India Brakepad Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, Material Type, and Region, 2025-2033

India Brakepad Market Overview:

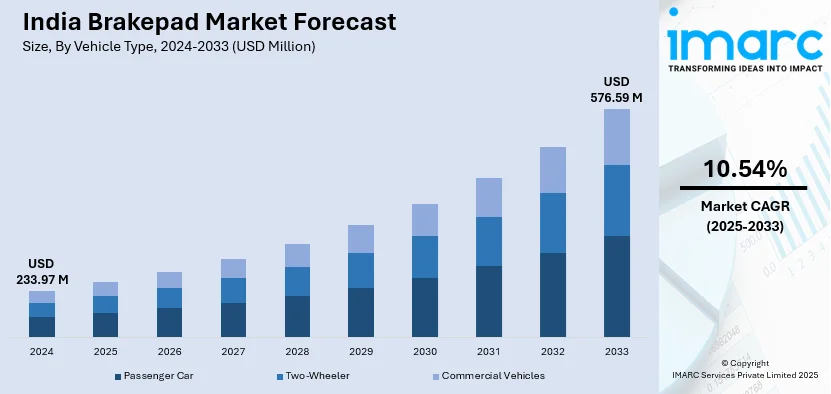

The India brakepad market size reached USD 233.97 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 576.59 Million by 2033, exhibiting a growth rate (CAGR) of 10.54% during 2025-2033. The rising vehicle production, increasing road safety regulations, growing consumer awareness of high-performance braking systems, and advancements in friction materials, such as ceramic and low-metallic formulations, are contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 233.97 Million |

| Market Forecast in 2033 | USD 576.59 Million |

| Market Growth Rate 2025-2033 | 10.54% |

India Brakepad Market Trends:

Advanced Friction Materials and Technological Innovations

Advanced friction materials and innovative manufacturing techniques are reshaping the brake pad landscape in India. Manufacturers are increasingly investing in R&D to develop premium formulations, such as ceramic, semi-metallic, and low-metallic compounds, that offer superior friction properties, improved thermal stability, and extended durability compared to traditional materials. In 2023, nearly 40% of new high-end vehicles were equipped with advanced brake pad technologies, a trend that is projected to accelerate as consumer safety and performance expectations rise. Simultaneously, precision manufacturing and digital quality control are reducing production variability and enhancing product reliability. Recent studies indicate that such technological upgrades have led to a 20% reduction in warranty claims and a 15% increase in the overall product lifespan, offering significant value to both OEMs and the aftermarket. The rising proliferation of electric cars (EVs) is also impacting brake pad design, as EVs require components that are optimized for regenerative braking circumstances. This dual push, which improves material performance while meeting rising EV needs, is fueling innovation and customer trust in premium brake pads.

To get more information on this market, Request Sample

Stringent Safety Regulations and Aftermarket Upgrades

Heightened regulatory scrutiny and an increased focus on road safety are significant drivers in the India brake pad market. The Indian government has implemented stricter safety norms, mandating enhanced braking system performance for new vehicles. In 2023, updated guidelines from the Ministry of Road Transport spurred a surge in demand for high-performance brake pads that not only meet but exceed regulatory standards. This regulatory push is complemented by growing consumer awareness—statistics show that the aftermarket brake pad replacement rate in India increased by 12% year-over-year in 2023 as drivers seek improved safety and reliability for aging vehicle fleets. In line with this, manufacturers are now emphasizing on innovations that reduce noise, enhance friction consistency, and extend product lifespan, all features critical to compliance with evolving safety norms. As new vehicles roll out with these advanced systems and consumers increasingly opt for aftermarket upgrades, the market is witnessing robust growth. Both OEM and aftermarket segments are aligning their product portfolios to meet these regulatory benchmarks, ensuring that enhanced safety features remain at the forefront of product development, which is boosting the market growth.

India Brakepad Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, sales channel, and material type.

Vehicle Type Insights:

- Passenger Car

- Two-Wheeler

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car, two-wheeler, and commercial vehicles.

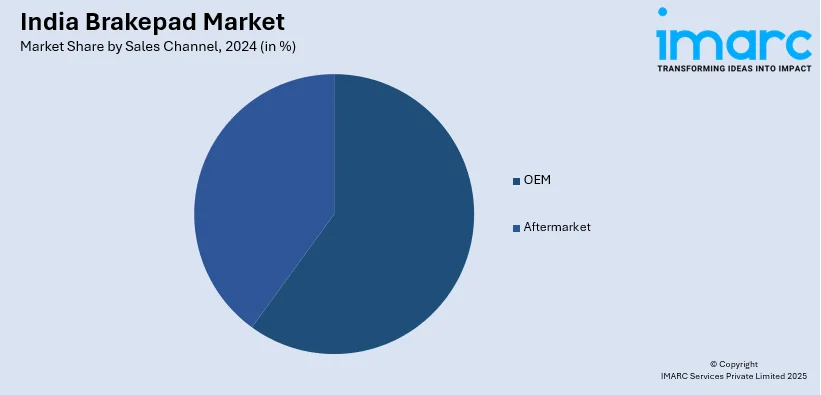

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Material Type Insights:

- Semi-Metallic

- Ceramic

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes semi-metallic, ceramic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Brakepad Market News:

- January 2025: Uno Minda unveiled its new Perfomaxx brake pad line for the Indian aftermarket. The series has sophisticated RMR technology and increased safety requirements. The heavy-duty organic brake pads with shim represent a substantial addition to the company's passenger car product offering.

- March 2024: Frasle Mobility expanded its worldwide reach, with its Indian operations playing a vital role through a joint venture with ASK Automotive. This collaboration enabled the local manufacturing of vehicle parts, such as brake pads and linings, under the Fras-le brand, which was suited to the unique demands of the Indian market.

India Brakepad Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Two-Wheeler, Commercial Vehicles |

| Sales Channels Covered | OEM, Aftermarket |

| Material Types Covered | Semi-Metallic, Ceramic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India brakepad market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India brakepad market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India brakepad industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The brakepad market in India was valued at USD 233.97 Million in 2024.

The India brakepad market is projected to exhibit a CAGR of 10.54% during 2025-2033, reaching a value of USD 576.59 Million in by 2033.

The market is driven by steady automotive sales, a growing replacement cycle, and rising awareness of braking efficiency. Urban traffic conditions accelerate wear, increasing aftermarket demand. Consumers are prioritizing low-noise, low-dust products, and OEMs are aligning with changing material preferences to meet safety standards and performance expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)