pad availability in India. ‘TRW TRUE Originals Brake Pads’, were designed and produced to the highest standards, providing reliable and consistent braking performance, ensuring driver safety and refined vehicle lifespan, while catering to the varied needs of Indian roads and vehicles.

India Brake Pads, Shoes and Linings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two-Wheeler, Three-Wheeler, Passenger Car, Light Commercial Vehicle, Medium and Heavy Commercial Vehicles |

| Demand Categories Covered | OEM, Replacement |

| Brake Types Covered | Brake Pads, Brake Shoes, Brake Linings |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India brake pads, shoes and linings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India brake pads, shoes and linings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India brake pads, shoes and linings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

The brake pads, shoes and linings market in India was valued at USD 1.00 Billion in 2024.

The India brake pads, shoes and linings market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 1.52 Billion by 2033.

The India brake pads, shoes and linings market is driven by the increasing automotive production and sales, rising demand for vehicle safety, and stricter government regulations on vehicle emissions and safety standards. Additionally, the growing user awareness about vehicle maintenance and advancements in brake technology is positively influencing the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)